See more : Tokens.com Corp. (COIN.V) Income Statement Analysis – Financial Results

Complete financial analysis of SEALSQ Corp (LAES) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of SEALSQ Corp, a leading company in the Semiconductors industry within the Technology sector.

- La Comer, S.A.B. de C.V. (LCMRF) Income Statement Analysis – Financial Results

- TC Energy Corporation (TRP) Income Statement Analysis – Financial Results

- Gix Internet Ltd (GIX.TA) Income Statement Analysis – Financial Results

- B. Riley Financial, Inc. (RILYH) Income Statement Analysis – Financial Results

- IRPC Public Company Limited (IRPSY) Income Statement Analysis – Financial Results

SEALSQ Corp (LAES)

About SEALSQ Corp

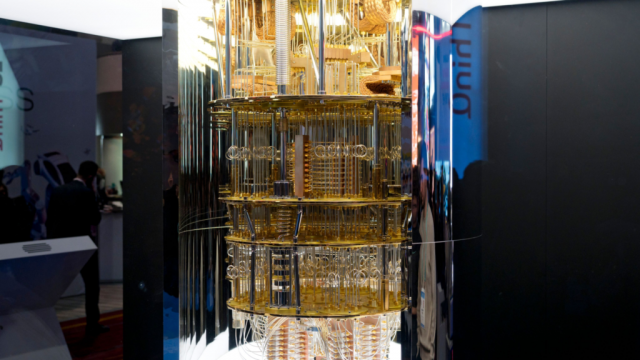

SEALSQ Corp develops and sells semiconductor chips for private and public sectors. The company offers semiconductors and smart card reader chips; identity provisioning services; and managed PKI for IoT solutions. It serves consumer electronics, aerospace and military, satellite and telecommunications, smart energy and smart building, smart industries, logistics, medical, and consumer industries. SEALSQ Corp was incorporated in 2022 and is based in Cointrin, Switzerland. SEALSQ Corp is a subsidiary of WISeKey International Holding AG.

| Metric | 2023 | 2022 | 2021 | 2020 |

|---|---|---|---|---|

| Revenue | 30.06M | 23.20M | 17.00M | 14.32M |

| Cost of Revenue | 16.01M | 13.40M | 9.85M | 8.88M |

| Gross Profit | 14.05M | 9.80M | 7.15M | 5.43M |

| Gross Profit Ratio | 46.74% | 42.24% | 42.05% | 37.95% |

| Research & Development | 3.95M | 2.31M | 3.05M | 4.13M |

| General & Administrative | 8.64M | 3.09M | 7.64M | 9.46M |

| Selling & Marketing | 5.65M | 3.82M | 4.25M | 3.10M |

| SG&A | 14.29M | 6.92M | 11.89M | 12.56M |

| Other Expenses | -48.00K | -4.00K | -94.00K | 1.00K |

| Operating Expenses | 18.19M | 7.22M | 14.85M | 16.69M |

| Cost & Expenses | 34.20M | 20.62M | 24.70M | 25.57M |

| Interest Income | 88.00K | 9.00K | 0.00 | 8.00K |

| Interest Expense | 987.00K | 605.00K | 168.00K | 9.00K |

| Depreciation & Amortization | 570.00K | 427.20K | 1.68M | 3.03M |

| EBITDA | -1.49M | 3.71M | -3.41M | -6.75M |

| EBITDA Ratio | -4.94% | 12.91% | -36.82% | -58.66% |

| Operating Income | -4.14M | 2.58M | -7.70M | -11.26M |

| Operating Income Ratio | -13.78% | 11.13% | -45.31% | -78.61% |

| Total Other Income/Expenses | 1.10M | -58.00K | -232.08K | -1.21M |

| Income Before Tax | -3.04M | 2.53M | -7.48M | -11.87M |

| Income Before Tax Ratio | -10.12% | 10.88% | -44.02% | -82.88% |

| Income Tax Expense | 225.00K | -3.25M | 6.00K | 5.00K |

| Net Income | -3.27M | 5.77M | -7.49M | -11.87M |

| Net Income Ratio | -10.87% | 24.87% | -44.05% | -82.92% |

| EPS | -0.24 | 0.38 | -0.49 | -0.78 |

| EPS Diluted | -0.24 | 0.38 | -0.49 | -0.78 |

| Weighted Avg Shares Out | 15.30M | 15.13M | 15.13M | 15.13M |

| Weighted Avg Shares Out (Dil) | 15.30M | 15.13M | 15.13M | 15.13M |

SEALSQ to Participate in Northland Growth Conference

SEALSQ to Launch Two New Quantum Resistant Chips

SEALSQ, WISeKey and The Hashgraph Association Join Forces to Bring Secure IoT and DePIN solutions to Saudi Arabia

SEALSQ Enhances Security of Electric Vehicle (EV) Charging Stations with Semiconductors and a Decentralized Physical Infrastructure Networks (DePINs)

SEALSQ RISC-V Chips Adoption is Predicted to Get AI Boost Making it a Viable Competitor to Traditional GPUs

SEALSQ USA Ltd Incorporated in Phoenix to Strengthen Global OSAT Network for Enhanced Localized Production and Support

SEALQ Quantum Computing and IoT: A Transformative Synergy with Next-Generation Root of Trust IoT

Quantum Leap: 3 Computing Stocks on the Brink of a Breakout

3 Promising Quantum Stocks Poised to Become the Next Big Thing

The Hashgraph Association and SEALSQ Build the Future of Decentralized Physical Infrastructure Network (DePIN) on the Hedera DLT Network

Source: https://incomestatements.info

Category: Stock Reports