See more : China Merchants Energy Shipping Co., Ltd. (601872.SS) Income Statement Analysis – Financial Results

Complete financial analysis of Lincoln Electric Holdings, Inc. (LECO) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Lincoln Electric Holdings, Inc., a leading company in the Manufacturing – Tools & Accessories industry within the Industrials sector.

- Avangrid, Inc. (AGR) Income Statement Analysis – Financial Results

- Renegade Exploration Limited (RNX.AX) Income Statement Analysis – Financial Results

- First Sensor AG (SIS.DE) Income Statement Analysis – Financial Results

- Ridings Consulting Engineers I (RIDINGS.BO) Income Statement Analysis – Financial Results

- Malath Cooperative Insurance Company (8020.SR) Income Statement Analysis – Financial Results

Lincoln Electric Holdings, Inc. (LECO)

Industry: Manufacturing - Tools & Accessories

Sector: Industrials

Website: https://www.lincolnelectric.com

About Lincoln Electric Holdings, Inc.

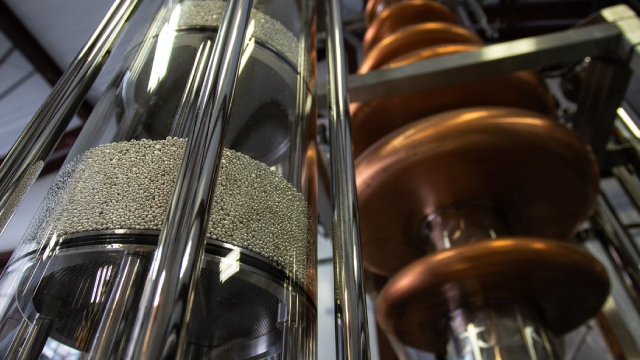

Lincoln Electric Holdings, Inc., through its subsidiaries, designs, develops, manufactures, and sells welding, cutting, and brazing products worldwide. The company operates through three segments: Americas Welding, International Welding, and The Harris Products Group. It offers welding products, including arc welding power sources, plasma cutters, wire feeding systems, robotic welding packages, integrated automation systems, fume extraction equipment, consumable electrodes, fluxes and welding accessories, and specialty welding consumables and fabrication products. The company's product offering also includes computer numeric controlled plasma and oxy-fuel cutting systems, and regulators and torches used in oxy-fuel welding, cutting, and brazing; and consumables used in the brazing and soldering alloys market. In addition, it is involved in the retail business in the United States. Further, the company manufactures copper and aluminum headers, distributor assemblies, and manifolds for the heating, ventilation, and air conditioning sector in the United States and Mexico. The company serves general fabrication, energy and process, automotive and transportation, and construction and infrastructure industries, as well as heavy fabrication, ship building, and maintenance and repair markets. It sells its products directly to users of welding products, as well as through industrial distributors, retailers, and agents. The company was founded in 1895 and is headquartered in Cleveland, Ohio.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 4.19B | 3.76B | 3.23B | 2.66B | 3.00B | 3.03B | 2.62B | 2.27B | 2.54B | 2.81B | 2.85B | 2.85B | 2.69B | 2.07B | 1.73B | 2.48B | 2.28B | 1.97B | 1.60B | 1.33B | 1.04B | 994.08M | 978.88M | 1.06B | 1.09B | 1.19B | 1.16B | 1.11B | 1.03B | 906.70M |

| Cost of Revenue | 2.71B | 2.48B | 2.17B | 1.78B | 2.00B | 2.00B | 1.74B | 1.49B | 1.69B | 1.86B | 1.91B | 1.99B | 1.96B | 1.51B | 1.27B | 1.76B | 1.63B | 1.42B | 1.16B | 971.32M | 759.92M | 694.05M | 671.55M | 668.79M | 685.30M | 701.50M | 690.00M | 657.00M | 604.90M | 528.30M |

