See more : 3 Sixty Risk Solutions Ltd. (SAYFF) Income Statement Analysis – Financial Results

Complete financial analysis of IperionX Limited (IPX) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of IperionX Limited, a leading company in the Industrial Materials industry within the Basic Materials sector.

- Konecranes Plc (KCR.HE) Income Statement Analysis – Financial Results

- Capital & Regional Plc (CRPLF) Income Statement Analysis – Financial Results

- Matinas BioPharma Holdings, Inc. (MTNB) Income Statement Analysis – Financial Results

- Pluri Inc. (PLUR) Income Statement Analysis – Financial Results

- Worksport Ltd. (WKSPW) Income Statement Analysis – Financial Results

IperionX Limited (IPX)

About IperionX Limited

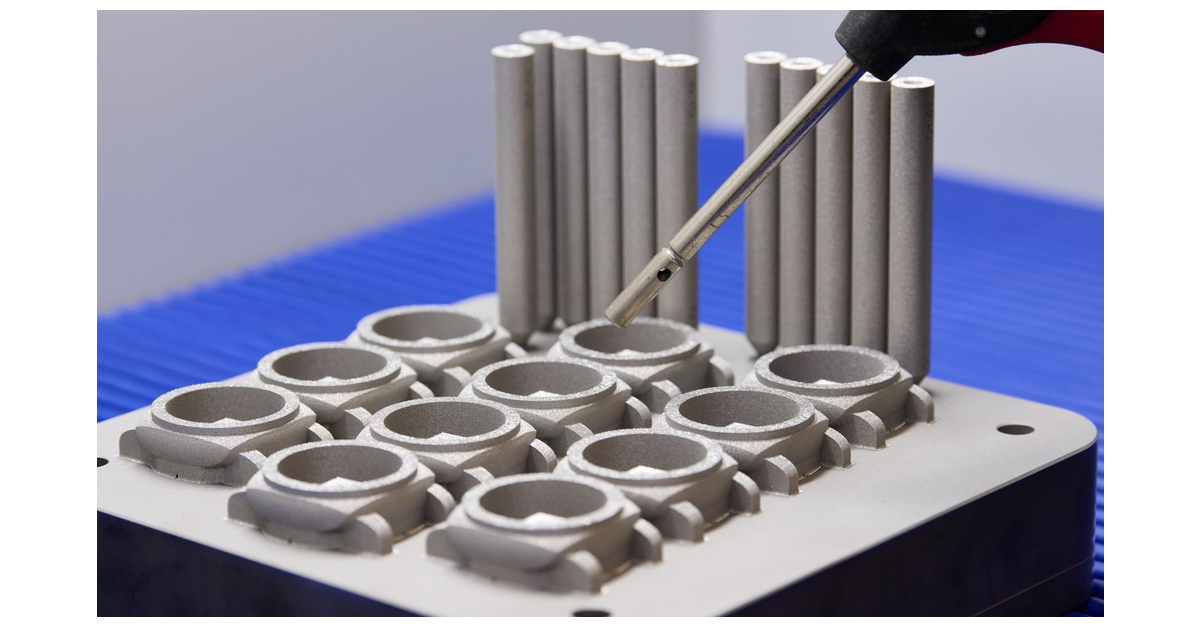

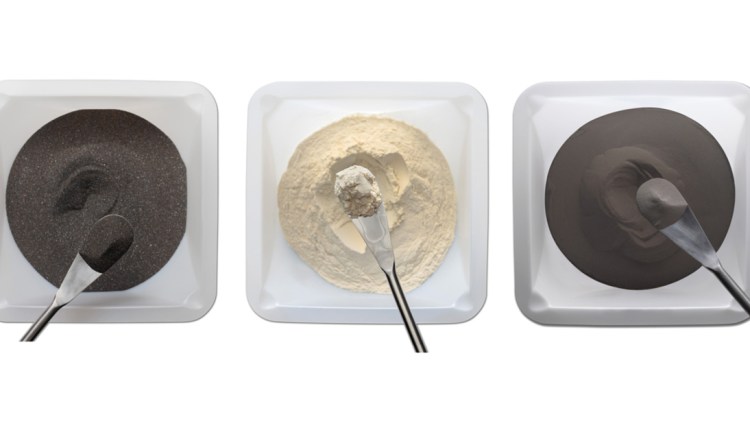

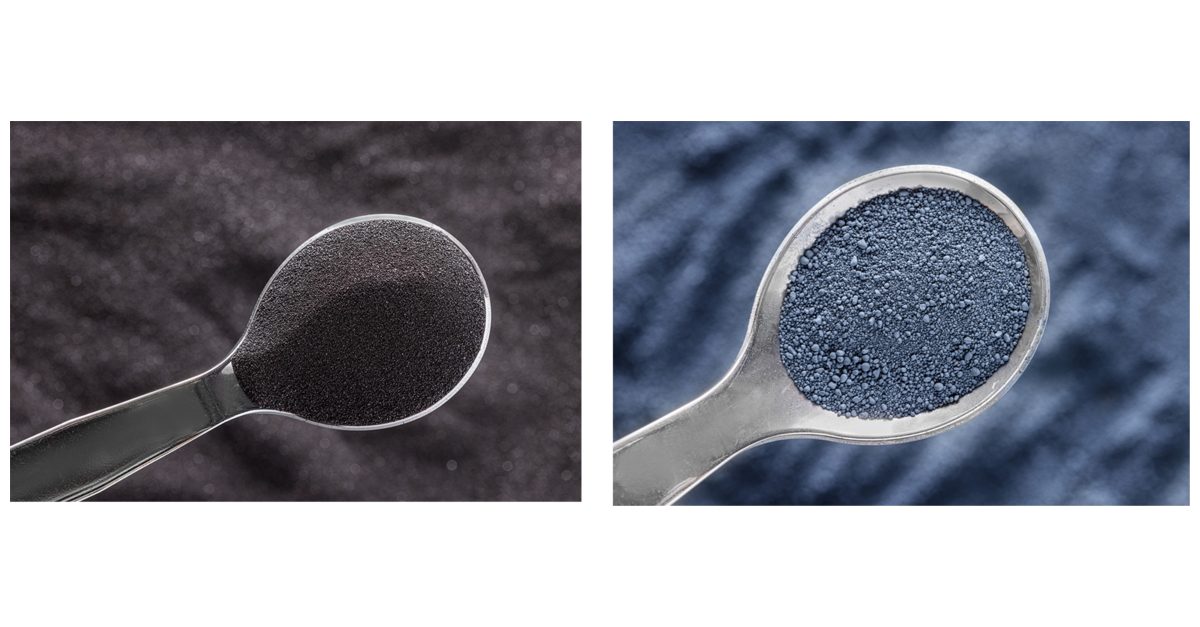

IperionX Limited engages in the exploration and development of mineral properties. It explores for epithermal and replacement style precious and base metal mineralization, as well as titanium, rare earth elements, silica sand, and zircon minerals. The company holds a 100% interest in the Milford project that includes 101 claims located in Utah, the United States. It also holds a 100% interest in Titan project covering an area of approximately 6,000 acres situated in Tennessee, the United States. The company was formerly known as Hyperion Metals Limited and changed its name to IperionX Limited in February 2022. IperionX Limited was incorporated in 2017 and is headquartered in Charlotte, North Carolina.

| Metric | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|---|---|---|

| Revenue | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Cost of Revenue | 657.16K | 634.11K | 211.58K | 9.38K | 22.73K | 0.00 | 0.00 | 0.00 |

| Gross Profit | -657.16K | -634.11K | -211.58K | -9.38K | -22.73K | 0.00 | 0.00 | 0.00 |

| Gross Profit Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Research & Development | 8.87M | 8.33M | 3.21M | 180.19K | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 0.00 | 6.58M | 11.40M | 3.71M | 365.91K | 398.37K | 711.26K | 0.00 |

| Selling & Marketing | 0.00 | 10.72M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 13.49M | 17.30M | 11.40M | 3.71M | 365.91K | 398.37K | 711.26K | 73.55K |

