See more : ResMed Inc. (RMD) Income Statement Analysis – Financial Results

Complete financial analysis of Loral Space & Communications Inc. (LORL) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Loral Space & Communications Inc., a leading company in the Telecommunications Services industry within the Communication Services sector.

- Reitmans (Canada) Limited (RET-A.V) Income Statement Analysis – Financial Results

- CLS Holdings plc (CLI.L) Income Statement Analysis – Financial Results

- Netweb Technologies India Limited (NETWEB.NS) Income Statement Analysis – Financial Results

- Jardine Matheson Holdings Limited (JARJ.L) Income Statement Analysis – Financial Results

- DBV Technologies S.A. (DBVT) Income Statement Analysis – Financial Results

Loral Space & Communications Inc. (LORL)

About Loral Space & Communications Inc.

Loral Space & Communications Inc., a satellite communications company, offers satellite-based communications services to the broadcast, telecom, corporate, and government customers worldwide. As of December 31, 2019, the company provided satellite services to its customers through a fleet of 16 in-orbit geostationary satellites; and owned the Canadian Ka-band payload on the ViaSat-1 satellite. It also offers video distribution and direct-to-home (DTH) video, as well as end-to-end communications services using satellite and hybrid satellite-ground networks; and broadcast services, including DTH, video distribution and contribution, and satellite transmission services for the broadcast of video news, sports, and live event coverage. In addition, the company provides telecommunication carrier and integrator services; maritime and aeronautical services; satellite services to the Canadian government; two-way broadband Internet services; communications services to the on and off shore oil and gas, and mining industries; and satellite operator services. Further, it is involved in the installation and maintenance of the end user terminal; maintenance of the VSAT hub; and provision of satellite capacity. Additionally, the company offers consulting services related to space and earth, government studies, satellite control services, and research and development; and X-band communications services to the United States, Spanish, and allied government users. Loral Space & Communications Inc. was founded in 1996 and is headquartered in New York, New York.

| Metric | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 823.58 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1.11B | 1.16B | 993.40M | 869.40M | 882.45M | 797.33M | 197.17M | 522.13M | 533.39M | 1.10B | 1.07B | 1.22B | 1.46B | 1.30B | 1.31B | 5.10M |

| Cost of Revenue | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 908.72M | 986.70M | 880.49M | 787.76M | 775.20M | 649.44M | 165.27M | 587.17M | 676.28M | 1.02B | 871.39M | 1.06B | 1.30B | 1.13B | 0.00 | 0.00 |

| Gross Profit | 823.58 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 198.65M | 172.29M | 112.91M | 81.64M | 107.25M | 147.90M | 31.90M | -65.04M | -142.90M | 79.17M | 198.18M | 166.91M | 160.78M | 171.83M | 1.31B | 5.10M |

| Gross Profit Ratio | 100.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 17.94% | 14.87% | 11.37% | 9.39% | 12.15% | 18.55% | 16.18% | -12.46% | -26.79% | 7.21% | 18.53% | 13.63% | 11.03% | 13.20% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 6.72M | 6.61M | 6.53M | 7.94M | 6.73M | 6.53M | 5.33M | 16.04M | 28.77M | 0.00 | 6.86M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 203.41M | 252.99M | 223.05M | 205.61M | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 6.72M | 6.61M | 6.53M | 7.94M | 6.73M | 6.53M | 5.33M | 16.04M | 28.77M | 0.00 | 6.86M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 203.41M | 252.99M | 223.05M | 205.61M | 0.00 | 0.00 |

| Other Expenses | -5.85M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 112.13M | 84.82M | 92.70M | 275.62M | 61.99M | 118.08M | 36.84M | 149.30M | 167.02M | 161.20M | 0.00 | 0.00 | 0.00 | 0.00 | 1.30B | 17.30M |

| Operating Expenses | 863.00K | 6.61M | 6.53M | 7.94M | 6.73M | 6.53M | 5.33M | 16.04M | 28.77M | 112.13M | 91.68M | 92.70M | 275.62M | 61.99M | 118.08M | 36.84M | 149.30M | 167.02M | 161.20M | 203.41M | 252.99M | 223.05M | 205.61M | 1.30B | 17.30M |

| Cost & Expenses | 863.00K | 6.61M | 6.53M | 7.94M | 6.73M | 6.53M | 5.33M | 16.04M | 28.77M | 1.02B | 1.08B | 973.19M | 1.06B | 837.20M | 767.52M | 202.11M | 736.47M | 843.30M | 1.18B | 1.07B | 1.31B | 1.52B | 1.34B | 1.30B | 17.30M |

