See more : Graphite India Limited (GRAPHITE.BO) Income Statement Analysis – Financial Results

Complete financial analysis of General Electric Company (GE) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of General Electric Company, a leading company in the Aerospace & Defense industry within the Industrials sector.

- Adams Diversified Equity Fund, Inc. (ADX) Income Statement Analysis – Financial Results

- Buzzi Unicem S.p.A. (BZZUF) Income Statement Analysis – Financial Results

- Geotech Holdings Ltd. (1707.HK) Income Statement Analysis – Financial Results

- Asarina Pharma AB (publ) (ASAP.ST) Income Statement Analysis – Financial Results

- Careerlink Co., Ltd. (6070.T) Income Statement Analysis – Financial Results

General Electric Company (GE)

About General Electric Company

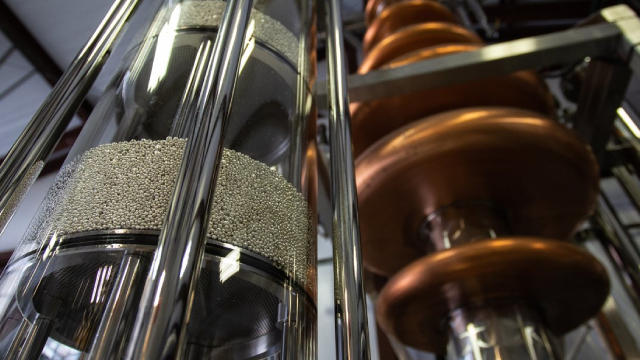

General Electric Company, doing business as GE Aerospace, designs and produces commercial and defense aircraft engines, integrated engine components, electric power, and mechanical aircraft systems. It also offers aftermarket services to support its products. The company operates in the United States, Europe, China, Asia, the Americas, the Middle East, and Africa. General Electric Company was incorporated in 1892 and is based in Evendale, Ohio.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 | 1987 | 1986 | 1985 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 67.95B | 58.10B | 56.47B | 75.83B | 95.22B | 121.62B | 120.47B | 119.69B | 115.16B | 147.81B | 143.03B | 144.80B | 147.30B | 150.21B | 156.78B | 182.52B | 172.74B | 163.39B | 149.70B | 152.36B | 134.19B | 131.70B | 125.91B | 129.85B | 110.83B | 99.82B | 88.54B | 78.54B | 69.28B | 59.32B | 59.83B | 56.27B | 59.38B | 57.66B | 53.88B | 38.79B | 39.32B | 35.21B | 28.29B |

| Cost of Revenue | 50.39B | 44.27B | 43.38B | 57.87B | 70.03B | 92.67B | 91.93B | 87.48B | 82.69B | 81.31B | 112.28B | 110.70B | 105.66B | 109.82B | 113.73B | 125.79B | 73.13B | 74.11B | 66.81B | 61.76B | 51.21B | 52.86B | 49.10B | 51.82B | 39.27B | 36.42B | 36.01B | 29.09B | 27.38B | 25.76B | 39.43B | 25.56B | 29.74B | 28.88B | 27.44B | 26.57B | 28.11B | 24.73B | 19.78B |

| Gross Profit | 17.56B | 13.83B | 13.09B | 17.96B | 25.19B | 28.94B | 28.53B | 32.21B | 32.47B | 66.50B | 30.75B | 34.10B | 41.64B | 40.39B | 43.06B | 56.72B | 99.61B | 89.28B | 82.89B | 90.60B | 82.98B | 78.84B | 76.82B | 78.03B | 71.57B | 63.40B | 52.53B | 49.46B | 41.90B | 33.56B | 20.40B | 30.71B | 29.64B | 28.79B | 26.44B | 12.23B | 11.20B | 10.48B | 8.51B |

| Gross Profit Ratio | 25.84% | 23.80% | 23.18% | 23.69% | 26.45% | 23.80% | 23.69% | 26.91% | 28.19% | 44.99% | 21.50% | 23.55% | 28.27% | 26.89% | 27.46% | 31.08% | 57.67% | 54.64% | 55.37% | 59.47% | 61.84% | 59.87% | 61.01% | 60.09% | 64.57% | 63.51% | 59.33% | 62.97% | 60.48% | 56.58% | 34.10% | 54.58% | 49.91% | 49.92% | 49.07% | 31.52% | 28.49% | 29.77% | 30.09% |

