See more : transcosmos inc. (9715.T) Income Statement Analysis – Financial Results

Complete financial analysis of Nuveen Municipal Income Fund, Inc. (NMI) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Nuveen Municipal Income Fund, Inc., a leading company in the Asset Management – Income industry within the Financial Services sector.

- Emira Property Fund Limited (EMI.JO) Income Statement Analysis – Financial Results

- Zhejiang Shengda Bio-Pharm Co., Ltd. (603079.SS) Income Statement Analysis – Financial Results

- Adroit Infotech Limited (ADROITINFO.BO) Income Statement Analysis – Financial Results

- Bus Online Co., Ltd. (002188.SZ) Income Statement Analysis – Financial Results

- Highlight Tech Corp. (6208.TWO) Income Statement Analysis – Financial Results

Nuveen Municipal Income Fund, Inc. (NMI)

Industry: Asset Management - Income

Sector: Financial Services

Website: https://www.nuveen.com/CEF/Product/Overview.aspx?FundCode=NMI&refsrc=vu_nuveen.com/nmi

About Nuveen Municipal Income Fund, Inc.

Nuveen Municipal Income Fund, Inc. is a closed ended fixed income mutual fund launched by Nuveen Investments Inc. The fund is co-managed by Nuveen Fund Advisors LLC and Nuveen Asset Management, LLC. It invests in the fixed income markets of the United States. The fund primarily invests in municipal obligations issued by state and local government authorities. Its investment portfolio comprises investment in companies operating in various industries, including healthcare, materials, education and civic organizations, and consumer staples. Nuveen Municipal Income Fund was formed on April 20, 1988 and is based in the United States.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 4.50M | -17.01M | 5.35M | 1.88M | 8.11M | 239.88K | 2.24M | 4.92M | 4.91M | 4.89M | 5.12M | 5.45M | 5.47M | 5.42M | 5.29M | 5.03M | 4.98M | 4.93M | 5.09M | 5.22M | 5.35M | 5.67M | 6.14M | 6.28M | 6.32M | 6.40M | 6.72M | 6.75M | 6.71M | 6.73M | 7.04M | 1.76M | 6.94M | 6.81M | 6.66M |

| Cost of Revenue | 0.00 | 685.92K | 719.56K | 676.52K | 680.56K | 675.09K | 634.04K | 653.64K | 630.94K | 610.00K | 630.00K | 630.00K | 590.00K | 610.00K | 550.00K | 580.00K | 610.00K | 610.00K | 620.00K | 610.00K | 620.00K | 640.00K | 650.00K | 650.00K | 690.00K | 690.00K | 680.00K | 680.00K | 680.00K | 680.00K | 700.00K | 170.00K | 510.00K | 510.00K | 490.00K |

| Gross Profit | 4.50M | -17.70M | 4.63M | 1.20M | 7.43M | -435.21K | 1.61M | 4.27M | 4.28M | 4.28M | 4.49M | 4.82M | 4.88M | 4.81M | 4.74M | 4.45M | 4.37M | 4.32M | 4.47M | 4.61M | 4.73M | 5.03M | 5.49M | 5.63M | 5.63M | 5.71M | 6.04M | 6.07M | 6.03M | 6.05M | 6.34M | 1.59M | 6.43M | 6.30M | 6.17M |

| Gross Profit Ratio | 100.00% | 104.03% | 86.55% | 63.98% | 91.61% | -181.43% | 71.71% | 86.71% | 87.15% | 87.52% | 87.70% | 88.44% | 89.21% | 88.75% | 89.60% | 88.47% | 87.75% | 87.63% | 87.82% | 88.31% | 88.41% | 88.71% | 89.41% | 89.65% | 89.08% | 89.22% | 89.88% | 89.93% | 89.87% | 89.90% | 90.06% | 90.34% | 92.65% | 92.51% | 92.64% |

