See more : NIHON CHOUZAI Co.,Ltd. (3341.T) Income Statement Analysis – Financial Results

Complete financial analysis of Lundin Mining Corporation (LUNMF) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Lundin Mining Corporation, a leading company in the Copper industry within the Basic Materials sector.

- Eden Research plc (EDEN.L) Income Statement Analysis – Financial Results

- Mahanagar Gas Limited (MGL.BO) Income Statement Analysis – Financial Results

- Atul Ltd (ATUL.BO) Income Statement Analysis – Financial Results

- Sanergy Group Limited (2459.HK) Income Statement Analysis – Financial Results

- NutraLife BioSciences, Inc. (NLBS) Income Statement Analysis – Financial Results

Lundin Mining Corporation (LUNMF)

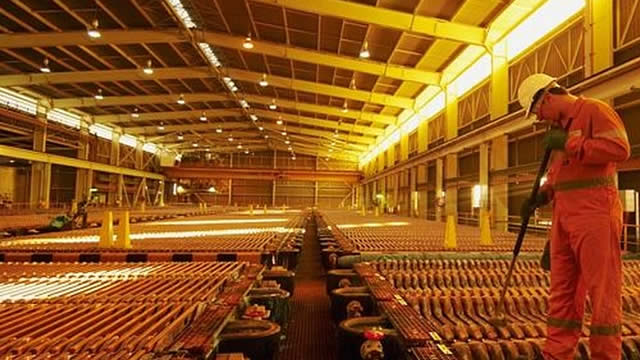

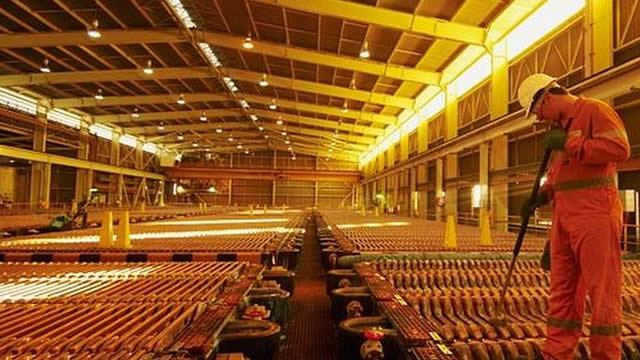

About Lundin Mining Corporation

Lundin Mining Corporation, a diversified base metals mining company, engages in the exploration, development, and mining of mineral properties in Brazil, Chile, Portugal, Sweden, and the United States. It primarily produces copper, zinc, nickel, and gold, as well as lead, silver, and other metals. The company holds 100% interests in the Chapada mine located in Brazil; the Neves-Corvo mine located in Portugal; the Eagle mine located in the United States; and the Zinkgruvan mine located in Sweden. It also holds 80% interests in the Candelaria and Ojos del Salado mining complex located in Chile. The company was formerly known as South Atlantic Ventures Ltd. and changed its name to Lundin Mining Corporation in August 2004. Lundin Mining Corporation was incorporated in 1994 and is headquartered in Toronto, Canada.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 3.39B | 3.04B | 3.33B | 2.04B | 1.89B | 1.73B | 2.08B | 1.55B | 1.70B | 951.31M | 727.78M | 721.11M | 783.79M | 849.22M | 745.99M | 835.29M | 1.06B | 539.76M | 192.07M | 43.20M | 0.00 | 0.00 | 0.00 |

| Cost of Revenue | 2.09B | 2.28B | 1.96B | 1.54B | 1.45B | 1.29B | 1.26B | 1.30B | 1.52B | 828.08M | 608.99M | 506.97M | 363.86M | 368.02M | 340.32M | 436.63M | 379.31M | 219.10M | 150.71M | 31.02M | 0.00 | 0.00 | 0.00 |

| Gross Profit | 1.31B | 762.57M | 1.37B | 498.12M | 440.39M | 436.60M | 820.35M | 246.54M | 184.59M | 123.24M | 118.79M | 214.13M | 419.93M | 481.20M | 405.67M | 398.66M | 680.46M | 320.66M | 41.36M | 12.17M | 0.00 | 0.00 | 0.00 |

| Gross Profit Ratio | 38.50% | 25.07% | 41.15% | 24.40% | 23.27% | 25.30% | 39.49% | 15.95% | 10.85% | 12.95% | 16.32% | 29.69% | 53.58% | 56.66% | 54.38% | 47.73% | 64.21% | 59.41% | 21.54% | 28.18% | 0.00% | 0.00% | 0.00% |

