See more : Kepler Weber S.A. (KEPL3.SA) Income Statement Analysis – Financial Results

Complete financial analysis of BlackRock MuniHoldings California Quality Fund, Inc. (MUC) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of BlackRock MuniHoldings California Quality Fund, Inc., a leading company in the Asset Management industry within the Financial Services sector.

- Daytona Corporation (7228.T) Income Statement Analysis – Financial Results

- Molina Healthcare, Inc. (MOH) Income Statement Analysis – Financial Results

- White Energy Company Limited (WECFF) Income Statement Analysis – Financial Results

- Hormel Foods Corporation (HO7.DE) Income Statement Analysis – Financial Results

- Crown Point Energy Inc. (CWV.V) Income Statement Analysis – Financial Results

BlackRock MuniHoldings California Quality Fund, Inc. (MUC)

Industry: Asset Management

Sector: Financial Services

About BlackRock MuniHoldings California Quality Fund, Inc.

BlackRock MuniHoldings California Quality Fund, Inc. is a closed ended fixed income mutual fund launched by BlackRock, Inc. It is managed by BlackRock Advisors, LLC. The fund invests in fixed income markets. It invests primarily in a portfolio of long-term investment-grade municipal obligations, the interest on which is exempt from Federal and California income taxes. BlackRock MuniHoldings California Quality Fund, Inc. was formed in 1997 and is domiciled in United States.

| Metric | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2010 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 78.81M | -29.73M | -94.50M | 35.80M | 38.41M | 45.01M | 6.88M | -9.93M | 42.99M | 41.39M | 43.00M | 45.46M | 0.00 |

| Cost of Revenue | 0.00 | 10.40M | 7.28M | 5.83M | 5.64M | 5.45M | 5.58M | 5.73M | 5.87M | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 78.81M | -40.13M | -101.78M | 29.97M | 32.77M | 39.55M | 1.30M | -15.67M | 37.12M | 41.39M | 43.00M | 45.46M | 0.00 |

| Gross Profit Ratio | 100.00% | 134.99% | 107.70% | 83.71% | 85.33% | 87.88% | 18.86% | 157.72% | 86.35% | 100.00% | 100.00% | 100.00% | 0.00% |

| Research & Development | 0.00 | 2.11 | -3.23 | 0.95 | 1.72 | 1.43 | 0.16 | -0.24 | 1.46 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 10.10M | 837.82K | 572.65K | 447.08K | 413.86K | 448.65K | 478.42K | 520.62K | 6.11M | 6.05M | 5.74M | 6.12M | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -6.11M | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 10.10M | 837.82K | 572.65K | 447.08K | 413.86K | 448.65K | 478.42K | 520.62K | 1.46 | 6.05M | 5.74M | 6.12M | 0.00 |

| Other Expenses | 0.00 | 18.72M | -518.61K | -291.84K | -342.74K | -458.82K | -514.77K | -452.71K | 41.00M | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 10.10M | 142.97K | 54.04K | 155.24K | 71.11K | -10.17K | -36.35K | 67.91K | 25.25M | 6.34M | 49.36M | 80.64M | 0.00 |

| Cost & Expenses | 10.10M | 142.97K | 54.04K | 155.24K | 71.11K | -10.17K | -36.35K | 67.91K | 37.12M | 6.34M | 49.36M | 80.64M | 0.00 |

| Interest Income | 77.11M | 75.16M | 47.84M | 36.00M | 36.97M | 38.71M | 40.65M | 40.92M | 4.10M | 3.44M | 3.61M | 4.27M | 0.00 |

| Interest Expense | 28.16M | 24.05M | 6.00M | 3.18M | 7.25M | 9.65M | 8.53M | 6.60M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | -68.71M | -65.54M | -39.92M | -30.00M | -31.16M | -33.10M | -34.87M | -35.00M | -35.71M | -35.33M | -37.26M | -39.34M | 0.00 |

| EBITDA | 0.00 | -29.87M | -230.62M | 0.00 | 0.00 | 0.00 | 0.00 | -3.41M | 0.00 | 0.00 | 0.00 | -78.78M | 0.00 |

| EBITDA Ratio | 0.00% | 100.48% | 94.10% | 99.57% | 99.81% | 100.02% | 224.56% | 34.28% | -46.47% | -9.02% | 119.74% | -173.29% | 0.00% |

