See more : China Customer Relations Centers, Inc. (CCRC) Income Statement Analysis – Financial Results

Complete financial analysis of Loral Space & Communications Inc. (LORL) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Loral Space & Communications Inc., a leading company in the Telecommunications Services industry within the Communication Services sector.

- First Bank (FRBA) Income Statement Analysis – Financial Results

- Banca Sistema S.p.A. (0R9H.L) Income Statement Analysis – Financial Results

- Area Quest Inc. (8912.T) Income Statement Analysis – Financial Results

- Starfleet Innotech, Inc. (SFIO) Income Statement Analysis – Financial Results

- Woolworths Holdings Limited (WLWHF) Income Statement Analysis – Financial Results

Loral Space & Communications Inc. (LORL)

About Loral Space & Communications Inc.

Loral Space & Communications Inc., a satellite communications company, offers satellite-based communications services to the broadcast, telecom, corporate, and government customers worldwide. As of December 31, 2019, the company provided satellite services to its customers through a fleet of 16 in-orbit geostationary satellites; and owned the Canadian Ka-band payload on the ViaSat-1 satellite. It also offers video distribution and direct-to-home (DTH) video, as well as end-to-end communications services using satellite and hybrid satellite-ground networks; and broadcast services, including DTH, video distribution and contribution, and satellite transmission services for the broadcast of video news, sports, and live event coverage. In addition, the company provides telecommunication carrier and integrator services; maritime and aeronautical services; satellite services to the Canadian government; two-way broadband Internet services; communications services to the on and off shore oil and gas, and mining industries; and satellite operator services. Further, it is involved in the installation and maintenance of the end user terminal; maintenance of the VSAT hub; and provision of satellite capacity. Additionally, the company offers consulting services related to space and earth, government studies, satellite control services, and research and development; and X-band communications services to the United States, Spanish, and allied government users. Loral Space & Communications Inc. was founded in 1996 and is headquartered in New York, New York.

| Metric | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 823.58 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1.11B | 1.16B | 993.40M | 869.40M | 882.45M | 797.33M | 197.17M | 522.13M | 533.39M | 1.10B | 1.07B | 1.22B | 1.46B | 1.30B | 1.31B | 5.10M |

| Cost of Revenue | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 908.72M | 986.70M | 880.49M | 787.76M | 775.20M | 649.44M | 165.27M | 587.17M | 676.28M | 1.02B | 871.39M | 1.06B | 1.30B | 1.13B | 0.00 | 0.00 |

| Gross Profit | 823.58 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 198.65M | 172.29M | 112.91M | 81.64M | 107.25M | 147.90M | 31.90M | -65.04M | -142.90M | 79.17M | 198.18M | 166.91M | 160.78M | 171.83M | 1.31B | 5.10M |

| Gross Profit Ratio | 100.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 17.94% | 14.87% | 11.37% | 9.39% | 12.15% | 18.55% | 16.18% | -12.46% | -26.79% | 7.21% | 18.53% | 13.63% | 11.03% | 13.20% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 6.72M | 6.61M | 6.53M | 7.94M | 6.73M | 6.53M | 5.33M | 16.04M | 28.77M | 0.00 | 6.86M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 203.41M | 252.99M | 223.05M | 205.61M | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 6.72M | 6.61M | 6.53M | 7.94M | 6.73M | 6.53M | 5.33M | 16.04M | 28.77M | 0.00 | 6.86M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 203.41M | 252.99M | 223.05M | 205.61M | 0.00 | 0.00 |

| Other Expenses | -5.85M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 112.13M | 84.82M | 92.70M | 275.62M | 61.99M | 118.08M | 36.84M | 149.30M | 167.02M | 161.20M | 0.00 | 0.00 | 0.00 | 0.00 | 1.30B | 17.30M |

| Operating Expenses | 863.00K | 6.61M | 6.53M | 7.94M | 6.73M | 6.53M | 5.33M | 16.04M | 28.77M | 112.13M | 91.68M | 92.70M | 275.62M | 61.99M | 118.08M | 36.84M | 149.30M | 167.02M | 161.20M | 203.41M | 252.99M | 223.05M | 205.61M | 1.30B | 17.30M |

| Cost & Expenses | 863.00K | 6.61M | 6.53M | 7.94M | 6.73M | 6.53M | 5.33M | 16.04M | 28.77M | 1.02B | 1.08B | 973.19M | 1.06B | 837.20M | 767.52M | 202.11M | 736.47M | 843.30M | 1.18B | 1.07B | 1.31B | 1.52B | 1.34B | 1.30B | 17.30M |

