See more : SMC Entertainment, Inc. (SMCE) Income Statement Analysis – Financial Results

Complete financial analysis of Manhattan Bridge Capital, Inc. (LOAN) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Manhattan Bridge Capital, Inc., a leading company in the REIT – Mortgage industry within the Real Estate sector.

- Alma Gold Inc. (ALMA.CN) Income Statement Analysis – Financial Results

- Technicolor SA (TCLRY) Income Statement Analysis – Financial Results

- Torex Gold Resources Inc. (TXG.TO) Income Statement Analysis – Financial Results

- Sichuan Xichang Electric Power Co.,Ltd. (600505.SS) Income Statement Analysis – Financial Results

- Autris (AUTR) Income Statement Analysis – Financial Results

Manhattan Bridge Capital, Inc. (LOAN)

About Manhattan Bridge Capital, Inc.

Manhattan Bridge Capital, Inc., a real estate finance company, originates, services, and manages a portfolio of first mortgage loans in the United States. It offers short-term, secured, and non-banking loans to real estate investors to fund their acquisition, renovation, rehabilitation, or enhancement of properties in the New York metropolitan area, including New Jersey and Connecticut, and in Florida. The company's loans are primarily secured by collateral consisting of real estate and accompanied by personal guarantees from the principals of the borrowers. It qualifies as a real estate investment trust for federal income tax purposes. The company generally would not be subject to federal corporate income taxes if it distributes at least 90% of its taxable income to its stockholders. Manhattan Bridge Capital, Inc. was founded in 1989 and is headquartered in Great Neck, New York.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 7.30M | 6.76M | 5.77M | 5.66M | 5.71M | 5.53M | 4.69M | 3.86M | 3.31M | 2.36M | 1.84M | 1.56M | 1.40M | 1.21M | 1.04M | 757.67K | 221.16K | 232.19K | 4.45M | 5.95M | 9.09M | 6.53M | 5.59M | 6.24M | 4.50M | 2.80M |

| Cost of Revenue | 31.73K | 6.81K | 9.80K | 7.01K | 5.16K | 5.42K | 8.30K | 12.49K | 8.07K | -544.42K | -416.79K | 280.65K | 0.00 | 0.00 | 0.00 | 74.02K | 49.34K | 189.29K | 659.46K | 902.33K | 2.12M | 1.73M | 1.50M | 1.42M | 300.00K | 400.00K |

| Gross Profit | 7.27M | 6.75M | 5.76M | 5.66M | 5.71M | 5.52M | 4.68M | 3.85M | 3.30M | 2.90M | 2.26M | 1.28M | 1.40M | 1.21M | 1.04M | 683.65K | 171.82K | 42.90K | 3.79M | 5.05M | 6.97M | 4.80M | 4.08M | 4.82M | 4.20M | 2.40M |

| Gross Profit Ratio | 99.57% | 99.90% | 99.83% | 99.88% | 99.91% | 99.90% | 99.82% | 99.68% | 99.76% | 123.08% | 122.62% | 81.97% | 100.00% | 100.00% | 100.00% | 90.23% | 77.69% | 18.48% | 85.17% | 84.83% | 76.69% | 73.51% | 73.12% | 77.20% | 93.33% | 85.71% |

| Research & Development | 0.00 | 0.61 | 0.65 | 0.60 | 0.61 | 0.58 | 0.58 | 0.61 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 1.83M | 1.55M | 1.35M | 1.43M | 1.20M | 1.32M | 1.23M | 1.01M | 1.04M | 876.91K | 837.79K | 864.40K | 866.71K | 783.23K | 673.22K | 0.00 | 756.75K | 906.72K | 2.63M | 2.83M | 3.23M | 3.06M | 2.74M | 2.96M | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 3.70K | 8.68K | 2.36K | 2.24K | 1.68K | 6.13K | 7.90K | 11.98K | 0.00 | 0.00 | 8.79K | 105.10K | 2.13M | 2.63M | 3.31M | 2.34M | 1.95M | 2.11M | 0.00 | 0.00 |

