See more : Vikram Thermo (India) Limited (VIKRAMTH.BO) Income Statement Analysis – Financial Results

Complete financial analysis of LKQ Corporation (LKQ) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of LKQ Corporation, a leading company in the Auto – Parts industry within the Consumer Cyclical sector.

- Plascar Participações Industriais S.A. (PLAS3.SA) Income Statement Analysis – Financial Results

- Nordea Invest – Virksomhedsobligationer (NDIVOBKL1.CO) Income Statement Analysis – Financial Results

- Ajinomoto (Malaysia) Bhd (2658.KL) Income Statement Analysis – Financial Results

- Aurania Resources Ltd. (ARU.V) Income Statement Analysis – Financial Results

- FRX Innovations Inc. (FRXIF) Income Statement Analysis – Financial Results

LKQ Corporation (LKQ)

About LKQ Corporation

LKQ Corporation distributes replacement parts, components, and systems used in the repair and maintenance of vehicles. It operates through three segments: North America, Europe, and Specialty. The company distributes bumper covers, automotive body panels, and lights, as well as automotive glass products, such as windshields; salvage products, including mechanical and collision parts comprising engines; transmissions; door assemblies; sheet metal products, such as trunk lids, fenders, and hoods; lights and bumper assemblies; scrap metal and other materials to metals recyclers; and brake pads, discs and sensors, clutches, steering and suspension products, filters, and oil and automotive fluids, as well as electrical products, including spark plugs and batteries. In addition, the company distributes recreational vehicle appliances and air conditioners, towing hitches, truck bed covers, vehicle protection products, cargo management products, wheels, tires, and suspension products. It serves collision and mechanical repair shops, and new and used car dealerships, as well as retail customers. The company operates in the United States, Canada, the United Kingdom, Germany, Belgium, the Netherlands, Luxembourg, Italy, the Czech Republic, Austria, Poland, Slovakia, Taiwan, and other European countries. LKQ Corporation was incorporated in 1998 and is headquartered in Chicago, Illinois.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 13.87B | 12.79B | 13.09B | 11.63B | 12.51B | 11.88B | 9.74B | 8.58B | 7.19B | 6.74B | 5.06B | 4.12B | 3.27B | 2.47B | 2.05B | 1.94B | 1.13B | 789.38M | 547.39M | 424.76M | 327.97M | 287.13M | 250.46M | 226.30M | 178.00M | 31.00M |

| Cost of Revenue | 8.29B | 7.57B | 7.77B | 7.04B | 7.65B | 7.30B | 5.94B | 5.23B | 4.36B | 4.09B | 2.99B | 2.40B | 1.88B | 1.38B | 1.12B | 1.08B | 621.08M | 431.83M | 289.79M | 227.14M | 174.24M | 154.57M | 132.52M | 119.31M | 94.00M | 16.00M |

| Gross Profit | 5.58B | 5.22B | 5.32B | 4.59B | 4.85B | 4.57B | 3.80B | 3.35B | 2.83B | 2.65B | 2.08B | 1.72B | 1.39B | 1.09B | 927.81M | 856.67M | 505.75M | 357.55M | 257.60M | 197.62M | 153.74M | 132.55M | 117.94M | 106.99M | 84.00M | 15.00M |

| Gross Profit Ratio | 40.21% | 40.82% | 40.66% | 39.50% | 38.80% | 38.52% | 39.02% | 39.05% | 39.39% | 39.35% | 41.00% | 41.82% | 42.57% | 44.27% | 45.30% | 44.22% | 44.88% | 45.29% | 47.06% | 46.52% | 46.87% | 46.17% | 47.09% | 47.28% | 47.19% | 48.39% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 3.87B | 3.54B | 3.57B | 3.27B | 3.58B | 3.35B | 1.13B | 986.38M | 828.33M | 762.89M | 597.05M | 495.59M | 685.37M | 544.22M | 477.78M | 439.63M | 257.42M | 188.47M | 134.61M | -47.77B | -35.14B | 0.00 | 39.64M | 0.00 | 72.00M | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 784.49M | 683.81M | 602.90M | 577.34M | 431.95M | 375.84M | 287.63M | 212.72M | 181.92M | 180.06M | 108.19M | 80.09M | 61.48M | 47.93B | 35.26B | 0.00 | 24.62M | 21.89M | 0.00 | 0.00 |

| SG&A | 3.87B | 3.54B | 3.57B | 3.27B | 3.58B | 3.35B | 1.92B | 1.67B | 1.43B | 1.34B | 1.03B | 871.43M | 972.99M | 756.94M | 659.70M | 619.69M | 365.61M | 268.56M | 196.09M | 155.84M | 122.23M | 106.69M | 64.26M | 21.89M | 72.00M | 0.00 |