| Research & Development | 0.00 | 18.11 | 1.15 | 0.41 | 1.65 | -0.01 | 0.42 | 1.10 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 721.03K | 111.32K | 129.43K | 122.08K | 170.85K | 267.61K | 159.42K | 710.54K | 692.62K | 695.90K | 678.20K | 90.00K | 60.00K | 50.00K | 80.00K | 150.00K | 150.00K | 50.00K | 60.00K | 90.00K | 330.00K | 140.00K | 80.00K | 50.00K | 80.00K | 60.00K | 80.00K | 50.00K | 60.00K | 70.00K | 70.00K | 30.00K | 60.00K | 80.00K | 100.00K |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -710.54K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 721.03K | 111.32K | 129.43K | 122.08K | 170.85K | 267.61K | 159.42K | 1.10 | 692.62K | 695.90K | 678.20K | 90.00K | 60.00K | 50.00K | 80.00K | 150.00K | 150.00K | 50.00K | 60.00K | 90.00K | 330.00K | 140.00K | 80.00K | 50.00K | 80.00K | 60.00K | 80.00K | 50.00K | 60.00K | 70.00K | 70.00K | 30.00K | 60.00K | 80.00K | 100.00K |

| Other Expenses | 0.00 | 6.35K | 7.56K | 6.91K | 7.33K | 7.92K | 10.84K | 8.31M | 11.16K | 10.00K | 10.00K | 0.00 | 10.00K | 0.00 | 10.00K | -10.00K | -20.00K | -20.00K | 0.00 | 0.00 | 10.00K | 0.00 | 0.00 | 0.00 | 0.00 | 30.00K | 10.00K | 10.00K | 30.00K | 30.00K | 40.00K | 10.00K | 30.00K | 30.00K | 20.00K |

| Operating Expenses | 721.03K | 117.67K | 136.98K | 128.99K | 178.18K | 275.53K | 170.26K | 506.85K | 1.10M | 5.64M | 7.50M | 90.00K | 70.00K | 50.00K | 90.00K | 140.00K | 130.00K | 30.00K | 60.00K | 90.00K | 340.00K | 140.00K | 80.00K | 50.00K | 80.00K | 90.00K | 90.00K | 60.00K | 90.00K | 100.00K | 110.00K | 40.00K | 90.00K | 110.00K | 120.00K |

| Cost & Expenses | 721.03K | 117.67K | 136.98K | 128.99K | 178.18K | 275.53K | 170.26K | 4.27M | 1.10M | 5.64M | 7.50M | 720.00K | 660.00K | 660.00K | 640.00K | 720.00K | 740.00K | 640.00K | 680.00K | 700.00K | 960.00K | 780.00K | 730.00K | 700.00K | 770.00K | 780.00K | 770.00K | 740.00K | 770.00K | 780.00K | 810.00K | 210.00K | 600.00K | 620.00K | 610.00K |

| Interest Income | 4.50M | 338.00 | 87.00 | 0.00 | 0.00 | 0.00 | 0.00 | 28.93K | 7.93K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | ||

| Interest Expense | 761.00 | 338.00 | 87.00 | 0.00 | 0.00 | 0.00 | 0.00 | 28.93K | 6.34M | 7.43M | 0.00 | 3.62M | 8.63M | 0.00 | 0.00 | 1.29M | 690.00K | 2.63M | -1.28M | -2.43M | -580.00K | -2.86M | -4.81M | 870.00K | 860.00K | -180.00K | 3.42M | -6.93M | 3.13M | -2.56M | 1.34M | -740.00K | 4.76M | ||

| Depreciation & Amortization | -3.78M | -3.44M | -3.52M | -3.72M | -3.74M | -3.75M | -4.02M | -4.23M | -4.22M | -4.19M | -4.44M | 14.85M | -1.59M | 7.24M | 17.26M | -24.64M | -4.59M | 2.58M | 1.38M | 5.26M | -2.56M | -4.87M | -1.16M | -5.72M | -9.61M | 1.73M | 1.72M | -370.00K | 6.84M | -13.86M | 6.26M | -5.13M | 2.68M | -1.48M | 9.52M |

| EBITDA | 0.00 | -17.13M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -408.76K | 6.33M | -2.38M | 19.58M | 3.22M | 11.99M | 21.91M | -20.32M | -350.00K | 6.87M | 5.80M | 9.78M | 1.83M | 30.00K | 4.26M | -130.00K | -4.06M | 7.35M | 7.67M | 5.64M | 12.78M | -7.91M | 12.49M | -3.58M | 9.01M | 4.72M | 15.57M |

