See more : Tigo Energy, Inc. (TYGO) Income Statement Analysis – Financial Results

Complete financial analysis of Luther Burbank Corporation (LBC) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Luther Burbank Corporation, a leading company in the Banks – Regional industry within the Financial Services sector.

- Selvita S.A. (SLV.WA) Income Statement Analysis – Financial Results

- Sanix Incorporated (4651.T) Income Statement Analysis – Financial Results

- Perusahaan Perseroan (Persero) PT Telekomunikasi Indonesia Tbk (TLKMF) Income Statement Analysis – Financial Results

- M&T Bank Corporation (MTB) Income Statement Analysis – Financial Results

- Grand City Properties S.A. (GYC.DE) Income Statement Analysis – Financial Results

Luther Burbank Corporation (LBC)

About Luther Burbank Corporation

Luther Burbank Corporation operates as the bank holding company for Luther Burbank Savings that provides various banking products and services for real estate investors, professionals, entrepreneurs, depositors, and commercial businesses. The company offers interest and noninterest-bearing transaction accounts, certificates of deposit, and money market accounts. It also provides commercial real estate loans, including first mortgage loans for the purchase, refinance, or build-out of tenant improvements on investor-owned multifamily residential properties, as well as loans for the purchase, refinance, or improvement of office, retail, and light industrial properties; single family residential loans; and a portfolio of 30-year fixed rate first mortgage and a forgivable second mortgage. In addition, the company offers ATM, debit cards, online and mobile banking, and real estate investment services; and issues trust preferred securities. As of December 31, 2021, it operated ten full service branches in California located in Sonoma, Marin, Santa Clara, and Los Angeles Counties; one full service branch in Washington located in King County; six loan production offices located throughout California; and a loan production office in Clackamas County, Oregon. Luther Burbank Corporation was founded in 1983 and is headquartered in Santa Rosa, California.

| Metric | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 |

|---|---|---|---|---|---|---|---|---|

| Revenue | 178.91M | 172.35M | 141.14M | 133.08M | 129.22M | 118.40M | 102.48M | 91.84M |

| Cost of Revenue | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 178.91M | 172.35M | 141.14M | 133.08M | 129.22M | 118.40M | 102.48M | 91.84M |

| Gross Profit Ratio | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 40.20M | 44.33M | 48.92M | 41.51M | 44.07M | 41.50M | 43.60M | 45.65M |

| Selling & Marketing | 3.51M | 1.24M | 1.68M | 5.05M | 3.50M | 935.00K | 875.00K | 1.34M |

| SG&A | 43.72M | 45.57M | 50.60M | 46.56M | 47.56M | 42.44M | 44.47M | 46.99M |

| Other Expenses | -18.79M | -93.91M | -135.08M | -110.18M | -12.88M | -11.96M | -43.49M | -59.55M |

| Operating Expenses | 5.95M | -48.35M | -84.48M | -63.62M | 34.68M | 2.97M | 985.00K | -12.57M |

| Cost & Expenses | 5.95M | -48.35M | -84.48M | -63.62M | 34.68M | 2.97M | 985.00K | -12.57M |

| Interest Income | 260.95M | 227.92M | 241.39M | 267.14M | 226.06M | 174.29M | 144.16M | 127.55M |

| Interest Expense | 83.70M | 57.46M | 102.77M | 138.74M | 100.97M | 63.34M | 49.52M | 42.63M |

| Depreciation & Amortization | 2.95M | 2.56M | 2.69M | 2.62M | 2.81M | 2.90M | 2.87M | 2.29M |

| EBITDA | 200.39M | 310.80M | 252.66M | 297.34M | 261.25M | 246.91M | 106.34M | 81.56M |

| EBITDA Ratio | 112.00% | 73.43% | 42.05% | 54.16% | 129.02% | 111.04% | 103.76% | 88.81% |

| Operating Income | 197.44M | 124.00M | 56.66M | 69.46M | 163.90M | 128.57M | 103.46M | 79.27M |

| Operating Income Ratio | 110.35% | 71.95% | 40.14% | 52.20% | 126.84% | 108.59% | 100.96% | 86.32% |

| Total Other Income/Expenses | -59.22M | -2.78M | -33.89M | -17.05M | -31.60M | -50.20M | -1.73M | -5.72M |

