Complete financial analysis of Full House Resorts, Inc. (FLL) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Full House Resorts, Inc., a leading company in the Gambling, Resorts & Casinos industry within the Consumer Cyclical sector.

- Public Joint Stock Company Territorial Generation Company No. 14 (TGKN.ME) Income Statement Analysis – Financial Results

- Journey Energy Inc. (JOY.TO) Income Statement Analysis – Financial Results

- Eagle Eye Solutions Group plc (EYE.L) Income Statement Analysis – Financial Results

- SinoSun Technology Co. Ltd. (300333.SZ) Income Statement Analysis – Financial Results

- Lasa Supergenerics Limited (LASA.NS) Income Statement Analysis – Financial Results

Full House Resorts, Inc. (FLL)

Industry: Gambling, Resorts & Casinos

Sector: Consumer Cyclical

Website: https://www.fullhouseresorts.com

About Full House Resorts, Inc.

Full House Resorts, Inc. owns, develops, invests in, operates, manages, and leases casinos, and related hospitality and entertainment facilities in the United States. The company owns and operates the Silver Slipper Casino and Hotel in Hancock County, Mississippi, which has 757 slot machines and 24 table games, a surface parking lot, and a 129 hotel rooms; an on-site sportsbook, a fine-dining restaurant, a buffet, and a quick-service restaurant, as well as an oyster bar, a casino bar, and a beachfront bar; and 37-space beachfront RV park. It also owns and operates the Bronco Billy's Casino and Hotel in Cripple Creek, Colorado that has gaming space and 14 hotel rooms, as well as a steakhouse and a casual dining outlet. In addition, the company owns and operates the Rising Star Casino Resort in Rising Sun, Indiana, which has 642 slot machines and 16 table games; a land-based pavilion with approximately 31,500 square feet of meeting and convention space; a contiguous 190-guest-room hotel and an adjacent leased 104-guest-room hotel; a 56-space RV park; surface parking; an 18-hole golf course on approximately 230 acres; and four dining outlets. Further, it owns and operates the Stockman's Casino that is located in Fallon, Nevada, which has 186 slot machines, a bar, a fine-dining restaurant, and a coffee shop; and the Grand Lodge Casino that has 269 slot machines and 9 table games, which is integrated into the Hyatt Regency Lake Tahoe Resort, Spa and Casino in Incline Village, Nevada. Full House Resorts, Inc. was incorporated in 1987 and is headquartered in Las Vegas, Nevada.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 241.06M | 163.28M | 180.16M | 125.59M | 165.43M | 163.88M | 161.27M | 145.99M | 124.59M | 121.42M | 144.73M | 128.76M | 105.46M | 32.90M | 19.01M | 9.67M | 9.56M | 3.86M | 3.70M | 3.59M | 3.34M | 4.82M | 5.00M | 3.92M | 3.60M | 4.60M | 8.30M | 7.70M | 5.60M | 5.60M | 4.40M |

| Cost of Revenue | 109.69M | 73.13M | 73.95M | 58.76M | 93.79M | 98.16M | 91.84M | 80.46M | 68.72M | 67.18M | 81.34M | 74.56M | 51.44M | 4.18M | 4.24M | 4.72M | 4.19M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 122.44K | 528.90K | 300.00K | 700.00K | 3.40M | 3.90M | 4.00M | 3.40M | 2.80M |

| Gross Profit | 131.37M | 90.15M | 106.21M | 66.83M | 71.64M | 65.71M | 69.43M | 65.53M | 55.87M | 54.24M | 63.39M | 54.20M | 54.02M | 28.72M | 14.77M | 4.95M | 5.38M | 3.86M | 3.70M | 3.59M | 3.34M | 4.82M | 4.87M | 3.39M | 3.30M | 3.90M | 4.90M | 3.80M | 1.60M | 2.20M | 1.60M |

| Gross Profit Ratio | 54.50% | 55.21% | 58.96% | 53.22% | 43.31% | 40.10% | 43.05% | 44.89% | 44.84% | 44.67% | 43.80% | 42.09% | 51.22% | 87.31% | 77.69% | 51.19% | 56.20% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 97.55% | 86.52% | 91.67% | 84.78% | 59.04% | 49.35% | 28.57% | 39.29% | 36.36% |