| Other Expenses | 0.00 | 60.47K | 0.00 | -3.86M | 17.79K | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 22.36M | 25.62M | 21.87M | 9.93M | 381.53K | 398.37K | 711.26K | 73.55K |

| Cost & Expenses | 23.01M | 26.26M | 21.87M | 9.93M | 381.53K | 398.37K | 711.26K | 73.55K |

| Interest Income | 555.59K | 207.68K | 24.04K | 3.81K | 10.78K | 21.58K | 1.62K | 0.00 |

| Interest Expense | 124.88K | 131.03K | 45.54K | 5.62K | 3.31K | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 657.16K | 634.11K | 211.58K | 9.38K | 22.73K | 120.14K | 118.61K | 40.20K |

| EBITDA | -21.44M | -25.62M | -29.39M | -13.30M | -490.94K | -398.37K | -711.26K | -73.56K |

| EBITDA Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Operating Income | -23.01M | -26.26M | -21.85M | -9.93M | -352.96K | -398.37K | -711.26K | -73.56K |

| Operating Income Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Total Other Income/Expenses | 787.17K | 322.31K | 480.94K | -3.39M | 38.28K | -139.64K | 2.21K | 2.30 |

| Income Before Tax | -22.23M | -25.93M | -21.52M | -9.93M | -355.23K | -376.79K | -709.64K | -73.55K |

| Income Before Tax Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Income Tax Expense | 912.05K | -2.00 | 45.54K | -9.38K | 20.06K | -120.14K | -118.61K | -40.20K |

| Net Income | -22.23M | -25.93M | -21.52M | -9.93M | -355.23K | -376.79K | -709.64K | -73.55K |

| Net Income Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| EPS | -0.10 | -0.15 | -0.16 | -0.08 | 0.00 | 0.00 | -0.01 | -0.31 |

| EPS Diluted | -0.10 | -0.15 | -0.16 | -0.08 | 0.00 | 0.00 | -0.01 | -0.31 |

| Weighted Avg Shares Out | 217.84M | 168.03M | 134.61M | 132.03M | 132.03M | 132.03M | 132.03M | 237.50K |

| Weighted Avg Shares Out (Dil) | 217.84M | 168.03M | 134.61M | 132.03M | 132.03M | 132.03M | 132.03M | 237.50K |

IperionX & Panerai Partner to Develop Sustainable Luxury Goods

IperionX Produces Titanium Metal From Tennessee Minerals

IperionX Produces Titanium Metal From Tennessee Minerals

IperionX Successfully Develops Low Carbon Titanium Enrichment Process

IperionX and Oak Ridge National Laboratory Technical Collaboration

IperionX and Oak Ridge National Laboratory Technical Collaboration

IperionX Company Presentation – Scoping Study Update

IperionX Company Presentation – Scoping Study Update

IperionX – Titan Project Scoping Study

IperionX Company Presentation – NASDAQ Listing

Source: https://incomestatements.info

Category: Stock Reports