| Gross Profit | 1.48B | 1.28B | 1.07B | 871.34M | 1.01B | 1.03B | 880.33M | 789.30M | 841.14M | 949.30M | 942.65M | 866.66M | 736.74M | 563.82M | 456.27M | 720.15M | 647.57M | 552.28M | 436.92M | 362.36M | 280.67M | 300.03M | 307.33M | 389.81M | 400.90M | 485.20M | 469.10M | 452.10M | 427.50M | 378.40M |

| Gross Profit Ratio | 35.23% | 34.05% | 33.04% | 32.81% | 33.55% | 33.96% | 33.54% | 34.70% | 33.17% | 33.74% | 33.04% | 30.37% | 27.34% | 27.24% | 26.38% | 29.05% | 28.39% | 28.01% | 27.29% | 27.17% | 26.97% | 30.18% | 31.40% | 36.82% | 36.91% | 40.89% | 40.47% | 40.76% | 41.41% | 41.73% |

| Research & Development | 71.24M | 63.21M | 55.97M | 51.41M | 56.85M | 54.17M | 47.90M | 44.72M | 47.18M | 43.26M | 42.13M | 37.31M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 627.70M | 545.68M | 466.68M | 639.49M | 545.50M | 527.21M | 495.22M | 439.78M | 377.77M | 333.40M | 405.38M | 370.12M | 315.83M | 285.31M | 256.62M | 210.70M | 198.04M | 190.16M | 216.22M | 223.80M | 309.70M | 305.80M | 310.30M | 289.80M | 261.70M |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 703.65M | 656.64M | 597.11M | 543.80M | 621.49M | 627.70M | 545.68M | 466.68M | 639.49M | 545.50M | 527.21M | 495.22M | 439.78M | 377.77M | 333.40M | 405.38M | 370.12M | 315.83M | 285.31M | 256.62M | 210.70M | 198.04M | 190.16M | 216.22M | 223.80M | 309.70M | 305.80M | 310.30M | 289.80M | 261.70M |

| Other Expenses | -15.04M | 9.99M | -114.46M | 3.94M | 21.00M | 10.69M | 5.22M | 3.17M | 4.18M | 4.00M | 4.19M | 2.69M | 0.00 | -384.00K | 0.00 | 0.00 | 0.00 | 0.00 | 1.76M | 2.44M | 1.74M | 10.47M | 0.00 | 34.71M | 29.10M | 28.10M | 28.40M | 29.50M | 29.70M | 28.00M |

| Operating Expenses | 758.91M | 656.64M | 597.11M | 543.80M | 621.49M | 627.70M | 545.68M | 466.68M | 639.49M | 545.50M | 527.21M | 495.22M | 440.06M | 377.77M | 333.40M | 424.75M | 370.12M | 315.83M | 287.07M | 259.06M | 212.45M | 208.50M | 190.16M | 250.93M | 252.90M | 337.80M | 334.20M | 339.80M | 319.50M | 289.70M |

| Cost & Expenses | 3.47B | 3.14B | 2.76B | 2.33B | 2.62B | 2.63B | 2.29B | 1.95B | 2.33B | 2.41B | 2.44B | 2.48B | 2.40B | 1.88B | 1.61B | 2.18B | 2.00B | 1.74B | 1.45B | 1.23B | 972.37M | 902.56M | 861.71M | 919.72M | 938.20M | 1.04B | 1.02B | 996.80M | 924.40M | 818.00M |

| Interest Income | 0.00 | 1.61M | 1.57M | 1.99M | 2.53M | 0.00 | 4.79M | 2.09M | 2.71M | 3.09M | 3.32M | 3.99M | 3.12M | 2.38M | 3.46M | 8.85M | 8.29M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 44.37M | 29.50M | 22.21M | 21.97M | 23.42M | 17.57M | 24.22M | 19.08M | 21.82M | 10.43M | 2.86M | 4.19M | 6.70M | 6.69M | 8.52M | 12.16M | 11.43M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 86.67M | 78.06M | 81.15M | 80.49M | 81.49M | 72.35M | 68.12M | 65.07M | 64.01M | 69.61M | 68.88M | 65.33M | 62.05M | 57.36M | 56.60M | 56.93M | 51.49M | 45.71M | 41.87M | 42.30M | 37.65M | 37.04M | 36.21M | 34.71M | 29.10M | 28.10M | 28.40M | 29.50M | 29.70M | 28.00M |