| Income Before Tax | 113.74M | 124.00M | 56.66M | 69.46M | 62.93M | 65.23M | 53.94M | 36.64M |

| Income Before Tax Ratio | 63.57% | 71.95% | 40.14% | 52.20% | 48.70% | 55.09% | 52.64% | 39.90% |

| Income Tax Expense | 33.54M | 36.25M | 16.75M | 20.60M | 17.87M | -4.15M | 1.82M | 1.25M |

| Net Income | 80.20M | 87.75M | 39.91M | 48.86M | 45.06M | 69.38M | 52.12M | 35.39M |

| Net Income Ratio | 44.82% | 50.92% | 28.28% | 36.71% | 34.87% | 58.60% | 50.86% | 38.54% |

| EPS | 1.58 | 1.70 | 0.75 | 0.87 | 0.79 | 1.62 | 0.96 | 0.65 |

| EPS Diluted | 1.54 | 1.70 | 0.75 | 0.87 | 0.79 | 1.62 | 0.96 | 0.65 |

| Weighted Avg Shares Out | 50.76M | 51.58M | 53.00M | 55.97M | 56.33M | 42.92M | 54.15M | 54.15M |

| Weighted Avg Shares Out (Dil) | 51.96M | 51.62M | 53.22M | 56.16M | 57.04M | 42.96M | 54.15M | 54.15M |

Geode Capital Management LLC Boosts Stake in Luther Burbank Corp (NASDAQ:LBC)

Home Foreclosures And Evictions Banned Through Summer

Where it might make sense to cut police budgets

Trade orgs say FHLBank targets may increase small member participation

First Trust Advisors LP Sells 5,468 Shares of Luther Burbank Corp (NASDAQ:LBC)

America's broken system of training police

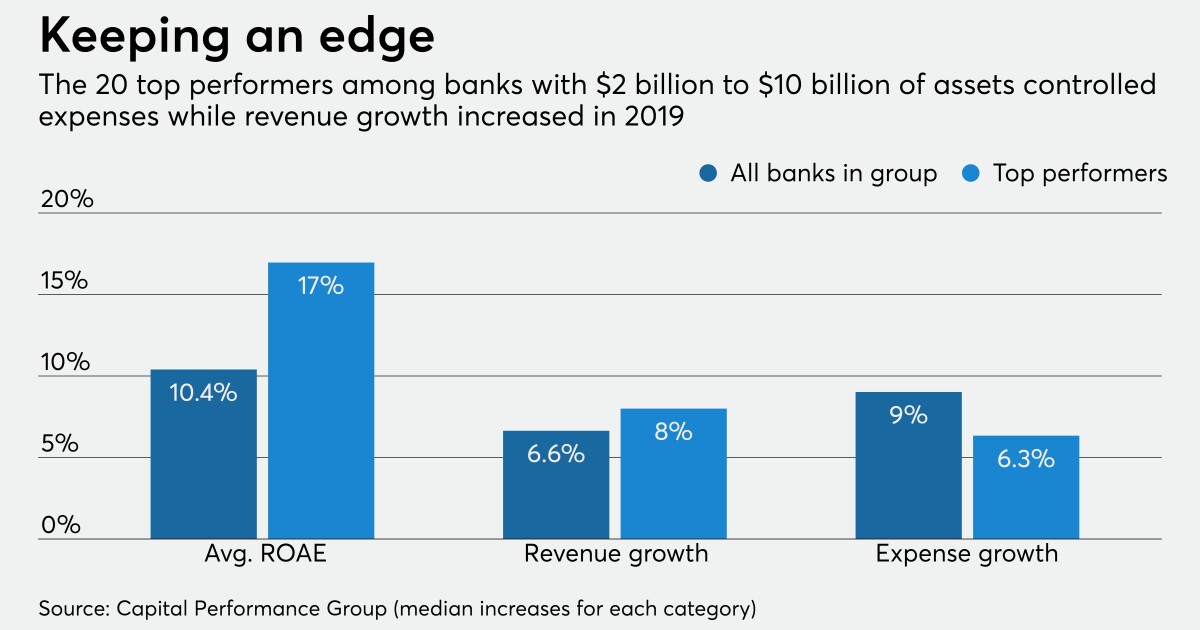

Once-highflying community banks encounter turbulence

Source: https://incomestatements.info

Category: Stock Reports