See more : Prime Meridian Resources Corp. (PMDRF) Income Statement Analysis – Financial Results

Complete financial analysis of HeadHunter Group PLC (HHR) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of HeadHunter Group PLC, a leading company in the Staffing & Employment Services industry within the Industrials sector.

- Samsung SDI Co., Ltd. (006405.KS) Income Statement Analysis – Financial Results

- ImmuPharma plc (IMMPF) Income Statement Analysis – Financial Results

- TotalEnergies SE (TOTB.DE) Income Statement Analysis – Financial Results

- Esprinet S.p.A. (PRT.MI) Income Statement Analysis – Financial Results

- The Straits Trading Company Limited (STTSY) Income Statement Analysis – Financial Results

HeadHunter Group PLC (HHR)

About HeadHunter Group PLC

HeadHunter Group PLC, together with its subsidiaries, operates an online recruitment platform in Russia, Kazakhstan, Belarus, and internationally. The company offers employers and recruiters paid access to its curriculum vitae database and job postings platform; and job seekers and employers with value-added services. It provides its services for businesses that are looking for job seekers to fill vacancies inside their organizations. The company was formerly known as Zemenik Trading Limited and changed its name to HeadHunter Group PLC in March 2018. The company was founded in 2000 and is headquartered in Moscow, Russia.

| Metric | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2015 |

|---|---|---|---|---|---|---|---|

| Revenue | 18.09B | 15.97B | 8.28B | 7.79B | 6.12B | 4.73B | 3.10B |

| Cost of Revenue | 494.76M | 430.28M | 194.64M | 186.34M | 188.50M | 117.75M | 84.53M |

| Gross Profit | 17.59B | 15.54B | 8.09B | 7.60B | 5.93B | 4.62B | 3.02B |

| Gross Profit Ratio | 97.26% | 97.31% | 97.65% | 97.61% | 96.92% | 97.51% | 97.28% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 6.78B | 5.13B | 3.27B | 2.90B | 2.21B | 1.90B | 1.18B |

| Selling & Marketing | 2.41B | 2.11B | 1.11B | 1.05B | 939.72M | 693.25M | 222.24M |

| SG&A | 9.19B | 7.24B | 4.38B | 3.95B | 3.15B | 2.60B | 1.41B |

| Other Expenses | 1.48B | 1.34B | 868.61M | 850.54M | 676.51M | 0.00 | 0.00 |

| Operating Expenses | 10.67B | 8.59B | 5.25B | 4.80B | 3.83B | 3.23B | 1.55B |

| Cost & Expenses | 11.16B | 9.02B | 5.44B | 4.98B | 4.02B | 3.35B | 1.63B |

| Interest Income | 215.96M | 243.11M | 59.33M | 76.76M | 90.27M | 70.92M | 123.40M |

| Interest Expense | 795.36M | 659.58M | 409.55M | 603.28M | 644.33M | 706.04M | 0.00 |

| Depreciation & Amortization | 1.57B | 1.67B | 808.42M | 753.39M | 586.13M | 560.96M | 88.66M |

| EBITDA | 8.49B | 8.62B | 3.65B | 3.56B | 2.78B | 2.02B | 1.68B |

| EBITDA Ratio | 46.96% | 54.01% | 44.05% | 45.69% | 45.37% | 42.59% | 54.27% |

| Operating Income | 6.92B | 6.95B | 2.84B | 2.81B | 2.10B | 1.38B | 1.47B |

| Operating Income Ratio | 38.27% | 43.54% | 34.29% | 36.02% | 34.31% | 29.25% | 47.42% |

| Total Other Income/Expenses | -1.69B | -84.93M | -268.65M | -579.71M | -556.34M | -99.70M | 197.99M |

| Income Before Tax | 5.24B | 6.87B | 2.57B | 2.23B | 1.54B | 1.28B | 1.67B |

| Income Before Tax Ratio | 28.95% | 43.01% | 31.05% | 28.57% | 25.21% | 27.14% | 53.79% |

