See more : Strategi Invest Aktier (WEISTA.CO) Income Statement Analysis – Financial Results

Complete financial analysis of Hailiang Education Group Inc. (HLG) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Hailiang Education Group Inc., a leading company in the Education & Training Services industry within the Consumer Defensive sector.

- Tofflon Science and Technology Group Co., Ltd. (300171.SZ) Income Statement Analysis – Financial Results

- Groupe Plus-Values SA (MLPVG.PA) Income Statement Analysis – Financial Results

- East Japan Railway Company (EJPRF) Income Statement Analysis – Financial Results

- Nagoya Railroad Co., Ltd. (9048.T) Income Statement Analysis – Financial Results

- Inui Global Logistics Co., Ltd. (9308.T) Income Statement Analysis – Financial Results

Hailiang Education Group Inc. (HLG)

Industry: Education & Training Services

Sector: Consumer Defensive

Website: https://www.hailiangedu.com

About Hailiang Education Group Inc.

Hailiang Education Group Inc. provides K-12 educational and management services in the People's Republic of China. The company operates 14 affiliated schools; and 27 managed schools. It offers K-12 student management, high school curriculum education, and operation and management services, including branding, academic management, education resources, school culture, admission, finance, human resources, procurement, IT, internal audit, and property and logistics management services, as well as after-school enrichment, accommodations, and transportation services. The company also provides ancillary educational services, such as well-rounded education, academic subject tutoring, study trip, and overseas study consulting services; and hotel management services. In addition, its schools offer basic educational and international programs at the primary school, middle school, and high school levels; courses designed for students, such as A-levels courses for the United Kingdom universities, AP courses for the United States universities, Victorian Certificate of Education (VCE) courses for Australian universities, and International Baccalaureate (IB) courses for various countries in the world; and language courses, including Japanese, Korean, and Spanish. As of June 30, 2021, the company had 10,402 students enrolled in its affiliated schools; and 43,897 students enrolled in its managed schools. Hailiang Education Group Inc. was founded in 1995 and is based in Hangzhou, the People's Republic of China.

| Metric | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 |

|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 1.38B | 1.48B | 1.50B | 1.17B | 853.30M | 654.06M | 514.79M | 462.75M | 436.99M | 349.60M |

| Cost of Revenue | 728.59M | 983.18M | 1.03B | 804.67M | 645.76M | 491.36M | 334.53M | 299.68M | 293.76M | 239.07M |

| Gross Profit | 647.20M | 499.42M | 472.12M | 364.67M | 207.54M | 162.70M | 180.26M | 163.07M | 143.23M | 110.53M |

| Gross Profit Ratio | 47.04% | 33.69% | 31.50% | 31.19% | 24.32% | 24.88% | 35.02% | 35.24% | 32.78% | 31.62% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 51.32M | 77.54M | 72.66M | 63.37M | 31.11M | 43.74M | 33.33M | 28.62M | 23.08M | 24.75M |

| Selling & Marketing | 29.74M | 26.90M | 25.00M | 24.54M | 21.90M | 16.75M | 15.54M | 15.64M | 17.63M | 16.30M |

| SG&A | 81.06M | 104.44M | 97.66M | 87.91M | 53.01M | 60.49M | 48.87M | 44.26M | 40.71M | 41.05M |

| Other Expenses | -46.63M | -72.78M | -25.44M | -5.83M | -6.33M | -1.76M | -2.46M | -1.79M | -4.09M | -4.05M |

| Operating Expenses | 34.43M | 31.66M | 72.23M | 82.08M | 46.69M | 58.74M | 46.41M | 42.47M | 36.62M | 37.00M |

| Cost & Expenses | 763.01M | 1.01B | 1.10B | 886.76M | 692.44M | 550.09M | 380.94M | 342.15M | 330.38M | 276.06M |

| Interest Income | 35.99M | 24.83M | 24.47M | 11.72M | 6.71M | 4.91M | 7.23M | 20.15M | 17.19M | 11.79M |

| Interest Expense | 1.15M | 4.36M | 465.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 169.73M | 165.83M | 133.52M | 113.57M | 111.15M | 65.99M | 26.19M | 25.05M | 24.88M | 22.77M |

| EBITDA | 571.33M | 662.95M | 536.12M | 402.45M | 278.89M | 165.42M | 167.18M | 165.72M | 148.07M | 105.80M |

| EBITDA Ratio | 41.53% | 44.72% | 35.76% | 34.42% | 32.68% | 25.29% | 32.48% | 35.81% | 33.88% | 30.26% |