| Research & Development | 10.96M | 107.60M | 8.20M | 18.03M | 16.83M | 10.08M | 8.23M | 9.38M | 7.93M | 39.16M | 9.59M | 15.21M | 8.13M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 66.72M | 53.88M | 52.20M | 44.17M | 47.10M | 49.44M | 38.84M | 27.20M | 27.53M | 27.61M | 23.88M | 27.85M | 20.24M | 21.09M | 25.59M | 49.48M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 50.49M | 297.00K | 771.00K | 1.93M | 3.70M | 3.61M | 1.25M | 4.58M | 9.00K | 0.00 | 0.00 | 0.00 | 25.93M | 0.00 | 0.00 | -9.93M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 117.22M | 53.88M | 52.20M | 44.17M | 47.10M | 49.44M | 38.84M | 27.20M | 27.53M | 27.61M | 23.88M | 27.85M | 46.17M | 21.09M | 25.59M | 39.56M | 42.81M | 19.43M | 10.86M | 5.78M | 517.30K | 559.98K | 329.72K |

| Other Expenses | 0.00 | 51.09M | 45.84M | 36.55M | 70.75M | -1.98M | -5.66M | -49.52M | -13.66M | 19.07M | 12.31M | 5.35M | 11.61M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 117.22M | 212.58M | 106.24M | 98.75M | 134.68M | 140.51M | 125.86M | 88.20M | 90.94M | 104.53M | 69.47M | 95.74M | 242.54M | 171.65M | 278.20M | -662.39M | 253.89M | 104.28M | 18.01M | 8.77M | 599.81K | 575.06K | 384.05K |

| Cost & Expenses | 2.20B | 2.49B | 2.07B | 1.64B | 1.59B | 1.43B | 1.38B | 1.39B | 1.61B | 932.60M | 678.46M | 602.72M | 606.40M | 539.67M | 618.52M | -225.76M | 633.20M | 323.38M | 168.72M | 39.79M | 599.81K | 575.06K | 384.05K |

| Interest Income | 11.14M | 4.21M | 613.00K | 5.99M | 12.17M | 25.49M | 21.61M | 1.53M | 564.00K | 1.86M | 1.42M | 2.07M | 3.60M | 49.30M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 92.33M | 11.63M | 7.52M | 12.32M | 13.93M | 27.08M | 70.80M | 79.94M | 83.66M | 23.04M | 3.47M | 6.29M | 16.74M | 8.76M | 15.03M | 14.73M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 653.60M | 546.54M | 527.19M | 482.02M | 405.04M | 308.57M | 401.05M | 434.47M | 555.02M | 208.70M | 148.15M | 122.38M | 153.80M | 123.39M | 170.00M | 202.32M | 171.23M | 71.90M | 48.92M | 9.28M | 0.00 | 0.00 | 0.00 |

| EBITDA | 1.25B | 1.00B | 1.77B | 883.07M | 715.95M | 630.82M | 1.09B | 641.19M | 333.86M | 286.38M | 282.58M | 275.30M | 397.62M | 518.97M | 249.90M | -525.12M | 602.27M | 291.37M | 75.36M | 11.79M | -599.81K | -575.06K | 199.00K |

| EBITDA Ratio | 36.83% | 32.98% | 53.70% | 39.76% | 35.99% | 35.83% | 52.24% | 35.27% | 38.85% | 35.72% | 42.00% | 48.62% | 56.27% | 61.11% | 31.90% | 32.43% | 56.83% | 53.98% | 37.63% | 29.37% | 0.00% | 0.00% | 0.00% |

| Operating Income | 1.19B | 448.16M | 1.26B | 364.23M | 294.98M | 298.92M | 704.03M | 110.31M | 106.17M | 131.11M | 157.55M | 228.24M | 287.28M | 395.58M | 67.94M | 68.54M | 431.04M | 219.47M | 23.36M | 3.41M | -599.81K | -575.06K | 199.00K |

| Operating Income Ratio | 35.05% | 14.74% | 38.00% | 17.84% | 15.58% | 17.32% | 33.89% | 7.14% | 6.24% | 13.78% | 21.65% | 31.65% | 36.65% | 46.58% | 9.11% | 8.21% | 40.67% | 40.66% | 12.16% | 7.89% | 0.00% | 0.00% | 0.00% |

