See more : Reach Resources Limited (RR1.AX) Income Statement Analysis – Financial Results

Complete financial analysis of BNY Mellon Strategic Municipals, Inc. (LEO) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of BNY Mellon Strategic Municipals, Inc., a leading company in the Asset Management industry within the Financial Services sector.

- Capital Estate Limited (0193.HK) Income Statement Analysis – Financial Results

- Sarissa Capital Acquisition Corp. (SRSAW) Income Statement Analysis – Financial Results

- BOMESC Offshore Engineering Company Limited (603727.SS) Income Statement Analysis – Financial Results

- Ratos AB (publ) (RTOBF) Income Statement Analysis – Financial Results

- Beijing Tieke Shougang Rail Way-Tech Co., Ltd. (688569.SS) Income Statement Analysis – Financial Results

BNY Mellon Strategic Municipals, Inc. (LEO)

Industry: Asset Management

Sector: Financial Services

Website: https://im.bnymellon.com/us/en/intermediary/products/closed-end-funds.jsp

About BNY Mellon Strategic Municipals, Inc.

BNY Mellon Strategic Municipals, Inc. is a closed ended fixed income mutual fund launched and managed by BNY Mellon Investment Adviser, Inc. It invests in the fixed income markets of the United States. The fund primarily invests in investment grade municipal bonds, the income from which is exempt from federal income tax. It employs fundamental analysis to create its portfolio. The fund was formerly known as Dreyfus Strategic Municipals, Inc. BNY Mellon Strategic Municipals, Inc. was formed on September 23, 1987 and is domiciled in the United States.

| Metric | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 73.46M | 5.16M | -111.22M | 47.29M | 7.89M | 53.22M | 5.37M | 3.74M | 44.42M | 40.05M | 39.82M | 39.77M | 42.09M | 42.86M | 44.16M | 46.93M | 48.85M | 50.39M | 48.16M | 46.69M | 45.97M | 50.26M | 55.48M | 55.96M | 48.58M | 37.60M | 38.83M | 42.37M | 43.37M | 44.52M | 44.81M | 45.16M | 43.92M | 43.67M | 42.30M | 40.76M |

| Cost of Revenue | 0.00 | 3.63M | 4.13M | 4.47M | 4.28M | 4.25M | 3.96M | 2.09M | 4.95M | 927.75K | 940.00K | 590.00K | 540.00K | 490.00K | 260.00K | 0.00 | 890.00K | 1.60M | 1.03M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 73.46M | 1.53M | -115.35M | 42.82M | 3.61M | 48.97M | 1.41M | 1.65M | 39.47M | 39.12M | 38.88M | 39.18M | 41.55M | 42.37M | 43.90M | 46.93M | 47.96M | 48.79M | 47.13M | 46.69M | 45.97M | 50.26M | 55.48M | 55.96M | 48.58M | 37.60M | 38.83M | 42.37M | 43.37M | 44.52M | 44.81M | 45.16M | 43.92M | 43.67M | 42.30M | 40.76M |

| Gross Profit Ratio | 100.00% | 29.57% | 103.71% | 90.55% | 45.78% | 92.02% | 26.23% | 44.05% | 88.85% | 97.68% | 97.64% | 98.52% | 98.72% | 98.86% | 99.41% | 100.00% | 98.18% | 96.82% | 97.86% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | -5.36 | 1.37 | 0.34 | 1.37 | 0.12 | 0.09 | 1.25 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 413.66K | 483.57K | 559.90K | 570.75K | 495.53K | 507.33K | 718.87K | 751.50K | 5.32M | 5.22M | 5.14M | 5.86M | 6.47M | 6.18M | 6.77M | 6.69M | 7.46M | 7.61M | 6.80M | 6.91M | 7.53M | 7.54M | 7.60M | 7.82M | 6.63M | 4.88M | 4.97M | 4.81M | 4.79M | 4.74M | 4.74M | 4.74M | 4.60M | 4.32M | 4.24M | 4.21M |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -5.32M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 413.66K | 483.57K | 559.90K | 570.75K | 495.53K | 507.33K | 718.87K | 751.50K | 1.23 | 5.22M | 5.14M | 5.86M | 6.47M | 6.18M | 6.77M | 6.69M | 7.46M | 7.61M | 6.80M | 6.91M | 7.53M | 7.54M | 7.60M | 7.82M | 6.63M | 4.88M | 4.97M | 4.81M | 4.79M | 4.74M | 4.74M | 4.74M | 4.60M | 4.32M | 4.24M | 4.21M |