| Research & Development | 1.91B | 1.79B | 1.68B | 2.57B | 3.12B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 12.08B | 11.77B | 10.35B | 14.99B | 17.24B | 0.00 | 0.00 | 0.00 | 0.00 | 28.02B | 0.00 | 0.00 | 2.91B | 41.12B | 40.82B | 45.23B | 43.77B | 40.63B | 40.75B | 53.78B | 48.10B | 46.32B | 43.22B | 45.39B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 12.08B | 11.77B | 10.35B | 14.99B | 17.24B | 18.11B | 18.28B | 18.38B | 17.83B | 28.02B | 0.00 | 0.00 | 2.91B | 3.01B | 3.02B | 45.23B | 43.77B | 40.63B | 40.75B | 53.78B | 48.10B | 46.32B | 43.22B | 45.39B | 39.72B | 34.69B | 30.95B | 27.33B | 21.83B | 17.37B | 4.16B | 15.51B | 13.75B | 13.41B | 12.50B | 11.66B | 5.98B | 5.96B | 4.35B |

| Other Expenses | 0.00 | 779.00M | -499.00M | -2.22B | -1.08B | -982.00M | -3.63B | -982.00M | -2.61B | -34.03B | -33.93B | -36.10B | -37.28B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 13.99B | 13.55B | 12.03B | 17.55B | 17.24B | 18.11B | 16.66B | 14.37B | 15.60B | 3.22B | 1.80B | 1.33B | 7.00B | 10.20B | 13.95B | 11.37B | 48.31B | 44.47B | 44.59B | 57.66B | 51.85B | 49.41B | 45.71B | 47.44B | 46.41B | 40.55B | 35.03B | 31.11B | 25.43B | 20.57B | 7.42B | 18.33B | 16.58B | 15.92B | 14.75B | 13.93B | 7.52B | 7.42B | 5.58B |

| Cost & Expenses | 64.38B | 57.82B | 55.41B | 75.43B | 87.27B | 110.78B | 108.59B | 101.86B | 98.30B | 84.53B | 114.09B | 112.03B | 112.66B | 120.02B | 127.67B | 137.17B | 121.44B | 118.58B | 111.40B | 119.42B | 103.05B | 102.27B | 94.80B | 99.26B | 85.68B | 76.97B | 71.04B | 60.20B | 52.80B | 46.33B | 46.85B | 43.89B | 46.32B | 44.79B | 42.20B | 40.49B | 35.64B | 32.15B | 25.35B |

| Interest Income | 739.00M | 474.00M | 585.00M | 0.00 | 1.51B | 669.00M | 299.00M | 167.00M | 65.00M | 0.00 | 21.00M | 114.00M | 206.00M | 173.00M | 0.00 | 567.00M | 25.00M | 280.00M | 96.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 1.12B | 1.48B | 1.79B | 3.52B | 4.23B | 5.06B | 4.87B | 5.03B | 3.46B | 9.48B | 10.12B | 12.51B | 14.55B | 15.98B | 18.77B | 26.21B | 23.79B | 19.29B | 15.19B | 11.91B | 10.43B | 10.22B | 11.06B | 11.72B | 10.01B | 9.75B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 2.08B | 2.90B | 2.36B | 3.46B | 5.60B | 8.22B | 5.14B | 5.00B | 4.85B | 9.28B | 9.76B | 9.35B | 9.19B | 10.01B | 10.64B | 11.49B | 10.28B | 9.16B | 8.54B | 8.39B | 6.96B | 6.00B | 7.09B | 7.74B | 6.69B | 5.86B | 4.08B | 3.79B | 3.59B | 3.21B | 3.26B | 2.82B | 2.83B | 2.51B | 2.26B | 2.27B | 1.54B | 1.46B | 1.23B |

| EBITDA | 13.38B | 3.54B | 3.38B | 2.83B | 11.07B | -9.85B | 850.00M | 16.95B | 16.50B | 29.26B | 28.94B | 32.77B | 43.57B | 39.51B | 38.92B | 57.01B | 61.58B | 50.62B | 46.84B | 40.26B | 34.94B | 35.62B | 38.20B | 38.33B | 32.28B | 29.09B | 21.59B | 22.13B | 20.07B | 16.19B | 16.24B | 15.21B | 15.89B | 15.38B | 13.94B | 569.00M | 5.22B | 4.52B | 4.16B |

