See more : Zaklady Magnezytowe ROPCZYCE S.A. (RPC.WA) Income Statement Analysis – Financial Results

Complete financial analysis of Miller Industries, Inc. (MLR) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Miller Industries, Inc., a leading company in the Auto – Parts industry within the Consumer Cyclical sector.

- Decora S.A. (DCR.WA) Income Statement Analysis – Financial Results

- CoAsia Electronics Corp. (8096.TWO) Income Statement Analysis – Financial Results

- Platt Nera International Limited (1949.HK) Income Statement Analysis – Financial Results

- Golden Band Resources Inc. (GBRIF) Income Statement Analysis – Financial Results

- Ruichang Intl Hldg Ltd (1334.HK) Income Statement Analysis – Financial Results

Miller Industries, Inc. (MLR)

About Miller Industries, Inc.

Miller Industries, Inc., together with its subsidiaries, manufactures and sells towing and recovery equipment. The company offers wreckers that are used to recover and tow disabled vehicles and other equipment; and car carriers, which are specialized flatbed vehicles with hydraulic tilt mechanisms, which are used to transport new or disabled vehicles and other equipment. It also provides transport trailers for moving various vehicles for auto auctions, car dealerships, leasing companies, and other related applications. The company markets its products under the Century, Challenger, Holmes, Champion, Eagle, Titan, Jige, Boniface, Vulcan, and Chevron brands. Miller Industries, Inc. sells its products through independent distributors in the United States, Canada, Mexico, Europe, the Pacific Rim, the Middle East, South America, and Africa; and through prime contractors to governmental entities. The company was incorporated in 1990 and is based in Ooltewah, Tennessee.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 1.15B | 848.46M | 717.48M | 651.29M | 818.17M | 711.71M | 615.10M | 601.12M | 540.97M | 492.78M | 404.17M | 342.66M | 412.66M | 306.90M | 237.57M | 270.99M | 400.03M | 409.42M | 351.88M | 236.31M | 206.00M | 203.06M | 495.46M | 581.49M | 525.90M | 397.20M | 292.40M | 125.70M | 94.70M |

| Cost of Revenue | 1.00B | 766.04M | 647.62M | 572.93M | 721.68M | 628.37M | 548.00M | 536.84M | 483.35M | 439.79M | 361.73M | 302.61M | 342.56M | 260.57M | 202.27M | 237.36M | 343.89M | 349.64M | 301.94M | 205.02M | 179.01M | 174.52M | 0.00 | 472.19M | 420.20M | 309.30M | 232.80M | 103.90M | 78.00M |

| Gross Profit | 151.85M | 82.42M | 69.85M | 78.36M | 96.49M | 83.34M | 67.10M | 64.28M | 57.61M | 52.99M | 42.44M | 40.06M | 70.10M | 46.33M | 35.30M | 33.63M | 56.15M | 59.78M | 49.94M | 31.29M | 26.99M | 28.54M | 495.46M | 109.30M | 105.70M | 87.90M | 59.60M | 21.80M | 16.70M |

| Gross Profit Ratio | 13.17% | 9.71% | 9.74% | 12.03% | 11.79% | 11.71% | 10.91% | 10.69% | 10.65% | 10.75% | 10.50% | 11.69% | 16.99% | 15.10% | 14.86% | 12.41% | 14.04% | 14.60% | 14.19% | 13.24% | 13.10% | 14.06% | 100.00% | 18.80% | 20.10% | 22.13% | 20.38% | 17.34% | 17.63% |

| Research & Development | 0.00 | 4.03M | 3.56M | 4.72M | 3.70M | 3.13M | 1.94M | 1.80M | 1.60M | 1.90M | 1.30M | 1.44M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 1.18M | 943.00K | 200.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 71.91M | 51.88M | 46.03M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 73.09M | 52.83M | 46.23M | 39.71M | 43.39M | 39.54M | 35.56M | 32.32M | 31.49M | 28.50M | 28.32M | 27.51M | 31.41M | 26.67M | 24.91M | 25.94M | 27.11M | 26.84M | 24.29M | 18.90M | 17.41M | 17.43M | 65.39M | 82.63M | 75.40M | 49.40M | 30.20M | 8.70M | 7.60M |

