See more : KPa-BM Holdings Limited (2663.HK) Income Statement Analysis – Financial Results

Complete financial analysis of NVE Corporation (NVEC) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of NVE Corporation, a leading company in the Semiconductors industry within the Technology sector.

- Harfang Exploration Inc. (HRFEF) Income Statement Analysis – Financial Results

- Big Tech 50 R&D-Limited Partnership (BIGT.TA) Income Statement Analysis – Financial Results

- Banco del Bajío, S.A., Institución de Banca Múltiple (BBAJIOO.MX) Income Statement Analysis – Financial Results

- Pan Pacific International Holdings Corporation (DQJCY) Income Statement Analysis – Financial Results

- Rapicut Carbides Limited (RAPICUT.BO) Income Statement Analysis – Financial Results

NVE Corporation (NVEC)

About NVE Corporation

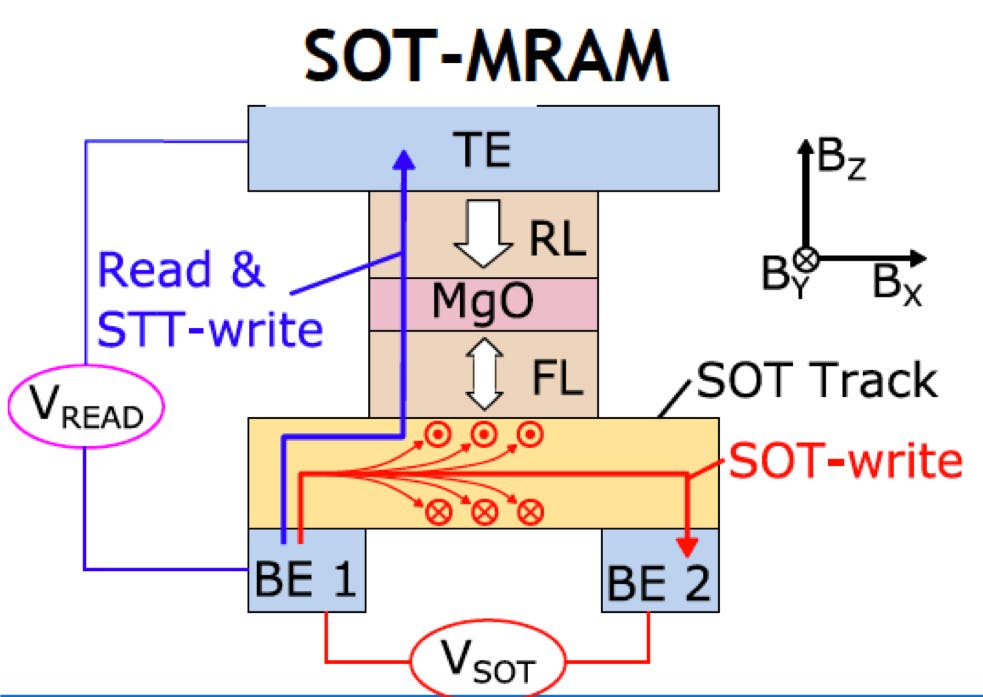

NVE Corporation develops and sells devices that use spintronics, a nanotechnology that relies on electron spin to acquire, store, and transmit information in the United States and internationally. The company manufactures spintronic products, including sensors and couplers for use in acquiring and transmitting data. Its products comprise standard sensors to detect the presence of a magnetic or metallic material to determine position or speed primarily for the factory automation market; and custom and medical sensors for medical devices to replace electromechanical magnetic switches. The company also offers spintronic couplers for industrial Internet of Things market. In addition, it undertakes contracts for research and development, and licensing of spintronic magnetoresistive random access memory technology. NVE Corporation was founded in 1989 and is headquartered in Eden Prairie, Minnesota.

