See more : Topicus.com Inc. (TOI.V) Income Statement Analysis – Financial Results

Complete financial analysis of BlackRock MuniHoldings Fund, Inc. (MHD) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of BlackRock MuniHoldings Fund, Inc., a leading company in the Asset Management industry within the Financial Services sector.

- Lakeshore Acquisition II Corp. (LBBBR) Income Statement Analysis – Financial Results

- General Electric Company (GE.SW) Income Statement Analysis – Financial Results

- Sto SE & Co. KGaA (0G5B.L) Income Statement Analysis – Financial Results

- AVIC Shenyang Aircraft Company Limited (600760.SS) Income Statement Analysis – Financial Results

- Ströer SE & Co. KGaA (SOTDF) Income Statement Analysis – Financial Results

BlackRock MuniHoldings Fund, Inc. (MHD)

Industry: Asset Management

Sector: Financial Services

Website: https://www.blackrock.com/investing/products/240204/blackrock-muniholdings-fund-inc-usd-fund

About BlackRock MuniHoldings Fund, Inc.

BlackRock MuniHoldings Fund, Inc. is a closed-ended fixed income mutual fund launched by BlackRock, Inc. It is managed by BlackRock Advisors, LLC. The fund invests in the fixed income markets of the United States. It primarily invests in investment grade municipal bonds that are exempt from federal income taxes. The fund seeks to invest in securities with a maturity of more than ten years. BlackRock MuniHoldings Fund, Inc. was formed on May 2, 1997 and is domiciled in the United States.

| Metric | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2010 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | -11.91M | -122.73M | 55.18M | -8.59M | 14.87M | 7.34M | 18.05M | 17.99M | 18.26M | 18.43M | 19.08M | 0.00 |

| Cost of Revenue | 0.00 | 0.00 | 34.50M | 0.00 | 0.00 | 0.00 | 4.34M | 3.47M | 3.41M | 0.00 | 0.00 | 0.00 |

| Gross Profit | 48.46M | 49.84M | 20.68M | 15.62M | 17.23M | 7.34M | 13.71M | 14.52M | 14.85M | 18.43M | 19.08M | 0.00 |

| Gross Profit Ratio | -406.86% | -40.61% | 37.48% | -181.90% | 115.92% | 100.00% | 75.96% | 80.73% | 81.31% | 100.00% | 100.00% | 0.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 395.39K | 487.80K | 242.01K | 249.62K | 238.74K | 270.79K | 265.28K | 262.64K | 274.07K | 2.37M | 2.59M | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 395.39K | 487.80K | 242.01K | 249.62K | 238.74K | 270.79K | 265.28K | 262.64K | 274.07K | 2.37M | 2.59M | 0.00 |

| Other Expenses | 0.00 | -97.21K | -117.59K | 21.01K | 23.10K | 22.46K | 23.21K | 45.81K | 45.96K | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 431.81K | 390.59K | 124.42K | 270.62K | 261.84K | 293.25K | 288.49K | 308.45K | 320.03K | 19.51M | 11.69M | 0.00 |

| Cost & Expenses | -44.36M | 16.61M | 35.91M | -21.66M | 763.71K | 293.25K | 4.63M | 3.77M | 3.73M | -19.51M | 11.69M | 0.00 |

| Interest Income | 48.03M | 52.16M | 20.68M | 15.52M | 17.19M | 17.62M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |

| Interest Expense | 16.45M | 5.10M | 1.79M | 2.82M | 3.39M | 2.77M | 5.84M | 11.01M | 1.36M | 1.48M | 0.00 | |

| Depreciation & Amortization | -41.75M | -42.59M | -17.34M | -13.31M | -14.92M | 52.52K | -30.47M | 11.68M | 22.03M | -16.07M | -16.49M | 0.00 |

| EBITDA | -70.55M | 5.43M | 35.67M | -24.98M | -3.70M | 9.82M | -17.05M | 25.90M | 36.56M | -19.86M | 11.21M | 0.00 |

| EBITDA Ratio | 592.23% | -4.43% | 64.64% | 290.91% | -24.91% | 133.76% | -94.43% | 143.98% | 200.18% | -107.73% | 58.78% | 0.00% |

| Operating Income | 41.75M | 42.59M | 17.34M | 13.31M | 14.92M | 9.82M | 13.42M | 14.21M | 14.53M | 16.07M | 16.49M | 0.00 |