| Other Expenses | 0.00 | -481.00K | -498.00K | 668.00K | -331.00K | -253.00K | 387.00K | 277.00K | -340.00K | -437.00K | -119.00K | -815.00K | -161.00K | 0.00 | -442.00K | 0.00 | 3.52M | 16.91M | 4.66M | 4.66M | 0.00 | 0.00 | 0.00 | 17.79M | 15.50M | 10.20M | 5.80M | 900.00K | 500.00K |

| Operating Expenses | 73.09M | 52.83M | 46.23M | 39.71M | 43.39M | 39.54M | 35.56M | 32.32M | 31.49M | 28.50M | 28.20M | 26.69M | 31.25M | 26.67M | 24.46M | 25.94M | 27.11M | 26.84M | 24.29M | 18.90M | 17.41M | 17.43M | 65.39M | 100.42M | 90.90M | 59.60M | 36.00M | 9.60M | 8.10M |

| Cost & Expenses | 1.07B | 818.86M | 693.86M | 612.64M | 765.07M | 667.91M | 583.56M | 569.16M | 514.84M | 468.29M | 389.94M | 329.30M | 373.80M | 287.23M | 226.74M | 263.30M | 370.99M | 376.48M | 326.24M | 223.93M | 196.42M | 191.95M | 505.07M | 572.62M | 511.10M | 368.90M | 268.80M | 113.50M | 86.10M |

| Interest Income | 0.00 | 3.38M | 1.36M | 1.22M | 2.38M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -1.24M | -249.00K | 0.00 | 0.00 | -1.60M | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 5.97M | 3.38M | 1.36M | 1.22M | 2.38M | 1.88M | 1.59M | 1.16M | 919.00K | 554.00K | 369.00K | 712.00K | 728.00K | 305.00K | 883.00K | 1.24M | 3.39M | 3.52M | 4.01M | 4.66M | 21.83M | 53.59M | 16.73M | 12.43M | 10.40M | 3.40M | 600.00K | 600.00K | 0.00 |

| Depreciation & Amortization | 13.24M | 11.76M | 11.04M | 9.60M | 9.13M | 7.75M | 6.15M | 4.83M | 4.32M | 4.02M | 3.76M | 3.81M | 3.68M | 3.53M | 3.48M | 3.52M | 3.26M | 2.84M | 3.24M | 4.03M | 8.07M | 6.55M | 0.00 | 17.79M | 15.50M | 10.20M | 5.80M | 900.00K | 500.00K |

| EBITDA | 93.00M | 41.35M | 34.66M | 48.24M | 62.22M | 51.54M | 37.69M | 36.79M | 30.44M | 28.50M | 18.00M | 17.17M | 42.53M | 23.13M | 14.31M | 11.88M | 32.18M | 35.67M | 28.55M | 15.62M | 17.64M | 17.66M | -9.61M | 20.68M | 25.97M | 30.30M | 29.40M | 29.40M | 9.10M |

| EBITDA Ratio | 8.06% | 3.43% | 3.22% | 6.04% | 6.45% | 6.12% | 5.19% | 5.36% | 4.77% | 4.88% | 3.52% | 5.01% | 10.31% | 7.56% | 6.02% | 4.38% | 8.07% | 8.74% | 8.21% | 6.95% | 8.23% | 8.70% | -1.94% | 18.84% | 5.76% | 10.73% | 10.05% | 10.26% | 9.61% |

| Operating Income | 78.77M | 17.35M | 12.09M | 29.71M | 43.64M | 43.54M | 31.54M | 31.08M | 24.86M | 23.50M | 13.86M | 12.65M | 38.86M | 19.67M | 10.83M | 7.69M | 29.04M | 32.95M | 25.65M | 12.38M | 10.26M | 11.11M | -9.61M | 8.87M | 14.80M | 28.30M | 23.60M | 12.20M | 8.60M |

