See more : HANA Micron Inc. (067310.KQ) Income Statement Analysis – Financial Results

Complete financial analysis of NovaGold Resources Inc. (NG) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of NovaGold Resources Inc., a leading company in the Gold industry within the Basic Materials sector.

- Société Parisienne d’Apports en Capital Société Anonyme (FPN.PA) Income Statement Analysis – Financial Results

- PT Jasa Marga (Persero) Tbk (PTJSF) Income Statement Analysis – Financial Results

- Senkon Logistics Co., Ltd. (9051.T) Income Statement Analysis – Financial Results

- Capstone Technologies Group, Inc. (CATG) Income Statement Analysis – Financial Results

- Velocity Acquisition Corp. (VELO) Income Statement Analysis – Financial Results

NovaGold Resources Inc. (NG)

About NovaGold Resources Inc.

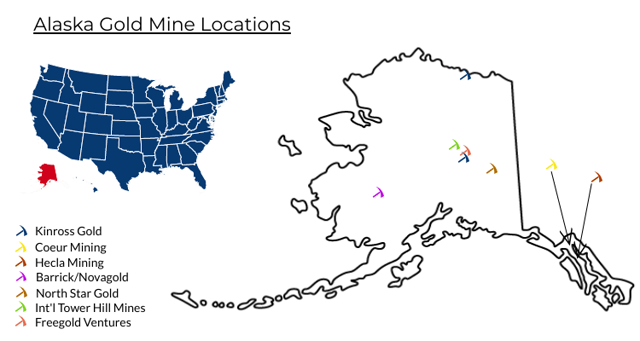

NovaGold Resources Inc. explores for and develops gold mineral properties in the United States. Its principal asset is the Donlin Gold project consisting of 493 mining claims covering an area of approximately 29,008 hectares located in the Kuskokwim region of southwestern Alaska. The company was formerly known as NovaCan Mining Resources (1985) Limited and changed its name to NovaGold Resources Inc. in March 1987. NovaGold Resources Inc. was incorporated in 1984 and is based in Vancouver, Canada.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 388.34K | 587.53K | 1.52M | 3.54M | 7.07M | 7.27M | 3.15M | 3.16M | 1.23M | 1.48M | 1.80M | 1.82M | 2.11M | 65.10K | 70.27K | 74.21K |

| Cost of Revenue | 9.96K | 7.00K | 7.00K | 7.00K | 15.00K | 22.00K | 34.00K | 33.00K | 0.00 | 0.00 | 0.00 | 7.35M | 215.96K | 253.06K | 37.65M | 39.95M | 165.13K | 184.07K | 366.93K | 237.11K | 256.07K | 151.98K | 138.54K | 1.26M | 1.22M | 0.00 | 0.00 | 0.00 |

| Gross Profit | -9.96K | -7.00K | -7.00K | -7.00K | -15.00K | -22.00K | -34.00K | -33.00K | 0.00 | 0.00 | 0.00 | -7.35M | 172.38K | 334.47K | -36.13M | -36.42M | 6.91M | 7.09M | 2.79M | 2.92M | 970.27K | 1.33M | 1.66M | 551.47K | 882.83K | 65.10K | 70.27K | 74.21K |

| Gross Profit Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 44.39% | 56.93% | -2,375.20% | -1,029.75% | 97.67% | 97.47% | 88.36% | 92.50% | 79.12% | 89.75% | 92.28% | 30.36% | 41.94% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 878.84K | 484.21K | 1.25M | 1.40M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 21.78M | 20.10M | 20.20M | 18.73M | 16.31M | 18.47M | 20.77M | 20.15M | 19.89M | 22.05M | 26.99M | 44.05M | 86.05M | 44.39M | 22.24M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | -10.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 21.77M | 20.10M | 20.20M | 18.73M | 16.31M | 18.47M | 20.77M | 20.15M | 19.89M | 22.05M | 26.99M | 44.05M | 86.05M | 44.39M | 22.24M | 27.19M | 113.92M | 34.13M | 9.70M | 10.00M | 4.15M | 3.18M | 1.46M | 963.55K | 1.36M | 1.11M | 632.47K | 519.48K |

| Other Expenses | 0.00 | -849.00K | 2.76M | 3.34M | 92.00K | 0.00 | 0.00 | 0.00 | 401.00K | 36.00K | 37.00K | 0.00 | -19.77M | 11.52M | 2.61M | -4.45M | 920.74K | 404.16K | 426.75K | 0.00 | 92.03K | 0.00 | 47.68K | 102.53K | 271.64K | 325.52K | 351.37K | 148.42K |

