See more : Minda Corporation Limited (MINDACORP.NS) Income Statement Analysis – Financial Results

Complete financial analysis of Lundin Mining Corporation (LUNMF) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Lundin Mining Corporation, a leading company in the Copper industry within the Basic Materials sector.

- Organo Corporation (6368.T) Income Statement Analysis – Financial Results

- Asukanet Co., Ltd. (2438.T) Income Statement Analysis – Financial Results

- Veritas (India) Limited (VERITAS.BO) Income Statement Analysis – Financial Results

- IP Group Plc (IPZYF) Income Statement Analysis – Financial Results

- Kkalpana Industries (India) Limited (KKALPANAIND.BO) Income Statement Analysis – Financial Results

Lundin Mining Corporation (LUNMF)

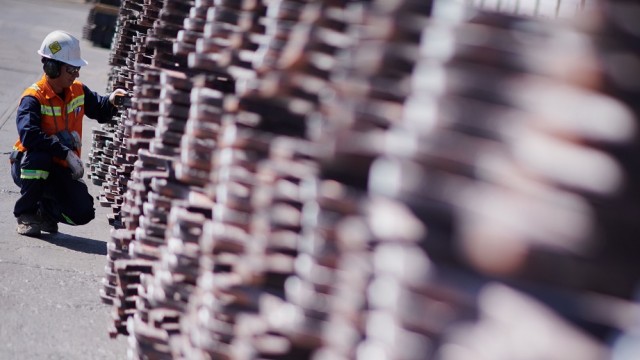

About Lundin Mining Corporation

Lundin Mining Corporation, a diversified base metals mining company, engages in the exploration, development, and mining of mineral properties in Brazil, Chile, Portugal, Sweden, and the United States. It primarily produces copper, zinc, nickel, and gold, as well as lead, silver, and other metals. The company holds 100% interests in the Chapada mine located in Brazil; the Neves-Corvo mine located in Portugal; the Eagle mine located in the United States; and the Zinkgruvan mine located in Sweden. It also holds 80% interests in the Candelaria and Ojos del Salado mining complex located in Chile. The company was formerly known as South Atlantic Ventures Ltd. and changed its name to Lundin Mining Corporation in August 2004. Lundin Mining Corporation was incorporated in 1994 and is headquartered in Toronto, Canada.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 3.39B | 3.04B | 3.33B | 2.04B | 1.89B | 1.73B | 2.08B | 1.55B | 1.70B | 951.31M | 727.78M | 721.11M | 783.79M | 849.22M | 745.99M | 835.29M | 1.06B | 539.76M | 192.07M | 43.20M | 0.00 | 0.00 | 0.00 |

| Cost of Revenue | 2.09B | 2.28B | 1.96B | 1.54B | 1.45B | 1.29B | 1.26B | 1.30B | 1.52B | 828.08M | 608.99M | 506.97M | 363.86M | 368.02M | 340.32M | 436.63M | 379.31M | 219.10M | 150.71M | 31.02M | 0.00 | 0.00 | 0.00 |

| Gross Profit | 1.31B | 762.57M | 1.37B | 498.12M | 440.39M | 436.60M | 820.35M | 246.54M | 184.59M | 123.24M | 118.79M | 214.13M | 419.93M | 481.20M | 405.67M | 398.66M | 680.46M | 320.66M | 41.36M | 12.17M | 0.00 | 0.00 | 0.00 |

| Gross Profit Ratio | 38.50% | 25.07% | 41.15% | 24.40% | 23.27% | 25.30% | 39.49% | 15.95% | 10.85% | 12.95% | 16.32% | 29.69% | 53.58% | 56.66% | 54.38% | 47.73% | 64.21% | 59.41% | 21.54% | 28.18% | 0.00% | 0.00% | 0.00% |

