See more : PT Sriwahana Adityakarta Tbk (SWAT.JK) Income Statement Analysis – Financial Results

Complete financial analysis of Lonestar Resources US Inc. (LONE) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Lonestar Resources US Inc., a leading company in the Oil & Gas Exploration & Production industry within the Energy sector.

- Alumis Inc. Common Stock (ALMS) Income Statement Analysis – Financial Results

- WINDMILL Group Limited (1850.HK) Income Statement Analysis – Financial Results

- Tokyo Electric Power Company Holdings, Incorporated (TKECF) Income Statement Analysis – Financial Results

- The Italian Sea Group S.p.A. (TISG.MI) Income Statement Analysis – Financial Results

- Misawa & Co.,Ltd. (3169.T) Income Statement Analysis – Financial Results

Lonestar Resources US Inc. (LONE)

About Lonestar Resources US Inc.

Lonestar Resources US, Inc. is engaged in the exploration, development, and production of unconventional oil and natural gas properties. The company is headquartered in Fort Worth, Texas and currently employs 74 full-time employees. The firm is focused on the development, production and acquisition of unconventional oil, natural gas liquids (NGLs) and natural gas properties in the Eagle Ford Shale in Texas. The company has accumulated approximately 38,242 gross acres in crude oil and condensate windows, as of December 31, 2015. As of December 31, 2015, it held a portfolio of conventional, crude oil-weighted onshore assets in Texas. The company is conducting resource evaluation on approximately 44,084 gross acres in the West Poplar area of the Bakken-Three Forks trend in Roosevelt County, Montana. Its properties in Eagle Ford Shale Trend-Western Region include Asherton, Beall Ranch, Burns Ranch Area and Horned Frog. The firm also operates Southern Gonzales County property in Eagle Ford Shale Trend-Central Region, and Brazos and Robertson Counties in Eagle Ford Shale Trend-Eastern Region. The company has leased approximately 1,450 gross acres in its Cyclone project area.

| Metric | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 |

|---|---|---|---|---|---|---|---|---|---|

| Revenue | 10.90M | 195.15M | 201.17M | 94.07M | 57.97M | 81.69M | 116.53M | 81.20M | 26.66M |

| Cost of Revenue | 0.00 | 136.37M | 120.62M | 75.63M | 68.67M | 78.88M | 58.25M | 42.10M | 18.76M |

| Gross Profit | 10.90M | 58.78M | 80.55M | 18.44M | -10.70M | 2.81M | 58.28M | 39.10M | 7.91M |

| Gross Profit Ratio | 100.00% | 30.12% | 40.04% | 19.60% | -18.45% | 3.44% | 50.01% | 48.15% | 29.65% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 1.51M | 16.49M | 16.02M | 12.63M | 11.77M | 13.41M | 10.85M | 9.78M | 7.00M |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 1.51M | 16.49M | 16.02M | 12.63M | 11.77M | 13.41M | 10.85M | 9.78M | 7.00M |

| Other Expenses | 0.00 | 0.00 | 0.00 | 76.00K | 1.44M | 5.20M | 7.13M | 5.03M | 1.43M |

| Operating Expenses | 1.51M | 16.49M | 16.02M | 12.70M | 13.21M | 18.61M | 17.98M | 14.81M | 8.43M |

| Cost & Expenses | 1.51M | 152.86M | 136.64M | 88.33M | 81.88M | 97.49M | 76.23M | 56.91M | 27.18M |

| Interest Income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 1.48M | 41.25M | 35.19M | 20.77M | 22.84M | 24.58M | 19.95M | 3.74M | -373.00K |

| Depreciation & Amortization | 2.09M | -116.56M | -3.20M | -53.38M | -20.19M | -48.32M | 38.55M | 5.16M | -5.21M |

| EBITDA | 2.85M | -74.26M | 61.33M | -47.64M | -44.09M | -64.12M | 78.85M | 29.45M | -5.73M |

| EBITDA Ratio | 26.17% | -38.05% | 30.49% | -50.64% | -76.05% | -78.49% | 67.66% | 36.27% | -21.50% |

| Operating Income | 760.00K | 42.30M | 64.53M | 5.74M | -23.90M | -15.80M | 40.30M | 24.29M | -524.00K |

| Operating Income Ratio | 6.97% | 21.67% | 32.08% | 6.10% | -41.23% | -19.34% | 34.58% | 29.92% | -1.97% |

| Total Other Income/Expenses | -1.48M | -157.81M | -38.39M | -74.14M | -43.03M | -72.90M | 18.60M | 1.41M | -4.84M |

| Income Before Tax | -716.00K | -115.51M | 26.14M | -68.40M | -66.93M | -88.70M | 58.90M | 25.71M | -5.36M |