| EBITDA Ratio | 19.69% | 8.01% | 5.99% | 2.19% | 7.21% | 8.10% | 6.84% | 14.08% | 12.38% | 19.79% | 20.24% | 22.63% | 23.52% | 20.10% | 18.57% | 24.85% | 35.65% | 33.03% | 31.29% | 27.12% | 28.39% | 26.90% | 30.34% | 29.52% | 28.02% | 28.11% | 21.78% | 27.36% | 27.88% | 25.96% | 25.92% | 25.60% | 25.31% | 25.36% | 24.60% | -27.65% | 12.84% | 9.28% | 11.30% |

| Operating Income | 3.57B | 276.00M | 1.06B | 409.00M | 7.94B | 10.83B | 11.88B | 17.83B | 16.86B | 63.29B | 28.94B | 32.77B | 34.64B | 30.19B | 29.11B | 45.35B | 51.30B | 44.81B | 38.30B | 32.94B | 31.13B | 29.43B | 31.11B | 30.59B | 25.16B | 22.85B | 17.50B | 18.34B | 16.48B | 12.99B | 12.98B | 12.39B | 13.06B | 12.87B | 11.69B | -1.70B | 3.68B | 3.06B | 2.94B |

| Operating Income Ratio | 5.26% | 0.48% | 1.87% | 0.54% | 8.34% | 8.91% | 9.86% | 14.90% | 14.64% | 42.81% | 20.24% | 22.63% | 23.52% | 20.10% | 18.57% | 24.85% | 29.70% | 27.43% | 25.59% | 21.62% | 23.20% | 22.35% | 24.71% | 23.56% | 22.70% | 22.89% | 19.77% | 23.35% | 23.78% | 21.89% | 21.70% | 22.01% | 21.99% | 22.32% | 21.69% | -4.37% | 9.36% | 8.69% | 10.38% |

| Total Other Income/Expenses | 6.62B | -1.08B | -6.75B | 5.56B | -5.21B | -27.75B | -23.03B | -7.15B | 4.21B | -5.59B | -3.25B | -12.00B | -14.55B | -16.00B | -18.31B | -25.76B | -24.69B | -19.74B | -15.73B | -12.34B | -10.77B | -10.54B | -11.41B | -12.15B | -9.58B | -9.37B | -6.32B | -7.54B | -6.74B | -4.33B | -6.41B | -6.11B | -6.62B | -6.72B | -5.99B | 6.42B | -472.00M | 632.00M | 593.00M |

| Income Before Tax | 10.19B | -799.00M | -5.70B | 5.97B | 1.15B | -20.13B | -8.79B | 9.03B | 8.19B | 17.23B | 16.15B | 17.41B | 20.10B | 14.21B | 10.34B | 19.14B | 26.60B | 24.62B | 22.13B | 20.11B | 19.90B | 18.89B | 19.70B | 18.45B | 15.58B | 13.48B | 11.18B | 10.81B | 9.74B | 8.66B | 6.58B | 6.27B | 6.44B | 6.15B | 5.70B | 4.72B | 3.21B | 3.69B | 3.53B |

| Income Before Tax Ratio | 15.00% | -1.38% | -10.09% | 7.87% | 1.21% | -16.56% | -7.30% | 7.54% | 7.11% | 11.66% | 11.29% | 12.02% | 13.64% | 9.46% | 6.60% | 10.49% | 15.40% | 15.07% | 14.78% | 13.20% | 14.83% | 14.34% | 15.65% | 14.21% | 14.05% | 13.50% | 12.63% | 13.76% | 14.06% | 14.60% | 10.99% | 11.15% | 10.84% | 10.66% | 10.58% | 12.17% | 8.16% | 10.49% | 12.47% |

| Income Tax Expense | 1.16B | -3.00M | -757.00M | -487.00M | 726.00M | 583.00M | -3.04B | -464.00M | 6.49B | 1.77B | 676.00M | 2.50B | 5.73B | 1.05B | -1.09B | 1.05B | 4.13B | 3.95B | 3.85B | 3.51B | 4.32B | 3.76B | 5.57B | 5.71B | 4.86B | 4.18B | 2.98B | 3.53B | 3.16B | 2.75B | 2.15B | 1.97B | 2.00B | 1.84B | 1.76B | 1.34B | 1.09B | 1.20B | 1.19B |