| EBITDA Ratio | 0.00% | 100.69% | 97.44% | 93.13% | 97.80% | -14.86% | 92.40% | -10.72% | -8.49% | 129.59% | -133.49% | 359.27% | 58.87% | 221.22% | 414.18% | -403.98% | -7.03% | 139.35% | 113.95% | 187.36% | 34.21% | 0.53% | 69.38% | -2.07% | -64.24% | 114.84% | 114.14% | 83.56% | 190.46% | -117.53% | 177.41% | -203.41% | 129.83% | 69.31% | 233.78% |

| Operating Income | 3.78M | -117.67K | 5.21M | 1.75M | 7.94M | -275.53K | -170.26K | 4.23M | 4.22M | 4.19M | 4.44M | 4.73M | 4.81M | 4.75M | 4.65M | 4.32M | 4.24M | 4.29M | 4.42M | 4.52M | 4.39M | 4.90M | 5.42M | 5.59M | 5.55M | 5.62M | 5.95M | 6.01M | 5.94M | 5.95M | 6.23M | 1.55M | 6.33M | 6.20M | 6.05M |

| Operating Income Ratio | 83.99% | 0.69% | 97.44% | 93.13% | 97.80% | -114.86% | -7.60% | 85.97% | 85.89% | 85.76% | 86.75% | 86.79% | 87.93% | 87.64% | 87.90% | 85.88% | 85.14% | 87.02% | 86.84% | 86.59% | 82.06% | 86.42% | 88.27% | 89.01% | 87.82% | 87.81% | 88.54% | 89.04% | 88.52% | 88.41% | 88.49% | 88.07% | 91.21% | 91.04% | 90.84% |

| Total Other Income/Expenses | -866.12K | 685.92K | 1.70M | -1.97M | 4.20M | 675.09K | -1.95M | 1.19M | -416.69K | 6.33M | -6.84M | 7.42M | -800.00K | 3.62M | 8.63M | -12.32M | -2.30M | 1.29M | 690.00K | 2.63M | -1.28M | -2.44M | -580.00K | -2.86M | -4.80M | 860.00K | 860.00K | -190.00K | 3.42M | -6.93M | 3.13M | -2.57M | 1.34M | -740.00K | 4.76M |

| Income Before Tax | 2.92M | -17.13M | 5.21M | 1.75M | 7.94M | -35.65K | 2.07M | 5.42M | 3.80M | 10.52M | -2.39M | 12.15M | 4.01M | 8.37M | 13.28M | -8.00M | 1.94M | 5.58M | 5.11M | 7.15M | 3.11M | 2.46M | 4.84M | 2.73M | 750.00K | 6.48M | 6.81M | 5.82M | 9.36M | -980.00K | 9.36M | -1.02M | 7.67M | 5.46M | 10.81M |

| Income Before Tax Ratio | 64.76% | 100.69% | 97.44% | 93.13% | 97.80% | -14.86% | 92.40% | 110.13% | 77.41% | 215.35% | -46.74% | 222.94% | 73.31% | 154.43% | 251.04% | -159.05% | 38.96% | 113.18% | 100.39% | 136.97% | 58.13% | 43.39% | 78.83% | 43.47% | 11.87% | 101.25% | 101.34% | 86.22% | 139.49% | -14.56% | 132.95% | -57.95% | 110.52% | 80.18% | 162.31% |

| Income Tax Expense | 0.00 | 17.01M | 3.52M | 3.72M | 3.74M | -239.88K | -2.24M | 5.45M | 817.52K | -12.68M | 13.65M | -14.85M | 1.59M | -7.24M | -17.26M | 24.64M | 4.59M | -2.58M | -1.38M | -5.26M | 2.56M | 4.87M | 1.16M | 5.72M | 9.61M | -1.73M | -1.72M | 370.00K | -6.84M | 13.86M | -6.26M | 5.13M | -2.68M | 1.48M | -9.52M |