| Metric | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 29.80M | 38.25M | 26.99M | 21.37M | 25.41M | 26.47M | 29.86M | 28.33M | 27.72M | 30.58M | 25.93M | 27.03M | 28.58M | 31.20M | 28.15M | 23.37M | 20.53M | 16.46M | 12.17M | 11.62M | 12.01M | 9.45M | 7.00M | 7.17M | 3.86M | 5.50M | 5.95M | 8.75M | 5.90M |

| Cost of Revenue | 6.77M | 8.06M | 6.26M | 4.12M | 4.89M | 5.22M | 6.27M | 6.08M | 6.62M | 6.02M | 5.72M | 7.03M | 9.33M | 9.78M | 8.31M | 6.72M | 6.83M | 5.79M | 6.22M | 7.01M | 7.44M | 5.91M | 5.82M | 381.94K | 176.52K | 300.00K | 3.46M | 4.62M | 3.04M |

| Gross Profit | 23.03M | 30.19M | 20.72M | 17.24M | 20.52M | 21.26M | 23.59M | 22.25M | 21.10M | 24.56M | 20.21M | 20.01M | 19.25M | 21.41M | 19.83M | 16.65M | 13.70M | 10.67M | 5.95M | 4.60M | 4.57M | 3.54M | 1.17M | 6.78M | 3.68M | 5.20M | 2.48M | 4.13M | 2.87M |

| Gross Profit Ratio | 77.28% | 78.92% | 76.79% | 80.71% | 80.76% | 80.30% | 78.99% | 78.54% | 76.13% | 80.32% | 77.94% | 74.01% | 67.37% | 68.64% | 70.47% | 71.23% | 66.71% | 64.84% | 48.90% | 39.64% | 38.02% | 37.43% | 16.77% | 94.67% | 95.42% | 94.55% | 41.77% | 47.24% | 48.56% |

| Research & Development | 2.73M | 2.58M | 2.93M | 3.18M | 3.69M | 4.11M | 3.70M | 3.34M | 3.06M | 3.00M | 3.59M | 2.57M | 2.60M | 1.27M | 1.12M | 1.22M | 1.49M | 2.18M | 1.72M | 1.39M | 1.10M | 1.31M | 1.58M | 5.05M | 0.00 | 1.90M | 1.78M | 7.25M | 303.00K |

| General & Administrative | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1.22M | 1.44M | 1.46M | 1.75M | 2.31M | 2.24M | 2.24M | 2.38M | 2.47M | 2.41M | 2.18M | 2.16M | 1.95M | 1.76M | 1.87M | 1.83M | 1.84M | 1.81M | 1.37M | 434.46K | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 1.78M | 1.96M | 1.47M | 1.32M | 1.32M | 1.22M | 1.44M | 1.46M | 1.75M | 2.31M | 2.24M | 2.24M | 2.38M | 2.47M | 2.41M | 2.18M | 2.16M | 1.95M | 1.76M | 1.87M | 1.83M | 1.84M | 1.81M | 1.37M | 434.46K | 2.10M | 3.15M | 2.79M | 1.20M |

| Other Expenses | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 300.00K | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 4.51M | 4.55M | 4.40M | 4.50M | 5.01M | 5.33M | 5.14M | 4.80M | 4.81M | 5.31M | 5.82M | 4.81M | 4.98M | 3.74M | 3.54M | 3.40M | 3.65M | 4.13M | 3.48M | 3.26M | 2.93M | 3.15M | 3.39M | 6.42M | 434.46K | 4.30M | 4.93M | 10.03M | 1.51M |

| Cost & Expenses | 11.29M | 12.61M | 10.66M | 8.62M | 9.90M | 10.55M | 11.41M | 10.88M | 11.43M | 11.33M | 11.54M | 11.84M | 14.31M | 13.53M | 11.85M | 10.12M | 10.48M | 9.92M | 9.70M | 10.27M | 10.38M | 9.06M | 9.21M | 6.80M | 610.98K | 4.60M | 8.39M | 14.65M | 4.54M |