| Total Other Income/Expenses | -656.91M | 48.16M | -18.49M | -57.90M | -38.83M | -4.28M | -56.17M | -30.16M | -373.81M | -201.24M | -69.16M | 28.24M | -52.47M | 30.66M | -3.08M | -932.50M | -516.06M | -11.27M | 20.71M | 2.73M | 2.24M | 245.24K | 485.02K |

| Income Before Tax | 531.85M | 598.16M | 1.24B | 341.48M | 269.60M | 291.81M | 638.32M | 128.18M | -255.54M | 54.65M | 130.96M | 146.63M | 234.81M | 430.27M | 64.86M | -850.45M | -89.49M | 205.10M | 44.07M | 6.44M | 1.33M | 335.31K | -248.77K |

| Income Before Tax Ratio | 15.68% | 19.67% | 37.40% | 16.73% | 14.24% | 16.91% | 30.73% | 8.29% | -15.01% | 5.74% | 17.99% | 20.33% | 29.96% | 50.67% | 8.70% | -101.81% | -8.44% | 38.00% | 22.94% | 14.90% | 0.00% | 0.00% | 0.00% |

| Income Tax Expense | 216.60M | 134.63M | 365.69M | 152.42M | 80.42M | 76.37M | 191.40M | 4.31M | 26.25M | -68.74M | -5.79M | 23.45M | 51.05M | 113.15M | -3.27M | -130.45M | 64.67M | 52.14M | 13.29M | 1.28M | 421.13K | 46.13K | 199.92K |

| Net Income | 241.56M | 426.85M | 780.35M | 168.80M | 167.26M | 195.85M | 426.49M | -661.74M | -294.08M | 112.61M | 136.75M | 123.18M | 183.77M | 306.28M | 73.71M | -957.06M | -154.16M | 152.96M | 29.96M | 4.76M | 906.64K | -381.44K | 48.85K |

| Net Income Ratio | 7.12% | 14.04% | 23.44% | 8.27% | 8.84% | 11.35% | 20.53% | -42.81% | -17.28% | 11.84% | 18.79% | 17.08% | 23.45% | 36.07% | 9.88% | -114.58% | -14.55% | 28.34% | 15.60% | 11.03% | 0.00% | 0.00% | 0.00% |

| EPS | 0.31 | 0.54 | 1.05 | 0.24 | 0.23 | 0.27 | 0.59 | -0.92 | -0.41 | 0.19 | 0.23 | 0.21 | 0.32 | 0.53 | 0.13 | -2.41 | -0.46 | 1.02 | 0.26 | 0.08 | 0.04 | -0.02 | 0.00 |

| EPS Diluted | 0.31 | 0.54 | 1.05 | 0.24 | 0.23 | 0.27 | 0.59 | -0.92 | -0.41 | 0.19 | 0.23 | 0.21 | 0.32 | 0.53 | 0.13 | -2.41 | -0.46 | 1.01 | 0.26 | 0.08 | 0.04 | -0.02 | 0.00 |

| Weighted Avg Shares Out | 772.53M | 762.52M | 736.79M | 734.07M | 735.31M | 731.73M | 726.99M | 720.33M | 719.09M | 600.44M | 584.28M | 582.94M | 582.07M | 579.92M | 550.00M | 396.42M | 338.64M | 149.44M | 115.25M | 66.48M | 23.16M | 18.03M | 23.37M |

| Weighted Avg Shares Out (Dil) | 773.29M | 763.59M | 739.30M | 735.32M | 736.06M | 733.55M | 729.74M | 721.21M | 719.09M | 602.36M | 584.94M | 584.01M | 582.96M | 580.54M | 550.05M | 396.42M | 338.64M | 151.15M | 115.98M | 66.77M | 24.10M | 18.03M | 23.37M |

Lundin Mining: Copper Production Solid In Q3

Lundin Mining price target lowered to SEK 128 from SEK 132 at JPMorgan

Lundin Mining Corporation (LUNMF) Q3 2024 Earnings Call Transcript

Lundin Mining (LUNMF) Misses Q3 Earnings and Revenue Estimates

Lundin Mining: Not All That Glitters Is Gold

Lundin Mining (LUNMF) Earnings Expected to Grow: Should You Buy?

5 Non-Ferrous Metal Mining Stocks to Watch Despite Industry Concerns

Lundin Mining: Attractively Priced Given Excellent Long-Term Growth Potential

Should Value Investors Buy Lundin Mining (LUNMF) Stock?

Are Basic Materials Stocks Lagging Lundin Mining (LUNMF) This Year?

Source: https://incomestatements.info

Category: Stock Reports