See more : Motivating the Masses, Inc. (MNMT) Income Statement Analysis – Financial Results

Complete financial analysis of ICC Holdings, Inc. (ICCH) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of ICC Holdings, Inc., a leading company in the Insurance – Specialty industry within the Financial Services sector.

- FSP Technology Inc. (3015.TW) Income Statement Analysis – Financial Results

- Peab AB (publ) (PEAB-B.ST) Income Statement Analysis – Financial Results

- Kuo Toong International Co., Ltd. (8936.TWO) Income Statement Analysis – Financial Results

- Entergy Corporation (ETR) Income Statement Analysis – Financial Results

- Chijet Motor Company, Inc. (CJET) Income Statement Analysis – Financial Results

ICC Holdings, Inc. (ICCH)

About ICC Holdings, Inc.

ICC Holdings, Inc., together with its subsidiaries, provides property and casualty insurance products to the food and beverage industry in the United States. The company offers commercial multi-peril, liquor liability, workers' compensation, and umbrella liability insurance products. It markets its products through a network of 186 independent agents in Arizona, Colorado, Illinois, Indiana, Iowa, Kansas, Minnesota, Michigan, Missouri, Ohio, Oregon, Pennsylvania, Tennessee, Utah, and Wisconsin. ICC Holdings, Inc. was founded in 1950 and is headquartered in Rock Island, Illinois.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 |

|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 82.94M | 69.68M | 61.44M | 54.88M | 59.52M | 51.16M | 48.18M | 44.87M | 41.82M | 39.83M |

| Cost of Revenue | 1.78B | 1.73B | 1.68B | 1.44B | 1.75B | 18.21B | 17.31B | 0.00 | 0.00 | 0.00 |

| Gross Profit | -1.70B | -1.66B | -1.62B | -1.39B | -1.69B | -18.16B | -17.26B | 44.87M | 41.82M | 39.83M |

| Gross Profit Ratio | -2,047.77% | -2,386.35% | -2,629.37% | -2,523.84% | -2,838.53% | -35,501.39% | -35,824.37% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 784.31K | 776.75K | 723.35K | 641.76K | 579.71K | 545.99K | 555.11K | 464.38K | 314.12K | 263.48K |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 784.31K | 776.75K | 723.35K | 641.76K | 579.71K | 545.99K | 555.11K | 464.38K | 314.12K | 263.48K |

| Other Expenses | 82.16M | 1.77M | -57.55M | -50.71M | -54.97M | -50.57M | 17.26B | -41.35M | -39.12M | -37.73M |

| Operating Expenses | 82.94M | 1.77M | -56.83M | -50.07M | -54.39M | -50.02M | 17.26B | -40.88M | -38.81M | -37.47M |

| Cost & Expenses | 82.94M | 70.40M | 56.48M | 50.30M | 54.44M | 50.16M | 47.09M | 40.88M | 38.81M | 37.47M |

| Interest Income | 0.00 | 196.07K | 235.00K | 207.72K | 128.79K | 0.00 | 0.00 | 0.00 | 2.33M | 2.15M |

| Interest Expense | 184.12K | 196.07K | 235.00K | 207.72K | 128.79K | 140.88K | 225.38K | 226.10K | 136.30K | 133.78K |

| Depreciation & Amortization | 763.82K | 693.07K | 708.38K | 684.74K | 794.51K | 733.49K | 822.62K | 817.77K | 505.56K | 511.29K |

| EBITDA | 6.47M | 167.31K | 5.32M | 5.47M | 5.93M | 1.87M | 2.13M | 5.03M | 3.66M | 3.01M |

| EBITDA Ratio | 7.80% | -0.75% | 8.65% | 10.01% | 9.96% | 3.66% | 4.42% | 11.21% | 8.75% | 7.56% |

| Operating Income | 0.00 | -1.22M | 4.61M | 4.81M | 5.13M | 1.14M | 1.09M | 3.99M | 3.02M | 2.36M |

| Operating Income Ratio | 0.00% | -1.75% | 7.50% | 8.76% | 8.63% | 2.23% | 2.26% | 8.89% | 7.21% | 5.94% |

| Total Other Income/Expenses | 5.52M | -196.07K | 1.56B | 1.43M | 1.65B | -140.88K | -225.38K | -226.10K | -136.30K | -133.78K |

| Income Before Tax | 5.52M | -721.83K | 4.96M | 4.58M | 5.08M | 999.38K | 1.09M | 3.99M | 3.02M | 2.36M |

| Income Before Tax Ratio | 6.66% | -1.04% | 8.07% | 8.34% | 8.54% | 1.95% | 2.26% | 8.89% | 7.21% | 5.94% |

| Income Tax Expense | 1.27M | -250.48K | 667.73K | 1.05M | 787.22K | 106.09K | 372.29K | 1.18M | 861.74K | 779.15K |

| Net Income | 4.26M | -471.34K | 4.14M | 3.53M | 4.29M | 893.30K | 716.76K | 2.81M | 2.15M | 1.59M |

| Net Income Ratio | 5.13% | -0.68% | 6.74% | 6.43% | 7.21% | 1.75% | 1.49% | 6.26% | 5.15% | 3.98% |

| EPS | 1.44 | -0.16 | 1.36 | 1.17 | 1.43 | 0.29 | 0.22 | 0.80 | 0.62 | 0.45 |

| EPS Diluted | 1.43 | -0.16 | 1.35 | 1.16 | 1.42 | 0.29 | 0.22 | 0.80 | 0.62 | 0.45 |

| Weighted Avg Shares Out | 2.95M | 3.03M | 3.05M | 3.03M | 3.01M | 3.12M | 3.16M | 3.50M | 3.50M | 3.50M |

| Weighted Avg Shares Out (Dil) | 2.97M | 3.03M | 3.07M | 3.04M | 3.01M | 3.12M | 3.16M | 3.50M | 3.50M | 3.50M |

ICC becomes leading sports body for Facebook video views in 2020

India remain hosts for ICC 2021 T20 World Cup, Australia to hold 2022 edition

Women's World Cup postponed until 2022 due to coronavirus pandemic

India to host T20 World Cup in 2021: ICC

England v Pakistan: first Test, day three – live!

T20 World Cup: India retain hosting rights for 2021, 2022 edition in Australia

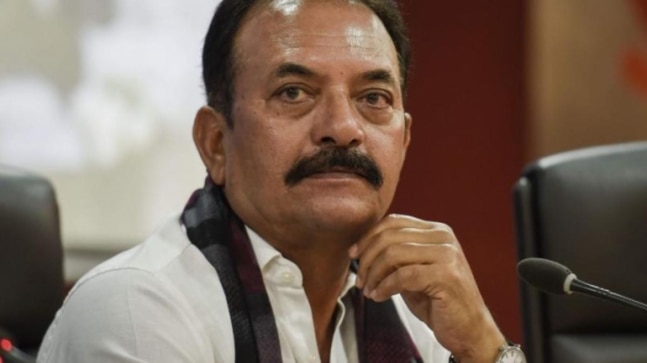

Lot of Pakistan players don't think before speaking: Madan Lal on claims of BCCI role in T20 World Cup delay

Our channel most viewed among sporting bodies with 1.65 bn views: ICC

ICC Says Video Channel Most Viewed Among Sporting Bodies

The Latest: ICC reports surge in video views during pandemic

Source: https://incomestatements.info

Category: Stock Reports