See more : Longboat Energy plc (LBE.L) Income Statement Analysis – Financial Results

Complete financial analysis of General Electric Company (GE) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of General Electric Company, a leading company in the Aerospace & Defense industry within the Industrials sector.

- Aktia Pankki Oyj (AKTIA.HE) Income Statement Analysis – Financial Results

- Meritz Securities Co., Ltd. (008560.KS) Income Statement Analysis – Financial Results

- Beijing Jingxi Culture & Tourism Co.,Ltd (000802.SZ) Income Statement Analysis – Financial Results

- K.B. Recycling Industries Ltd. (AKMYF) Income Statement Analysis – Financial Results

- LeTech Corporation (3497.T) Income Statement Analysis – Financial Results

General Electric Company (GE)

About General Electric Company

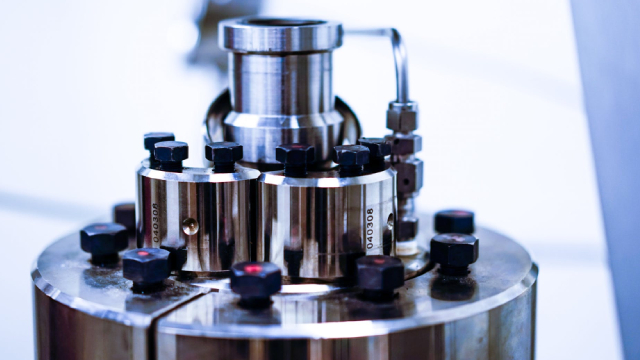

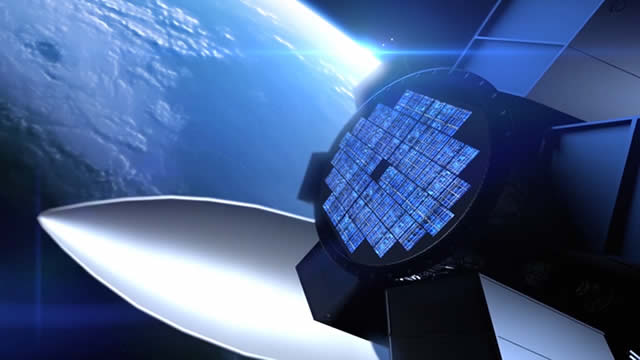

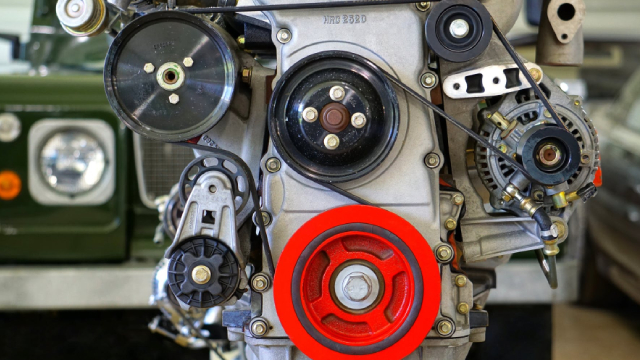

General Electric Company, doing business as GE Aerospace, designs and produces commercial and defense aircraft engines, integrated engine components, electric power, and mechanical aircraft systems. It also offers aftermarket services to support its products. The company operates in the United States, Europe, China, Asia, the Americas, the Middle East, and Africa. General Electric Company was incorporated in 1892 and is based in Evendale, Ohio.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 | 1987 | 1986 | 1985 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 67.95B | 58.10B | 56.47B | 75.83B | 95.22B | 121.62B | 120.47B | 119.69B | 115.16B | 147.81B | 143.03B | 144.80B | 147.30B | 150.21B | 156.78B | 182.52B | 172.74B | 163.39B | 149.70B | 152.36B | 134.19B | 131.70B | 125.91B | 129.85B | 110.83B | 99.82B | 88.54B | 78.54B | 69.28B | 59.32B | 59.83B | 56.27B | 59.38B | 57.66B | 53.88B | 38.79B | 39.32B | 35.21B | 28.29B |

| Cost of Revenue | 50.39B | 44.27B | 43.38B | 57.87B | 70.03B | 92.67B | 91.93B | 87.48B | 82.69B | 81.31B | 112.28B | 110.70B | 105.66B | 109.82B | 113.73B | 125.79B | 73.13B | 74.11B | 66.81B | 61.76B | 51.21B | 52.86B | 49.10B | 51.82B | 39.27B | 36.42B | 36.01B | 29.09B | 27.38B | 25.76B | 39.43B | 25.56B | 29.74B | 28.88B | 27.44B | 26.57B | 28.11B | 24.73B | 19.78B |