| Other Expenses | 348.00M | 237.00M | 259.99M | 272.29M | 290.77M | 274.21M | 1.02B | 880.35M | 2.26M | 2.89M | -2.50M | -1.64M | 49.93M | 38.00M | 34.11M | 30.69M | 17.10M | 11.82M | 8.57M | 6.87M | 5.45M | 5.01M | 40.57M | 80.49M | 8.00M | 14.00M |

| Operating Expenses | 4.22B | 3.78B | 3.83B | 3.54B | 3.87B | 3.63B | 2.93B | 2.55B | 2.11B | 1.99B | 1.54B | 1.28B | 1.02B | 794.94M | 693.81M | 650.38M | 382.70M | 280.38M | 204.66M | 162.71M | 127.68M | 111.71M | 104.83M | 102.38M | 80.00M | 14.00M |

| Cost & Expenses | 12.51B | 11.35B | 11.59B | 10.57B | 11.53B | 10.93B | 8.87B | 7.78B | 6.47B | 6.08B | 4.52B | 3.68B | 2.90B | 2.17B | 1.81B | 1.73B | 1.00B | 712.22M | 494.45M | 389.85M | 301.91M | 266.28M | 237.35M | 221.69M | 174.00M | 30.00M |

| Interest Income | 44.00M | 15.00M | 20.40M | 15.95M | 32.76M | 6.50M | 17.54M | 2.25M | 2.72M | 1.04M | 2.13M | 4.29M | 1.86M | 1.45M | 1.35M | 2.31M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 214.00M | 78.00M | 72.08M | 103.78M | 138.50M | 146.38M | 101.64M | 88.26M | 57.86M | 64.54M | 51.18M | 31.43M | 22.45M | 28.32M | 30.90M | 37.85M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -1.00M | 1.00M |

| Depreciation & Amortization | 319.00M | 264.00M | 284.00M | 299.50M | 314.12M | 294.00M | 231.00M | 206.09M | 128.19M | 125.44M | 86.46M | 70.17M | 54.51M | 41.43M | 38.06M | 33.42M | 18.02M | 12.09M | 8.57M | 6.87M | 5.45M | 5.01M | 7.90M | 7.54M | -2.00M | 0.00 |

| EBITDA | 1.74B | 1.71B | 1.75B | 1.30B | 1.27B | 1.20B | 1.11B | 969.84M | 852.33M | 790.11M | 626.82M | 510.76M | 408.94M | 330.94M | 275.63M | 234.86M | 144.05M | 89.25M | 61.52M | 41.98M | 31.51M | 25.86M | 21.01M | 12.16M | 2.00M | 1.00M |

| EBITDA Ratio | 12.58% | 13.45% | 13.75% | 11.78% | 10.62% | 10.51% | 11.45% | 11.76% | 11.88% | 11.77% | 12.37% | 12.46% | 12.95% | 13.76% | 13.28% | 12.74% | 12.41% | 11.12% | 11.12% | 9.73% | 9.57% | 8.95% | 8.39% | 5.37% | 1.12% | 3.23% |

| Operating Income | 1.36B | 1.58B | 1.47B | 985.58M | 896.64M | 882.24M | 847.32M | 763.40M | 704.63M | 649.87M | 530.18M | 437.95M | 361.48M | 297.88M | 231.45M | 197.70M | 122.66M | 77.17M | 52.94M | 34.91M | 26.06M | 20.84M | 13.11M | 4.62M | 4.00M | 1.00M |

| Operating Income Ratio | 9.79% | 12.36% | 11.26% | 8.48% | 7.17% | 7.43% | 8.70% | 8.89% | 9.80% | 9.64% | 10.47% | 10.62% | 11.05% | 12.06% | 11.30% | 10.20% | 10.89% | 9.78% | 9.67% | 8.22% | 7.95% | 7.26% | 5.24% | 2.04% | 2.25% | 3.23% |

| Total Other Income/Expenses | -122.00M | -63.00M | -75.24M | -100.58M | -105.62M | -138.81M | -78.37M | -86.12M | -55.60M | -61.98M | -54.35M | -28.79M | -25.71M | -27.75M | -26.13M | -34.11M | -14.39M | -4.35M | -1.26M | -1.05M | -1.91M | -2.58M | -4.94M | -4.86M | -1.00M | 0.00 |

| Income Before Tax | 1.24B | 1.52B | 1.40B | 885.00M | 791.02M | 743.43M | 766.63M | 677.28M | 649.03M | 587.89M | 475.83M | 409.17M | 335.77M | 270.13M | 205.32M | 163.59M | 108.27M | 72.82M | 51.68M | 33.86M | 24.15M | 18.27M | 8.17M | -241.00K | 3.00M | 1.00M |

| Income Before Tax Ratio | 8.91% | 11.86% | 10.69% | 7.61% | 6.33% | 6.26% | 7.87% | 7.89% | 9.02% | 8.72% | 9.40% | 9.92% | 10.27% | 10.94% | 10.03% | 8.44% | 9.61% | 9.23% | 9.44% | 7.97% | 7.36% | 6.36% | 3.26% | -0.11% | 1.69% | 3.23% |