| Other Expenses | 73.05M | 4.67M | -522.02K | -581.57K | -558.86K | -545.95K | -5.27M | -5.69M | 61.97M | -625.29K | -590.00K | -690.00K | -690.00K | -550.00K | -690.00K | -660.00K | -810.00K | -790.00K | 80.00K | 70.00K | 60.00K | 60.00K | 50.00K | 40.00K | 20.00K | 20.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 73.46M | 5.16M | 37.87K | -10.83K | -63.33K | -38.62K | 146.09K | 132.29K | 17.50M | 7.30M | 40.45M | 78.63M | 5.78M | 5.63M | 6.08M | 6.03M | 6.65M | 6.82M | 6.88M | 6.98M | 7.59M | 7.60M | 7.65M | 7.86M | 6.65M | 4.90M | 4.97M | 4.81M | 4.79M | 4.74M | 4.74M | 4.74M | 4.60M | 4.32M | 4.24M | 4.21M |

| Cost & Expenses | 73.46M | 5.16M | 37.87K | -10.83K | -63.33K | -38.62K | 8.84M | 7.30M | 39.47M | 7.30M | 40.45M | 78.63M | 6.32M | 6.12M | 6.34M | 6.03M | 7.54M | 8.42M | 7.91M | 6.98M | 7.59M | 7.60M | 7.65M | 7.86M | 6.65M | 4.90M | 4.97M | 4.81M | 4.79M | 4.74M | 4.74M | 4.74M | 4.60M | 4.32M | 4.24M | 4.21M |

| Interest Income | 28.70M | 28.61M | 30.18M | 31.61M | 34.94M | 37.48M | 40.09M | 39.20M | 1.21M | 938.34K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Interest Expense | 8.54M | 6.31M | 2.31M | 1.43M | 3.81M | 4.76M | 3.96M | 2.09M | 1.21M | 45.59M | 592.08K | 40.00K | -10.31M | -7.76M | -33.62M | -8.53M | 5.89M | 2.34M | 4.28M | -3.66M | -27.56M | -18.78M | -140.00K | -10.05M | 4.58M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Depreciation & Amortization | 0.00 | 9.96M | -25.88M | -26.96M | -30.49M | -33.01M | -35.22M | -33.98M | -33.75M | -34.84M | -34.68M | -33.91M | 55.94M | -24.83M | 1.36M | -4.03M | -84.57M | -16.29M | 7.64M | 17.02M | 3.54M | -36.67M | -40.07M | 10.99M | -9.38M | -41.97M | 14.51M | 9.05M | -5.32M | 13.24M | -38.44M | 16.39M | 7.75M | 13.92M | -7.39M | 10.00M |

| EBITDA | 0.00 | 11.45M | -108.95M | 0.00 | 0.00 | 0.00 | -26.02M | -23.92M | 4.14M | -2.43M | 0.00 | 0.00 | 91.71M | 11.90M | 39.18M | 36.87M | -43.26M | 25.68M | 47.90M | 56.73M | 41.93M | 5.98M | 7.75M | 59.09M | 32.55M | -9.27M | 48.37M | 46.61M | 33.27M | 53.02M | 1.63M | 56.80M | 47.07M | 53.28M | 30.66M | 46.54M |

| EBITDA Ratio | 0.00% | 221.92% | 97.95% | 100.02% | 100.80% | 100.07% | -386.91% | -660.57% | 14.70% | -7.97% | 111.71% | -185.54% | 217.89% | 27.76% | 88.72% | 78.56% | -88.56% | 50.96% | 99.46% | 121.50% | 91.21% | 11.90% | 13.97% | 105.59% | 67.00% | -24.65% | 124.57% | 110.01% | 76.71% | 119.09% | 3.64% | 125.78% | 107.17% | 122.01% | 72.48% | 114.18% |