| Gross Profit | 17.56B | 13.83B | 13.09B | 17.96B | 25.19B | 28.94B | 28.53B | 32.21B | 32.47B | 66.50B | 30.75B | 34.10B | 41.64B | 40.39B | 43.06B | 56.72B | 99.61B | 89.28B | 82.89B | 90.60B | 82.98B | 78.84B | 76.82B | 78.03B | 71.57B | 63.40B | 52.53B | 49.46B | 41.90B | 33.56B | 20.40B | 30.71B | 29.64B | 28.79B | 26.44B | 12.23B | 11.20B | 10.48B | 8.51B |

| Gross Profit Ratio | 25.84% | 23.80% | 23.18% | 23.69% | 26.45% | 23.80% | 23.69% | 26.91% | 28.19% | 44.99% | 21.50% | 23.55% | 28.27% | 26.89% | 27.46% | 31.08% | 57.67% | 54.64% | 55.37% | 59.47% | 61.84% | 59.87% | 61.01% | 60.09% | 64.57% | 63.51% | 59.33% | 62.97% | 60.48% | 56.58% | 34.10% | 54.58% | 49.91% | 49.92% | 49.07% | 31.52% | 28.49% | 29.77% | 30.09% |

| Research & Development | 1.91B | 1.79B | 1.68B | 2.57B | 3.12B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 12.08B | 11.77B | 10.35B | 14.99B | 17.24B | 0.00 | 0.00 | 0.00 | 0.00 | 28.02B | 0.00 | 0.00 | 2.91B | 41.12B | 40.82B | 45.23B | 43.77B | 40.63B | 40.75B | 53.78B | 48.10B | 46.32B | 43.22B | 45.39B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 12.08B | 11.77B | 10.35B | 14.99B | 17.24B | 18.11B | 18.28B | 18.38B | 17.83B | 28.02B | 0.00 | 0.00 | 2.91B | 3.01B | 3.02B | 45.23B | 43.77B | 40.63B | 40.75B | 53.78B | 48.10B | 46.32B | 43.22B | 45.39B | 39.72B | 34.69B | 30.95B | 27.33B | 21.83B | 17.37B | 4.16B | 15.51B | 13.75B | 13.41B | 12.50B | 11.66B | 5.98B | 5.96B | 4.35B |

| Other Expenses | 0.00 | 779.00M | -499.00M | -2.22B | -1.08B | -982.00M | -3.63B | -982.00M | -2.61B | -34.03B | -33.93B | -36.10B | -37.28B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 13.99B | 13.55B | 12.03B | 17.55B | 17.24B | 18.11B | 16.66B | 14.37B | 15.60B | 3.22B | 1.80B | 1.33B | 7.00B | 10.20B | 13.95B | 11.37B | 48.31B | 44.47B | 44.59B | 57.66B | 51.85B | 49.41B | 45.71B | 47.44B | 46.41B | 40.55B | 35.03B | 31.11B | 25.43B | 20.57B | 7.42B | 18.33B | 16.58B | 15.92B | 14.75B | 13.93B | 7.52B | 7.42B | 5.58B |

| Cost & Expenses | 64.38B | 57.82B | 55.41B | 75.43B | 87.27B | 110.78B | 108.59B | 101.86B | 98.30B | 84.53B | 114.09B | 112.03B | 112.66B | 120.02B | 127.67B | 137.17B | 121.44B | 118.58B | 111.40B | 119.42B | 103.05B | 102.27B | 94.80B | 99.26B | 85.68B | 76.97B | 71.04B | 60.20B | 52.80B | 46.33B | 46.85B | 43.89B | 46.32B | 44.79B | 42.20B | 40.49B | 35.64B | 32.15B | 25.35B |

| Interest Income | 739.00M | 474.00M | 585.00M | 0.00 | 1.51B | 669.00M | 299.00M | 167.00M | 65.00M | 0.00 | 21.00M | 114.00M | 206.00M | 173.00M | 0.00 | 567.00M | 25.00M | 280.00M | 96.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 1.12B | 1.48B | 1.79B | 3.52B | 4.23B | 5.06B | 4.87B | 5.03B | 3.46B | 9.48B | 10.12B | 12.51B | 14.55B | 15.98B | 18.77B | 26.21B | 23.79B | 19.29B | 15.19B | 11.91B | 10.43B | 10.22B | 11.06B | 11.72B | 10.01B | 9.75B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 2.08B | 2.90B | 2.36B | 3.46B | 5.60B | 8.22B | 5.14B | 5.00B | 4.85B | 9.28B | 9.76B | 9.35B | 9.19B | 10.01B | 10.64B | 11.49B | 10.28B | 9.16B | 8.54B | 8.39B | 6.96B | 6.00B | 7.09B | 7.74B | 6.69B | 5.86B | 4.08B | 3.79B | 3.59B | 3.21B | 3.26B | 2.82B | 2.83B | 2.51B | 2.26B | 2.27B | 1.54B | 1.46B | 1.23B |

