See more : Telefonaktiebolaget LM Ericsson (publ) (ERCG.DE) Income Statement Analysis – Financial Results

Complete financial analysis of Nuveen Municipal Income Fund, Inc. (NMI) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Nuveen Municipal Income Fund, Inc., a leading company in the Asset Management – Income industry within the Financial Services sector.

- Tabio Corporation (2668.T) Income Statement Analysis – Financial Results

- F.I.L.A. – Fabbrica Italiana Lapis ed Affini S.p.A. (FILA.MI) Income Statement Analysis – Financial Results

- Sunlight Real Estate Investment Trust (0435.HK) Income Statement Analysis – Financial Results

- Holy Stone Healthcare Co., Ltd. (4194.TWO) Income Statement Analysis – Financial Results

- Octaware Technologies Limited (OCTAWARE.BO) Income Statement Analysis – Financial Results

Nuveen Municipal Income Fund, Inc. (NMI)

Industry: Asset Management - Income

Sector: Financial Services

Website: https://www.nuveen.com/CEF/Product/Overview.aspx?FundCode=NMI&refsrc=vu_nuveen.com/nmi

About Nuveen Municipal Income Fund, Inc.

Nuveen Municipal Income Fund, Inc. is a closed ended fixed income mutual fund launched by Nuveen Investments Inc. The fund is co-managed by Nuveen Fund Advisors LLC and Nuveen Asset Management, LLC. It invests in the fixed income markets of the United States. The fund primarily invests in municipal obligations issued by state and local government authorities. Its investment portfolio comprises investment in companies operating in various industries, including healthcare, materials, education and civic organizations, and consumer staples. Nuveen Municipal Income Fund was formed on April 20, 1988 and is based in the United States.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 4.50M | -17.01M | 5.35M | 1.88M | 8.11M | 239.88K | 2.24M | 4.92M | 4.91M | 4.89M | 5.12M | 5.45M | 5.47M | 5.42M | 5.29M | 5.03M | 4.98M | 4.93M | 5.09M | 5.22M | 5.35M | 5.67M | 6.14M | 6.28M | 6.32M | 6.40M | 6.72M | 6.75M | 6.71M | 6.73M | 7.04M | 1.76M | 6.94M | 6.81M | 6.66M |

| Cost of Revenue | 0.00 | 685.92K | 719.56K | 676.52K | 680.56K | 675.09K | 634.04K | 653.64K | 630.94K | 610.00K | 630.00K | 630.00K | 590.00K | 610.00K | 550.00K | 580.00K | 610.00K | 610.00K | 620.00K | 610.00K | 620.00K | 640.00K | 650.00K | 650.00K | 690.00K | 690.00K | 680.00K | 680.00K | 680.00K | 680.00K | 700.00K | 170.00K | 510.00K | 510.00K | 490.00K |

| Gross Profit | 4.50M | -17.70M | 4.63M | 1.20M | 7.43M | -435.21K | 1.61M | 4.27M | 4.28M | 4.28M | 4.49M | 4.82M | 4.88M | 4.81M | 4.74M | 4.45M | 4.37M | 4.32M | 4.47M | 4.61M | 4.73M | 5.03M | 5.49M | 5.63M | 5.63M | 5.71M | 6.04M | 6.07M | 6.03M | 6.05M | 6.34M | 1.59M | 6.43M | 6.30M | 6.17M |

| Gross Profit Ratio | 100.00% | 104.03% | 86.55% | 63.98% | 91.61% | -181.43% | 71.71% | 86.71% | 87.15% | 87.52% | 87.70% | 88.44% | 89.21% | 88.75% | 89.60% | 88.47% | 87.75% | 87.63% | 87.82% | 88.31% | 88.41% | 88.71% | 89.41% | 89.65% | 89.08% | 89.22% | 89.88% | 89.93% | 89.87% | 89.90% | 90.06% | 90.34% | 92.65% | 92.51% | 92.64% |