| Research & Development | 10.96M | 107.60M | 8.20M | 18.03M | 16.83M | 10.08M | 8.23M | 9.38M | 7.93M | 39.16M | 9.59M | 15.21M | 8.13M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 66.72M | 53.88M | 52.20M | 44.17M | 47.10M | 49.44M | 38.84M | 27.20M | 27.53M | 27.61M | 23.88M | 27.85M | 20.24M | 21.09M | 25.59M | 49.48M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 50.49M | 297.00K | 771.00K | 1.93M | 3.70M | 3.61M | 1.25M | 4.58M | 9.00K | 0.00 | 0.00 | 0.00 | 25.93M | 0.00 | 0.00 | -9.93M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 117.22M | 53.88M | 52.20M | 44.17M | 47.10M | 49.44M | 38.84M | 27.20M | 27.53M | 27.61M | 23.88M | 27.85M | 46.17M | 21.09M | 25.59M | 39.56M | 42.81M | 19.43M | 10.86M | 5.78M | 517.30K | 559.98K | 329.72K |

| Other Expenses | 0.00 | 51.09M | 45.84M | 36.55M | 70.75M | -1.98M | -5.66M | -49.52M | -13.66M | 19.07M | 12.31M | 5.35M | 11.61M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 117.22M | 212.58M | 106.24M | 98.75M | 134.68M | 140.51M | 125.86M | 88.20M | 90.94M | 104.53M | 69.47M | 95.74M | 242.54M | 171.65M | 278.20M | -662.39M | 253.89M | 104.28M | 18.01M | 8.77M | 599.81K | 575.06K | 384.05K |

| Cost & Expenses | 2.20B | 2.49B | 2.07B | 1.64B | 1.59B | 1.43B | 1.38B | 1.39B | 1.61B | 932.60M | 678.46M | 602.72M | 606.40M | 539.67M | 618.52M | -225.76M | 633.20M | 323.38M | 168.72M | 39.79M | 599.81K | 575.06K | 384.05K |

| Interest Income | 11.14M | 4.21M | 613.00K | 5.99M | 12.17M | 25.49M | 21.61M | 1.53M | 564.00K | 1.86M | 1.42M | 2.07M | 3.60M | 49.30M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 92.33M | 11.63M | 7.52M | 12.32M | 13.93M | 27.08M | 70.80M | 79.94M | 83.66M | 23.04M | 3.47M | 6.29M | 16.74M | 8.76M | 15.03M | 14.73M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 653.60M | 546.54M | 527.19M | 482.02M | 405.04M | 308.57M | 401.05M | 434.47M | 555.02M | 208.70M | 148.15M | 122.38M | 153.80M | 123.39M | 170.00M | 202.32M | 171.23M | 71.90M | 48.92M | 9.28M | 0.00 | 0.00 | 0.00 |

| EBITDA | 1.25B | 1.00B | 1.77B | 883.07M | 715.95M | 630.82M | 1.09B | 641.19M | 333.86M | 286.38M | 282.58M | 275.30M | 397.62M | 518.97M | 249.90M | -525.12M | 602.27M | 291.37M | 75.36M | 11.79M | -599.81K | -575.06K | 199.00K |

| EBITDA Ratio | 36.83% | 32.98% | 53.70% | 39.76% | 35.99% | 35.83% | 52.24% | 35.27% | 38.85% | 35.72% | 42.00% | 48.62% | 56.27% | 61.11% | 31.90% | 32.43% | 56.83% | 53.98% | 37.63% | 29.37% | 0.00% | 0.00% | 0.00% |

| Operating Income | 1.19B | 448.16M | 1.26B | 364.23M | 294.98M | 298.92M | 704.03M | 110.31M | 106.17M | 131.11M | 157.55M | 228.24M | 287.28M | 395.58M | 67.94M | 68.54M | 431.04M | 219.47M | 23.36M | 3.41M | -599.81K | -575.06K | 199.00K |

| Operating Income Ratio | 35.05% | 14.74% | 38.00% | 17.84% | 15.58% | 17.32% | 33.89% | 7.14% | 6.24% | 13.78% | 21.65% | 31.65% | 36.65% | 46.58% | 9.11% | 8.21% | 40.67% | 40.66% | 12.16% | 7.89% | 0.00% | 0.00% | 0.00% |

| Total Other Income/Expenses | -656.91M | 48.16M | -18.49M | -57.90M | -38.83M | -4.28M | -56.17M | -30.16M | -373.81M | -201.24M | -69.16M | 28.24M | -52.47M | 30.66M | -3.08M | -932.50M | -516.06M | -11.27M | 20.71M | 2.73M | 2.24M | 245.24K | 485.02K |