| Income Tax Expense | 306.00M | 385.00M | 330.59M | 249.50M | 215.33M | 191.40M | 235.56M | 220.57M | 219.70M | 204.26M | 164.20M | 147.94M | 125.51M | 103.01M | 78.18M | 63.69M | 42.37M | 28.43M | 20.80M | 13.28M | 9.58M | 7.26M | 3.94M | 637.00K | 2.00M | 1.00M |

| Net Income | 936.00M | 1.15B | 1.09B | 638.42M | 541.26M | 480.12M | 533.74M | 463.98M | 423.22M | 381.52M | 311.62M | 261.23M | 210.26M | 169.07M | 127.52M | 99.90M | 65.90M | 44.40M | 30.89M | 20.57M | 14.58M | -38.89M | 4.23M | -878.00K | 1.00M | 0.00 |

| Net Income Ratio | 6.75% | 8.98% | 8.34% | 5.49% | 4.33% | 4.04% | 5.48% | 5.41% | 5.88% | 5.66% | 6.16% | 6.34% | 6.43% | 6.85% | 6.23% | 5.16% | 5.85% | 5.62% | 5.64% | 4.84% | 4.44% | -13.55% | 1.69% | -0.39% | 0.56% | 0.00% |

| EPS | 3.52 | 4.15 | 3.68 | 2.10 | 1.75 | 1.53 | 1.72 | 1.51 | 1.39 | 1.26 | 1.04 | 0.88 | 0.72 | 0.59 | 0.46 | 0.37 | 0.29 | 0.21 | 0.18 | 0.13 | 0.11 | -0.28 | 0.03 | -0.01 | 0.01 | 0.00 |

| EPS Diluted | 3.51 | 4.13 | 3.66 | 2.09 | 1.74 | 1.52 | 1.71 | 1.50 | 1.38 | 1.25 | 1.02 | 0.87 | 0.71 | 0.58 | 0.45 | 0.36 | 0.28 | 0.20 | 0.16 | 0.12 | 0.10 | -0.25 | 0.03 | -0.01 | 0.01 | 0.00 |

| Weighted Avg Shares Out | 267.60M | 277.10M | 296.84M | 304.64M | 310.16M | 314.43M | 308.61M | 306.90M | 304.72M | 302.34M | 299.57M | 295.81M | 292.25M | 286.54M | 281.08M | 272.98M | 227.24M | 211.40M | 176.50M | 161.36M | 129.56M | 141.23M | 141.00M | 140.48M | 129.00M | 50.00M |

| Weighted Avg Shares Out (Dil) | 268.30M | 278.00M | 297.72M | 305.01M | 310.97M | 315.85M | 310.65M | 309.78M | 307.50M | 306.05M | 304.13M | 300.69M | 296.75M | 291.71M | 287.98M | 282.05M | 239.64M | 221.98M | 196.11M | 178.90M | 145.76M | 155.19M | 153.82M | 140.48M | 129.00M | 50.00M |

LKQ: Durable Compounder At An Attractive Valuation

LKQ Corporation to Release Second Quarter 2024 Results on Thursday, July 25, 2024

LKQ and Verdi Reach New Two-Year Collective Bargaining Agreement in Germany

LKQ Publishes 2023 Global Sustainability Report

LKQ (LKQ) Up 1.5% Since Last Earnings Report: Can It Continue?

LKQ Corporation Executes Agreement to Sell Elit Polska in Poland to MEKO AB

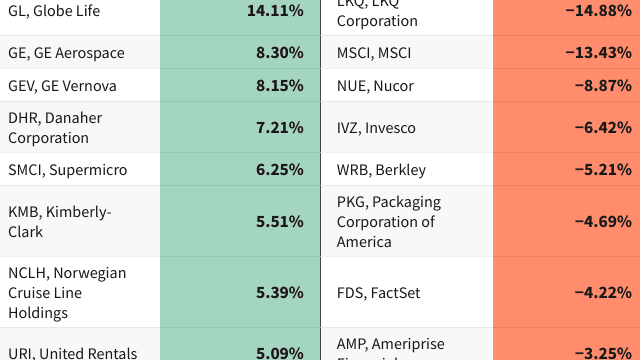

S&P 500 Gains and Losses Today: Auto Parts Provider LKQ Sinks Amid Soft Demand

LKQ Q1 Earnings Miss Estimates, Decline Y/Y, Guidance Revised

MSCI and LKQ Are the S&P 500's Leading Decliners Tuesday. Here's Why.

Compared to Estimates, LKQ (LKQ) Q1 Earnings: A Look at Key Metrics

Source: https://incomestatements.info

Category: Stock Reports