| Income Before Tax Ratio | -6.57% | -59.19% | 12.99% | -72.72% | -115.45% | -108.58% | 50.54% | 31.66% | -20.10% |

| Income Tax Expense | 1.48M | -12.50M | 6.79M | -29.74M | 27.41M | -31.60M | 22.43M | -4.93M | 103.00K |

| Net Income | -2.19M | -103.02M | 19.35M | -38.66M | -94.34M | -57.09M | 36.47M | 30.64M | -5.46M |

| Net Income Ratio | -20.11% | -52.79% | 9.62% | -41.10% | -162.73% | -69.89% | 31.29% | 37.74% | -20.49% |

| EPS | -0.09 | -4.11 | 0.78 | -1.74 | -4.32 | -7.59 | 0.05 | 4.39 | -2.31 |

| EPS Diluted | -0.09 | -4.11 | 0.78 | -1.74 | -4.32 | -7.59 | 0.05 | 4.39 | -2.31 |

| Weighted Avg Shares Out | 25.36M | 25.05M | 24.74M | 22.25M | 21.82M | 7.52M | 733.05M | 6.97M | 2.37M |

| Weighted Avg Shares Out (Dil) | 25.36M | 25.05M | 24.74M | 22.25M | 21.82M | 7.52M | 753.48M | 6.97M | 2.37M |

Lonestar Resources: Continues To Teeter On The Edge Of Bankruptcy

Lonestar Announces Second Quarter 2020 Results

ConocoPhillips: Drilling Deeper Uncovers Value (NYSE:COP)

Callon Petroleum (CPE) Q2 2020 Earnings Call Transcript | The Motley Fool

Nine Energy Service Announces Second Quarter 2020 Results

Jim Farley, nuevo CEO de Ford, apuesta por una expansión tecnológica

Ford, struggling in a changing industry, replaces its CEO - The Boston Globe

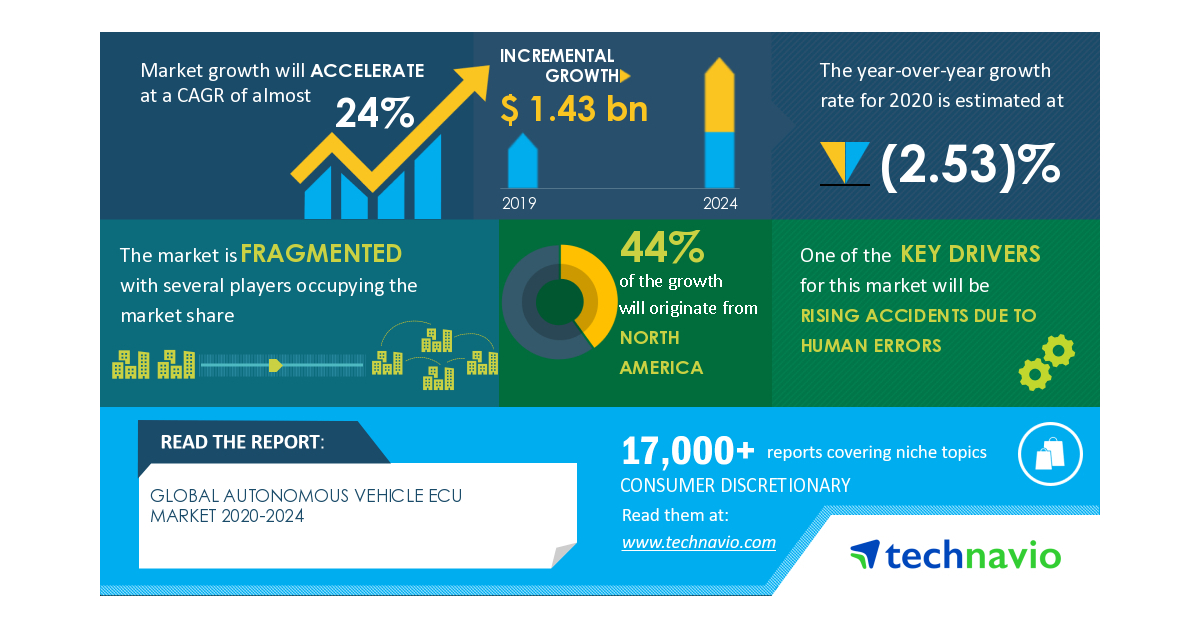

Autonomous Vehicle ECU Market Analysis 2020-2024 Highlights the Impact of COVID-19 | Rise in Accidents due to Human Error will Boost Market Growth | Technavio

Source: https://incomestatements.info

Category: Stock Reports