| Research & Development | 0.00 | 18.11 | 1.15 | 0.41 | 1.65 | -0.01 | 0.42 | 1.10 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 721.03K | 111.32K | 129.43K | 122.08K | 170.85K | 267.61K | 159.42K | 710.54K | 692.62K | 695.90K | 678.20K | 90.00K | 60.00K | 50.00K | 80.00K | 150.00K | 150.00K | 50.00K | 60.00K | 90.00K | 330.00K | 140.00K | 80.00K | 50.00K | 80.00K | 60.00K | 80.00K | 50.00K | 60.00K | 70.00K | 70.00K | 30.00K | 60.00K | 80.00K | 100.00K |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -710.54K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 721.03K | 111.32K | 129.43K | 122.08K | 170.85K | 267.61K | 159.42K | 1.10 | 692.62K | 695.90K | 678.20K | 90.00K | 60.00K | 50.00K | 80.00K | 150.00K | 150.00K | 50.00K | 60.00K | 90.00K | 330.00K | 140.00K | 80.00K | 50.00K | 80.00K | 60.00K | 80.00K | 50.00K | 60.00K | 70.00K | 70.00K | 30.00K | 60.00K | 80.00K | 100.00K |

| Other Expenses | 0.00 | 6.35K | 7.56K | 6.91K | 7.33K | 7.92K | 10.84K | 8.31M | 11.16K | 10.00K | 10.00K | 0.00 | 10.00K | 0.00 | 10.00K | -10.00K | -20.00K | -20.00K | 0.00 | 0.00 | 10.00K | 0.00 | 0.00 | 0.00 | 0.00 | 30.00K | 10.00K | 10.00K | 30.00K | 30.00K | 40.00K | 10.00K | 30.00K | 30.00K | 20.00K |

| Operating Expenses | 721.03K | 117.67K | 136.98K | 128.99K | 178.18K | 275.53K | 170.26K | 506.85K | 1.10M | 5.64M | 7.50M | 90.00K | 70.00K | 50.00K | 90.00K | 140.00K | 130.00K | 30.00K | 60.00K | 90.00K | 340.00K | 140.00K | 80.00K | 50.00K | 80.00K | 90.00K | 90.00K | 60.00K | 90.00K | 100.00K | 110.00K | 40.00K | 90.00K | 110.00K | 120.00K |

| Cost & Expenses | 721.03K | 117.67K | 136.98K | 128.99K | 178.18K | 275.53K | 170.26K | 4.27M | 1.10M | 5.64M | 7.50M | 720.00K | 660.00K | 660.00K | 640.00K | 720.00K | 740.00K | 640.00K | 680.00K | 700.00K | 960.00K | 780.00K | 730.00K | 700.00K | 770.00K | 780.00K | 770.00K | 740.00K | 770.00K | 780.00K | 810.00K | 210.00K | 600.00K | 620.00K | 610.00K |

| Interest Income | 4.50M | 338.00 | 87.00 | 0.00 | 0.00 | 0.00 | 0.00 | 28.93K | 7.93K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ||

| Interest Expense | 761.00 | 338.00 | 87.00 | 0.00 | 0.00 | 0.00 | 0.00 | 28.93K | 6.34M | 7.43M | 0.00 | 3.62M | 8.63M | 0.00 | 0.00 | 1.29M | 690.00K | 2.63M | -1.28M | -2.43M | -580.00K | -2.86M | -4.81M | 870.00K | 860.00K | -180.00K | 3.42M | -6.93M | 3.13M | -2.56M | 1.34M | -740.00K | 4.76M | ||

| Depreciation & Amortization | -3.78M | -3.44M | -3.52M | -3.72M | -3.74M | -3.75M | -4.02M | -4.23M | -4.22M | -4.19M | -4.44M | 14.85M | -1.59M | 7.24M | 17.26M | -24.64M | -4.59M | 2.58M | 1.38M | 5.26M | -2.56M | -4.87M | -1.16M | -5.72M | -9.61M | 1.73M | 1.72M | -370.00K | 6.84M | -13.86M | 6.26M | -5.13M | 2.68M | -1.48M | 9.52M |

