See more : Axiom Holdings, Inc. (AIOM) Income Statement Analysis – Financial Results

Complete financial analysis of BNY Mellon Strategic Municipals, Inc. (LEO) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of BNY Mellon Strategic Municipals, Inc., a leading company in the Asset Management industry within the Financial Services sector.

- China Health Industries Holdings, Inc. (CHHE) Income Statement Analysis – Financial Results

- AVTECH Sweden AB (publ) (AVT-B.ST) Income Statement Analysis – Financial Results

- AGNC Investment Corp. (AGNCP) Income Statement Analysis – Financial Results

- Czerwona Torebka Spólka Akcyjna (CZT.WA) Income Statement Analysis – Financial Results

- Widad Group Berhad (0162.KL) Income Statement Analysis – Financial Results

BNY Mellon Strategic Municipals, Inc. (LEO)

Industry: Asset Management

Sector: Financial Services

Website: https://im.bnymellon.com/us/en/intermediary/products/closed-end-funds.jsp

About BNY Mellon Strategic Municipals, Inc.

BNY Mellon Strategic Municipals, Inc. is a closed ended fixed income mutual fund launched and managed by BNY Mellon Investment Adviser, Inc. It invests in the fixed income markets of the United States. The fund primarily invests in investment grade municipal bonds, the income from which is exempt from federal income tax. It employs fundamental analysis to create its portfolio. The fund was formerly known as Dreyfus Strategic Municipals, Inc. BNY Mellon Strategic Municipals, Inc. was formed on September 23, 1987 and is domiciled in the United States.

| Metric | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 73.46M | 5.16M | -111.22M | 47.29M | 7.89M | 53.22M | 5.37M | 3.74M | 44.42M | 40.05M | 39.82M | 39.77M | 42.09M | 42.86M | 44.16M | 46.93M | 48.85M | 50.39M | 48.16M | 46.69M | 45.97M | 50.26M | 55.48M | 55.96M | 48.58M | 37.60M | 38.83M | 42.37M | 43.37M | 44.52M | 44.81M | 45.16M | 43.92M | 43.67M | 42.30M | 40.76M |

| Cost of Revenue | 0.00 | 3.63M | 4.13M | 4.47M | 4.28M | 4.25M | 3.96M | 2.09M | 4.95M | 927.75K | 940.00K | 590.00K | 540.00K | 490.00K | 260.00K | 0.00 | 890.00K | 1.60M | 1.03M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 73.46M | 1.53M | -115.35M | 42.82M | 3.61M | 48.97M | 1.41M | 1.65M | 39.47M | 39.12M | 38.88M | 39.18M | 41.55M | 42.37M | 43.90M | 46.93M | 47.96M | 48.79M | 47.13M | 46.69M | 45.97M | 50.26M | 55.48M | 55.96M | 48.58M | 37.60M | 38.83M | 42.37M | 43.37M | 44.52M | 44.81M | 45.16M | 43.92M | 43.67M | 42.30M | 40.76M |

| Gross Profit Ratio | 100.00% | 29.57% | 103.71% | 90.55% | 45.78% | 92.02% | 26.23% | 44.05% | 88.85% | 97.68% | 97.64% | 98.52% | 98.72% | 98.86% | 99.41% | 100.00% | 98.18% | 96.82% | 97.86% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | -5.36 | 1.37 | 0.34 | 1.37 | 0.12 | 0.09 | 1.25 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 413.66K | 483.57K | 559.90K | 570.75K | 495.53K | 507.33K | 718.87K | 751.50K | 5.32M | 5.22M | 5.14M | 5.86M | 6.47M | 6.18M | 6.77M | 6.69M | 7.46M | 7.61M | 6.80M | 6.91M | 7.53M | 7.54M | 7.60M | 7.82M | 6.63M | 4.88M | 4.97M | 4.81M | 4.79M | 4.74M | 4.74M | 4.74M | 4.60M | 4.32M | 4.24M | 4.21M |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -5.32M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 413.66K | 483.57K | 559.90K | 570.75K | 495.53K | 507.33K | 718.87K | 751.50K | 1.23 | 5.22M | 5.14M | 5.86M | 6.47M | 6.18M | 6.77M | 6.69M | 7.46M | 7.61M | 6.80M | 6.91M | 7.53M | 7.54M | 7.60M | 7.82M | 6.63M | 4.88M | 4.97M | 4.81M | 4.79M | 4.74M | 4.74M | 4.74M | 4.60M | 4.32M | 4.24M | 4.21M |

