See more : Santander Bank Polska S.A. (BKZHF) Income Statement Analysis – Financial Results

Complete financial analysis of IT Tech Packaging, Inc. (ITP) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of IT Tech Packaging, Inc., a leading company in the Paper, Lumber & Forest Products industry within the Basic Materials sector.

- RenetJapanGroup,Inc. (3556.T) Income Statement Analysis – Financial Results

- Brookfield Renewable Partners L.P. (BRENF) Income Statement Analysis – Financial Results

- Raute Oyj (RAUTE.HE) Income Statement Analysis – Financial Results

- MultiChoice Group Limited (MCHOY) Income Statement Analysis – Financial Results

- ShanDongDenghai Seeds Co.,Ltd (002041.SZ) Income Statement Analysis – Financial Results

IT Tech Packaging, Inc. (ITP)

About IT Tech Packaging, Inc.

IT Tech Packaging, Inc., through its subsidiaries, engages in the production and distribution of paper products in the People's Republic of China. The company offers corrugating medium papers to companies making corrugating cardboards; and offset printing papers to printing companies. It also provides tissue paper products, including toilet papers, boxed and soft-packed tissues, handkerchief tissues, and paper napkins, as well as bathroom and kitchen paper towels under the Dongfang Paper brand. In addition, the company produces and sells non-medical single-use face masks, and medical face masks. The company was formerly known as Orient Paper, Inc. and changed its name to IT Tech Packaging, Inc. in August 2018. IT Tech Packaging, Inc. was founded in 1996 and is headquartered in Baoding, the People's' Republic of China.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 86.55M | 100.35M | 160.88M | 100.94M | 117.61M | 86.75M | 117.02M | 134.74M | 135.30M | 137.04M | 125.72M | 151.12M | 150.75M | 123.99M | 102.14M | 65.20M | 39.71M | 30.56M |

| Cost of Revenue | 85.55M | 95.60M | 149.86M | 95.24M | 103.94M | 80.93M | 97.07M | 109.21M | 107.44M | 114.26M | 102.39M | 124.06M | 117.80M | 97.81M | 82.11M | 52.64M | 33.10M | 25.23M |

| Gross Profit | 999.89K | 4.75M | 11.02M | 5.70M | 13.68M | 5.82M | 19.96M | 25.53M | 27.86M | 22.78M | 23.33M | 27.06M | 32.95M | 26.18M | 20.04M | 12.56M | 6.61M | 5.33M |

| Gross Profit Ratio | 1.16% | 4.74% | 6.85% | 5.65% | 11.63% | 6.71% | 17.05% | 18.95% | 20.59% | 16.62% | 18.55% | 17.90% | 21.86% | 21.11% | 19.61% | 19.26% | 16.64% | 17.44% |

| Research & Development | 90.77K | 145.54K | 101.41K | 69.21K | 74.83K | 30.19K | 31.92K | 21.60K | 28.45K | 20.28K | 25.13K | 21.64K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 11.31M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 273.94K | 292.83K |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 8.98M | 10.06M | 9.56M | 11.16M | 9.78M | 13.10M | 11.31M | 12.40M | 9.66M | 4.86M | 4.57M | 3.36M | 2.52M | 3.07M | 2.03M | 327.83K | 273.94K | 292.83K |

| Other Expenses | 0.00 | 0.00 | -198.53K | -220.48K | -261.14K | 241.19K | 41.53K | 0.00 | 555.61K | 22.61K | 171.13K | 0.00 | 0.00 | 1.12M | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 9.08M | 10.06M | 9.36M | 10.94M | 9.52M | 12.86M | 11.27M | 12.40M | 9.11M | 4.84M | 4.40M | 3.36M | 2.52M | 4.19M | 2.03M | 327.83K | 273.94K | 292.83K |