| Operating Income | 612.78M | 467.77M | 399.56M | 280.45M | 160.85M | 108.87M | 133.85M | 120.61M | 106.62M | 73.53M |

| Operating Income Ratio | 44.54% | 31.55% | 26.65% | 23.98% | 18.85% | 16.65% | 26.00% | 26.06% | 24.40% | 21.03% |

| Total Other Income/Expenses | 34.69M | 20.76M | 24.94M | 16.74M | 6.89M | 5.75M | 7.15M | 20.07M | 16.58M | 11.58M |

| Income Before Tax | 647.47M | 488.52M | 424.49M | 297.19M | 167.74M | 99.43M | 140.99M | 140.67M | 123.19M | 85.12M |

| Income Before Tax Ratio | 47.06% | 32.95% | 28.32% | 25.42% | 19.66% | 15.20% | 27.39% | 30.40% | 28.19% | 24.35% |

| Income Tax Expense | 165.36M | 121.92M | 108.71M | 66.29M | 6.89M | 5.75M | 7.15M | 20.07M | 16.58M | 11.58M |

| Net Income | 235.09M | 370.83M | 293.42M | 222.59M | 167.74M | 99.43M | 140.99M | 140.67M | 123.19M | 83.03M |

| Net Income Ratio | 17.09% | 25.01% | 19.57% | 19.04% | 19.66% | 15.20% | 27.39% | 30.40% | 28.19% | 23.75% |

| EPS | 9.12 | 14.39 | 11.38 | 8.63 | 6.53 | 3.88 | 5.82 | 5.48 | 4.80 | 3.23 |

| EPS Diluted | 9.12 | 14.39 | 11.38 | 8.63 | 6.53 | 3.88 | 5.82 | 5.48 | 4.80 | 3.23 |

| Weighted Avg Shares Out | 25.78M | 25.78M | 25.78M | 25.78M | 25.70M | 25.65M | 24.24M | 25.67M | 25.67M | 25.67M |

| Weighted Avg Shares Out (Dil) | 25.78M | 25.78M | 25.78M | 25.78M | 25.70M | 25.65M | 24.24M | 25.67M | 25.67M | 25.67M |

Hailiang Education and China's Authoritative Official Media Jointly Introduced the Non-Profit Cloud Classroom; the First Lecture Attracted More Than One Million People

Hailiang Education Group (NASDAQ:HLG) Cut to "Sell" at BidaskClub

Hailiang Education Group (NASDAQ:HLG) Upgraded to Hold by BidaskClub

Critical Review: RISE Education Cayman (NASDAQ:REDU) and Hailiang Education Group (NASDAQ:HLG)

Analyzing Hailiang Education Group (NASDAQ:HLG) & BioHiTech Global (NASDAQ:BHTG)

Coronavirus is slowing LCD production, and TV and monitor prices are expected to climb as a result

Hailiang Education Group (NASDAQ:HLG) Rating Increased to Sell at BidaskClub

Breakout Watch: Chegg Resets Base Count, Nears New Buy After 474% Run

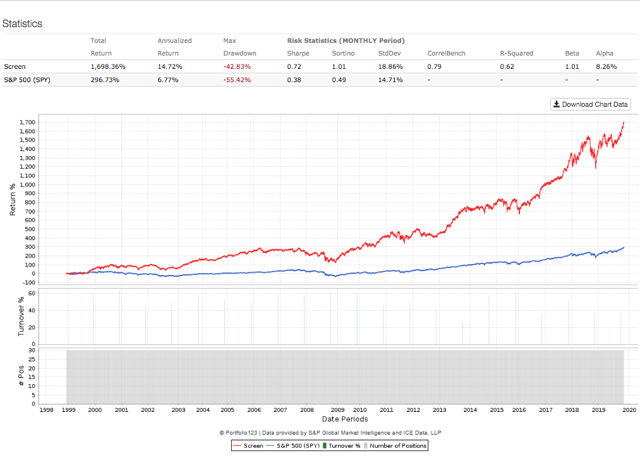

Screening For High-Quality Stocks With Superior Profitability

Hailiang Education Group Inc. (HLG): Are Hedge Funds Right About This Stock?

Source: https://incomestatements.info

Category: Stock Reports