| Net Income | 2.92M | -34.14M | 5.21M | 1.75M | 7.94M | -35.65K | 2.07M | 5.45M | 3.80M | 10.52M | -2.39M | 27.00M | 2.42M | 15.61M | 30.54M | -32.64M | -2.65M | 8.16M | 6.49M | 12.41M | 550.00K | -2.41M | 3.68M | -2.99M | -8.86M | 8.21M | 8.53M | 5.45M | 16.20M | -14.84M | 15.62M | -6.15M | 10.35M | 3.98M | 20.33M |

| Net Income Ratio | 64.76% | 200.69% | 97.44% | 93.13% | 97.80% | -14.86% | 92.40% | 110.72% | 77.41% | 215.35% | -46.74% | 495.41% | 44.24% | 288.01% | 577.32% | -648.91% | -53.21% | 165.52% | 127.50% | 237.74% | 10.28% | -42.50% | 59.93% | -47.61% | -140.19% | 128.28% | 126.93% | 80.74% | 241.43% | -220.51% | 221.88% | -349.43% | 149.14% | 58.44% | 305.26% |

| EPS | 0.29 | -3.40 | 0.52 | 0.19 | 0.90 | 0.00 | 0.26 | 1.01 | 0.46 | 1.27 | -0.29 | 3.27 | 0.29 | 1.90 | 3.73 | -4.01 | -0.33 | 1.01 | 0.80 | 1.53 | 0.07 | -0.30 | 0.46 | -0.37 | -1.11 | 1.04 | 1.09 | 0.70 | 2.10 | -1.95 | 2.06 | -0.82 | 1.39 | 0.54 | 2.77 |

| EPS Diluted | 0.29 | -3.40 | 0.52 | 0.19 | 0.90 | 0.00 | 0.26 | 8.36M | 0.46 | 1.27 | -0.29 | 3.27 | 0.29 | 1.90 | 3.73 | -4.01 | -0.33 | 1.01 | 0.80 | 1.53 | 0.07 | -0.30 | 0.46 | -0.37 | -1.11 | 1.04 | 1.09 | 0.70 | 2.10 | -1.95 | 2.06 | -0.82 | 1.39 | 0.54 | 2.77 |

| Weighted Avg Shares Out | 10.05M | 10.05M | 10.04M | 9.20M | 8.82M | 8.74M | 7.96M | 5.42M | 8.30M | 8.29M | 8.28M | 8.26M | 8.23M | 8.21M | 8.18M | 8.14M | 8.12M | 8.11M | 8.11M | 8.11M | 8.11M | 8.09M | 8.07M | 8.01M | 7.97M | 7.92M | 7.85M | 7.80M | 7.72M | 7.61M | 7.59M | 7.53M | 7.43M | 7.37M | 7.33M |

| Weighted Avg Shares Out (Dil) | 10.05M | 10.05M | 10.04M | 9.20M | 8.82M | 8.74M | 7.96M | 0.65 | 8.30M | 8.29M | 8.28M | 8.26M | 8.23M | 8.21M | 8.18M | 8.14M | 8.12M | 8.11M | 8.11M | 8.11M | 8.11M | 8.09M | 8.07M | 8.01M | 7.97M | 7.92M | 7.85M | 7.80M | 7.72M | 7.61M | 7.59M | 7.53M | 7.43M | 7.37M | 7.33M |