| Cost & Expenses | 94.62M | 105.66M | 159.22M | 106.18M | 113.46M | 93.78M | 108.33M | 121.61M | 116.55M | 119.10M | 106.79M | 127.42M | 120.31M | 102.00M | 84.14M | 52.97M | 33.37M | 25.52M |

| Interest Income | 315.10K | 24.26K | 38.77K | 32.03K | 64.72K | 36.63K | 34.59K | 96.98K | 70.32K | 149.78K | 90.26K | 30.67K | 36.44K | 163.18K | 108.61K | 65.32K | 3.35K | 0.00 |

| Interest Expense | 984.52K | 1.03M | 1.12M | 1.03M | 926.37K | 1.49M | 2.43M | 2.62M | 3.16M | 1.45M | 995.69K | 871.83K | 699.89K | 633.01K | 728.43K | 598.47K | 272.20K | 275.23K |

| Depreciation & Amortization | 14.23M | 14.79M | 15.36M | 15.79M | 15.30M | 14.29M | 14.63M | 15.29M | 13.40M | 8.29M | 7.79M | 8.38M | 4.42M | 4.15M | 3.51M | 3.84M | 2.95M | 1.87M |

| EBITDA | 5.61M | 10.96M | 22.94M | 10.16M | 19.53M | 3.39M | 19.39M | 28.34M | 32.22M | 25.87M | 26.90M | 29.39M | 34.57M | 26.30M | 21.62M | 16.14M | 9.29M | 8.98K |

| EBITDA Ratio | 6.48% | 9.47% | 10.60% | 10.49% | 16.60% | 8.40% | 19.96% | 21.16% | 23.81% | 19.25% | 21.33% | 21.25% | 23.15% | 21.21% | 21.17% | 24.75% | 23.39% | 22.61% |

| Operating Income | -9.58M | -5.28M | 1.46M | -5.20M | 3.90M | -11.18M | 4.68M | 12.95M | 18.20M | 17.41M | 18.84M | 20.98M | 30.11M | 21.99M | 18.01M | 12.23M | 6.33M | 5.04M |

| Operating Income Ratio | -11.06% | -5.26% | 0.91% | -5.15% | 3.31% | -12.89% | 4.00% | 9.61% | 13.45% | 12.71% | 14.99% | 13.88% | 19.97% | 17.73% | 17.63% | 18.76% | 15.95% | 16.49% |

| Total Other Income/Expenses | -23.19K | 444.56K | 4.99M | -1.20M | -600.52K | -5.12M | -6.33M | -2.70M | -2.53M | -1.78M | -649.34K | -841.49K | -984.66K | -469.83K | -619.82K | -533.16K | -272.20K | -8.98K |

| Income Before Tax | -9.60M | -4.86M | 6.45M | -6.66M | 3.30M | -12.40M | 2.32M | 10.43M | 15.67M | 16.14M | 18.11M | 20.14M | 29.45M | 21.52M | 17.39M | 11.70M | 6.06M | 4.76M |

| Income Before Tax Ratio | -11.09% | -4.84% | 4.01% | -6.59% | 2.80% | -14.29% | 1.98% | 7.74% | 11.58% | 11.78% | 14.40% | 13.33% | 19.53% | 17.35% | 17.02% | 17.94% | 15.27% | 15.57% |

| Income Tax Expense | 346.95K | 11.71M | 5.55M | -1.10M | 1.08M | -1.85M | 662.83K | 3.11M | 4.12M | 4.43M | 5.09M | 5.46M | 7.80M | 5.96M | 4.67M | 2.92M | 2.00M | 1.57M |

| Net Income | -9.95M | -16.57M | 905.54K | -5.55M | 2.22M | -10.55M | 1.66M | 7.31M | 11.54M | 11.71M | 13.01M | 14.67M | 21.65M | 15.55M | 12.72M | 8.77M | 4.06M | 3.19M |