| Income Tax Expense | 1.54B | 1.37B | 685.77M | 644.42M | 509.60M | 820.83M | 393.82M |

| Net Income | 3.65B | 5.39B | 1.75B | 1.45B | 949.31M | 401.49M | 1.23B |

| Net Income Ratio | 20.19% | 33.76% | 21.12% | 18.59% | 15.52% | 8.48% | 39.51% |

| EPS | 72.65 | 106.75 | 0.00 | 28.96 | 18.99 | 8.00 | 24.52 |

| EPS Diluted | 70.86 | 103.96 | 0.00 | 28.42 | 18.99 | 8.00 | 24.52 |

| Weighted Avg Shares Out | 50.26M | 50.50M | 0.00 | 50.00M | 50.00M | 50.00M | 50.00M |

| Weighted Avg Shares Out (Dil) | 51.54M | 51.86M | 0.00 | 50.96M | 50.00M | 50.00M | 50.00M |

Si avvicina il 18° appuntamento CIEP per costruire una comunità di innovazione tecnologica globale

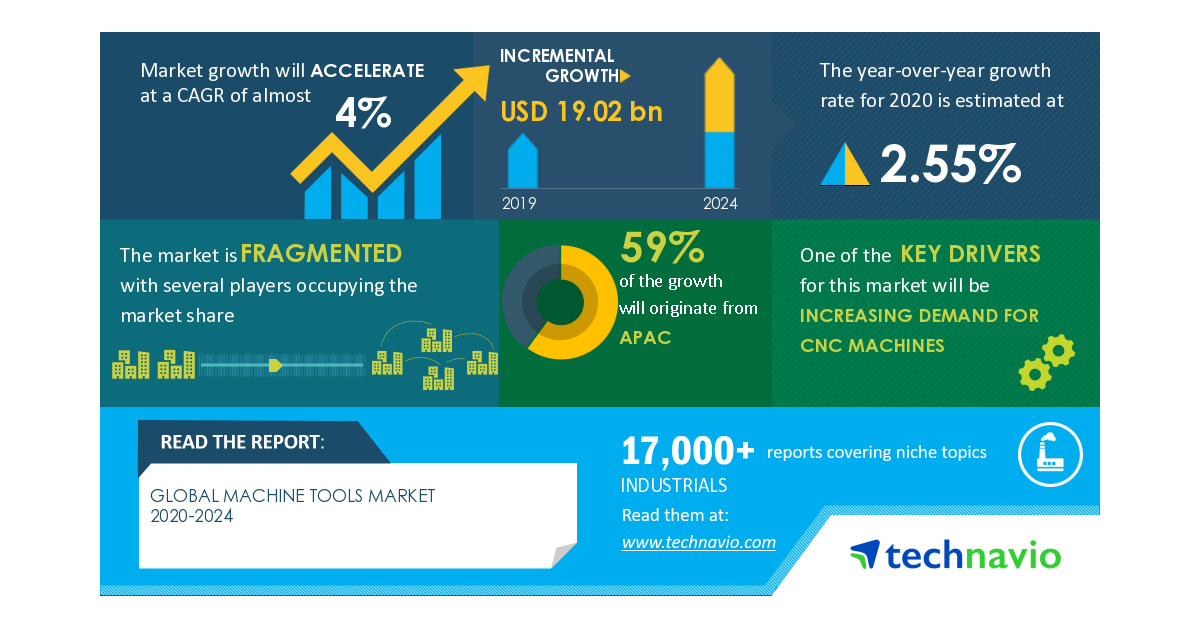

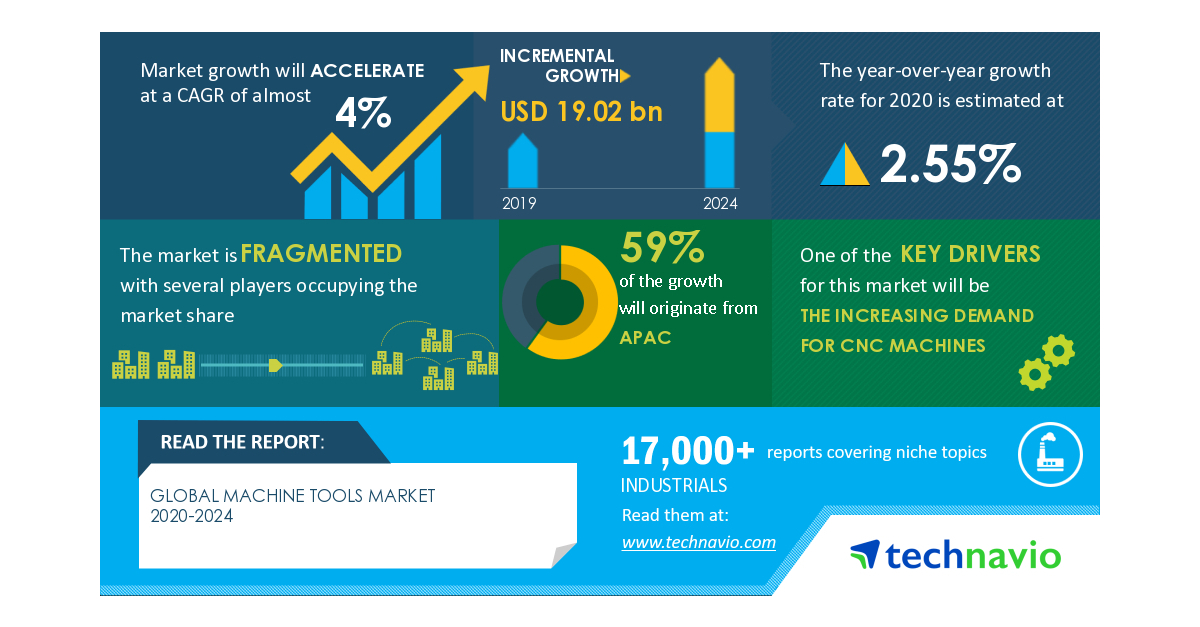

CNC Machine Tools Market 2020-2024 | Innovation in CNC Machines to Boost Growth | Technavio

Thomas Otter Joins Immedis Board of Directors

Thomas Otter Joins Immedis Board of Directors

Wells Fargo & Company MN Has $11.72 Million Stock Holdings in HeadHunter Group PLC (NYSE:HHR)

Zacks Investment Research Upgrades BOOHOO GRP PLC/ADR (OTCMKTS:BHOOY) to “Buy”