| Operating Income | 68.71M | -29.87M | -54.04K | 35.64M | 38.34M | 45.02M | 15.44M | -3.41M | 35.71M | 35.33M | 37.26M | 39.34M | 0.00 |

| Operating Income Ratio | 87.19% | 100.48% | 0.06% | 99.57% | 99.81% | 100.02% | 224.56% | 34.28% | 83.07% | 85.37% | 86.64% | 86.54% | 0.00% |

| Total Other Income/Expenses | -30.67M | 0.00 | 6.90M | 0.00 | 0.00 | 0.00 | -27.96M | 5.73M | 27.26M | -3.73M | 51.49M | -78.78M | 0.00 |

| Income Before Tax | 38.04M | -29.87M | -94.93M | 35.64M | 38.34M | 45.02M | 6.91M | -10.00M | 62.96M | 31.60M | 88.75M | -39.44M | 0.00 |

| Income Before Tax Ratio | 48.27% | 100.48% | 100.45% | 99.57% | 99.81% | 100.02% | 100.53% | 100.68% | 146.47% | 76.35% | 206.38% | -86.75% | 0.00% |

| Income Tax Expense | 0.00 | 41.49M | 88.87M | 26.83M | 23.91M | 23.45M | 34.87M | 35.00M | -51.33M | -3.73M | 51.49M | -78.78M | 0.00 |

| Net Income | 38.04M | -29.87M | -183.80M | 35.64M | 38.34M | 45.02M | 6.91M | -10.00M | 67.06M | 31.60M | 88.75M | -39.44M | 0.00 |

| Net Income Ratio | 48.27% | 100.48% | 194.50% | 99.57% | 99.81% | 100.02% | 100.53% | 100.68% | 156.00% | 76.35% | 206.38% | -86.75% | 0.00% |

| EPS | 0.40 | -0.31 | -1.88 | 0.87 | 0.94 | 1.10 | 0.17 | -0.24 | 1.07 | 0.77 | 2.16 | -0.96 | 0.00 |

| EPS Diluted | 0.40 | -0.31 | -1.88 | 0.87 | 0.94 | 1.10 | 0.17 | -0.24 | 43.67M | 0.77 | 2.16 | -0.96 | 0.00 |

| Weighted Avg Shares Out | 94.18M | 95.43M | 97.53M | 41.01M | 41.00M | 41.00M | 40.66M | 41.00M | 62.96M | 41.00M | 41.00M | 41.00M | 40.87M |

| Weighted Avg Shares Out (Dil) | 94.18M | 95.43M | 97.53M | 41.01M | 41.00M | 41.00M | 40.66M | 41.68M | 1.54 | 41.00M | 41.00M | 41.00M | 40.87M |

Distribution Dates and Amounts Announced for Certain BlackRock Closed-End Funds

Distribution Dates and Amounts Announced for Certain BlackRock Closed-End Funds

Certain BlackRock Closed-End Funds Announce Election To Opt In to Maryland Control Share Acquisition Act

Distribution Dates and Amounts Announced for Certain BlackRock Closed-End Funds

Certain Closed-End Funds Announce Renewal of Share Repurchase Programs

Distribution Dates and Amounts Announced for Certain BlackRock Closed-End Funds

Distribution Dates and Amounts Announced for Certain BlackRock Closed-End Funds

I Still Favor MUC Over The PIMCO Rivals

Distribution Dates and Amounts Announced for Certain BlackRock Closed-End Funds

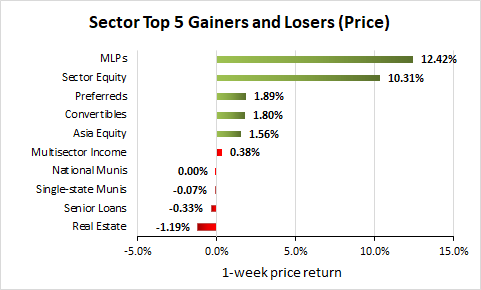

Weekly Closed-End Fund Roundup: June 21, 2020

Source: https://incomestatements.info

Category: Stock Reports