| EBITDA | 0.00 | -17.13M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -408.76K | 6.33M | -2.38M | 19.58M | 3.22M | 11.99M | 21.91M | -20.32M | -350.00K | 6.87M | 5.80M | 9.78M | 1.83M | 30.00K | 4.26M | -130.00K | -4.06M | 7.35M | 7.67M | 5.64M | 12.78M | -7.91M | 12.49M | -3.58M | 9.01M | 4.72M | 15.57M |

| EBITDA Ratio | 0.00% | 100.69% | 97.44% | 93.13% | 97.80% | -14.86% | 92.40% | -10.72% | -8.49% | 129.59% | -133.49% | 359.27% | 58.87% | 221.22% | 414.18% | -403.98% | -7.03% | 139.35% | 113.95% | 187.36% | 34.21% | 0.53% | 69.38% | -2.07% | -64.24% | 114.84% | 114.14% | 83.56% | 190.46% | -117.53% | 177.41% | -203.41% | 129.83% | 69.31% | 233.78% |

| Operating Income | 3.78M | -117.67K | 5.21M | 1.75M | 7.94M | -275.53K | -170.26K | 4.23M | 4.22M | 4.19M | 4.44M | 4.73M | 4.81M | 4.75M | 4.65M | 4.32M | 4.24M | 4.29M | 4.42M | 4.52M | 4.39M | 4.90M | 5.42M | 5.59M | 5.55M | 5.62M | 5.95M | 6.01M | 5.94M | 5.95M | 6.23M | 1.55M | 6.33M | 6.20M | 6.05M |

| Operating Income Ratio | 83.99% | 0.69% | 97.44% | 93.13% | 97.80% | -114.86% | -7.60% | 85.97% | 85.89% | 85.76% | 86.75% | 86.79% | 87.93% | 87.64% | 87.90% | 85.88% | 85.14% | 87.02% | 86.84% | 86.59% | 82.06% | 86.42% | 88.27% | 89.01% | 87.82% | 87.81% | 88.54% | 89.04% | 88.52% | 88.41% | 88.49% | 88.07% | 91.21% | 91.04% | 90.84% |

| Total Other Income/Expenses | -866.12K | 685.92K | 1.70M | -1.97M | 4.20M | 675.09K | -1.95M | 1.19M | -416.69K | 6.33M | -6.84M | 7.42M | -800.00K | 3.62M | 8.63M | -12.32M | -2.30M | 1.29M | 690.00K | 2.63M | -1.28M | -2.44M | -580.00K | -2.86M | -4.80M | 860.00K | 860.00K | -190.00K | 3.42M | -6.93M | 3.13M | -2.57M | 1.34M | -740.00K | 4.76M |

| Income Before Tax | 2.92M | -17.13M | 5.21M | 1.75M | 7.94M | -35.65K | 2.07M | 5.42M | 3.80M | 10.52M | -2.39M | 12.15M | 4.01M | 8.37M | 13.28M | -8.00M | 1.94M | 5.58M | 5.11M | 7.15M | 3.11M | 2.46M | 4.84M | 2.73M | 750.00K | 6.48M | 6.81M | 5.82M | 9.36M | -980.00K | 9.36M | -1.02M | 7.67M | 5.46M | 10.81M |

| Income Before Tax Ratio | 64.76% | 100.69% | 97.44% | 93.13% | 97.80% | -14.86% | 92.40% | 110.13% | 77.41% | 215.35% | -46.74% | 222.94% | 73.31% | 154.43% | 251.04% | -159.05% | 38.96% | 113.18% | 100.39% | 136.97% | 58.13% | 43.39% | 78.83% | 43.47% | 11.87% | 101.25% | 101.34% | 86.22% | 139.49% | -14.56% | 132.95% | -57.95% | 110.52% | 80.18% | 162.31% |

| Income Tax Expense | 0.00 | 17.01M | 3.52M | 3.72M | 3.74M | -239.88K | -2.24M | 5.45M | 817.52K | -12.68M | 13.65M | -14.85M | 1.59M | -7.24M | -17.26M | 24.64M | 4.59M | -2.58M | -1.38M | -5.26M | 2.56M | 4.87M | 1.16M | 5.72M | 9.61M | -1.73M | -1.72M | 370.00K | -6.84M | 13.86M | -6.26M | 5.13M | -2.68M | 1.48M | -9.52M |