| Income Before Tax | 531.85M | 598.16M | 1.24B | 341.48M | 269.60M | 291.81M | 638.32M | 128.18M | -255.54M | 54.65M | 130.96M | 146.63M | 234.81M | 430.27M | 64.86M | -850.45M | -89.49M | 205.10M | 44.07M | 6.44M | 1.33M | 335.31K | -248.77K |

| Income Before Tax Ratio | 15.68% | 19.67% | 37.40% | 16.73% | 14.24% | 16.91% | 30.73% | 8.29% | -15.01% | 5.74% | 17.99% | 20.33% | 29.96% | 50.67% | 8.70% | -101.81% | -8.44% | 38.00% | 22.94% | 14.90% | 0.00% | 0.00% | 0.00% |

| Income Tax Expense | 216.60M | 134.63M | 365.69M | 152.42M | 80.42M | 76.37M | 191.40M | 4.31M | 26.25M | -68.74M | -5.79M | 23.45M | 51.05M | 113.15M | -3.27M | -130.45M | 64.67M | 52.14M | 13.29M | 1.28M | 421.13K | 46.13K | 199.92K |

| Net Income | 241.56M | 426.85M | 780.35M | 168.80M | 167.26M | 195.85M | 426.49M | -661.74M | -294.08M | 112.61M | 136.75M | 123.18M | 183.77M | 306.28M | 73.71M | -957.06M | -154.16M | 152.96M | 29.96M | 4.76M | 906.64K | -381.44K | 48.85K |

| Net Income Ratio | 7.12% | 14.04% | 23.44% | 8.27% | 8.84% | 11.35% | 20.53% | -42.81% | -17.28% | 11.84% | 18.79% | 17.08% | 23.45% | 36.07% | 9.88% | -114.58% | -14.55% | 28.34% | 15.60% | 11.03% | 0.00% | 0.00% | 0.00% |

| EPS | 0.31 | 0.54 | 1.05 | 0.24 | 0.23 | 0.27 | 0.59 | -0.92 | -0.41 | 0.19 | 0.23 | 0.21 | 0.32 | 0.53 | 0.13 | -2.41 | -0.46 | 1.02 | 0.26 | 0.08 | 0.04 | -0.02 | 0.00 |

| EPS Diluted | 0.31 | 0.54 | 1.05 | 0.24 | 0.23 | 0.27 | 0.59 | -0.92 | -0.41 | 0.19 | 0.23 | 0.21 | 0.32 | 0.53 | 0.13 | -2.41 | -0.46 | 1.01 | 0.26 | 0.08 | 0.04 | -0.02 | 0.00 |

| Weighted Avg Shares Out | 772.53M | 762.52M | 736.79M | 734.07M | 735.31M | 731.73M | 726.99M | 720.33M | 719.09M | 600.44M | 584.28M | 582.94M | 582.07M | 579.92M | 550.00M | 396.42M | 338.64M | 149.44M | 115.25M | 66.48M | 23.16M | 18.03M | 23.37M |

| Weighted Avg Shares Out (Dil) | 773.29M | 763.59M | 739.30M | 735.32M | 736.06M | 733.55M | 729.74M | 721.21M | 719.09M | 602.36M | 584.94M | 584.01M | 582.96M | 580.54M | 550.05M | 396.42M | 338.64M | 151.15M | 115.98M | 66.77M | 24.10M | 18.03M | 23.37M |

LUNMF or SCCO: Which Is the Better Value Stock Right Now?

3 OTC Stocks With the Potential to Deliver Multibagger Paydays by 2026

Copper bull market "fast tracked" with higher prices to come soon, Jefferies says

Lundin Mining reports record 2023 copper production and Outlines Growth Plans for 2024

Lundin Mining reports record copper production in Q3, cuts attributable net loss

Lundin Mining Corporation (LUNMF) Q3 2023 Earnings Call Transcript

LUNMF vs. SCCO: Which Stock Is the Better Value Option?

Lundin Mining shares hit after new CEO announcement

Lundin Mining CEO steps down

Lundin Mining reports net earnings of $61.3 million in Q2, reiterates 2023 production guidance

Source: https://incomestatements.info

Category: Stock Reports