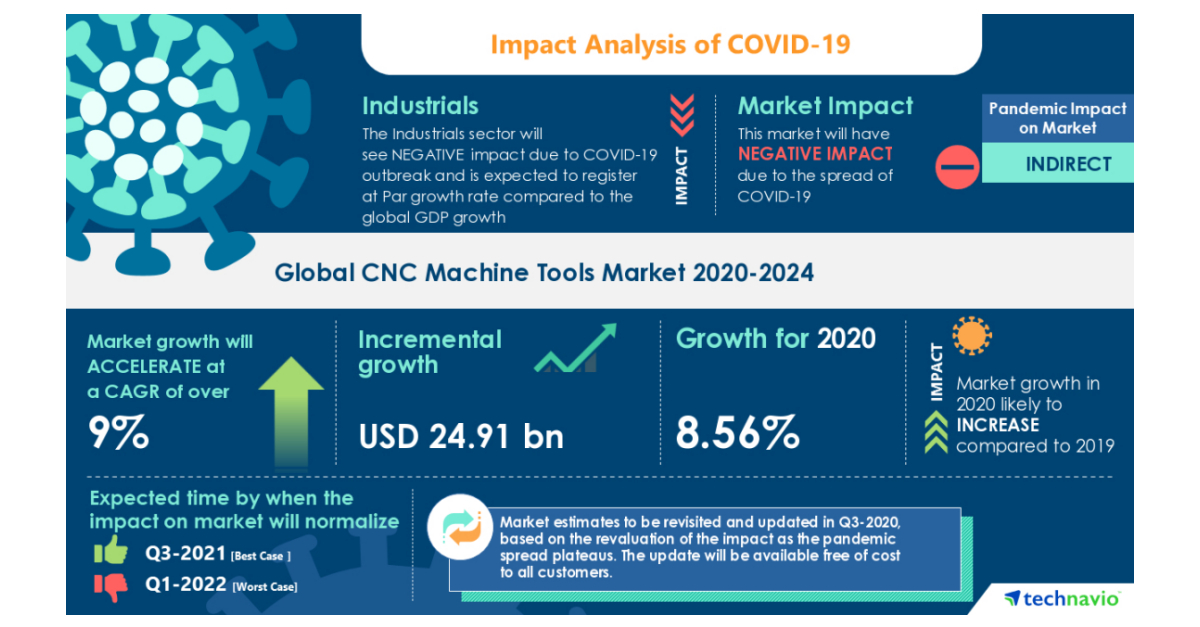

Burden of COVID-19 on the Market & Rehabilitation Plan | Machine Tools Market 2020-2024 | Increasing Demand for CNC Machines to Boost Growth | Technavio

COVID-19 Impact and Recovery Analysis- Global Machine Tools Market 2020-2024 | Increasing Demand for CNC Machines to Boost Growth | Technavio

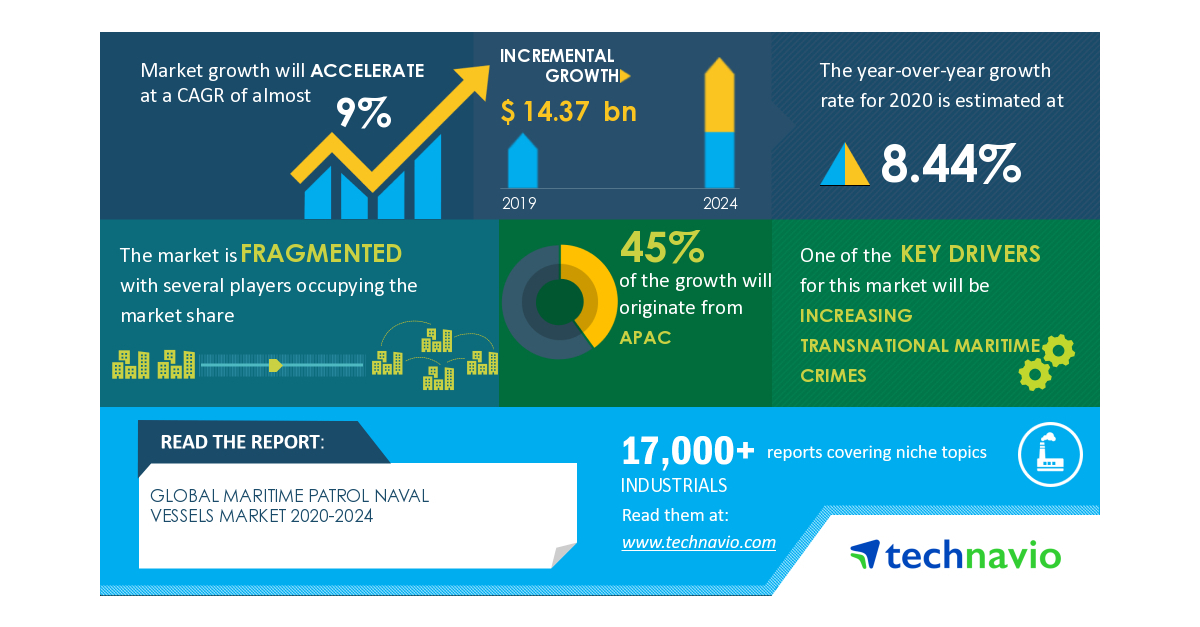

COVID-19 Impact and Recovery Analysis | Maritime Patrol Naval Vessels Market 2020-2024 | Increasing Transnational Maritime Crimes to Boost Growth | Technavio

Source: https://incomestatements.info

Category: Stock Reports