| Operating Income Ratio | -350.53% | -34.70% | 31.43% | -154.94% | 100.33% | 133.76% | 74.36% | 79.02% | 79.55% | 87.16% | 86.44% | 0.00% |

| Total Other Income/Expenses | -54.10M | 14.65M | 37.46M | -22.16M | -311.29K | -2.77M | -15.24M | 5.84M | 11.01M | -18.50M | 12.80M | 0.00 |

| Income Before Tax | -12.34M | -123.12M | 54.80M | -8.86M | 14.61M | 7.05M | -1.81M | 20.05M | 25.54M | -2.44M | 29.30M | 0.00 |

| Income Before Tax Ratio | 103.63% | 100.32% | 99.32% | 103.15% | 98.24% | 96.01% | -10.04% | 111.50% | 139.87% | -13.22% | 153.55% | 0.00% |

| Income Tax Expense | -70.55M | 185.80M | 35.67M | -24.98M | -3.70M | 0.00 | 0.00 | 0.00 | 0.00 | -19.86M | 11.33M | 0.00 |

| Net Income | -12.34M | -123.12M | 54.80M | -8.86M | 14.61M | 7.05M | -1.81M | 20.05M | 25.54M | -2.44M | 29.18M | 0.00 |

| Net Income Ratio | 103.63% | 100.32% | 99.32% | 103.15% | 98.24% | 96.01% | -10.04% | 111.50% | 139.87% | -13.22% | 152.95% | 0.00% |

| EPS | -0.23 | -2.30 | 2.58 | -0.62 | 1.03 | 0.49 | -0.13 | 1.42 | 1.81 | -0.17 | 2.07 | 0.00 |

| EPS Diluted | -0.23 | -2.30 | 2.58 | -0.62 | 1.03 | 0.49 | -0.13 | 1.42 | 1.81 | -0.17 | 2.07 | 0.00 |

| Weighted Avg Shares Out | 52.78M | 53.36M | 53.36M | 14.21M | 14.18M | 14.19M | 14.17M | 14.14M | 14.13M | 14.13M | 14.12M | 14.00M |

| Weighted Avg Shares Out (Dil) | 52.78M | 53.53M | 53.36M | 14.29M | 14.18M | 14.39M | 14.17M | 14.14M | 14.13M | 14.13M | 14.12M | 14.00M |