| Other Expenses | 73.05M | 4.67M | -522.02K | -581.57K | -558.86K | -545.95K | -5.27M | -5.69M | 61.97M | -625.29K | -590.00K | -690.00K | -690.00K | -550.00K | -690.00K | -660.00K | -810.00K | -790.00K | 80.00K | 70.00K | 60.00K | 60.00K | 50.00K | 40.00K | 20.00K | 20.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 73.46M | 5.16M | 37.87K | -10.83K | -63.33K | -38.62K | 146.09K | 132.29K | 17.50M | 7.30M | 40.45M | 78.63M | 5.78M | 5.63M | 6.08M | 6.03M | 6.65M | 6.82M | 6.88M | 6.98M | 7.59M | 7.60M | 7.65M | 7.86M | 6.65M | 4.90M | 4.97M | 4.81M | 4.79M | 4.74M | 4.74M | 4.74M | 4.60M | 4.32M | 4.24M | 4.21M |

| Cost & Expenses | 73.46M | 5.16M | 37.87K | -10.83K | -63.33K | -38.62K | 8.84M | 7.30M | 39.47M | 7.30M | 40.45M | 78.63M | 6.32M | 6.12M | 6.34M | 6.03M | 7.54M | 8.42M | 7.91M | 6.98M | 7.59M | 7.60M | 7.65M | 7.86M | 6.65M | 4.90M | 4.97M | 4.81M | 4.79M | 4.74M | 4.74M | 4.74M | 4.60M | 4.32M | 4.24M | 4.21M |

| Interest Income | 28.70M | 28.61M | 30.18M | 31.61M | 34.94M | 37.48M | 40.09M | 39.20M | 1.21M | 938.34K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Interest Expense | 8.54M | 6.31M | 2.31M | 1.43M | 3.81M | 4.76M | 3.96M | 2.09M | 1.21M | 45.59M | 592.08K | 40.00K | -10.31M | -7.76M | -33.62M | -8.53M | 5.89M | 2.34M | 4.28M | -3.66M | -27.56M | -18.78M | -140.00K | -10.05M | 4.58M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Depreciation & Amortization | 0.00 | 9.96M | -25.88M | -26.96M | -30.49M | -33.01M | -35.22M | -33.98M | -33.75M | -34.84M | -34.68M | -33.91M | 55.94M | -24.83M | 1.36M | -4.03M | -84.57M | -16.29M | 7.64M | 17.02M | 3.54M | -36.67M | -40.07M | 10.99M | -9.38M | -41.97M | 14.51M | 9.05M | -5.32M | 13.24M | -38.44M | 16.39M | 7.75M | 13.92M | -7.39M | 10.00M |

| EBITDA | 0.00 | 11.45M | -108.95M | 0.00 | 0.00 | 0.00 | -26.02M | -23.92M | 4.14M | -2.43M | 0.00 | 0.00 | 91.71M | 11.90M | 39.18M | 36.87M | -43.26M | 25.68M | 47.90M | 56.73M | 41.93M | 5.98M | 7.75M | 59.09M | 32.55M | -9.27M | 48.37M | 46.61M | 33.27M | 53.02M | 1.63M | 56.80M | 47.07M | 53.28M | 30.66M | 46.54M |

