See more : Metadvertise Société anonyme (ALMTA.PA) Income Statement Analysis – Financial Results

Complete financial analysis of Medallion Resources Ltd. (MLLOF) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Medallion Resources Ltd., a leading company in the Industrial Materials industry within the Basic Materials sector.

- Gasporox AB (publ) (GPX.ST) Income Statement Analysis – Financial Results

- Alinma Bank (1150.SR) Income Statement Analysis – Financial Results

- Bylog Group Corp. (BYLG) Income Statement Analysis – Financial Results

- Atlas Salt Inc. (SALT.V) Income Statement Analysis – Financial Results

- Kirin Group Holdings Limited (8109.HK) Income Statement Analysis – Financial Results

Medallion Resources Ltd. (MLLOF)

About Medallion Resources Ltd.

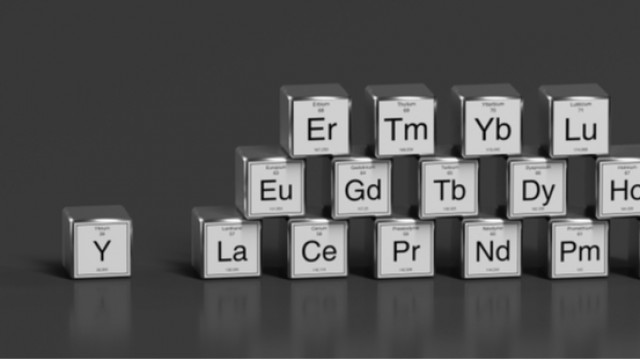

Medallion Resources Ltd. focuses on a rare earth element business. It is involving in processing monazite, a by-product mineral from heavy-mineral-sands mining operations. The company was incorporated in 1989 and is based in Vancouver, Canada.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 4.52K | 3.44K | 841.00 | 842.00 | 397.80K | 51.28K | 0.00 | 5.64K | 76.42K |

| Cost of Revenue | 0.00 | 49.22K | 565.22 | 275.79 | 283.60 | 95.70 | 99.96 | 290.00 | 238.00 | 160.78 | 528.53 | 697.12 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 0.00 | -49.22K | -565.22 | -275.79 | -283.60 | -95.70 | -99.96 | -290.00 | -238.00 | -160.78 | -528.53 | -697.12 | 0.00 | 0.00 | 0.00 | 0.00 | 4.52K | 3.44K | 841.00 | 842.00 | 397.80K | 51.28K | 0.00 | 5.64K | 76.42K |

| Gross Profit Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 0.00% | 100.00% | 100.00% |

| Research & Development | 79.04K | 320.38K | 535.22K | 275.79K | 283.60K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 697.12K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 298.69K | 1.63M | 842.00K | 1.62M | 993.43K | 600.22K | 725.54K | 481.07K | 701.77K | 1.05M | 1.72M | 980.48K | 1.71M | 1.36M | 711.35K | 489.14K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 106.24K | 148.76K |

| Selling & Marketing | 18.14K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 11.56K | 7.52K |

| SG&A | 316.82K | 1.63M | 842.00K | 1.62M | 993.43K | 600.22K | 725.54K | 481.07K | 701.77K | 1.05M | 1.72M | 980.48K | 1.71M | 1.36M | 711.35K | 489.14K | 303.90K | 267.28K | 128.18K | 43.75K | 45.14K | 38.36K | 55.07K | 117.80K | 156.28K |

| Other Expenses | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 72.45K | 70.84K | 147.04K | 120.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 51.32K | 0.00 | 0.00 |

| Operating Expenses | 395.86K | 1.95M | 1.41M | 1.89M | 1.19M | 695.91K | 825.51K | 481.36K | 724.08K | 1.05M | 1.72M | 1.68M | 1.71M | 1.36M | -713.29K | 492.02K | 305.54K | 267.28K | 128.18K | 43.75K | 45.14K | 59.23K | 56.90K | 268.18K | 819.03K |

| Cost & Expenses | 395.86K | 2.00M | 1.41M | 1.89M | 1.19M | 695.91K | 825.51K | 481.36K | 724.08K | 1.05M | 1.72M | 1.68M | 1.71M | 1.36M | -713.29K | 492.02K | 305.54K | 267.28K | 128.18K | 43.75K | 45.14K | 59.23K | 56.90K | 268.18K | 819.03K |

| Interest Income | 274.86K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 3.68K | 12.83K | 33.67K | 14.04K | 141.00 | 2.69K | 4.52K | 0.00 | 841.00 | 842.00 | 451.00 | 0.00 | 259.00 | 0.00 | 0.00 |

| Interest Expense | 0.00 | 207.08K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 307.00 | 7.90K | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 18.61K | 49.22K | 1.21M | 1.64M | 1.13M | 623.69K | 290.00 | 290.00 | 238.00 | 432.00 | 785.00 | 870.00 | 1.02K | 1.35K | 1.93K | 2.88K | 1.63K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 758.00 | 2.28K | 2.28K |

| EBITDA | -395.86K | -1.68M | 0.00 | 0.00 | 0.00 | 0.00 | -722.18K | -420.69K | -570.28K | -881.18K | -1.50M | -1.36M | -1.09M | -1.32M | 834.23K | 907.68K | -299.39K | -263.84K | -127.34K | -42.91K | 352.66K | -7.95K | 45.62K | -260.26K | -740.32K |

