See more : Lansdowne Oil & Gas plc (LOGP.L) Income Statement Analysis – Financial Results

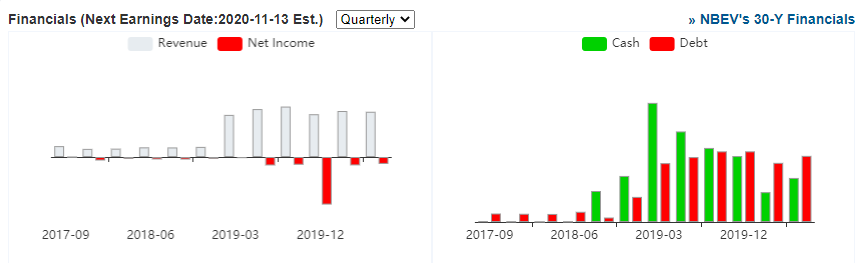

Complete financial analysis of NewAge, Inc. (NBEV) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of NewAge, Inc., a leading company in the Beverages – Non-Alcoholic industry within the Consumer Defensive sector.

- Mewah International Inc. (MV4.SI) Income Statement Analysis – Financial Results

- Fair Isaac Corporation (FICO) Income Statement Analysis – Financial Results

- Eugene Technology Co.,Ltd. (084370.KQ) Income Statement Analysis – Financial Results

- Dhanuka Agritech Limited (DHANUKA.NS) Income Statement Analysis – Financial Results

- Golden Mile Resources Limited (G88.AX) Income Statement Analysis – Financial Results

NewAge, Inc. (NBEV)

About NewAge, Inc.

NewAge, Inc. develops, markets, sells, and distributes healthy products in the United States, Japan, China, and internationally. The company operates in two segments, Direct / Social Selling and Direct Store. It provides health and wellness, energy drink, essential oil and anti-aging skincare, cosmetic, beverage, snacks, water and air filtration, and personal care products, as well as weight management, nutritional supplement, nutraceutical, and slenderiize products; diagnostic products, such as DNA testing and diagnostic kits and products; and CBD products. The company offers its products under the Tahitian Noni, LIMU, Zennoa, LIMU Blue Frog, Hiro Natural, TeMana, Lucim, Reviive, Puritii, and MaVie brands. It sells its products directly to customers, as well as through distributors, e-commerce sites, and direct-store-delivery systems. The company was formerly known as New Age Beverages Corporation and changed its name to NewAge, Inc. in July 2020. NewAge, Inc. was incorporated in 2010 and is headquartered in Denver, Colorado. On August 30, 2022, NewAge, Inc. along with its affiliates, filed a voluntary petition for reorganization under Chapter 11 in the U.S. Bankruptcy Court for the District of Delaware.

| Metric | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 |

|---|---|---|---|---|---|---|---|---|

| Revenue | 279.47M | 253.71M | 52.16M | 52.19M | 25.30M | 0.00 | 1.04M | 968.94K |

| Cost of Revenue | 101.98M | 101.00M | 42.87M | 39.79M | 19.51M | 0.00 | 879.46K | 684.59K |

| Gross Profit | 177.49M | 152.71M | 9.30M | 12.40M | 5.80M | 0.00 | 164.19K | 284.35K |

| Gross Profit Ratio | 63.51% | 60.19% | 17.82% | 23.76% | 22.91% | 0.00% | 15.73% | 29.35% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 113.21M | 0.00 | 20.29M | 14.61M | 7.84M | 0.00 | 1.28M | 415.09K |

| Selling & Marketing | 0.00 | 0.00 | 2.78M | 3.84M | 1.58M | 0.00 | 155.98K | 174.01K |

| SG&A | 113.21M | 0.00 | 23.07M | 18.45M | 9.42M | 0.00 | 1.44M | 589.11K |

| Other Expenses | 99.13M | 199.33M | 2.31M | 668.05M | 1.47M | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 212.34M | 199.33M | 25.38M | 18.45M | 9.42M | 0.00 | 1.44M | 589.11K |

| Cost & Expenses | 314.32M | 300.33M | 68.24M | 58.24M | 28.93M | 0.00 | 2.32M | 1.27M |

| Interest Income | 0.00 | -227.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 2.38M | 3.90M | 1.07M | 228.04K | 299.08K | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 8.93M | 8.76M | 2.31M | 1.61M | 523.75K | 77.82K | 169.40K | 103.21K |

| EBITDA | -29.93M | -64.50M | -17.68M | -1.70M | -2.81M | 0.00 | -1.08M | -227.14K |

| EBITDA Ratio | -10.71% | -25.42% | -33.90% | -3.26% | -11.11% | 0.00% | -103.52% | -23.44% |

| Operating Income | -34.85M | -80.00M | -19.37M | -6.05M | -3.63M | 0.00 | -1.28M | -304.75K |

| Operating Income Ratio | -12.47% | -31.53% | -37.14% | -11.59% | -14.33% | 0.00% | -122.27% | -31.45% |

| Total Other Income/Expenses | -2.60M | -98.17M | -1.69M | 2.51M | -6.32K | 0.00 | 26.32K | -25.59K |

| Income Before Tax | -37.45M | -77.17M | -21.06M | -3.54M | -3.63M | 0.00 | -1.25M | -330.34K |

| Income Before Tax Ratio | -13.40% | -30.42% | -40.38% | -6.78% | -14.36% | 0.00% | -119.75% | -34.09% |

| Income Tax Expense | -1.90M | 12.67M | -8.93M | 2.74M | 292.76K | 0.00 | 26.32K | -25.59K |

| Net Income | -39.34M | -89.84M | -12.14M | -3.54M | -3.63M | 0.00 | -1.25M | -330.34K |

| Net Income Ratio | -14.08% | -35.41% | -23.26% | -6.78% | -14.36% | 0.00% | -119.75% | -34.09% |

| EPS | -0.41 | -1.16 | -0.26 | -0.12 | -0.19 | 0.00 | -0.10 | -0.03 |

| EPS Diluted | -0.41 | -1.16 | -0.26 | -0.12 | -0.19 | 0.00 | -0.10 | -0.03 |

| Weighted Avg Shares Out | 96.35M | 77.25M | 46.45M | 30.62M | 18.89M | 18.89M | 12.39M | 12.56M |

| Weighted Avg Shares Out (Dil) | 96.35M | 77.25M | 46.45M | 30.62M | 18.89M | 18.89M | 12.39M | 12.56M |

NewAge: Don't Expect Much From The Acquisition Of ARIIX

40M Americans Could Lose Homes In Coronavirus Eviction Crisis

Brokerages Anticipate Aspen Technology, Inc. (NASDAQ:AZPN) Will Announce Quarterly Sales of $149.40 Million

State Board of Administration of Florida Retirement System Grows Position in Aspen Technology, Inc. (NASDAQ:AZPN)

‘I am beside myself’: millions in the US face evictions amid looming crisis

Digital Assets: Aspen Digital Trades on tZERO, First Tezos Based Digital Security to Trade

tZERO ATS Begins Trading the St. Regis Aspen Digital Security

This Week in Washington IP: Regulatory Tech in the Financial Industry, Resilient Disaster Tech Infrastructure and USPTO Invention-Con 2020

Source: https://incomestatements.info

Category: Stock Reports