| Research & Development | 0.00 | 228.00K | 782.00K | 423.00K | 1.04M | 843.00K | 284.00K | 1.31M | 891.00K | 296.00K | 67.00K | 1.86M | 792.75K | 423.16K | 218.35K | 151.12K | 431.44K | 513.18K | 1.23M | 1.07M | 692.40K | 954.06K | 1.08M | 0.00 | 1.60M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 92.93M | 57.01M | 57.17M | 45.39M | 51.85M | 44.89M | 49.77M | 46.36M | 42.04M | 46.68M | 44.27M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | -7.19M | 2.70M | 2.80M | 2.20M | 4.20M | 3.80M | 3.70M | 3.40M | 2.00M | 1.80M | 2.70M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 85.75M | 59.71M | 59.97M | 47.59M | 56.05M | 48.69M | 53.47M | 49.76M | 42.04M | 46.68M | 46.97M | 37.00M | 25.43M | 6.43M | 6.47M | 6.26M | 6.81M | 3.80M | 2.34M | 1.65M | 1.86M | 1.78M | 1.64M | 1.85M | 2.20M | 2.10M | 2.50M | 2.40M | 2.70M | 2.40M | 900.00K |

| Other Expenses | 46.78M | 17.49M | 7.24M | 7.67M | 8.33M | -13.00K | 8.60M | 7.93M | 12.00K | -23.00K | -15.00K | -6.00K | 3.70M | -1.67M | 2.09M | -5.66M | 1.02M | -1.60M | -964.93K | 102.26K | 176.56K | 216.55K | 5.17M | 586.48K | 700.00K | 800.00K | 600.00K | 500.00K | 1.20M | 500.00K | 400.00K |

| Operating Expenses | 85.75M | 77.42M | 67.98M | 55.67M | 65.42M | 58.21M | 62.36M | 59.00M | 50.82M | 56.16M | 56.43M | 45.75M | 29.93M | 5.18M | 8.78M | 750.96K | 8.26M | 2.71M | 2.61M | 2.82M | 2.73M | 2.95M | 7.89M | 2.43M | 4.50M | 2.90M | 3.10M | 2.90M | 3.90M | 2.90M | 1.30M |

| Cost & Expenses | 242.22M | 150.56M | 141.93M | 114.43M | 159.21M | 156.37M | 154.20M | 139.46M | 119.54M | 123.34M | 137.77M | 120.31M | 81.37M | 9.36M | 13.02M | 5.47M | 12.45M | 2.71M | 2.61M | 2.82M | 2.73M | 2.95M | 8.01M | 2.96M | 4.80M | 3.60M | 6.50M | 6.80M | 7.90M | 6.30M | 4.10M |

| Interest Income | 3.74M | 1.36M | 23.66M | 9.82M | 10.73M | 146.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 8.06K | 120.75K | 389.01K | 171.96K | 745.66K | 88.33K | 60.63K | 0.00 | 30.28K | 0.00 | 0.00 | 11.62K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 26.72M | 22.99M | 23.66M | 9.82M | 10.73M | 10.31M | 10.86M | 9.49M | 6.72M | 6.27M | 7.27M | 2.73M | 2.84M | 58.37K | 173.82K | 532.50K | 1.27M | 189.54K | 147.41K | 0.00 | 99.17K | 0.00 | 0.00 | 328.38K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 31.09M | 11.33M | 7.22M | 7.67M | 8.33M | 8.40M | 8.60M | 7.93M | 7.89M | 9.18M | 9.39M | 6.88M | 4.20M | 1.05M | 1.07M | 1.21M | 1.27M | 75.08K | 76.96K | 102.26K | 176.56K | 216.55K | 572.37K | 586.48K | 700.00K | 800.00K | 600.00K | 500.00K | 1.20M | 500.00K | 400.00K |

| EBITDA | 29.94M | 20.66M | 45.45M | 18.83M | 14.56M | 15.90M | 15.66M | 15.06M | 13.34M | -6.38M | 16.35M | 54.81M | 25.67M | 27.08M | 11.07M | 5.00M | -2.05M | 1.23M | 1.17M | 866.93K | 788.80K | 2.09M | -2.45M | 1.55M | -495.53K | 1.80M | 2.40M | 1.40M | -1.10M | -200.00K | 700.00K |

| EBITDA Ratio | 12.42% | 12.65% | 25.23% | 14.99% | 8.80% | 9.70% | 9.72% | 9.91% | 10.40% | 5.96% | 11.29% | 11.90% | 29.49% | 82.32% | 58.20% | 53.95% | -21.39% | -11.62% | 3.35% | 24.17% | 23.62% | 43.33% | 42.98% | 39.47% | -13.89% | 26.09% | 27.71% | 28.57% | 55.36% | -5.36% | 11.36% |