| EBITDA Ratio | 0.00% | 221.92% | 97.95% | 100.02% | 100.80% | 100.07% | -386.91% | -660.57% | 14.70% | -7.97% | 111.71% | -185.54% | 217.89% | 27.76% | 88.72% | 78.56% | -88.56% | 50.96% | 99.46% | 121.50% | 91.21% | 11.90% | 13.97% | 105.59% | 67.00% | -24.65% | 124.57% | 110.01% | 76.71% | 119.09% | 3.64% | 125.78% | 107.17% | 122.01% | 72.48% | 114.18% |

| Operating Income | -164.11M | 1.49M | -108.95M | 47.30M | 7.95M | 53.26M | 31.25M | 31.89M | 33.75M | 34.84M | 34.68M | 33.91M | 35.77M | 36.73M | 37.82M | 40.90M | 41.31M | 41.97M | 40.26M | 39.71M | 38.39M | 42.65M | 47.82M | 48.10M | 41.93M | 32.70M | 33.86M | 37.56M | 38.59M | 39.78M | 40.07M | 40.41M | 39.32M | 39.36M | 38.05M | 36.54M |

| Operating Income Ratio | -223.40% | 28.86% | 97.95% | 100.02% | 100.80% | 100.07% | 581.47% | 853.49% | 75.97% | 86.98% | 87.10% | 85.27% | 84.98% | 85.70% | 85.64% | 87.15% | 84.56% | 83.29% | 83.60% | 85.05% | 83.51% | 84.86% | 86.19% | 85.95% | 86.31% | 86.97% | 87.20% | 88.65% | 88.98% | 89.35% | 89.42% | 89.48% | 89.53% | 90.13% | 89.95% | 89.65% |

| Total Other Income/Expenses | 237.63M | 3.63M | 4.13M | 0.00 | -22.54M | 0.00 | -29.99M | -32.66M | 21.62M | -3.01M | 44.65M | -73.37M | 55.90M | -14.52M | 9.12M | 29.59M | -76.04M | -22.18M | 5.30M | 12.74M | 7.20M | -9.11M | -21.29M | 11.13M | 670.00K | -46.55M | 14.51M | 9.05M | -5.32M | 13.24M | -38.44M | 16.39M | 7.75M | 13.92M | -7.39M | 10.00M |

| Income Before Tax | 73.51M | 5.12M | -111.26M | 47.30M | 7.95M | 53.26M | 5.23M | 3.60M | 55.36M | 31.83M | 79.33M | -39.46M | 91.67M | 22.21M | 46.94M | 70.49M | -34.73M | 19.79M | 45.56M | 52.45M | 45.59M | 33.54M | 26.53M | 59.23M | 42.60M | -13.85M | 48.37M | 46.61M | 33.27M | 53.02M | 1.63M | 56.80M | 47.07M | 53.28M | 30.66M | 46.54M |

| Income Before Tax Ratio | 100.07% | 99.29% | 100.03% | 100.02% | 100.80% | 100.07% | 97.28% | 96.46% | 124.64% | 79.46% | 199.24% | -99.22% | 217.80% | 51.82% | 106.30% | 150.20% | -71.10% | 39.27% | 94.60% | 112.34% | 99.17% | 66.73% | 47.82% | 105.84% | 87.69% | -36.84% | 124.57% | 110.01% | 76.71% | 119.09% | 3.64% | 125.78% | 107.17% | 122.01% | 72.48% | 114.18% |

| Income Tax Expense | 0.00 | 0.00 | 25.88M | 25.53M | 26.68M | 28.25M | -52.21M | 2.00 | 16.27M | -3.01M | 44.65M | -73.37M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Net Income | 73.51M | 5.12M | -111.26M | 47.30M | 7.95M | 53.26M | 5.23M | 3.60M | 39.10M | 31.64M | 79.16M | -39.88M | 91.67M | 22.21M | 46.94M | 70.49M | -34.73M | 19.79M | 45.56M | 52.45M | 45.59M | 33.54M | 26.53M | 59.23M | 42.60M | -13.85M | 48.37M | 46.61M | 33.27M | 53.02M | 1.63M | 56.80M | 47.07M | 53.28M | 30.66M | 46.54M |