| Operating Income | -164.11M | 1.49M | -108.95M | 47.30M | 7.95M | 53.26M | 31.25M | 31.89M | 33.75M | 34.84M | 34.68M | 33.91M | 35.77M | 36.73M | 37.82M | 40.90M | 41.31M | 41.97M | 40.26M | 39.71M | 38.39M | 42.65M | 47.82M | 48.10M | 41.93M | 32.70M | 33.86M | 37.56M | 38.59M | 39.78M | 40.07M | 40.41M | 39.32M | 39.36M | 38.05M | 36.54M |

| Operating Income Ratio | -223.40% | 28.86% | 97.95% | 100.02% | 100.80% | 100.07% | 581.47% | 853.49% | 75.97% | 86.98% | 87.10% | 85.27% | 84.98% | 85.70% | 85.64% | 87.15% | 84.56% | 83.29% | 83.60% | 85.05% | 83.51% | 84.86% | 86.19% | 85.95% | 86.31% | 86.97% | 87.20% | 88.65% | 88.98% | 89.35% | 89.42% | 89.48% | 89.53% | 90.13% | 89.95% | 89.65% |

| Total Other Income/Expenses | 237.63M | 3.63M | 4.13M | 0.00 | -22.54M | 0.00 | -29.99M | -32.66M | 21.62M | -3.01M | 44.65M | -73.37M | 55.90M | -14.52M | 9.12M | 29.59M | -76.04M | -22.18M | 5.30M | 12.74M | 7.20M | -9.11M | -21.29M | 11.13M | 670.00K | -46.55M | 14.51M | 9.05M | -5.32M | 13.24M | -38.44M | 16.39M | 7.75M | 13.92M | -7.39M | 10.00M |

| Income Before Tax | 73.51M | 5.12M | -111.26M | 47.30M | 7.95M | 53.26M | 5.23M | 3.60M | 55.36M | 31.83M | 79.33M | -39.46M | 91.67M | 22.21M | 46.94M | 70.49M | -34.73M | 19.79M | 45.56M | 52.45M | 45.59M | 33.54M | 26.53M | 59.23M | 42.60M | -13.85M | 48.37M | 46.61M | 33.27M | 53.02M | 1.63M | 56.80M | 47.07M | 53.28M | 30.66M | 46.54M |

| Income Before Tax Ratio | 100.07% | 99.29% | 100.03% | 100.02% | 100.80% | 100.07% | 97.28% | 96.46% | 124.64% | 79.46% | 199.24% | -99.22% | 217.80% | 51.82% | 106.30% | 150.20% | -71.10% | 39.27% | 94.60% | 112.34% | 99.17% | 66.73% | 47.82% | 105.84% | 87.69% | -36.84% | 124.57% | 110.01% | 76.71% | 119.09% | 3.64% | 125.78% | 107.17% | 122.01% | 72.48% | 114.18% |

| Income Tax Expense | 0.00 | 0.00 | 25.88M | 25.53M | 26.68M | 28.25M | -52.21M | 2.00 | 16.27M | -3.01M | 44.65M | -73.37M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Net Income | 73.51M | 5.12M | -111.26M | 47.30M | 7.95M | 53.26M | 5.23M | 3.60M | 39.10M | 31.64M | 79.16M | -39.88M | 91.67M | 22.21M | 46.94M | 70.49M | -34.73M | 19.79M | 45.56M | 52.45M | 45.59M | 33.54M | 26.53M | 59.23M | 42.60M | -13.85M | 48.37M | 46.61M | 33.27M | 53.02M | 1.63M | 56.80M | 47.07M | 53.28M | 30.66M | 46.54M |

| Net Income Ratio | 100.07% | 99.29% | 100.03% | 100.02% | 100.80% | 100.07% | 97.28% | 96.46% | 88.02% | 79.01% | 198.81% | -100.27% | 217.80% | 51.82% | 106.30% | 150.20% | -71.10% | 39.27% | 94.60% | 112.34% | 99.17% | 66.73% | 47.82% | 105.84% | 87.69% | -36.84% | 124.57% | 110.01% | 76.71% | 119.09% | 3.64% | 125.78% | 107.17% | 122.01% | 72.48% | 114.18% |