| SG&A | 1.83M | 1.55M | 1.35M | 1.43M | 1.20M | 1.32M | 1.23M | 1.01M | 1.04M | 876.91K | 837.79K | 864.40K | 874.60K | 795.21K | 673.22K | 682.46K | 765.54K | 1.01M | 4.76M | 5.46M | 6.55M | 5.39M | 4.69M | 5.07M | 3.30M | 1.70M |

| Other Expenses | 2.15K | -1.28M | -2.70M | 20.00K | 12.00K | 3.00K | -1.22M | -1.00M | -1.03M | 21.20K | 27.55K | 27.55K | 0.00 | 0.00 | 0.00 | 0.00 | 24.34K | 137.67K | 0.00 | 0.00 | 26.04K | -5.85K | 91.67K | 0.00 | 100.00K | 0.00 |

| Operating Expenses | 1.83M | 273.57K | -1.35M | 1.45M | 1.21M | 1.32M | 1.23M | 1.01M | 1.04M | 879.15K | 839.47K | 870.53K | 874.60K | 795.21K | 673.22K | 682.46K | 789.89K | 1.15M | 4.76M | 5.46M | 6.57M | 5.39M | 4.78M | 5.07M | 3.40M | 1.70M |

| Cost & Expenses | 1.83M | 273.57K | -1.35M | 1.45M | 1.21M | 1.32M | 1.23M | 1.01M | 1.04M | 879.15K | 839.47K | 1.15M | 874.60K | 795.21K | 673.22K | 756.47K | 839.23K | 1.34M | 5.42M | 6.36M | 8.69M | 7.12M | 6.28M | 6.49M | 3.70M | 2.10M |

| Interest Income | 7.98M | 6.77M | 5.61M | 5.99M | 6.19M | 6.17M | 5.02M | 3.85M | 3.36M | 2.40M | 1.86M | 1.48M | 156.77K | 28.53K | 24.21K | 73.98K | 249.05K | 258.27K | 224.98K | 191.38K | 233.10K | 246.54K | 313.22K | 425.02K | 0.00 | 0.00 |

| Interest Expense | 2.53M | 1.82M | 1.05M | 1.36M | 1.64M | 1.70M | 1.23M | 780.12K | 691.39K | 563.37K | 442.66K | 280.65K | 156.77K | 28.53K | 24.21K | 73.98K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 4.06K | 1.55M | 1.36M | 1.44M | 2.84M | 3.02M | 2.46M | 1.79M | 5.71K | 563.37K | 442.66K | 588.00 | 1.84K | 3.03K | 3.96K | 4.84K | 53.88K | 44.15K | 85.43K | 125.04K | 174.26K | 133.10K | 118.09K | 133.30K | -100.00K | 0.00 |

| EBITDA | 7.97M | 7.02M | 5.45M | 5.57M | 4.50M | 4.21M | 3.47M | 2.86M | 2.27M | 2.05M | 1.41M | 664.97K | 370.91K | 540.37K | 369.57K | 1.20K | -593.72K | -1.01M | -883.61K | -285.51K | 568.30K | -454.86K | -579.30K | -118.30K | 0.00 | 700.00K |

| EBITDA Ratio | 109.19% | 104.08% | 76.67% | 74.70% | 78.71% | 106.89% | 100.09% | 94.26% | 89.67% | 85.81% | 77.06% | 42.73% | 43.34% | 34.92% | 33.68% | 88.34% | -299.58% | -444.05% | -26.34% | -11.44% | -7.61% | -6.79% | -13.65% | -1.90% | 15.56% | 25.00% |

| Operating Income | 5.44M | 7.04M | 4.42M | 4.23M | 4.50M | 5.90M | 3.46M | 2.85M | 2.27M | 1.46M | 977.42K | 664.38K | 369.08K | 385.92K | 365.60K | 1.20K | -593.72K | -1.11M | -969.04K | -410.55K | 420.08K | -593.81K | -605.72K | -251.59K | 800.00K | 700.00K |