| Net Income Ratio | 100.07% | 99.29% | 100.03% | 100.02% | 100.80% | 100.07% | 97.28% | 96.46% | 88.02% | 79.01% | 198.81% | -100.27% | 217.80% | 51.82% | 106.30% | 150.20% | -71.10% | 39.27% | 94.60% | 112.34% | 99.17% | 66.73% | 47.82% | 105.84% | 87.69% | -36.84% | 124.57% | 110.01% | 76.71% | 119.09% | 3.64% | 125.78% | 107.17% | 122.01% | 72.48% | 114.18% |

| EPS | 1.18 | 0.04 | -1.79 | 0.76 | 0.11 | 0.82 | 0.08 | 0.03 | 0.72 | 0.51 | 1.28 | -0.64 | 1.49 | 0.36 | 0.77 | 1.16 | -0.57 | 0.33 | 0.75 | 0.87 | 0.75 | 0.56 | 0.45 | 1.01 | 0.73 | -0.24 | 0.83 | 0.81 | 0.59 | 0.94 | 0.03 | 1.05 | 0.89 | 1.04 | 0.62 | 0.98 |

| EPS Diluted | 1.18 | 0.04 | -1.79 | 0.76 | 0.11 | 0.82 | 0.08 | 0.03 | 44.33M | 0.51 | 1.28 | -0.64 | 1.49 | 0.36 | 0.77 | 1.16 | -0.57 | 0.33 | 0.75 | 0.87 | 0.75 | 0.56 | 0.45 | 1.01 | 0.73 | -0.24 | 0.83 | 0.81 | 0.59 | 0.94 | 0.03 | 1.05 | 0.89 | 1.04 | 0.62 | 0.98 |

| Weighted Avg Shares Out | 62.29M | 44.99M | 62.29M | 62.28M | 62.21M | 62.20M | 62.20M | 60.05M | 54.65M | 61.85M | 61.85M | 61.85M | 61.68M | 61.28M | 61.11M | 60.77M | 60.77M | 60.72M | 60.59M | 60.59M | 60.59M | 60.17M | 59.23M | 58.55M | 58.55M | 58.55M | 58.31M | 57.62M | 56.68M | 56.19M | 55.63M | 54.24M | 52.81M | 51.21M | 49.31M | 47.60M |

| Weighted Avg Shares Out (Dil) | 62.29M | 44.99M | 62.29M | 62.28M | 62.21M | 62.20M | 62.77M | 60.05M | 0.88 | 61.85M | 61.85M | 61.85M | 61.68M | 61.28M | 61.11M | 60.77M | 60.77M | 60.72M | 60.59M | 60.59M | 60.59M | 60.17M | 59.23M | 58.55M | 58.55M | 58.55M | 58.31M | 57.62M | 56.68M | 56.19M | 55.63M | 54.24M | 52.81M | 51.21M | 49.31M | 47.60M |

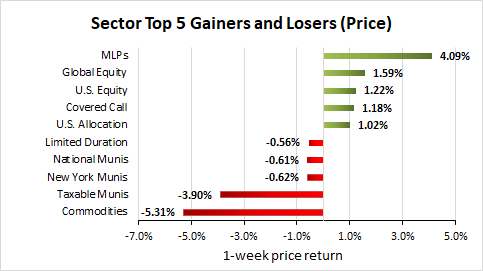

Weekly Closed-End Fund Roundup: MAV Boosts Again (August 16, 2020)

Time Runs Out for Dollar Bulls. Is This Time Different?

This growth fund's top 5 holdings have all more than doubled this year

This ‘dire’ economic situation ‘deserves to be called a depression — a pandemic depression’

Insight Investment Adds Two Strategic Hires to Expand U.S. Distribution Team

Source: https://incomestatements.info

Category: Stock Reports