| Net Income | 2.92M | -34.14M | 5.21M | 1.75M | 7.94M | -35.65K | 2.07M | 5.45M | 3.80M | 10.52M | -2.39M | 27.00M | 2.42M | 15.61M | 30.54M | -32.64M | -2.65M | 8.16M | 6.49M | 12.41M | 550.00K | -2.41M | 3.68M | -2.99M | -8.86M | 8.21M | 8.53M | 5.45M | 16.20M | -14.84M | 15.62M | -6.15M | 10.35M | 3.98M | 20.33M |

| Net Income Ratio | 64.76% | 200.69% | 97.44% | 93.13% | 97.80% | -14.86% | 92.40% | 110.72% | 77.41% | 215.35% | -46.74% | 495.41% | 44.24% | 288.01% | 577.32% | -648.91% | -53.21% | 165.52% | 127.50% | 237.74% | 10.28% | -42.50% | 59.93% | -47.61% | -140.19% | 128.28% | 126.93% | 80.74% | 241.43% | -220.51% | 221.88% | -349.43% | 149.14% | 58.44% | 305.26% |

| EPS | 0.29 | -3.40 | 0.52 | 0.19 | 0.90 | 0.00 | 0.26 | 1.01 | 0.46 | 1.27 | -0.29 | 3.27 | 0.29 | 1.90 | 3.73 | -4.01 | -0.33 | 1.01 | 0.80 | 1.53 | 0.07 | -0.30 | 0.46 | -0.37 | -1.11 | 1.04 | 1.09 | 0.70 | 2.10 | -1.95 | 2.06 | -0.82 | 1.39 | 0.54 | 2.77 |

| EPS Diluted | 0.29 | -3.40 | 0.52 | 0.19 | 0.90 | 0.00 | 0.26 | 8.36M | 0.46 | 1.27 | -0.29 | 3.27 | 0.29 | 1.90 | 3.73 | -4.01 | -0.33 | 1.01 | 0.80 | 1.53 | 0.07 | -0.30 | 0.46 | -0.37 | -1.11 | 1.04 | 1.09 | 0.70 | 2.10 | -1.95 | 2.06 | -0.82 | 1.39 | 0.54 | 2.77 |

| Weighted Avg Shares Out | 10.05M | 10.05M | 10.04M | 9.20M | 8.82M | 8.74M | 7.96M | 5.42M | 8.30M | 8.29M | 8.28M | 8.26M | 8.23M | 8.21M | 8.18M | 8.14M | 8.12M | 8.11M | 8.11M | 8.11M | 8.11M | 8.09M | 8.07M | 8.01M | 7.97M | 7.92M | 7.85M | 7.80M | 7.72M | 7.61M | 7.59M | 7.53M | 7.43M | 7.37M | 7.33M |

| Weighted Avg Shares Out (Dil) | 10.05M | 10.05M | 10.04M | 9.20M | 8.82M | 8.74M | 7.96M | 0.65 | 8.30M | 8.29M | 8.28M | 8.26M | 8.23M | 8.21M | 8.18M | 8.14M | 8.12M | 8.11M | 8.11M | 8.11M | 8.11M | 8.09M | 8.07M | 8.01M | 7.97M | 7.92M | 7.85M | 7.80M | 7.72M | 7.61M | 7.59M | 7.53M | 7.43M | 7.37M | 7.33M |