| Operating Income | -1.16M | 12.68M | 37.55M | 10.48M | 6.22M | 7.43M | 7.06M | 6.19M | 5.04M | -13.84M | 2.96M | 49.64M | 19.17M | 23.54M | 8.59M | 3.62M | -2.88M | 1.15M | 1.09M | 764.67K | 612.24K | 1.87M | -3.02M | 962.25K | -1.20M | 1.00M | 1.80M | 900.00K | -2.30M | -700.00K | 300.00K |

| Operating Income Ratio | -0.48% | 7.77% | 20.84% | 8.34% | 3.76% | 4.53% | 4.38% | 4.24% | 4.05% | -11.40% | 2.05% | 38.55% | 18.18% | 71.55% | 45.16% | 37.38% | -30.15% | 29.91% | 29.43% | 21.32% | 18.34% | 38.84% | -60.43% | 24.53% | -33.33% | 21.74% | 21.69% | 11.69% | -41.07% | -12.50% | 6.82% |

| Total Other Income/Expenses | -22.59M | -27.52M | -25.41M | -10.42M | -11.96M | -11.32M | -12.24M | -10.65M | -6.70M | -8.00M | -7.26M | -6.18M | -3.34M | 62.38K | 215.19K | -360.54K | -722.93K | 22.38K | -86.78K | -904.74K | -68.89K | -41.72K | -277.68K | -316.76K | -104.47K | 0.00 | -500.00K | -800.00K | -5.20M | 100.00K | 200.00K |

| Income Before Tax | -23.76M | -14.84M | 12.14M | 55.00K | -5.74M | -3.90M | -5.18M | -4.46M | -1.66M | -21.83M | -4.32M | 45.19M | 15.83M | 23.60M | 8.80M | 2.89M | 1.10M | 1.18M | 1.63M | 667.25K | 543.35K | 1.83M | -3.30M | 645.48K | -1.30M | 1.00M | 1.30M | 100.00K | -7.50M | -600.00K | 500.00K |

| Income Before Tax Ratio | -9.85% | -9.09% | 6.74% | 0.04% | -3.47% | -2.38% | -3.21% | -3.06% | -1.33% | -17.98% | -2.99% | 35.10% | 15.01% | 71.74% | 46.29% | 29.85% | 11.45% | 30.49% | 44.12% | 18.61% | 16.27% | 37.97% | -65.99% | 16.45% | -36.11% | 21.74% | 15.66% | 1.30% | -133.93% | -10.71% | 11.36% |

| Income Tax Expense | 1.15M | -31.00K | 435.00K | -92.00K | 80.00K | 476.00K | -150.00K | 630.00K | -342.00K | -988.00K | -361.00K | 15.18M | 3.24M | 5.74M | 3.18M | 1.31M | 441.02K | 537.22K | 793.68K | 347.46K | 350.15K | 873.53K | -846.05K | 490.39K | -300.00K | 300.00K | 300.00K | 1.70M | -1.90M | 700.00K | 200.00K |

| Net Income | -24.90M | -14.80M | 11.71M | 147.00K | -5.82M | -4.37M | -5.03M | -5.09M | -1.32M | -20.85M | -3.96M | 27.83M | 2.34M | 7.67M | 4.77M | 1.62M | 940.59K | 639.68K | 839.34K | 319.79K | 193.20K | 955.76K | -2.45M | 155.09K | -1.50M | 700.00K | 1.00M | -800.00K | -5.60M | -1.40M | 100.00K |

| Net Income Ratio | -10.33% | -9.07% | 6.50% | 0.12% | -3.52% | -2.67% | -3.12% | -3.49% | -1.06% | -17.17% | -2.74% | 21.62% | 2.22% | 23.31% | 25.08% | 16.73% | 9.83% | 16.57% | 22.68% | 8.92% | 5.79% | 19.84% | -49.05% | 3.95% | -41.67% | 15.22% | 12.05% | -10.39% | -100.00% | -25.00% | 2.27% |

| EPS | -0.72 | -0.43 | 0.36 | 0.01 | -0.22 | -0.17 | -0.22 | -0.26 | -0.07 | -1.10 | -0.20 | 1.42 | 0.12 | 0.41 | 0.25 | 0.08 | 0.05 | 0.04 | 0.06 | 0.05 | 0.02 | 0.07 | -0.23 | -0.01 | -0.14 | 0.05 | 0.08 | -0.07 | -0.54 | -0.16 | -0.03 |

| EPS Diluted | -0.72 | -0.43 | 0.34 | 0.01 | -0.22 | -0.17 | -0.22 | -0.26 | -0.07 | -1.05 | -0.20 | 1.42 | 0.12 | 0.41 | 0.25 | 0.08 | 0.05 | 0.04 | 0.05 | 0.05 | 0.02 | 0.07 | -0.23 | -0.01 | -0.14 | 0.05 | 0.08 | -0.07 | -0.54 | -0.16 | -0.03 |