| Interest Income | 1.05M | 5.73M | 4.75M | 2.48M | 194.00K | 138.00K | 581.00K | 1.24M | 1.93M | 21.35M | 13.55M | 8.31M | 11.86M | 39.28M | 31.53M | 4.13M | 9.95M | 15.20M | 12.91M | 28.89M | 129.24M | 0.00 | 53.87M | 0.00 | 0.00 |

| Interest Expense | 26.00K | 24.00K | 26.00K | 27.00K | 20.00K | 17.00K | 15.00K | 17.00K | 106.00K | 2.69M | 3.14M | 1.42M | 2.27M | 2.31M | 23.45M | 4.41M | 2.95M | 61.76M | 77.05M | 183.93M | 170.84M | 0.00 | 51.21M | 0.00 | 28.70M |

| Depreciation & Amortization | 4.00K | 15.00K | 26.00K | 38.00K | 60.00K | 41.00K | 42.00K | 18.00K | 62.00K | 32.51M | 33.73M | 39.80M | 36.37M | 70.17M | -8.21M | 16.02M | 134.80M | 189.27M | 187.00M | 227.78M | 216.26M | 174.91M | 135.03M | 62.76M | 1.10M |

| EBITDA | 106.01M | 95.95M | -29.68M | 207.64M | 75.79M | -115.70M | -33.88M | 18.46M | 328.18M | 251.02M | 215.10M | 278.49M | -608.54M | 115.43M | 21.61M | 6.92M | -52.24M | -127.03M | -850.12M | 224.96M | -1.07B | 5.51M | 51.31M | 137.64M | 41.60M |

| EBITDA Ratio | 12,871,800.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 22.67% | 18.56% | 28.03% | -70.00% | 13.08% | 2.71% | 3.51% | -10.00% | -23.82% | -77.39% | 21.03% | -87.67% | 0.38% | 3.94% | 10.49% | 815.69% |

| Operating Income | 106.01M | 95.93M | -29.71M | 207.60M | 75.73M | -115.74M | -33.92M | 18.44M | 328.11M | 218.51M | 181.37M | 238.70M | -644.90M | 45.26M | 29.82M | -9.10M | -187.03M | -316.30M | -1.04B | -2.82M | -1.29B | -169.40M | -83.72M | 74.88M | 40.50M |

| Operating Income Ratio | 12,871,300.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 19.73% | 15.65% | 24.03% | -74.18% | 5.13% | 3.74% | -4.62% | -35.82% | -59.30% | -94.42% | -0.26% | -105.34% | -11.62% | -6.43% | 5.70% | 794.12% |

| Total Other Income/Expenses | -116.74M | -101.43M | 24.45M | -216.37M | -83.73M | 105.55M | 25.89M | -33.97M | -355.33M | -108.52M | -88.27M | -211.72M | 493.38M | 112.53M | 299.00K | 3.71M | -20.82M | -22.28M | 889.77M | -157.45M | 1.23B | 107.26M | 58.09M | 52.11M | -24.00M |

| Income Before Tax | -10.74M | -5.50M | -5.26M | -8.77M | -8.00M | -10.19M | -8.03M | -15.53M | -27.21M | 109.99M | 93.09M | 26.98M | -151.52M | 157.79M | 30.12M | -5.40M | -207.85M | -338.58M | -147.35M | -160.27M | -56.84M | -62.14M | -25.63M | 126.98M | 16.50M |

| Income Before Tax Ratio | -1,303,706.40% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 9.93% | 8.03% | 2.72% | -17.43% | 17.88% | 3.78% | -2.74% | -39.81% | -63.48% | -13.42% | -14.98% | -4.64% | -4.26% | -1.97% | 9.67% | 323.53% |

| Income Tax Expense | 12.89M | 6.15M | -39.35M | 73.11M | 28.51M | -45.48M | -8.11M | 1.84M | -93.32M | 89.15M | -308.62M | 5.57M | 45.74M | 83.46M | 20.88M | 1.75M | -13.28M | 4.65M | 355.04M | 9.71M | 9.38M | 32.52M | 3.87M | 34.87M | 2.90M |

| Net Income | -23.62M | -11.65M | 34.09M | -81.88M | -36.51M | 35.29M | 75.00K | -17.37M | 66.10M | 20.85M | 401.72M | 21.40M | -197.27M | 74.33M | 9.24M | -7.15M | -194.57M | -343.22M | -502.40M | -169.98M | -66.22M | -94.65M | -29.50M | 92.11M | 13.60M |