| EBITDA Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | -6,628.01% | -7,672.06% | -15,141.14% | -5,096.08% | 88.65% | -15.50% | 0.00% | -4,618.58% | -968.73% |

| Operating Income | -395.86K | -2.00M | -1.82M | -1.88M | -1.19M | -695.91K | -825.51K | -481.36K | -724.08K | -1.05M | -1.72M | -1.72M | -1.75M | -1.32M | 832.30K | 904.80K | -301.02K | -263.84K | -127.34K | -42.91K | 352.66K | -7.95K | -158.67K | -262.54K | -742.61K |

| Operating Income Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | -6,664.14% | -7,672.06% | -15,141.14% | -5,096.08% | 88.65% | -15.50% | 0.00% | -4,659.11% | -971.72% |

| Total Other Income/Expenses | -1.38M | -416.69K | 745.44K | 18.44K | 223.12K | -72.22K | -103.04K | 0.00 | -3.62K | -15.50K | 105.70K | -268.26K | -469.96K | -6.84K | -1.52M | -2.79M | 0.00 | 263.84K | 127.34K | 42.91K | 397.35K | 7.95K | -50.45K | 0.00 | 0.00 |

| Income Before Tax | -1.77M | -2.09M | -997.26K | -1.90M | -1.19M | -695.91K | -825.51K | -481.36K | -727.71K | -1.06M | -1.62M | -1.98M | -2.22M | -1.33M | -685.12K | -1.89M | 0.00 | 0.00 | 0.00 | 0.00 | 750.01K | 43.15K | -209.12K | 0.00 | 0.00 |

| Income Before Tax Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 188.54% | 84.15% | 0.00% | 0.00% | 0.00% |

| Income Tax Expense | 0.00 | 207.08K | -411.16K | 7.99K | 81.97K | 3.00K | -103.33 | -60.39 | 3.62K | 15.50K | -105.70K | 305.03K | 585.63K | -126.00K | -103.06K | -112.71K | 0.00 | 263.84K | 127.34K | 43.22K | 405.25K | 61.13K | 101.51K | 0.00 | 0.00 |

| Net Income | -1.31M | -2.09M | -997.26K | -1.90M | -1.19M | -698.91K | -825.51K | -481.36K | -727.71K | -1.06M | -1.62M | -1.98M | -2.22M | -1.20M | -582.06K | -1.77M | -301.02K | -263.84K | -127.34K | -43.22K | 344.76K | -17.97K | -107.09K | -262.54K | -742.61K |

| Net Income Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | -6,664.14% | -7,672.06% | -15,141.14% | -5,132.66% | 86.67% | -35.05% | 0.00% | -4,659.11% | -971.72% |

| EPS | -0.18 | -0.21 | -0.10 | -0.23 | -0.19 | -0.16 | -0.25 | -0.17 | -0.29 | -0.54 | -0.94 | -1.23 | -0.20 | -0.14 | -0.13 | -0.58 | -0.15 | -0.15 | -0.09 | -0.03 | 0.24 | -0.01 | -0.08 | -0.19 | -0.67 |

| EPS Diluted | -0.18 | -0.21 | -0.10 | -0.23 | -0.19 | -0.16 | -0.25 | -0.17 | -0.29 | -0.54 | -0.94 | -1.23 | -0.20 | -0.14 | -0.13 | -0.58 | -0.15 | -0.15 | -0.09 | -0.03 | 0.24 | -0.01 | -0.08 | -0.19 | -0.67 |

| Weighted Avg Shares Out | 10.03M | 10.03M | 9.95M | 8.17M | 6.14M | 4.42M | 3.35M | 2.87M | 2.47M | 1.98M | 1.73M | 1.62M | 11.18M | 8.67M | 4.43M | 3.05M | 2.06M | 1.73M | 1.41M | 1.37M | 1.37M | 1.37M | 1.37M | 1.36M | 1.11M |

| Weighted Avg Shares Out (Dil) | 10.03M | 10.03M | 9.95M | 8.17M | 6.14M | 4.42M | 3.35M | 2.87M | 2.47M | 1.98M | 1.73M | 1.62M | 11.18M | 8.67M | 4.43M | 3.05M | 2.06M | 1.73M | 1.41M | 1.37M | 1.37M | 1.37M | 1.37M | 1.36M | 1.11M |

GABO Mining Ltd Announces $1,000,000 Private Placement

Medallion Changes Name to Gabo Mining Ltd.

Medallion Announced Board Changes

Purdue Research Foundation Terminates Medallion's License to Use Lad Chromatography

Medallion Receives Notice of Default From Purdue Research Foundation

Medallion Resources Appoints Gabriel Alonso-Mendoza as Interim CEO

Medallion Resources Extends Maturity of Unsecured Promissory Notes

Medallion Resources leading a revolution in sustainable rare earth processing

Medallion Resources achieves breakthrough in sustainable rare earth processing with revolutionary tech"

Medallion Resources receives proceeds of US1.0M from the issuance of US$1.15M principal amount unsecured promissory notes

Source: https://incomestatements.info

Category: Stock Reports