| Operating Expenses | 21.68M | 19.25M | 20.20M | 18.73M | 16.31M | 18.47M | 20.77M | 20.15M | 20.29M | 22.08M | 27.03M | 44.93M | 108.62M | 57.16M | 26.24M | 22.74M | 114.84M | 34.53M | 10.12M | 10.00M | 4.25M | 3.18M | 1.51M | 1.07M | 1.63M | 1.43M | 983.84K | 667.90K |

| Cost & Expenses | 21.69M | 19.26M | 20.21M | 18.74M | 16.32M | 18.49M | 20.80M | 20.18M | 20.29M | 22.08M | 27.03M | 52.28M | 108.84M | 57.41M | 63.90M | 62.69M | 115.00M | 34.72M | 10.49M | 10.24M | 4.50M | 3.33M | 1.64M | 2.33M | 2.85M | 1.43M | 983.84K | 667.90K |

| Interest Income | 5.77M | 1.59M | 458.00K | 1.74M | 4.19M | 2.00M | 1.17M | 947.00K | 740.00K | 854.00K | 942.00K | 1.52M | 395.12K | 565.95K | 391.42K | 1.80M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 13.01M | 7.96M | 5.92M | 6.01M | 7.29M | 6.46M | 5.23M | 4.55M | 5.19M | 6.84M | 12.61M | 15.68M | 14.55M | 14.90M | 17.46M | 94.26M | 0.00 | 647.25K | 0.00 | 72.03K | 2.19M | 321.96K | 172.25K | 0.00 | 475.37K | 4.04M | 1.41M | 0.00 |

| Depreciation & Amortization | 9.96K | 6.75K | 6.86K | 7.26K | 15.01K | 21.37K | 34.38K | 32.60K | 35.00K | 36.00K | 37.00K | 334.22K | 836.72K | 516.91K | 243.93K | 228.38K | 286.23K | 211.08K | 184.46K | 177.08K | 122.03K | 175.98K | 147.91K | 102.53K | 271.64K | -130.21K | 210.82K | -222.63K |

| EBITDA | -33.55M | -16.64M | -17.50M | -14.34M | -8.70M | -23.76M | -31.69M | -28.63M | -25.16M | -38.01M | -55.78M | 40.77M | 7.82M | -191.81M | -64.36M | -145.42M | -107.64M | -27.23M | -7.15M | -7.11M | -4.38M | -1.67M | 406.24K | -412.08K | -475.37K | 2.67M | 491.92K | -593.69K |

| EBITDA Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | -27,227.19% | -11,633.90% | -4,230.52% | 603.55% | -1,529.83% | -364.01% | -241.33% | -216.18% | -81.08% | -90.96% | 26.26% | -182.67% | -61.29% | 4,100.01% | 700.00% | -800.01% |

| Operating Income | -21.78M | -48.27M | -36.84M | -33.24M | -26.81M | -27.29M | -33.70M | -30.15M | -31.70M | -38.01M | -55.78M | -79.54M | -88.28M | -56.26M | -79.84M | -59.16M | -107.93M | -27.44M | -7.34M | -7.08M | -4.50M | -2.43M | -207.66K | 2.35M | -1.29M | -5.40M | -2.32M | -593.69K |

| Operating Income Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | -22,733.92% | -9,574.96% | -5,248.35% | -1,672.81% | -1,526.01% | -377.27% | -232.73% | -224.07% | -366.80% | -163.86% | -11.57% | 129.22% | -61.29% | -8,300.02% | -3,300.00% | -800.01% |

| Total Other Income/Expenses | -24.78M | -5.10M | -3.56M | -1.11M | -10.16M | -3.65M | -3.32M | -3.01M | -11.51M | -18.14M | -31.32M | 25.26M | -103.02M | -150.85M | -24.32M | -91.18M | 46.63M | -647.25K | 137.60K | 236.11K | -858.24K | 260.97K | 80.19K | -2.35M | 67.91K | -4.04M | -1.41M | 0.00 |

| Income Before Tax | -46.56M | -53.38M | -40.40M | -34.35M | -26.48M | -30.94M | -38.28M | -33.57M | -31.80M | -40.22M | -58.86M | 61.16M | -191.31M | -200.79M | -75.09M | -153.42M | -61.30M | -28.09M | -7.20M | -7.15M | -5.46M | -2.17M | -20.89K | 2.39M | -1.22M | -9.44M | -3.72M | 0.00 |

| Income Before Tax Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | -49,262.61% | -34,175.31% | -4,936.36% | -4,338.33% | -866.69% | -386.16% | -228.37% | -226.35% | -445.51% | -146.26% | -1.16% | 131.65% | -58.06% | -14,500.04% | -5,300.01% | 0.00% |