| Interest Income | 1.05M | 5.73M | 4.75M | 2.48M | 194.00K | 138.00K | 581.00K | 1.24M | 1.93M | 21.35M | 13.55M | 8.31M | 11.86M | 39.28M | 31.53M | 4.13M | 9.95M | 15.20M | 12.91M | 28.89M | 129.24M | 0.00 | 53.87M | 0.00 | 0.00 |

| Interest Expense | 26.00K | 24.00K | 26.00K | 27.00K | 20.00K | 17.00K | 15.00K | 17.00K | 106.00K | 2.69M | 3.14M | 1.42M | 2.27M | 2.31M | 23.45M | 4.41M | 2.95M | 61.76M | 77.05M | 183.93M | 170.84M | 0.00 | 51.21M | 0.00 | 28.70M |

| Depreciation & Amortization | 4.00K | 15.00K | 26.00K | 38.00K | 60.00K | 41.00K | 42.00K | 18.00K | 62.00K | 32.51M | 33.73M | 39.80M | 36.37M | 70.17M | -8.21M | 16.02M | 134.80M | 189.27M | 187.00M | 227.78M | 216.26M | 174.91M | 135.03M | 62.76M | 1.10M |

| EBITDA | 106.01M | 95.95M | -29.68M | 207.64M | 75.79M | -115.70M | -33.88M | 18.46M | 328.18M | 251.02M | 215.10M | 278.49M | -608.54M | 115.43M | 21.61M | 6.92M | -52.24M | -127.03M | -850.12M | 224.96M | -1.07B | 5.51M | 51.31M | 137.64M | 41.60M |

| EBITDA Ratio | 12,871,800.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 22.67% | 18.56% | 28.03% | -70.00% | 13.08% | 2.71% | 3.51% | -10.00% | -23.82% | -77.39% | 21.03% | -87.67% | 0.38% | 3.94% | 10.49% | 815.69% |

| Operating Income | 106.01M | 95.93M | -29.71M | 207.60M | 75.73M | -115.74M | -33.92M | 18.44M | 328.11M | 218.51M | 181.37M | 238.70M | -644.90M | 45.26M | 29.82M | -9.10M | -187.03M | -316.30M | -1.04B | -2.82M | -1.29B | -169.40M | -83.72M | 74.88M | 40.50M |

| Operating Income Ratio | 12,871,300.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 19.73% | 15.65% | 24.03% | -74.18% | 5.13% | 3.74% | -4.62% | -35.82% | -59.30% | -94.42% | -0.26% | -105.34% | -11.62% | -6.43% | 5.70% | 794.12% |

| Total Other Income/Expenses | -116.74M | -101.43M | 24.45M | -216.37M | -83.73M | 105.55M | 25.89M | -33.97M | -355.33M | -108.52M | -88.27M | -211.72M | 493.38M | 112.53M | 299.00K | 3.71M | -20.82M | -22.28M | 889.77M | -157.45M | 1.23B | 107.26M | 58.09M | 52.11M | -24.00M |

| Income Before Tax | -10.74M | -5.50M | -5.26M | -8.77M | -8.00M | -10.19M | -8.03M | -15.53M | -27.21M | 109.99M | 93.09M | 26.98M | -151.52M | 157.79M | 30.12M | -5.40M | -207.85M | -338.58M | -147.35M | -160.27M | -56.84M | -62.14M | -25.63M | 126.98M | 16.50M |

| Income Before Tax Ratio | -1,303,706.40% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 9.93% | 8.03% | 2.72% | -17.43% | 17.88% | 3.78% | -2.74% | -39.81% | -63.48% | -13.42% | -14.98% | -4.64% | -4.26% | -1.97% | 9.67% | 323.53% |

| Income Tax Expense | 12.89M | 6.15M | -39.35M | 73.11M | 28.51M | -45.48M | -8.11M | 1.84M | -93.32M | 89.15M | -308.62M | 5.57M | 45.74M | 83.46M | 20.88M | 1.75M | -13.28M | 4.65M | 355.04M | 9.71M | 9.38M | 32.52M | 3.87M | 34.87M | 2.90M |

| Net Income | -23.62M | -11.65M | 34.09M | -81.88M | -36.51M | 35.29M | 75.00K | -17.37M | 66.10M | 20.85M | 401.72M | 21.40M | -197.27M | 74.33M | 9.24M | -7.15M | -194.57M | -343.22M | -502.40M | -169.98M | -66.22M | -94.65M | -29.50M | 92.11M | 13.60M |

| Net Income Ratio | -2,868,348.36% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 1.88% | 34.66% | 2.15% | -22.69% | 8.42% | 1.16% | -3.62% | -37.26% | -64.35% | -45.74% | -15.89% | -5.41% | -6.49% | -2.27% | 7.02% | 266.67% |