The Muni Selloff That Was

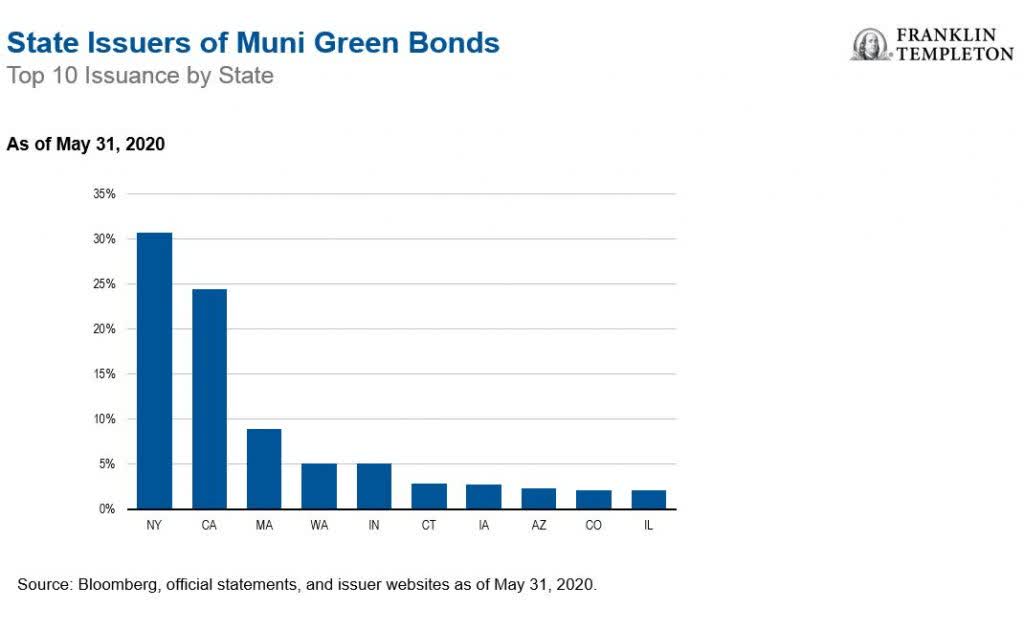

Responsible Investing In A Traditional Asset Class

The Reopening Killed The V-Shaped Recovery

The Chemist's Quality Closed-End Fund Report: June 2020

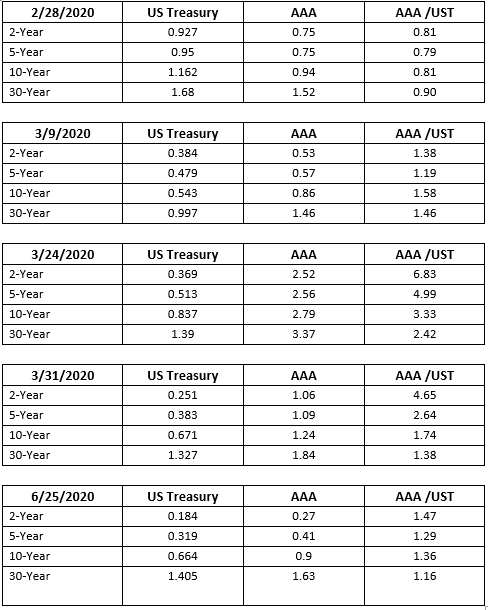

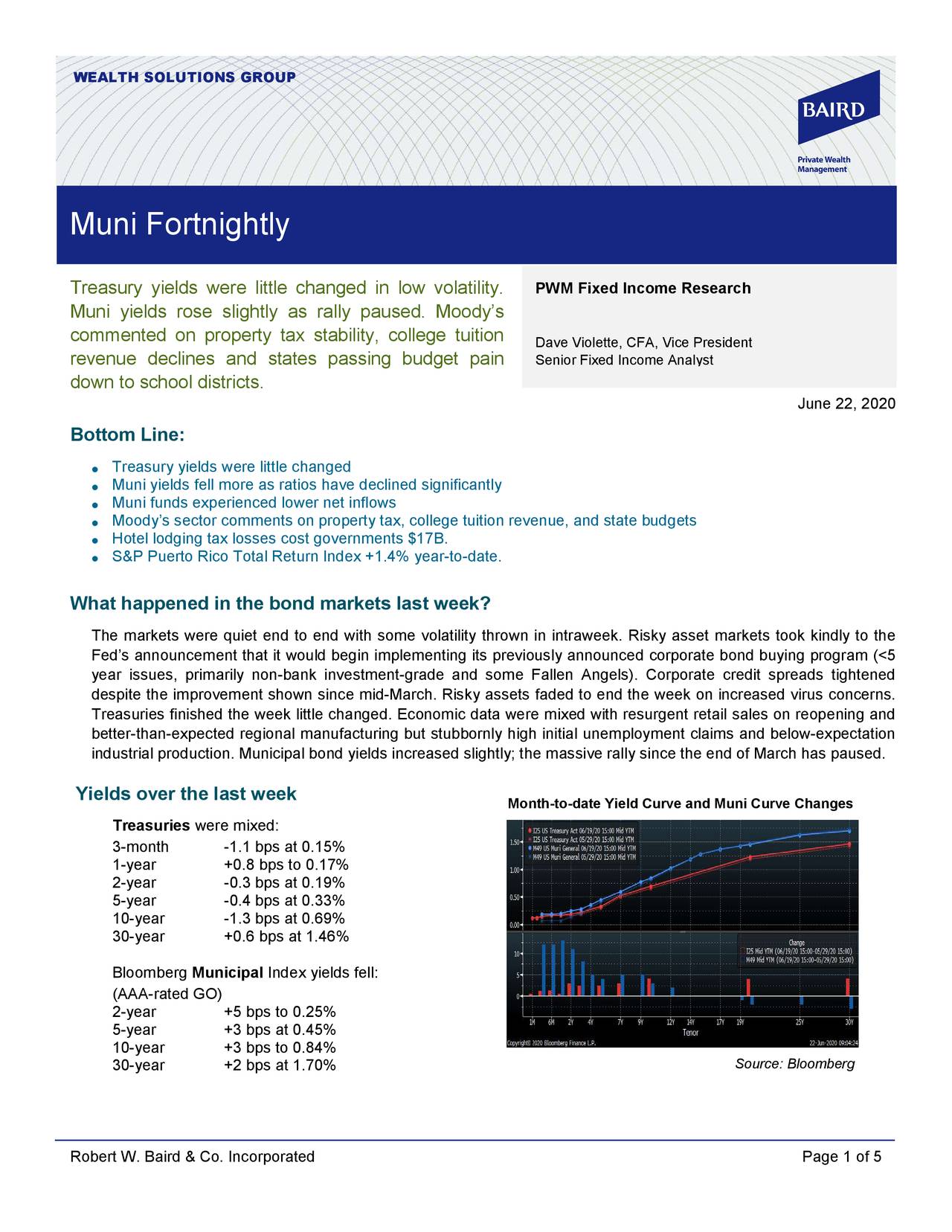

Treasury Yields Were Little Changed In Low Volatility - Muni Fortnightly, June 22, 2020