| Net Income | 9.48B | 339.00M | -6.34B | 5.70B | -4.98B | -22.36B | -5.79B | 8.83B | -6.13B | 15.23B | 14.06B | 13.64B | 14.15B | 11.64B | 11.03B | 17.41B | 22.21B | 20.83B | 16.35B | 16.59B | 15.00B | 14.12B | 13.68B | 12.74B | 10.72B | 9.30B | 8.20B | 7.28B | 6.57B | 4.73B | 4.32B | 4.73B | 2.64B | 4.30B | 3.94B | 3.39B | 2.12B | 2.49B | 2.34B |

| Net Income Ratio | 13.95% | 0.58% | -11.22% | 7.52% | -5.23% | -18.38% | -4.80% | 7.38% | -5.32% | 10.31% | 9.83% | 9.42% | 9.61% | 7.75% | 7.03% | 9.54% | 12.86% | 12.75% | 10.92% | 10.89% | 11.18% | 10.72% | 10.87% | 9.81% | 9.67% | 9.31% | 9.26% | 9.27% | 9.49% | 7.97% | 7.21% | 8.40% | 4.44% | 7.46% | 7.31% | 8.73% | 5.39% | 7.08% | 8.26% |

| EPS | 8.44 | 0.05 | -5.77 | 4.64 | -4.57 | -20.60 | -5.76 | 7.20 | -4.96 | 12.08 | 10.96 | 10.32 | 9.92 | 8.48 | 8.08 | 13.76 | 17.44 | 16.00 | 12.64 | 13.20 | 12.16 | 11.36 | 11.04 | 10.32 | 8.72 | 7.60 | 6.67 | 5.87 | 5.20 | 3.69 | 3.36 | 3.68 | 2.08 | 3.28 | 2.88 | 2.48 | 1.60 | 1.84 | 1.76 |

| EPS Diluted | 8.36 | 0.05 | -5.77 | 4.64 | -4.57 | -20.58 | -5.76 | 7.12 | -4.96 | 12.00 | 10.88 | 10.32 | 9.84 | 8.48 | 8.08 | 13.76 | 17.36 | 16.00 | 12.56 | 13.12 | 12.08 | 11.28 | 10.96 | 10.16 | 8.56 | 7.44 | 6.56 | 5.76 | 5.20 | 3.69 | 3.36 | 3.68 | 2.08 | 3.28 | 2.88 | 2.48 | 1.60 | 1.84 | 1.76 |

| Weighted Avg Shares Out | 1.09B | 1.10B | 1.10B | 1.09B | 1.09B | 1.09B | 1.08B | 1.13B | 1.24B | 1.26B | 1.28B | 1.32B | 1.32B | 1.33B | 1.33B | 1.26B | 1.27B | 1.29B | 1.32B | 1.30B | 1.25B | 1.66B | 1.65B | 1.65B | 1.23B | 1.23B | 1.23B | 1.26B | 1.26B | 1.28B | 1.28B | 1.28B | 1.27B | 1.31B | 1.37B | 1.37B | 1.32B | 1.35B | 1.33B |

| Weighted Avg Shares Out (Dil) | 1.10B | 1.10B | 1.10B | 1.10B | 1.09B | 1.09B | 1.08B | 1.14B | 1.25B | 1.27B | 1.29B | 1.32B | 1.33B | 1.33B | 1.33B | 1.26B | 1.28B | 1.30B | 1.33B | 1.31B | 1.26B | 1.67B | 1.67B | 1.67B | 1.25B | 1.25B | 1.25B | 1.26B | 1.26B | 1.28B | 1.31B | 1.28B | 1.27B | 1.31B | 1.37B | 1.37B | 1.32B | 1.35B | 1.33B |

Portland General Electric: Capitalizing On Oregon's Tech Boom

Use Options to Generate $1,000 in 30 Days From These 3 S&P 500 Stocks

The Zacks Analyst Blog The Progressive, Qualcomm, GE Aerospace, S&P Global and Boston Scientific

Buy 5 S&P 500 Stocks to Tap Potential Short-Term Price Appreciation

The Market Missed Something Important in GE Aerospace's Big News. Here's What You Need to Know.

GE Aerospace Stock Sinks: Time to Buy?

GE Aerospace Shares Fall Despite Upbeat Outlook. Is It Time to Buy the Stock on the Dip?

Does GE Stock Have An Upside?

3 Of My Favourite Dividend Stocks That Just Keep Winning

GE Aerospace: I Am Buying The Q3 Drop, Here's Why

Source: https://incomestatements.info

Category: Stock Reports