| EBITDA | 13.38B | 3.54B | 3.38B | 2.83B | 11.07B | -9.85B | 850.00M | 16.95B | 16.50B | 29.26B | 28.94B | 32.77B | 43.57B | 39.51B | 38.92B | 57.01B | 61.58B | 50.62B | 46.84B | 40.26B | 34.94B | 35.62B | 38.20B | 38.33B | 32.28B | 29.09B | 21.59B | 22.13B | 20.07B | 16.19B | 16.24B | 15.21B | 15.89B | 15.38B | 13.94B | 569.00M | 5.22B | 4.52B | 4.16B |

| EBITDA Ratio | 19.69% | 8.01% | 5.99% | 2.19% | 7.21% | 8.10% | 6.84% | 14.08% | 12.38% | 19.79% | 20.24% | 22.63% | 23.52% | 20.10% | 18.57% | 24.85% | 35.65% | 33.03% | 31.29% | 27.12% | 28.39% | 26.90% | 30.34% | 29.52% | 28.02% | 28.11% | 21.78% | 27.36% | 27.88% | 25.96% | 25.92% | 25.60% | 25.31% | 25.36% | 24.60% | -27.65% | 12.84% | 9.28% | 11.30% |

| Operating Income | 3.57B | 276.00M | 1.06B | 409.00M | 7.94B | 10.83B | 11.88B | 17.83B | 16.86B | 63.29B | 28.94B | 32.77B | 34.64B | 30.19B | 29.11B | 45.35B | 51.30B | 44.81B | 38.30B | 32.94B | 31.13B | 29.43B | 31.11B | 30.59B | 25.16B | 22.85B | 17.50B | 18.34B | 16.48B | 12.99B | 12.98B | 12.39B | 13.06B | 12.87B | 11.69B | -1.70B | 3.68B | 3.06B | 2.94B |

| Operating Income Ratio | 5.26% | 0.48% | 1.87% | 0.54% | 8.34% | 8.91% | 9.86% | 14.90% | 14.64% | 42.81% | 20.24% | 22.63% | 23.52% | 20.10% | 18.57% | 24.85% | 29.70% | 27.43% | 25.59% | 21.62% | 23.20% | 22.35% | 24.71% | 23.56% | 22.70% | 22.89% | 19.77% | 23.35% | 23.78% | 21.89% | 21.70% | 22.01% | 21.99% | 22.32% | 21.69% | -4.37% | 9.36% | 8.69% | 10.38% |

| Total Other Income/Expenses | 6.62B | -1.08B | -6.75B | 5.56B | -5.21B | -27.75B | -23.03B | -7.15B | 4.21B | -5.59B | -3.25B | -12.00B | -14.55B | -16.00B | -18.31B | -25.76B | -24.69B | -19.74B | -15.73B | -12.34B | -10.77B | -10.54B | -11.41B | -12.15B | -9.58B | -9.37B | -6.32B | -7.54B | -6.74B | -4.33B | -6.41B | -6.11B | -6.62B | -6.72B | -5.99B | 6.42B | -472.00M | 632.00M | 593.00M |

| Income Before Tax | 10.19B | -799.00M | -5.70B | 5.97B | 1.15B | -20.13B | -8.79B | 9.03B | 8.19B | 17.23B | 16.15B | 17.41B | 20.10B | 14.21B | 10.34B | 19.14B | 26.60B | 24.62B | 22.13B | 20.11B | 19.90B | 18.89B | 19.70B | 18.45B | 15.58B | 13.48B | 11.18B | 10.81B | 9.74B | 8.66B | 6.58B | 6.27B | 6.44B | 6.15B | 5.70B | 4.72B | 3.21B | 3.69B | 3.53B |

| Income Before Tax Ratio | 15.00% | -1.38% | -10.09% | 7.87% | 1.21% | -16.56% | -7.30% | 7.54% | 7.11% | 11.66% | 11.29% | 12.02% | 13.64% | 9.46% | 6.60% | 10.49% | 15.40% | 15.07% | 14.78% | 13.20% | 14.83% | 14.34% | 15.65% | 14.21% | 14.05% | 13.50% | 12.63% | 13.76% | 14.06% | 14.60% | 10.99% | 11.15% | 10.84% | 10.66% | 10.58% | 12.17% | 8.16% | 10.49% | 12.47% |

| Income Tax Expense | 1.16B | -3.00M | -757.00M | -487.00M | 726.00M | 583.00M | -3.04B | -464.00M | 6.49B | 1.77B | 676.00M | 2.50B | 5.73B | 1.05B | -1.09B | 1.05B | 4.13B | 3.95B | 3.85B | 3.51B | 4.32B | 3.76B | 5.57B | 5.71B | 4.86B | 4.18B | 2.98B | 3.53B | 3.16B | 2.75B | 2.15B | 1.97B | 2.00B | 1.84B | 1.76B | 1.34B | 1.09B | 1.20B | 1.19B |