| Weighted Avg Shares Out | 34.52M | 34.35M | 32.52M | 27.09M | 26.98M | 26.01M | 22.88M | 19.60M | 19.61M | 18.87M | 19.73M | 19.66M | 19.37M | 18.95M | 18.97M | 20.12M | 20.32M | 11.49M | 10.88M | 10.88M | 10.88M | 10.88M | 10.88M | 10.88M | 10.88M | 10.88M | 10.53M | 10.88M | 10.35M | 8.86M | 3.51M |

| Weighted Avg Shares Out (Dil) | 34.52M | 34.35M | 34.95M | 27.78M | 26.98M | 26.46M | 22.88M | 19.60M | 19.61M | 19.87M | 19.73M | 19.66M | 19.37M | 18.95M | 18.98M | 20.12M | 20.32M | 12.26M | 11.62M | 11.62M | 10.88M | 10.88M | 10.88M | 10.88M | 10.88M | 10.88M | 10.53M | 10.88M | 10.35M | 8.86M | 3.51M |

INVESTIGATION ALERT: The Schall Law Firm Announces it is Investigating Claims Against Las Vegas Sands Corp. and Encourages Investors with Losses of $100,000 to Contact the Firm

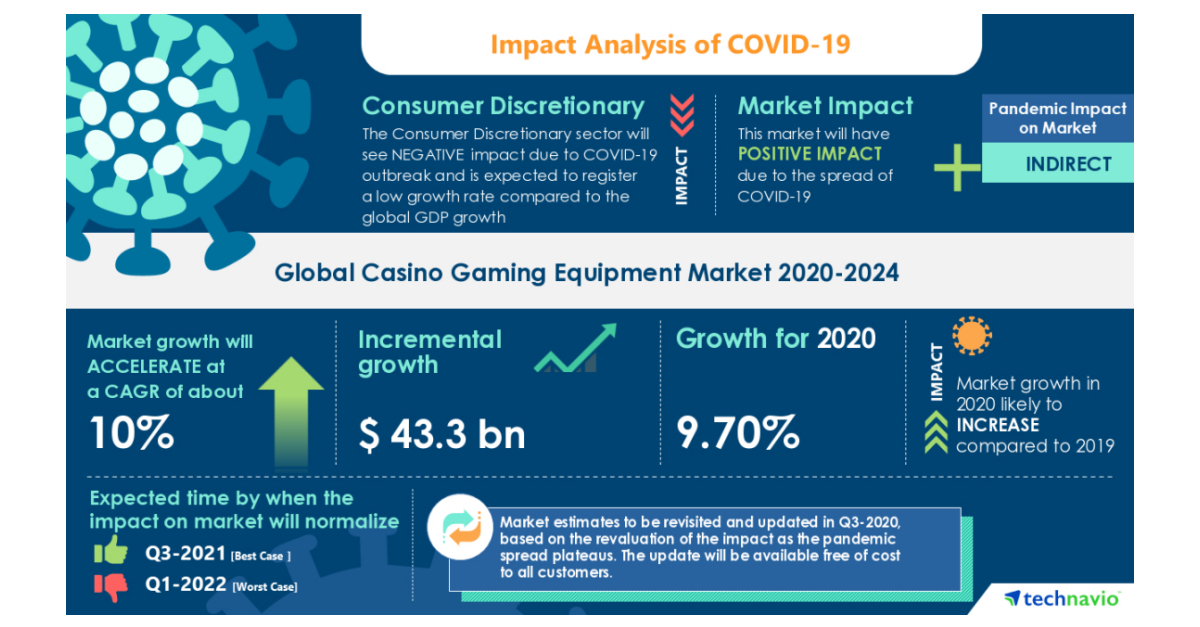

Casino Gaming Equipment Market- Roadmap for Recovery from COVID-19 | Expansion of Casinos to Boost the Market Growth | Technavio

First look: is this the UK's best socially distanced spa staycation?

Facts v feelings: how to stop our emotions misleading us

City Lodge reports R486m net loss, won’t be paying dividends

CITY LODGE HOTELS LIMITED – Results of Rights Offer - SENS

Wall Street Breakfast: The Week Ahead

Stocks To Watch: Spotlight On Palo Alto Networks, Best Buy And Xpeng Motors

Full House Resorts Announces Second Quarter Results

In the four-wheel drive market, retro-chic is all the rage

Source: https://incomestatements.info

Category: Stock Reports