| Income Tax Expense | 38.83K | -33.00K | 137.00K | -781.00K | 1.28M | 526.00K | 732.00K | 277.00K | 153.00K | 263.00K | 3.90M | -6.93M | -7.07M | -1.14M | -5.73M | 3.24M | -16.55M | -1.41M | -2.23M | -25.01K | 2.08M | 361.95K | 465.67K | -2.28M | 814.92K | 130.21K | -210.82K | 222.63K |

| Net Income | -46.80M | -53.34M | -40.54M | -33.56M | -27.76M | -112.77M | -39.02M | -33.85M | -31.95M | -40.48M | -62.76M | 68.09M | -148.32M | -199.65M | -69.36M | -156.66M | -44.74M | -26.68M | -4.97M | -7.05M | -5.36M | -2.21M | -314.31K | 1.76M | -1.56M | -5.53M | -2.11M | -816.33K |

| Net Income Ratio | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | -38,192.78% | -33,981.49% | -4,559.60% | -4,429.87% | -632.63% | -366.74% | -157.72% | -223.27% | -436.79% | -148.95% | -17.51% | 97.05% | -74.19% | -8,500.02% | -3,000.00% | -1,100.01% |

| EPS | -0.14 | -0.16 | -0.12 | -0.10 | -0.09 | -0.35 | -0.12 | -0.11 | -0.10 | -0.13 | -0.20 | 0.25 | -0.63 | -0.93 | -0.40 | -1.48 | -0.45 | -0.29 | -0.07 | -0.12 | -0.11 | -0.06 | -0.01 | 0.08 | -0.09 | -0.49 | -0.21 | -0.15 |

| EPS Diluted | -0.14 | -0.16 | -0.12 | -0.10 | -0.09 | -0.35 | -0.12 | -0.11 | -0.10 | -0.13 | -0.20 | 0.25 | -0.53 | -0.93 | -0.40 | -1.48 | -0.45 | -0.29 | -0.07 | -0.12 | -0.11 | -0.06 | -0.01 | 0.05 | -0.09 | -0.49 | -0.21 | -0.15 |

| Weighted Avg Shares Out | 334.06M | 333.24M | 331.55M | 329.27M | 325.79M | 322.49M | 321.66M | 319.77M | 317.85M | 317.20M | 313.37M | 272.24M | 236.12M | 213.60M | 172.65M | 105.73M | 99.56M | 91.52M | 66.95M | 59.16M | 48.68M | 35.93M | 24.70M | 20.82M | 17.14M | 11.18M | 10.00M | 5.50M |

| Weighted Avg Shares Out (Dil) | 334.06M | 333.24M | 331.55M | 329.27M | 325.79M | 322.49M | 321.66M | 319.77M | 317.85M | 317.20M | 313.37M | 272.24M | 277.58M | 213.60M | 172.65M | 105.73M | 99.56M | 91.52M | 66.95M | 59.16M | 48.68M | 35.93M | 24.70M | 33.83M | 17.14M | 11.18M | 10.00M | 5.50M |

NOVAGOLD Reports Fiscal Year 2020 Financial Results

Donlin Gold 2020 Q4 Drilling Program Assay Results Continue to Exceed Modeled Projections While Partners Deliver a Safe and Covid-Free Year

Analysts Predict a Wave of M&A Among Gold Miners in 2021

SAVE THE DATE: NOVAGOLD 2020 Year-End Financial Results Release, Conference Call and Webcast

Tracking John Paulson's Paulson & Company Portfolio - Q2 2020 Update

National Grid: One Of The Largest Private-Sector Utility Groups In The World

NovaGold: Investing In Gold That Is Pre-Buried

A Short Squeeze Can Push These Gold And Silver Miners Even Higher

Alaska Gold Mines: 2019 Actual And 2020 Forecast Production

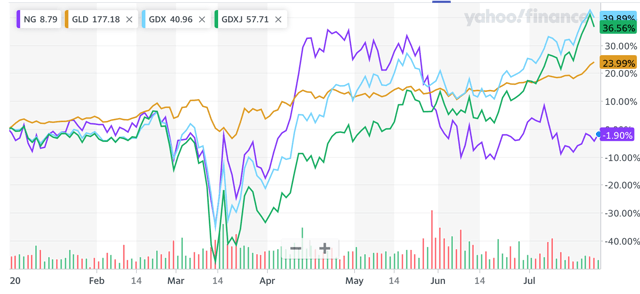

ClearBridge International Small Cap Strategy Portfolio Manager Commentary Q2 2020

Source: https://incomestatements.info

Category: Stock Reports