| Operating Income Ratio | 74.54% | 104.05% | 76.63% | 74.68% | 78.68% | 106.83% | 73.83% | 73.95% | 68.59% | 61.93% | 53.04% | 42.69% | 26.35% | 31.90% | 35.19% | 0.16% | -268.46% | -476.58% | -21.79% | -6.90% | 4.62% | -9.09% | -10.84% | -4.03% | 17.78% | 25.00% |

| Total Other Income/Expenses | 33.88K | 18.00K | 18.00K | 20.00K | -3.00K | 3.00K | -20.00K | -15.00K | -28.86K | 21.20K | -7.45K | 27.55K | 79.33K | 4.97K | 43.92K | -589.30K | 372.43K | 208.89K | 457.99K | 586.52K | 1.47M | 240.69K | 404.89K | 425.02K | 100.00K | 0.00 |

| Income Before Tax | 5.48M | 5.21M | 4.42M | 4.23M | 4.50M | 4.21M | 3.44M | 2.84M | 2.24M | 1.48M | 969.97K | 691.93K | 448.41K | 542.31K | 409.53K | -588.10K | -221.29K | -897.70K | -456.05K | 175.97K | 1.89M | -353.13K | -200.83K | 173.43K | 800.00K | 700.00K |

| Income Before Tax Ratio | 75.00% | 77.09% | 76.63% | 74.68% | 78.68% | 76.09% | 73.40% | 73.56% | 67.71% | 62.83% | 52.64% | 44.46% | 32.02% | 44.83% | 39.42% | -77.62% | -100.06% | -386.62% | -10.25% | 2.96% | 20.77% | -5.41% | -3.60% | 2.78% | 17.78% | 25.00% |

| Income Tax Expense | 650.00 | 650.00 | 647.00 | 645.00 | 572.00 | 642.00 | 2.97K | 2.15K | 1.60K | 27.84K | 387.00K | 303.32K | 191.88K | 222.85K | 173.78K | 4.67K | -182.47K | -932.48K | -457.99K | 70.80K | 288.25K | -155.13K | -83.75K | 87.67K | 400.00K | 300.00K |

| Net Income | 5.48M | 5.21M | 4.42M | 4.23M | 4.49M | 4.20M | 3.44M | 2.84M | 2.24M | 1.45M | 582.97K | 388.61K | 256.52K | 319.46K | 235.75K | -519.86K | -31.70K | -174.11K | -511.05K | 1.04M | 1.60M | -1.09M | -117.08K | -425.31K | 400.00K | 400.00K |

| Net Income Ratio | 75.00% | 77.08% | 76.62% | 74.67% | 78.67% | 76.07% | 73.34% | 73.50% | 67.66% | 61.65% | 31.64% | 24.97% | 18.32% | 26.41% | 22.69% | -68.61% | -14.34% | -74.99% | -11.49% | 17.40% | 17.60% | -16.74% | -2.10% | -6.82% | 8.89% | 14.29% |

| EPS | 0.48 | 0.45 | 0.42 | 0.44 | 0.47 | 0.48 | 0.42 | 0.37 | 0.33 | 0.29 | 0.14 | 0.09 | 0.07 | 0.10 | 0.07 | -0.16 | -0.01 | -0.05 | -0.16 | 0.34 | 0.55 | -0.37 | -0.04 | -0.15 | 0.19 | 0.29 |

| EPS Diluted | 0.48 | 0.45 | 0.42 | 0.44 | 0.47 | 0.48 | 0.42 | 0.37 | 0.33 | 0.29 | 0.14 | 0.09 | 0.07 | 0.09 | 0.07 | -0.16 | -0.01 | -0.05 | -0.16 | 0.32 | 0.53 | -0.37 | -0.04 | -0.15 | 0.19 | 0.29 |