| EPS | 1.18 | 0.04 | -1.79 | 0.76 | 0.11 | 0.82 | 0.08 | 0.03 | 0.72 | 0.51 | 1.28 | -0.64 | 1.49 | 0.36 | 0.77 | 1.16 | -0.57 | 0.33 | 0.75 | 0.87 | 0.75 | 0.56 | 0.45 | 1.01 | 0.73 | -0.24 | 0.83 | 0.81 | 0.59 | 0.94 | 0.03 | 1.05 | 0.89 | 1.04 | 0.62 | 0.98 |

| EPS Diluted | 1.18 | 0.04 | -1.79 | 0.76 | 0.11 | 0.82 | 0.08 | 0.03 | 44.33M | 0.51 | 1.28 | -0.64 | 1.49 | 0.36 | 0.77 | 1.16 | -0.57 | 0.33 | 0.75 | 0.87 | 0.75 | 0.56 | 0.45 | 1.01 | 0.73 | -0.24 | 0.83 | 0.81 | 0.59 | 0.94 | 0.03 | 1.05 | 0.89 | 1.04 | 0.62 | 0.98 |

| Weighted Avg Shares Out | 62.29M | 44.99M | 62.29M | 62.28M | 62.21M | 62.20M | 62.20M | 60.05M | 54.65M | 61.85M | 61.85M | 61.85M | 61.68M | 61.28M | 61.11M | 60.77M | 60.77M | 60.72M | 60.59M | 60.59M | 60.59M | 60.17M | 59.23M | 58.55M | 58.55M | 58.55M | 58.31M | 57.62M | 56.68M | 56.19M | 55.63M | 54.24M | 52.81M | 51.21M | 49.31M | 47.60M |

| Weighted Avg Shares Out (Dil) | 62.29M | 44.99M | 62.29M | 62.28M | 62.21M | 62.20M | 62.77M | 60.05M | 0.88 | 61.85M | 61.85M | 61.85M | 61.68M | 61.28M | 61.11M | 60.77M | 60.77M | 60.72M | 60.59M | 60.59M | 60.59M | 60.17M | 59.23M | 58.55M | 58.55M | 58.55M | 58.31M | 57.62M | 56.68M | 56.19M | 55.63M | 54.24M | 52.81M | 51.21M | 49.31M | 47.60M |