| EBITDA | 824.67M | 700.14M | 675.23M | 410.35M | 466.89M | 473.29M | 416.69M | 383.95M | 441.64M | 455.85M | 504.29M | 439.10M | 370.09M | 251.16M | 152.75M | 368.89M | 351.20M | 282.16M | 193.47M | 103.30M | 68.22M | 91.52M | 153.37M | 173.59M | 177.10M | 175.50M | 163.30M | 141.80M | 137.70M | 116.70M |

| EBITDA Ratio | 19.67% | 18.93% | 13.55% | 15.51% | 16.27% | 15.98% | 15.83% | 17.40% | 10.87% | 17.27% | 17.41% | 15.72% | 13.63% | 12.03% | 10.29% | 14.81% | 14.29% | 14.39% | 11.79% | 10.83% | 10.05% | 13.76% | 15.33% | 17.40% | 19.03% | 14.34% | 13.52% | 11.59% | 12.96% | 12.08% |

| Operating Income | 717.85M | 612.34M | 357.04M | 282.07M | 370.91M | 375.54M | 377.71M | 288.27M | 181.70M | 373.75M | 406.99M | 362.08M | 296.68M | 186.43M | 92.98M | 295.40M | 277.63M | 232.97M | 149.85M | 103.30M | 68.22M | 91.52M | 117.17M | 138.88M | 148.00M | 147.40M | 134.90M | 112.30M | 108.00M | 88.70M |

| Operating Income Ratio | 17.13% | 16.28% | 11.04% | 10.62% | 12.35% | 12.40% | 14.39% | 12.67% | 7.17% | 13.28% | 14.27% | 12.69% | 11.01% | 9.01% | 5.38% | 11.92% | 12.17% | 11.81% | 9.36% | 7.75% | 6.56% | 9.21% | 11.97% | 13.12% | 13.63% | 12.42% | 11.64% | 10.13% | 10.46% | 9.78% |

| Total Other Income/Expenses | -30.98M | -19.51M | -136.67M | -18.03M | -2.42M | -6.88M | -10.71M | -10.89M | -11.91M | 2.07M | 9.46M | 7.49M | 4.65M | 678.00K | -6.50M | 4.41M | 9.53M | 5.20M | 4.05M | 4.48M | 1.01M | -3.58M | -1.12M | -17.20M | -33.80M | -400.00K | 200.00K | 5.60M | -8.40M | -8.50M |

| Income Before Tax | 686.87M | 592.83M | 325.00M | 264.04M | 368.49M | 368.66M | 366.24M | 277.39M | 169.79M | 375.81M | 416.44M | 369.57M | 301.33M | 187.11M | 86.48M | 299.81M | 287.16M | 238.17M | 153.90M | 107.78M | 69.23M | 87.94M | 116.04M | 121.68M | 114.20M | 147.00M | 135.10M | 117.90M | 99.60M | 80.20M |

| Income Before Tax Ratio | 16.39% | 15.76% | 10.05% | 9.94% | 12.27% | 12.17% | 13.95% | 12.19% | 6.70% | 13.36% | 14.60% | 12.95% | 11.18% | 9.04% | 5.00% | 12.09% | 12.59% | 12.08% | 9.61% | 8.08% | 6.65% | 8.85% | 11.85% | 11.49% | 10.51% | 12.39% | 11.66% | 10.63% | 9.65% | 8.85% |

| Income Tax Expense | 141.62M | 120.60M | 48.42M | 57.90M | 75.41M | 81.67M | 118.76M | 79.02M | 42.38M | 121.93M | 124.75M | 112.35M | 84.32M | 54.90M | 37.91M | 87.52M | 84.42M | 63.16M | 31.59M | 27.18M | 14.69M | 21.06M | 32.45M | 43.59M | 40.30M | 53.30M | 49.70M | 43.60M | 38.10M | 32.20M |