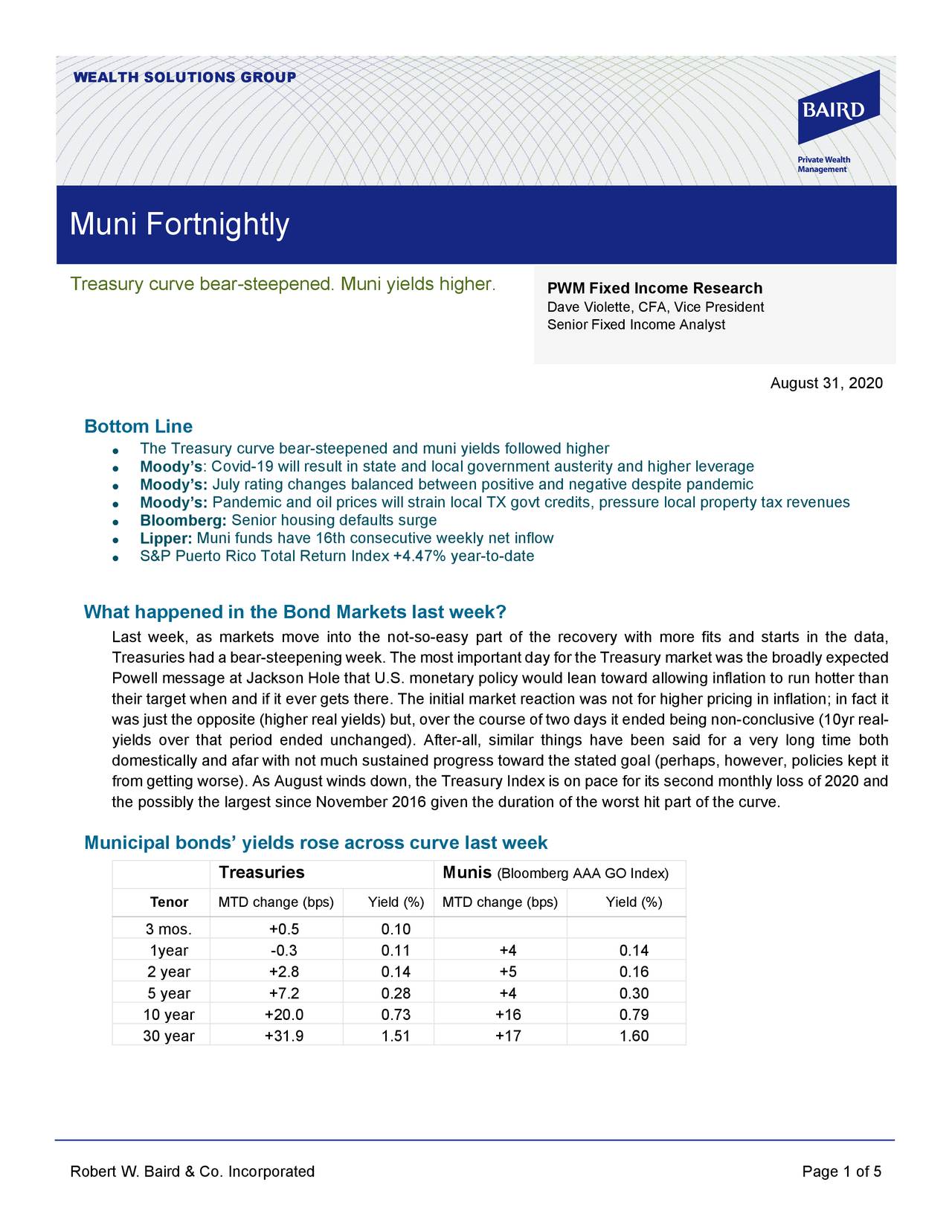

Treasury Curve Bear-Steepened; Muni Yields Higher - Muni Fortnightly, August 31, 2020