| Interest Income | 1.95M | 1.45M | 1.17M | 1.50M | 1.79M | 1.79M | 1.56M | 1.65M | 1.89M | 2.19M | 2.12M | 2.36M | 2.35M | 2.02M | 1.62M | 1.17M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 0.00 | 0.00 | 1.17M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 646.85K | 0.00 | 0.00 | 0.00 | 1.10M | 0.00 | 0.00 | 4.14K |

| Depreciation & Amortization | 308.15K | 257.61K | 424.98K | 542.93K | 549.97K | 705.20K | 979.65K | 1.15M | 850.97K | 934.37K | 844.34K | 647.16K | 500.12K | 411.55K | 389.27K | 473.74K | 560.53K | 530.05K | 569.89K | 573.44K | 524.73K | 511.05K | 332.29K | 256.28K | 1.69M | 300.00K | 342.17K | 206.03K | 101.98K |

| EBITDA | 18.83M | 25.64M | 16.75M | 13.29M | 16.06M | 16.63M | 19.43M | 18.59M | 17.14M | 20.19M | 15.24M | 15.84M | 14.77M | 18.08M | 16.69M | 14.90M | 10.61M | 7.08M | 3.04M | 1.92M | 1.63M | 901.48K | -1.89M | 623.31K | 3.25M | 1.20M | -2.10M | -5.69M | 1.46M |

| EBITDA Ratio | 63.17% | 67.04% | 60.51% | 59.64% | 61.05% | 60.16% | 65.06% | 65.64% | 61.83% | 66.00% | 58.76% | 58.61% | 51.69% | 57.96% | 59.29% | 63.76% | 51.41% | 42.83% | 24.63% | 16.04% | 17.28% | 8.63% | -29.28% | 8.73% | 43.62% | 43.64% | -35.76% | -65.44% | 24.75% |

| Operating Income | 18.52M | 25.64M | 16.33M | 12.74M | 15.51M | 15.92M | 18.45M | 17.45M | 16.29M | 19.25M | 14.39M | 15.20M | 14.27M | 17.67M | 16.30M | 13.25M | 10.05M | 6.55M | 2.47M | 1.34M | 1.63M | 390.43K | -2.22M | 110.76K | 3.25M | 900.00K | -2.44M | -5.90M | 1.36M |

| Operating Income Ratio | 62.14% | 67.04% | 60.51% | 59.64% | 61.05% | 60.16% | 61.78% | 61.59% | 58.76% | 62.95% | 55.50% | 56.22% | 49.94% | 56.64% | 57.90% | 56.70% | 48.95% | 39.76% | 20.30% | 11.57% | 13.58% | 4.13% | -31.70% | 1.55% | 84.16% | 16.36% | -41.07% | -67.43% | 23.02% |

| Total Other Income/Expenses | 1.95M | 1.45M | 1.17M | 1.50M | 1.79M | 1.79M | 1.56M | 1.65M | 1.89M | 2.19M | 2.12M | 2.36M | 2.35M | 2.02M | 1.62M | 1.18M | 1.03M | 646.23K | 369.75K | 276.07K | 243.36K | 86.17K | 162.76K | 16.50K | 1.69M | -1.10M | 99.34K | 57.04K | -4.14K |

| Income Before Tax | 20.47M | 27.09M | 17.50M | 14.24M | 17.30M | 17.71M | 20.01M | 19.10M | 18.18M | 21.44M | 16.52M | 17.56M | 16.62M | 19.69M | 17.92M | 14.43M | 11.08M | 7.19M | 2.84M | 1.62M | 1.87M | 646.85K | -2.10M | 127.26K | 4.94M | -200.00K | -2.34M | -5.84M | 1.35M |

| Income Before Tax Ratio | 68.67% | 70.82% | 64.85% | 66.66% | 68.09% | 66.90% | 67.00% | 67.41% | 65.58% | 70.10% | 63.68% | 64.94% | 58.17% | 63.12% | 63.65% | 61.73% | 53.97% | 43.69% | 23.34% | 13.95% | 15.61% | 6.85% | -30.03% | 1.78% | 128.06% | -3.64% | -39.40% | -66.77% | 22.95% |