Small Ways Muni Investors Can Make A Big Difference

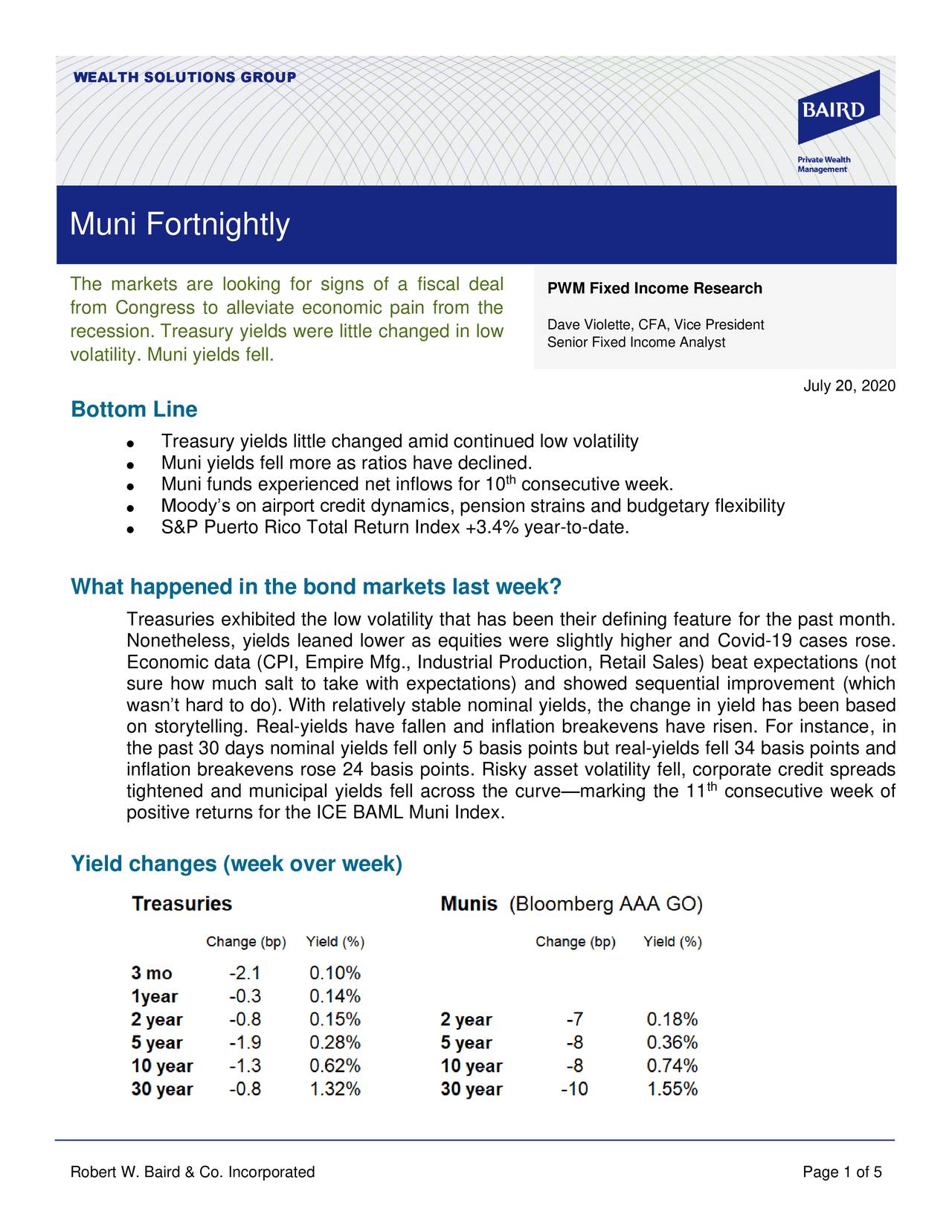

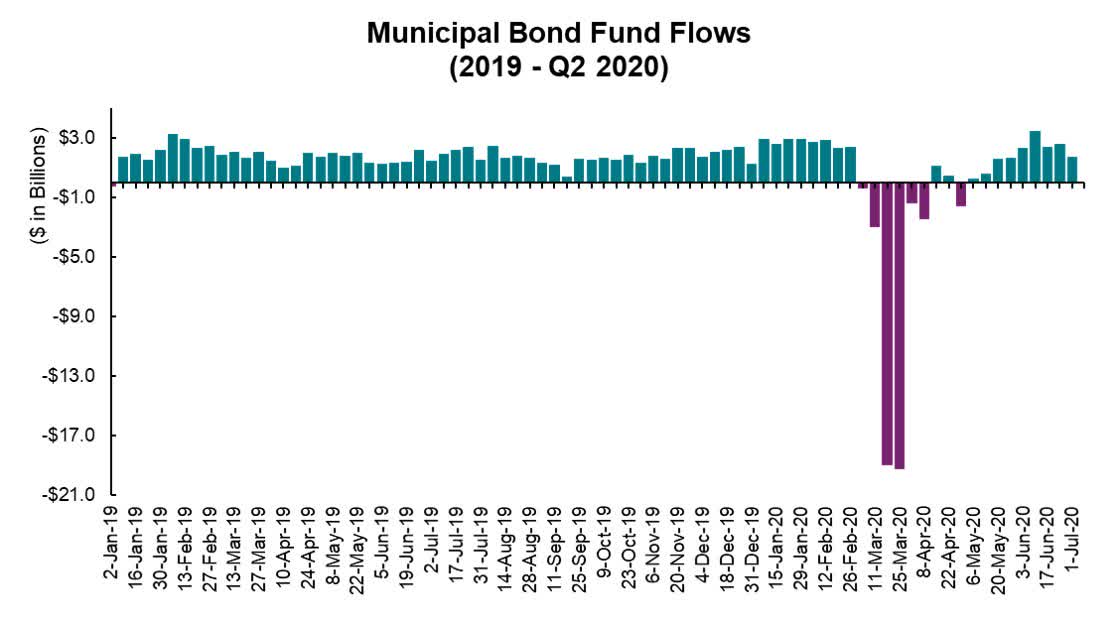

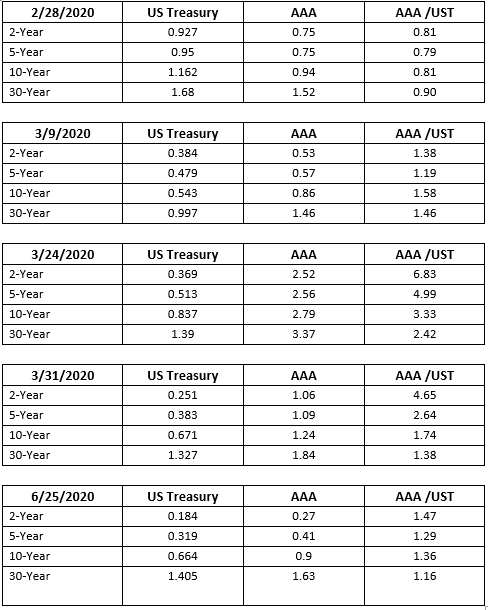

What Happened In The Bond Markets Last Week? Muni Fortnightly, July 20, 2020

2020 Muni Market Midyear Update

Arbitrage Opportunities In BlackRock Muni Closed-End Fund Reorganizations

Heroes And Villains