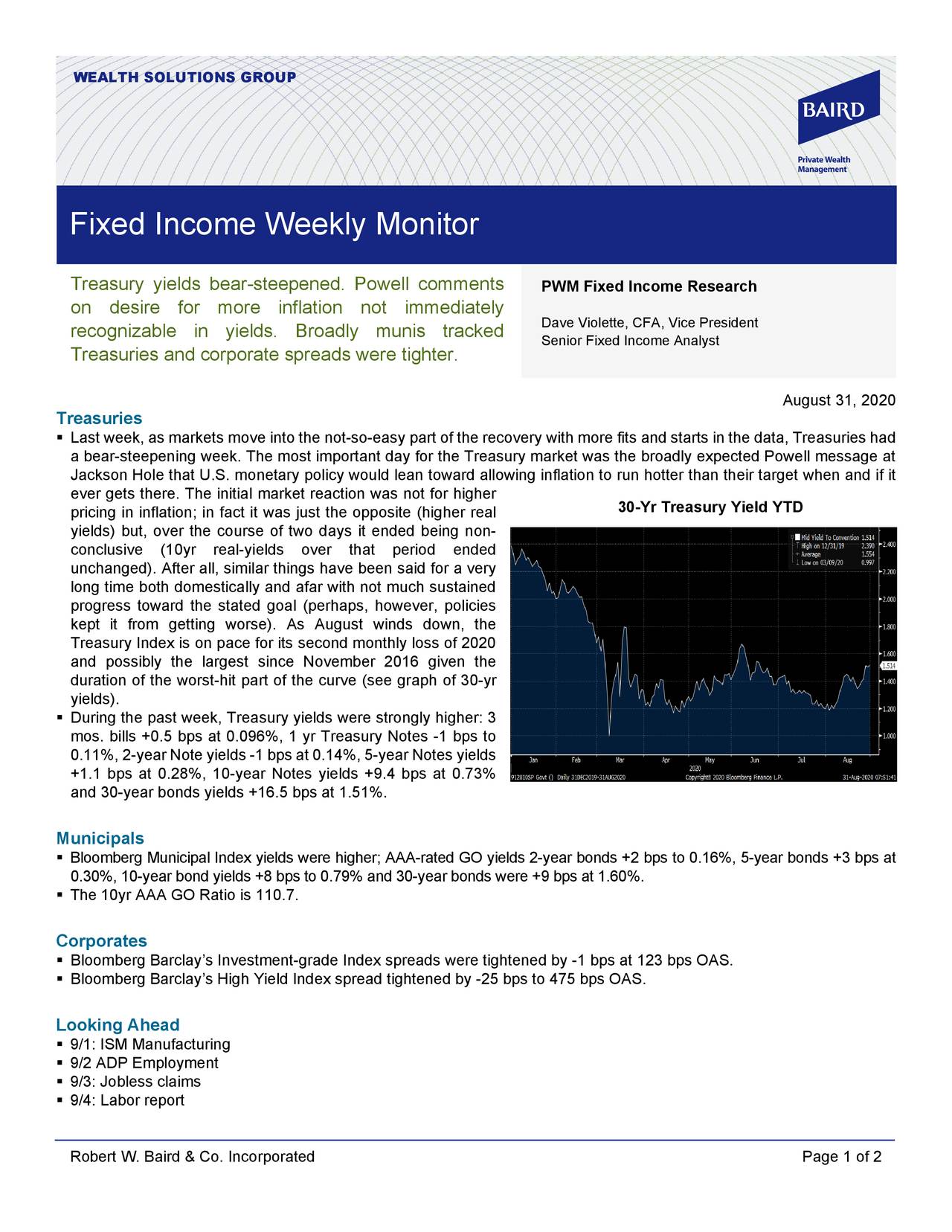

Treasuries Had A Bear-Steepening Week: Fixed Income Weekly Monitor, August 31, 2020