Dow closes 400 points lower as tech sell-off resumes

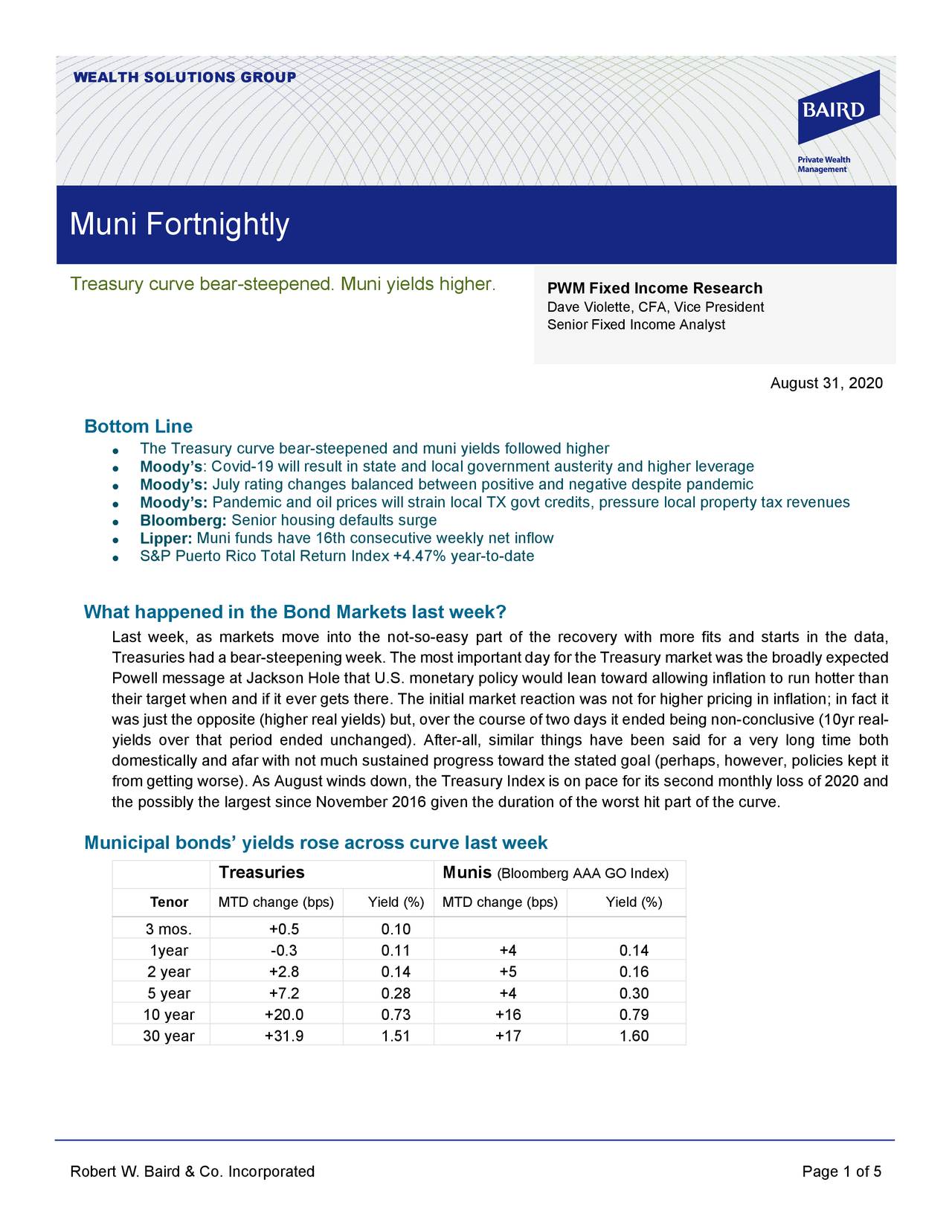

Treasury Curve Bear-Steepened; Muni Yields Higher - Muni Fortnightly, August 31, 2020