| Net Income | 9.48B | 339.00M | -6.34B | 5.70B | -4.98B | -22.36B | -5.79B | 8.83B | -6.13B | 15.23B | 14.06B | 13.64B | 14.15B | 11.64B | 11.03B | 17.41B | 22.21B | 20.83B | 16.35B | 16.59B | 15.00B | 14.12B | 13.68B | 12.74B | 10.72B | 9.30B | 8.20B | 7.28B | 6.57B | 4.73B | 4.32B | 4.73B | 2.64B | 4.30B | 3.94B | 3.39B | 2.12B | 2.49B | 2.34B |

| Net Income Ratio | 13.95% | 0.58% | -11.22% | 7.52% | -5.23% | -18.38% | -4.80% | 7.38% | -5.32% | 10.31% | 9.83% | 9.42% | 9.61% | 7.75% | 7.03% | 9.54% | 12.86% | 12.75% | 10.92% | 10.89% | 11.18% | 10.72% | 10.87% | 9.81% | 9.67% | 9.31% | 9.26% | 9.27% | 9.49% | 7.97% | 7.21% | 8.40% | 4.44% | 7.46% | 7.31% | 8.73% | 5.39% | 7.08% | 8.26% |

| EPS | 8.44 | 0.05 | -5.77 | 4.64 | -4.57 | -20.60 | -5.76 | 7.20 | -4.96 | 12.08 | 10.96 | 10.32 | 9.92 | 8.48 | 8.08 | 13.76 | 17.44 | 16.00 | 12.64 | 13.20 | 12.16 | 11.36 | 11.04 | 10.32 | 8.72 | 7.60 | 6.67 | 5.87 | 5.20 | 3.69 | 3.36 | 3.68 | 2.08 | 3.28 | 2.88 | 2.48 | 1.60 | 1.84 | 1.76 |

| EPS Diluted | 8.36 | 0.05 | -5.77 | 4.64 | -4.57 | -20.58 | -5.76 | 7.12 | -4.96 | 12.00 | 10.88 | 10.32 | 9.84 | 8.48 | 8.08 | 13.76 | 17.36 | 16.00 | 12.56 | 13.12 | 12.08 | 11.28 | 10.96 | 10.16 | 8.56 | 7.44 | 6.56 | 5.76 | 5.20 | 3.69 | 3.36 | 3.68 | 2.08 | 3.28 | 2.88 | 2.48 | 1.60 | 1.84 | 1.76 |

| Weighted Avg Shares Out | 1.09B | 1.10B | 1.10B | 1.09B | 1.09B | 1.09B | 1.08B | 1.13B | 1.24B | 1.26B | 1.28B | 1.32B | 1.32B | 1.33B | 1.33B | 1.26B | 1.27B | 1.29B | 1.32B | 1.30B | 1.25B | 1.66B | 1.65B | 1.65B | 1.23B | 1.23B | 1.23B | 1.26B | 1.26B | 1.28B | 1.28B | 1.28B | 1.27B | 1.31B | 1.37B | 1.37B | 1.32B | 1.35B | 1.33B |

| Weighted Avg Shares Out (Dil) | 1.10B | 1.10B | 1.10B | 1.10B | 1.09B | 1.09B | 1.08B | 1.14B | 1.25B | 1.27B | 1.29B | 1.32B | 1.33B | 1.33B | 1.33B | 1.26B | 1.28B | 1.30B | 1.33B | 1.31B | 1.26B | 1.67B | 1.67B | 1.67B | 1.25B | 1.25B | 1.25B | 1.26B | 1.26B | 1.28B | 1.31B | 1.28B | 1.27B | 1.31B | 1.37B | 1.37B | 1.32B | 1.35B | 1.33B |

GE Aviation stock gets overbought and overvalued: is it a buy?

GE Aerospace Partners With Microsoft to Bring New AI Tools to Its Workforce

General Electric will solve Vineyard Wind turbine blade malfunctions, Iberdrola chairman says

2 Top Dividend Growth Stocks With Payout Ratios Below 50%

Forget Tesla -- These Unstoppable Stocks Are Better Buys

GE Vernova plans 'leaner' offshore wind unit, will cut hundreds of jobs

The New Magnificent Seven? These Stocks Not Named Nvidia Clear Buy Points

Calls of the Day: Elanco Animal Health CEO, Casey's General Store, GE Vernova, Spotify

GE Vernova To Rally Over 30%? Here Are 10 Top Analyst Forecasts For Tuesday

These Were the 5 Biggest Companies in 1999, and Here Are the 5 Biggest Companies Now

Source: https://incomestatements.info

Category: Stock Reports