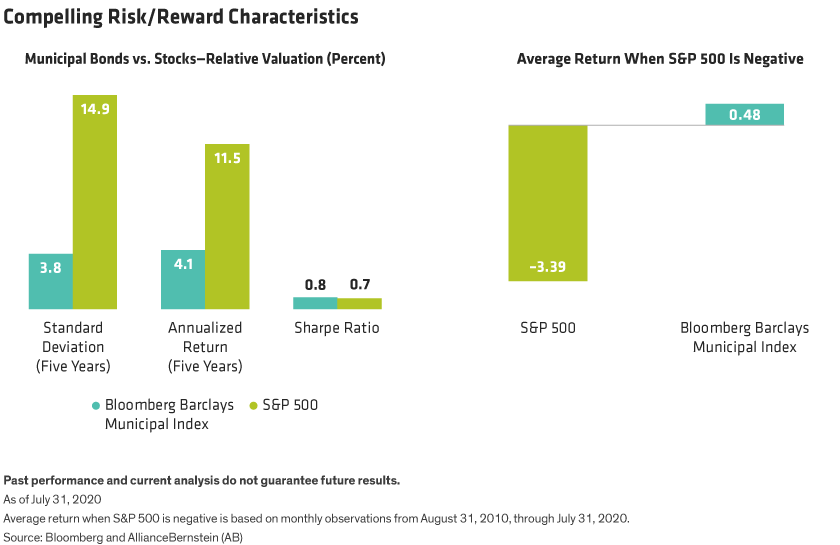

Rule #1 For Bonds: Don't Lose Money

For Muni Investors, COVID-19 Provides Lessons In Liquidity

Small Ways Muni Investors Can Make A Big Difference

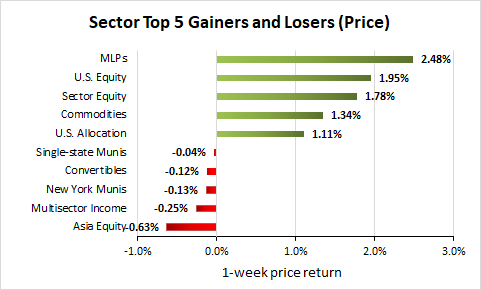

Weekly Closed-End Fund Roundup: July 19, 2020

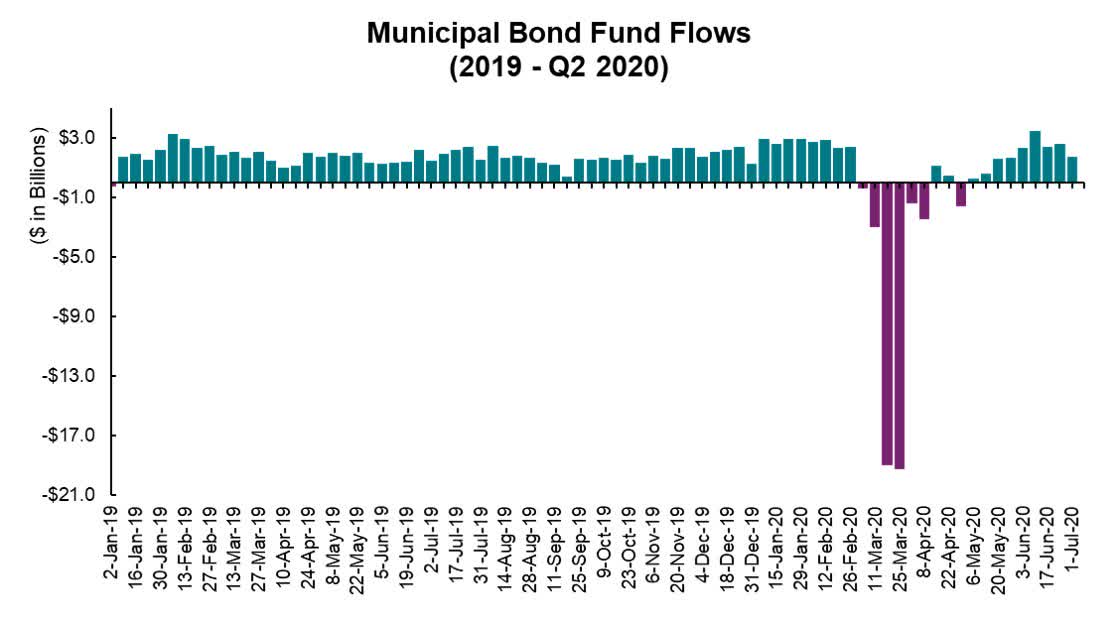

What Happened In The Bond Markets Last Week? Muni Fortnightly, July 20, 2020

2020 Muni Market Midyear Update

Nuveen Municipal Income Fund Inc. (NYSE:NMI) Declares $0.03 Monthly Dividend

Heroes And Villains

Source: https://incomestatements.info

Category: Stock Reports