| Net Income Ratio | -11.49% | -16.51% | 0.56% | -5.50% | 1.89% | -12.16% | 1.42% | 5.43% | 8.53% | 8.54% | 10.35% | 9.71% | 14.36% | 12.54% | 12.45% | 13.46% | 10.23% | 10.45% |

| EPS | -0.99 | -1.66 | 0.15 | -2.10 | 1.01 | -4.90 | 0.80 | 3.40 | 5.70 | 6.10 | 7.10 | 7.90 | 11.80 | 8.90 | 10.40 | 7.70 | 4.00 | 4.23 |

| EPS Diluted | -0.99 | -1.66 | 0.15 | -2.10 | 1.01 | -4.88 | 0.80 | 3.40 | 5.70 | 6.10 | 7.10 | 7.90 | 11.80 | 8.90 | 10.40 | 7.70 | 4.00 | 4.23 |

| Weighted Avg Shares Out | 10.07M | 9.97M | 5.98M | 2.65M | 2.20M | 2.15M | 2.15M | 2.14M | 2.03M | 1.93M | 1.85M | 1.85M | 1.83M | 1.74M | 1.22M | 1.08M | 1.00M | 754.53K |

| Weighted Avg Shares Out (Dil) | 10.07M | 9.97M | 5.98M | 2.65M | 2.20M | 2.16M | 2.15M | 2.14M | 2.03M | 1.93M | 1.85M | 1.85M | 1.83M | 1.74M | 1.22M | 1.08M | 1.00M | 754.53K |

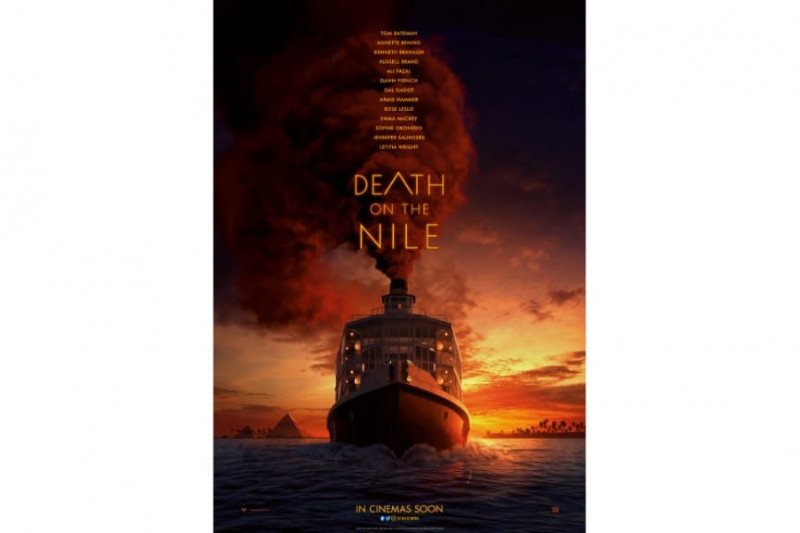

Petualangan Hercule Poirot berlanjut di film "Death on the Nile"

Nova Measuring Instruments (NASDAQ:NVMI) Stock Rating Upgraded by Zacks Investment Research

Compass Minerals International (NYSE:CMP) Trading Up 7.4% on Earnings Beat

Nova Measuring Instruments' (NVMI) CEO Eitan Oppenhaim on Q2 2020 Results - Earnings Call Transcript

Compass Minerals Posts Strong Second-Quarter 2020 Earnings Growth

Oregon Public Employees Retirement Fund Decreases Stock Holdings in Compass Minerals International, Inc. (NYSE:CMP)

FY2020 Earnings Forecast for IT Tech Packaging (NASDAQ:TFII) Issued By National Bank Financial

Compass Minerals International (CMP) Set to Announce Quarterly Earnings on Tuesday

Guest column: The case for local ownership of Maine power delivery

Compass Minerals International, Inc. (NYSE:CMP) Expected to Post Earnings of -$0.20 Per Share

Source: https://incomestatements.info

Category: Stock Reports