The Muni Selloff That Was

Guggenheim Capital LLC Has $4 Million Stake in BlackRock MuniHoldings Fund Inc. (NYSE:MHD)

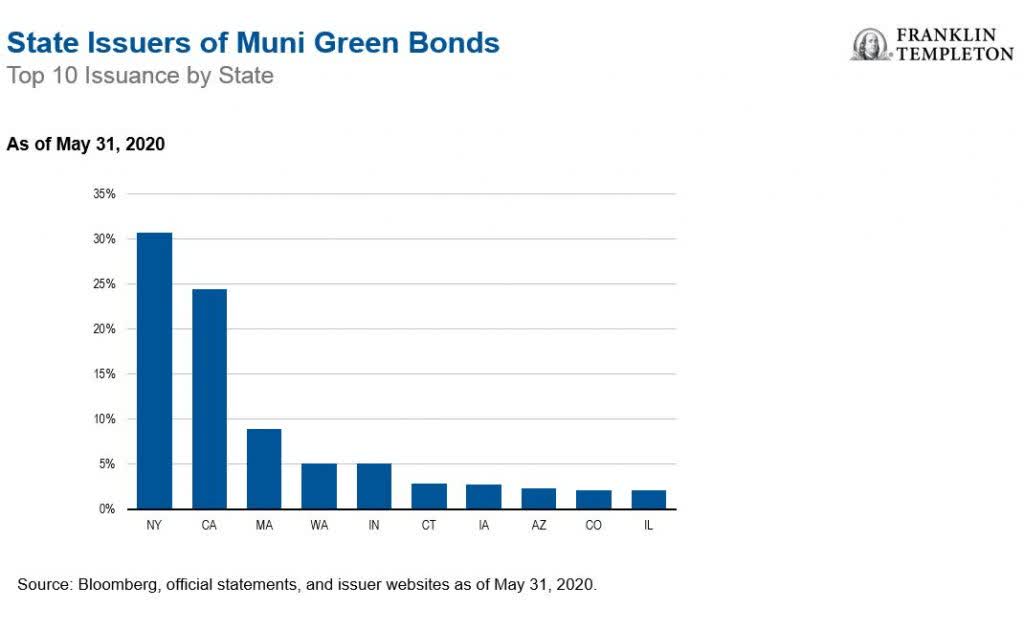

Responsible Investing In A Traditional Asset Class

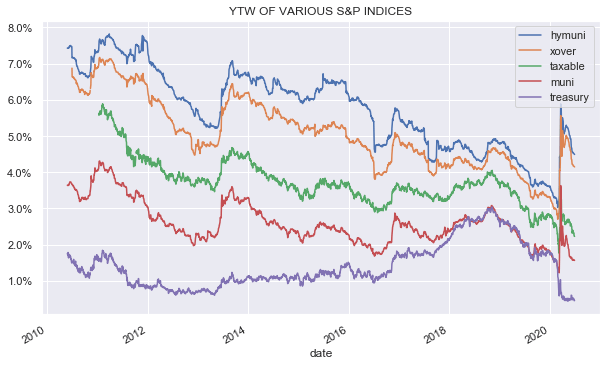

Municipal CEF Yields Remain Attractive

The Reopening Killed The V-Shaped Recovery

Source: https://incomestatements.info

Category: Stock Reports