| Operating Income Ratio | 6.83% | 2.04% | 1.68% | 4.56% | 5.33% | 6.12% | 5.13% | 5.17% | 4.60% | 4.77% | 3.43% | 3.69% | 9.42% | 6.41% | 4.56% | 2.84% | 7.26% | 8.05% | 7.29% | 5.24% | 4.98% | 5.47% | -1.94% | 1.53% | 2.81% | 7.12% | 8.07% | 9.71% | 9.08% |

| Total Other Income/Expenses | -4.98M | 140.00K | 1.75M | 4.17M | -2.71M | -2.13M | -1.20M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -728.00K | -305.00K | -441.00K | -1.92M | -3.39M | -3.52M | -4.01M | -4.66M | -6.29M | -4.37M | 0.00 | -16.73M | -14.03M | -10.30M | -7.40M | 200.00K | 3.80M |

| Income Before Tax | 73.78M | 25.73M | 21.77M | 38.10M | 50.39M | 41.66M | 30.34M | 31.08M | 24.86M | 23.50M | 13.86M | 12.65M | 38.13M | 19.29M | 9.95M | 5.77M | 25.65M | 29.43M | 21.64M | 7.73M | 3.29M | 6.74M | -9.61M | -86.45M | 4.50M | 20.90M | 22.90M | 12.40M | 8.70M |

| Income Before Tax Ratio | 6.40% | 3.03% | 3.03% | 5.85% | 6.16% | 5.85% | 4.93% | 5.17% | 4.60% | 4.77% | 3.43% | 3.69% | 9.24% | 6.29% | 4.19% | 2.13% | 6.41% | 7.19% | 6.15% | 3.27% | 1.60% | 3.32% | -1.94% | -14.87% | 0.86% | 5.26% | 7.83% | 9.86% | 9.19% |

| Income Tax Expense | 15.49M | 5.39M | 5.51M | 8.27M | 11.27M | 7.92M | 7.32M | 11.16M | 8.89M | 8.66M | 5.18M | 3.53M | 15.12M | 7.58M | 3.93M | 2.18M | 9.32M | 2.45M | 2.94M | 740.00K | 1.22M | 3.22M | -3.17M | -13.31M | 2.30M | 8.20M | 8.40M | 4.60M | 3.30M |

| Net Income | 58.29M | 20.35M | 16.26M | 29.83M | 39.11M | 33.75M | 23.02M | 19.92M | 15.98M | 14.90M | 9.23M | 9.12M | 23.01M | 11.71M | 6.02M | 3.59M | 16.33M | 45.34M | 18.59M | 5.48M | -14.15M | -45.69M | -6.43M | -73.14M | 2.20M | 12.70M | 14.50M | 7.80M | 5.70M |

| Net Income Ratio | 5.05% | 2.40% | 2.27% | 4.58% | 4.78% | 4.74% | 3.74% | 3.31% | 2.95% | 3.02% | 2.28% | 2.66% | 5.58% | 3.81% | 2.53% | 1.32% | 4.08% | 11.07% | 5.28% | 2.32% | -6.87% | -22.50% | -1.30% | -12.58% | 0.42% | 3.20% | 4.96% | 6.21% | 6.02% |

| EPS | 5.10 | 1.78 | 1.42 | 2.62 | 3.43 | 2.96 | 2.02 | 1.76 | 1.41 | 1.32 | 0.82 | 0.82 | 1.98 | 1.00 | 0.52 | 0.31 | 1.41 | 3.99 | 1.66 | 0.50 | -1.51 | -4.89 | -0.69 | -7.83 | 0.24 | 1.40 | 1.85 | 1.24 | 1.10 |

| EPS Diluted | 5.07 | 1.78 | 1.42 | 2.62 | 3.43 | 2.96 | 2.02 | 1.75 | 1.41 | 1.31 | 0.82 | 0.82 | 1.92 | 0.96 | 0.51 | 0.31 | 1.40 | 3.91 | 1.62 | 0.50 | -1.51 | -4.89 | -0.69 | -7.83 | 0.23 | 1.35 | 1.75 | 1.24 | 1.10 |