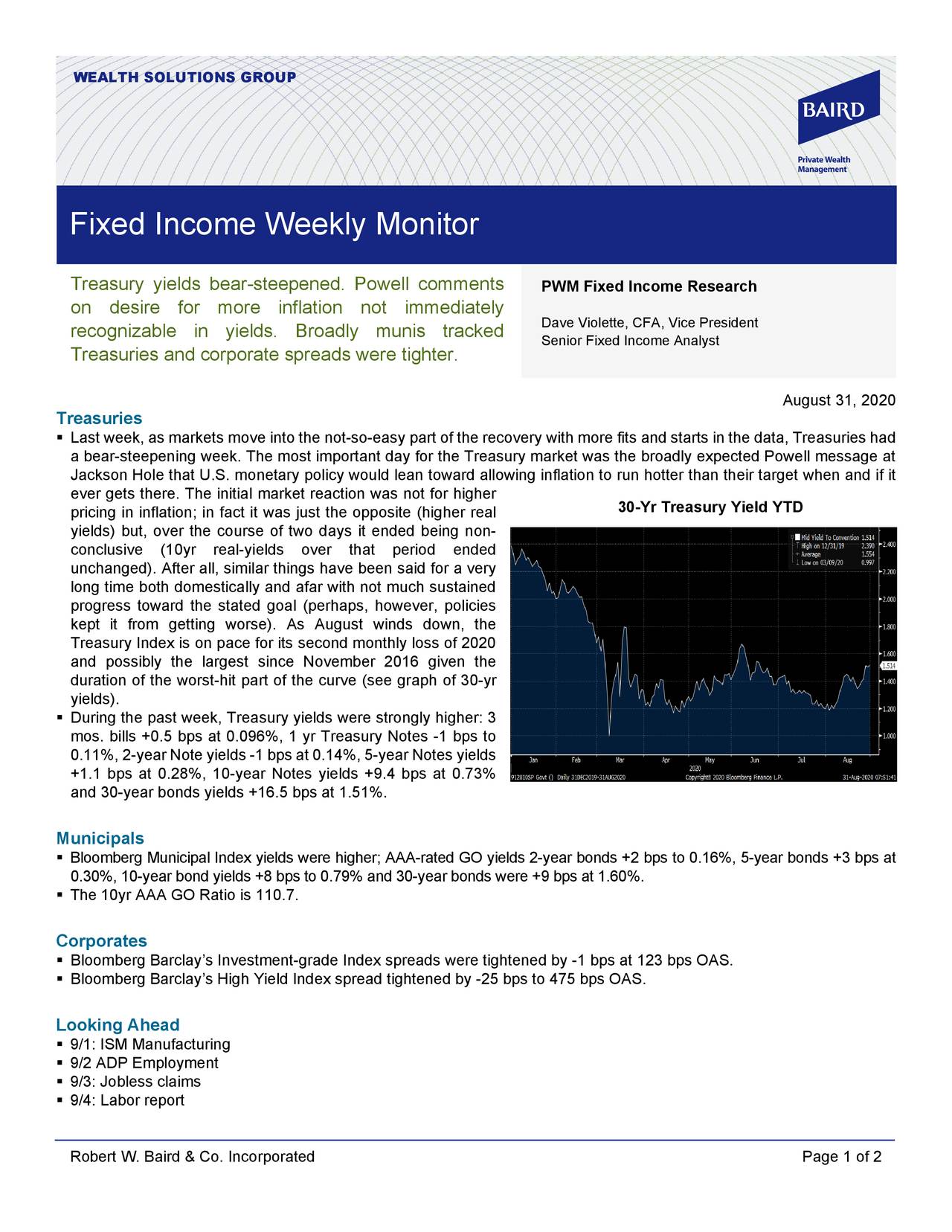

Treasuries Had A Bear-Steepening Week: Fixed Income Weekly Monitor, August 31, 2020

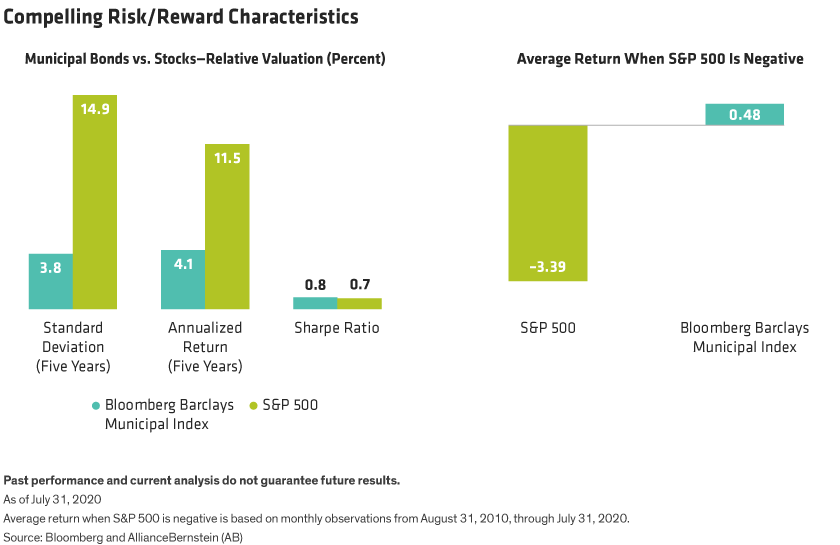

Rule #1 For Bonds: Don't Lose Money

Les batteries, une thématique porteuse pour les investisseurs en Bourse

BNY Mellon Municipal Bond Closed-End Funds Declare Distributions

BNY Mellon Municipal Bond Closed-End Funds Declare Distributions

For Muni Investors, COVID-19 Provides Lessons In Liquidity

BNY Mellon Alcentra Global Credit Income 2024 Target Term Fund, Inc. Declares Monthly Distribution

BNY Mellon High Yield Strategies Fund Declares Dividend

Source: https://incomestatements.info

Category: Stock Reports