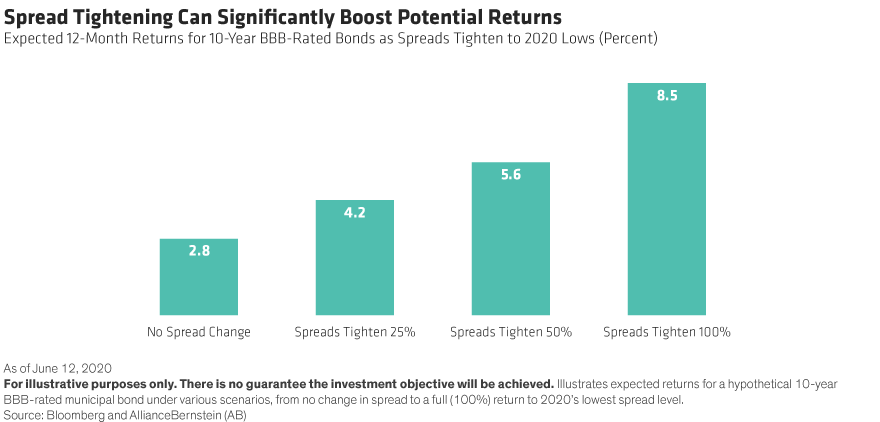

Mid-Grade Munis Have Room To Rebound

EU Offers Rwf55 Billion to Rwanda in COVID-19 Grant

Reviewing The Latest UNII/Coverage Of Blackrock And Nuveen CEFs

NMI (NMIH) Set to Announce Earnings on Wednesday

Arden Trust Co Makes New Investment in NMI Holdings Inc (NASDAQ:NMIH)

Source: https://incomestatements.info

Category: Stock Reports