| Net Income | 545.25M | 472.22M | 276.58M | 206.12M | 293.11M | 287.07M | 247.50M | 198.40M | 127.48M | 254.69M | 293.78M | 257.41M | 217.19M | 130.24M | 48.58M | 212.29M | 202.74M | 175.01M | 122.31M | 80.60M | 54.54M | 29.28M | 83.59M | 78.09M | 73.90M | 93.70M | 85.40M | 74.30M | 61.50M | 48.00M |

| Net Income Ratio | 13.01% | 12.56% | 8.55% | 7.76% | 9.76% | 9.48% | 9.43% | 8.72% | 5.03% | 9.05% | 10.30% | 9.02% | 8.06% | 6.29% | 2.81% | 8.56% | 8.89% | 8.88% | 7.64% | 6.04% | 5.24% | 2.94% | 8.54% | 7.38% | 6.80% | 7.90% | 7.37% | 6.70% | 5.96% | 5.29% |

| EPS | 9.51 | 8.14 | 4.66 | 3.46 | 4.73 | 4.42 | 3.76 | 2.94 | 1.72 | 3.22 | 3.58 | 3.10 | 2.60 | 1.54 | 0.57 | 2.49 | 2.37 | 2.06 | 1.47 | 0.98 | 0.66 | 0.35 | 0.99 | 0.92 | 0.82 | 0.96 | 0.87 | 0.75 | 0.66 | 1.10 |

| EPS Diluted | 9.37 | 8.04 | 4.60 | 3.42 | 4.68 | 4.37 | 3.71 | 2.91 | 1.70 | 3.18 | 3.54 | 3.06 | 2.56 | 1.53 | 0.57 | 2.47 | 2.34 | 2.04 | 1.45 | 0.97 | 0.66 | 0.34 | 0.98 | 0.92 | 0.81 | 0.96 | 0.87 | 0.75 | 0.66 | 1.10 |

| Weighted Avg Shares Out | 57.36M | 58.03M | 59.31M | 59.63M | 61.96M | 64.89M | 65.74M | 67.46M | 74.11M | 79.19M | 81.98M | 83.09M | 83.68M | 84.41M | 84.78M | 85.30M | 85.80M | 85.16M | 83.49M | 82.38M | 82.64M | 84.86M | 84.86M | 85.35M | 90.67M | 97.60M | 98.73M | 99.73M | 93.54M | 43.84M |

| Weighted Avg Shares Out (Dil) | 58.22M | 58.75M | 60.06M | 60.25M | 62.66M | 65.68M | 66.64M | 68.16M | 74.85M | 80.10M | 83.04M | 84.18M | 84.71M | 85.22M | 85.27M | 86.11M | 86.78M | 86.00M | 84.35M | 83.29M | 83.27M | 86.10M | 85.29M | 85.35M | 91.23M | 98.12M | 98.73M | 99.73M | 93.54M | 43.84M |

Lincoln Electric: Unloved And Ripe To Buy

Lincoln Electric Holdings, Inc. (LECO) Q3 2024 Earnings Call Transcript

Lincoln Electric (LECO) Q3 Earnings: Taking a Look at Key Metrics Versus Estimates

Lincoln Electric Holdings (LECO) Q3 Earnings and Revenues Surpass Estimates

Lincoln Electric Reports Third Quarter 2024 Results

Earnings Preview: Lincoln Electric Holdings (LECO) Q3 Earnings Expected to Decline

Lincoln Electric Announces 5.6% Dividend Increase

Lincoln Electric Announces Retirement of Executive Chair Christopher L. Mapes and Election of Steven B.

Lincoln Electric Schedules Webcast for Third Quarter 2024 Results

Lincoln Electric: Back To Appealing Territory

Source: https://incomestatements.info

Category: Stock Reports