| Weighted Avg Shares Out | 11.47M | 11.49M | 10.52M | 9.63M | 9.66M | 8.79M | 8.12M | 7.59M | 6.76M | 5.03M | 4.27M | 4.32M | 3.63M | 3.32M | 3.33M | 3.25M | 3.24M | 3.18M | 3.19M | 3.07M | 2.91M | 2.92M | 2.91M | 2.91M | 2.11M | 1.38M |

| Weighted Avg Shares Out (Dil) | 11.47M | 11.49M | 10.52M | 9.63M | 9.66M | 8.80M | 8.13M | 7.61M | 6.79M | 5.06M | 4.29M | 4.33M | 3.65M | 3.37M | 3.33M | 3.25M | 3.24M | 3.18M | 3.19M | 3.24M | 3.02M | 2.92M | 2.91M | 2.92M | 2.11M | 1.38M |

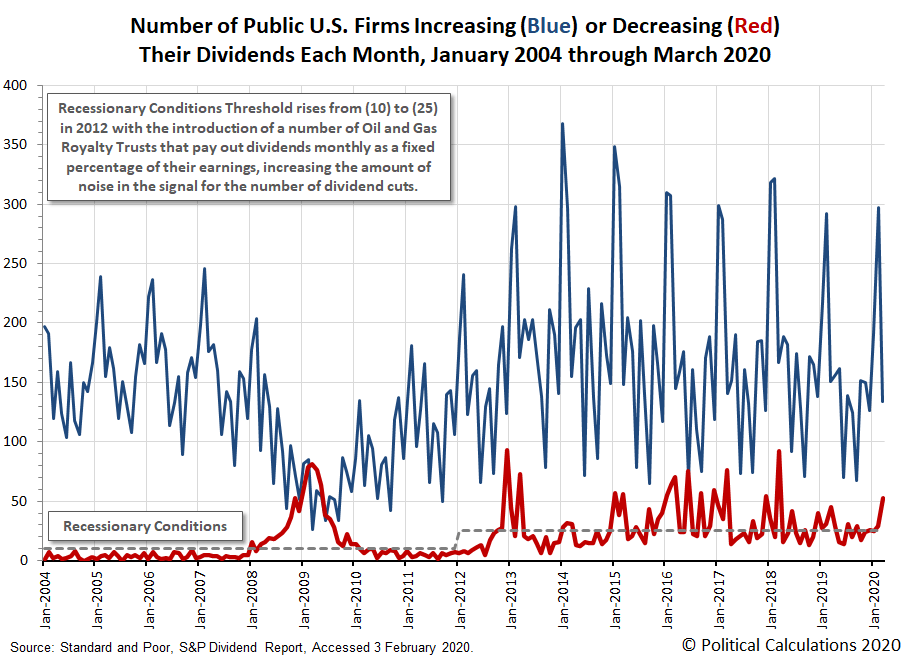

Dividend Increases: May 2-8, 2020

Dividend Increases: April 25-May 1, 2020

Zacks: Analysts Set $5.38 Target Price for Manhattan Bridge Capital Inc. (NASDAQ:LOAN)

Critical Contrast: Manhattan Bridge Capital (NASDAQ:LOAN) vs. American Campus Communities (NASDAQ:ACC)

Reviewing Manhattan Bridge Capital (NASDAQ:LOAN) and Hannon Armstrong Sustnbl Infrstr Cap (NASDAQ:HASI)

Small businesses: This may help secure PPP loan in round 2

Shake Shack Is Not the Problem

Analysts Offer Insights on Financial Companies: Manhattan Bridge Capital (LOAN), Zions Bancorporation National Association (ZION) and Ladder Capital (LADR)

Dividends By The Numbers In March 2020 And Q1 2020

Analyzing Starwood Property Trust (NYSE:STWD) and Manhattan Bridge Capital (NYSE:LOAN)

Source: https://incomestatements.info

Category: Stock Reports