| EPS | -0.76 | -0.38 | 1.10 | -2.65 | -1.18 | 1.14 | 0.00 | -0.56 | 2.15 | 0.68 | 13.35 | 0.72 | -9.67 | 3.70 | 0.46 | -0.18 | -4.41 | -7.83 | -13.48 | -5.75 | -2.24 | -3.26 | -1.22 | 3.81 | 0.59 |

| EPS Diluted | -0.76 | -0.38 | 1.10 | -2.64 | -1.18 | 1.14 | 0.00 | -0.56 | 2.13 | 0.67 | 13.01 | 0.71 | -9.67 | 3.70 | 0.46 | -0.18 | -4.41 | -7.83 | -13.48 | -5.75 | -2.24 | -3.26 | -1.21 | 3.78 | 0.59 |

| Weighted Avg Shares Out | 30.93M | 31.01M | 31.01M | 30.93M | 30.93M | 30.93M | 30.92M | 30.85M | 30.70M | 30.68M | 30.09M | 29.74M | 20.41M | 20.09M | 20.00M | 40.09M | 44.11M | 43.82M | 37.27M | 29.58M | 29.58M | 29.02M | 24.21M | 24.21M | 22.90M |

| Weighted Avg Shares Out (Dil) | 30.93M | 31.01M | 31.01M | 31.01M | 31.01M | 30.93M | 30.92M | 31.00M | 30.99M | 31.17M | 30.89M | 29.97M | 20.41M | 20.09M | 20.00M | 40.09M | 44.13M | 43.82M | 37.27M | 29.58M | 29.58M | 29.02M | 24.36M | 24.36M | 22.90M |

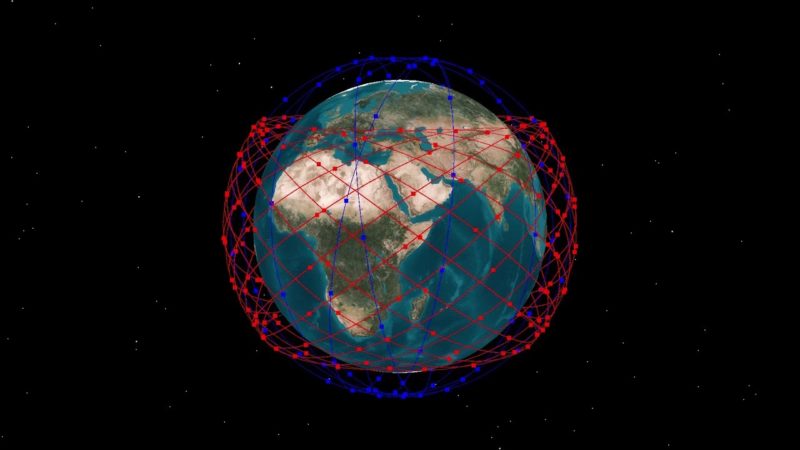

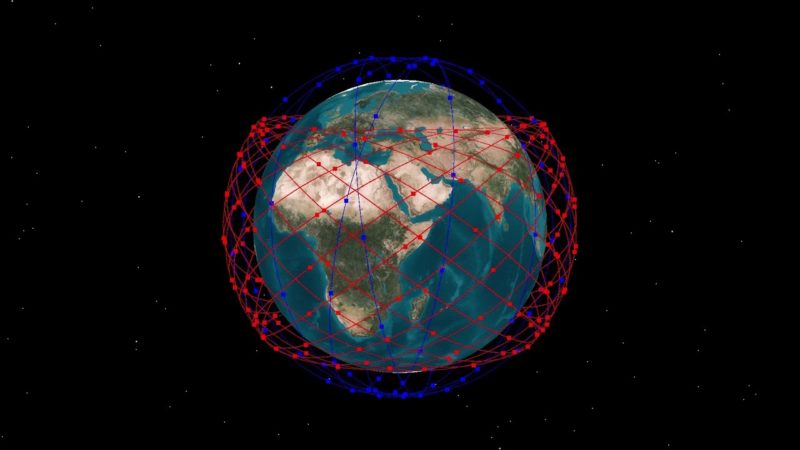

Loral-Telesat Merger Creates Attractive Call Option On LEO Economics

Telesat Third Quarter 2020 Conference Call

Telesat and Lockheed Martin Will Integrate Telesat LEO with SDA Transport Layer - Via Satellite -

Nelco to Use Telesat LEO to Provide Satellite Connectivity in India - Via Satellite -

Internet everywhere, but at a cost: The race for the low-Earth satellite market

Telesat Canada preparing to go public next year

Tracking Prem Watsa's Fairfax Financial Holdings Portfolio - Q2 2020 Update

Loral: LEO Vendor Selection And Ownership Resolution Catalysts Looming (NASDAQ:LORL)

Source: https://incomestatements.info

Category: Stock Reports