| Net Income Ratio | -2,868,348.36% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 1.88% | 34.66% | 2.15% | -22.69% | 8.42% | 1.16% | -3.62% | -37.26% | -64.35% | -45.74% | -15.89% | -5.41% | -6.49% | -2.27% | 7.02% | 266.67% |

| EPS | -0.76 | -0.38 | 1.10 | -2.65 | -1.18 | 1.14 | 0.00 | -0.56 | 2.15 | 0.68 | 13.35 | 0.72 | -9.67 | 3.70 | 0.46 | -0.18 | -4.41 | -7.83 | -13.48 | -5.75 | -2.24 | -3.26 | -1.22 | 3.81 | 0.59 |

| EPS Diluted | -0.76 | -0.38 | 1.10 | -2.64 | -1.18 | 1.14 | 0.00 | -0.56 | 2.13 | 0.67 | 13.01 | 0.71 | -9.67 | 3.70 | 0.46 | -0.18 | -4.41 | -7.83 | -13.48 | -5.75 | -2.24 | -3.26 | -1.21 | 3.78 | 0.59 |

| Weighted Avg Shares Out | 30.93M | 31.01M | 31.01M | 30.93M | 30.93M | 30.93M | 30.92M | 30.85M | 30.70M | 30.68M | 30.09M | 29.74M | 20.41M | 20.09M | 20.00M | 40.09M | 44.11M | 43.82M | 37.27M | 29.58M | 29.58M | 29.02M | 24.21M | 24.21M | 22.90M |

| Weighted Avg Shares Out (Dil) | 30.93M | 31.01M | 31.01M | 31.01M | 31.01M | 30.93M | 30.92M | 31.00M | 30.99M | 31.17M | 30.89M | 29.97M | 20.41M | 20.09M | 20.00M | 40.09M | 44.13M | 43.82M | 37.27M | 29.58M | 29.58M | 29.02M | 24.36M | 24.36M | 22.90M |

Charles Schwab Investment Management Inc. Boosts Holdings in Loral Space & Communications Ltd. (NASDAQ:LORL)

Tracking Prem Watsa's Fairfax Financial Holdings Portfolio - Q4 2019 Update

Loral Space & Communications Ltd. (NASDAQ:LORL) Sets New 1-Year Low at $22.74

Loral Space & Communications Ltd. (NASDAQ:LORL) Shares Purchased by Alphasimplex Group LLC

Space Now Gets Crowded With Satellites, and It's Not Good News!

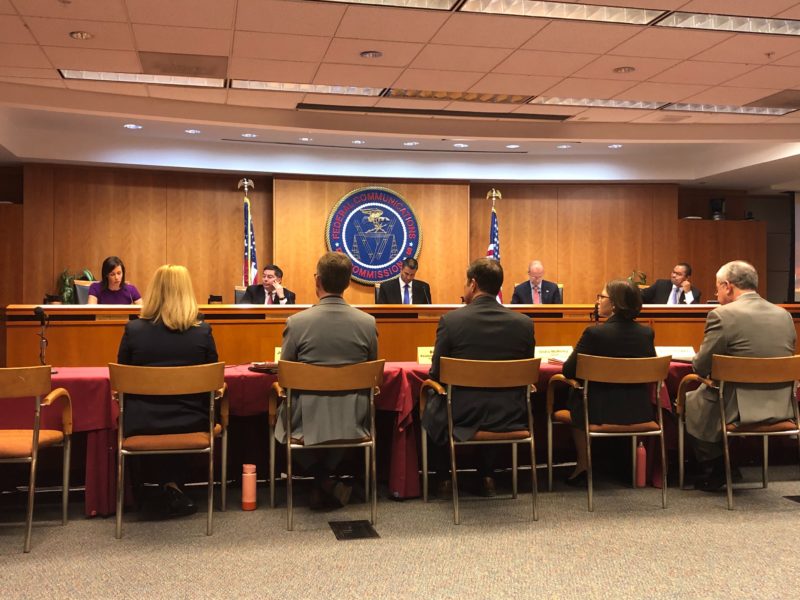

FCC Releases Final C-Band Order - Via Satellite -

Loral Space & Communications Ltd. (NASDAQ:LORL) Position Boosted by California Public Employees Retirement System

FCC Approves Public C-Band Auction - Via Satellite -

Telesat Reports Results for the Quarter and Year Ended December 31, 2019

Telesat CEO Daniel Goldberg on how disrupters such as Netflix kicked the company into high gear

Source: https://incomestatements.info

Category: Stock Reports