| Weighted Avg Shares Out | 11.44M | 11.42M | 11.41M | 11.41M | 11.40M | 11.39M | 11.37M | 11.35M | 11.32M | 11.30M | 11.23M | 11.07M | 11.60M | 11.67M | 11.61M | 11.59M | 11.56M | 11.36M | 11.23M | 10.86M | 9.34M | 9.34M | 9.34M | 9.34M | 9.27M | 9.07M | 7.84M | 6.30M | 5.18M |

| Weighted Avg Shares Out (Dil) | 11.51M | 11.42M | 11.41M | 11.41M | 11.40M | 11.39M | 11.39M | 11.37M | 11.36M | 11.35M | 11.32M | 11.26M | 11.98M | 12.16M | 11.90M | 11.66M | 11.66M | 11.60M | 11.47M | 10.98M | 9.39M | 9.35M | 9.34M | 9.34M | 9.46M | 9.41M | 8.29M | 6.30M | 5.18M |

Contrasting Miller Industries (NYSE:MLR) and Nikola (NYSE:NKLA)

Bank of New York Mellon Corp Sells 6,615 Shares of Miller Industries, Inc. (NYSE:MLR)

America's Car-Mart and Diamond Hill Look Like Undiscovered Gems

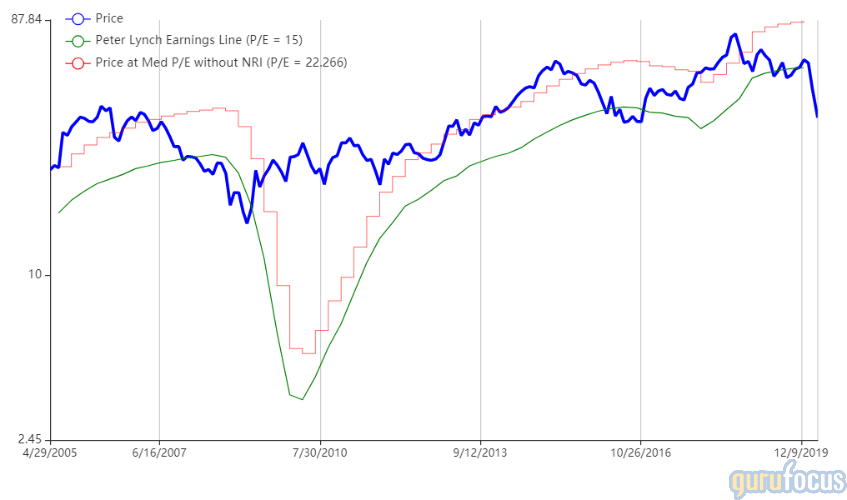

Peter Lynch Stocks to Consider on Temporary Setbacks

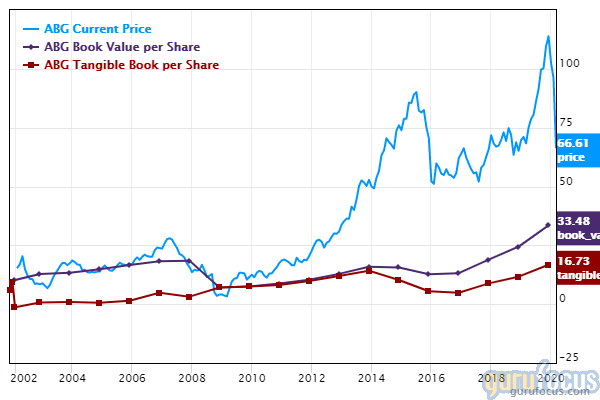

5 Cyclical Companies Boosting Book Value

Edited Transcript of MLR earnings conference call or presentation 5-Mar-20 3:00pm GMT

Source: https://incomestatements.info

Category: Stock Reports