| Income Tax Expense | 3.34M | 4.40M | 2.99M | 2.55M | 2.78M | 3.20M | 6.10M | 6.15M | 5.88M | 7.07M | 5.38M | 5.73M | 5.24M | 6.33M | 5.92M | 4.64M | 3.89M | 2.41M | 1.04M | -138.40K | -233.02K | -646.85K | 2.10M | -16.50K | 244.33K | -500.00K | 83.90K | 318.78K | 527.00K |

| Net Income | 17.12M | 22.69M | 14.51M | 11.69M | 14.53M | 14.51M | 13.91M | 12.95M | 12.29M | 14.37M | 11.14M | 11.83M | 11.38M | 13.36M | 12.00M | 9.78M | 7.19M | 4.78M | 1.80M | 1.76M | 2.11M | 646.85K | -2.10M | 127.26K | 4.70M | 300.00K | -2.43M | -6.16M | 827.63K |

| Net Income Ratio | 57.46% | 59.33% | 53.76% | 54.73% | 57.16% | 54.80% | 46.59% | 45.71% | 44.35% | 46.98% | 42.94% | 43.76% | 39.82% | 42.83% | 42.63% | 41.86% | 35.01% | 29.04% | 14.77% | 15.14% | 17.55% | 6.85% | -30.03% | 1.78% | 121.73% | 5.45% | -40.81% | -70.42% | 14.02% |

| EPS | 3.54 | 4.70 | 3.00 | 2.42 | 3.00 | 3.00 | 2.87 | 2.68 | 2.53 | 2.96 | 2.30 | 2.44 | 2.37 | 2.83 | 2.56 | 2.10 | 1.55 | 1.03 | 0.39 | 0.39 | 0.49 | 0.16 | -0.61 | 0.05 | 23.00 | 1.50 | -12.86 | -41.73 | 7.00 |

| EPS Diluted | 3.54 | 4.70 | 3.00 | 2.42 | 3.00 | 2.99 | 2.87 | 2.68 | 2.53 | 2.95 | 2.29 | 2.43 | 2.34 | 2.76 | 2.47 | 2.04 | 1.51 | 1.00 | 0.39 | 0.37 | 0.45 | 0.15 | -0.61 | 0.04 | 23.00 | 1.50 | -12.86 | -41.73 | 7.00 |

| Weighted Avg Shares Out | 4.83M | 4.83M | 4.83M | 4.83M | 4.85M | 4.84M | 4.84M | 4.84M | 4.85M | 4.86M | 4.85M | 4.84M | 4.80M | 4.73M | 4.69M | 4.66M | 4.64M | 4.62M | 4.58M | 4.51M | 4.30M | 4.13M | 3.42M | 3.37M | 203.98K | 194.17K | 188.68K | 147.66K | 117.02K |

| Weighted Avg Shares Out (Dil) | 4.84M | 4.83M | 4.84M | 4.83M | 4.85M | 4.85M | 4.85M | 4.84M | 4.85M | 4.87M | 4.87M | 4.86M | 4.86M | 4.84M | 4.86M | 4.79M | 4.76M | 4.77M | 4.67M | 4.73M | 4.73M | 4.32M | 3.42M | 3.54M | 203.98K | 197.10K | 188.68K | 147.66K | 117.02K |

Squarepoint Ops LLC Sells 9,025 Shares of NVE Corp (NASDAQ:NVEC)

La polémica fiebre eólica con la que Noruega quiere dar portazo a su pasado petrolífero

Inside Action Park: Founder’s son explores thrills, spills and legacy.

IEEE Events Reveal Future Memory And Storage

Norway to slow down onshore wind power developments

NIA arrests 2 for theft of computer hardware from aircraft carrier in Kochi; Recovers some stolen devices

WINTON GROUP Ltd Sells 8,046 Shares of Everspin Technologies Inc (NASDAQ:MRAM)

Everspin Technologies Appoints Daniel Berenbaum as Chief Financial Officer

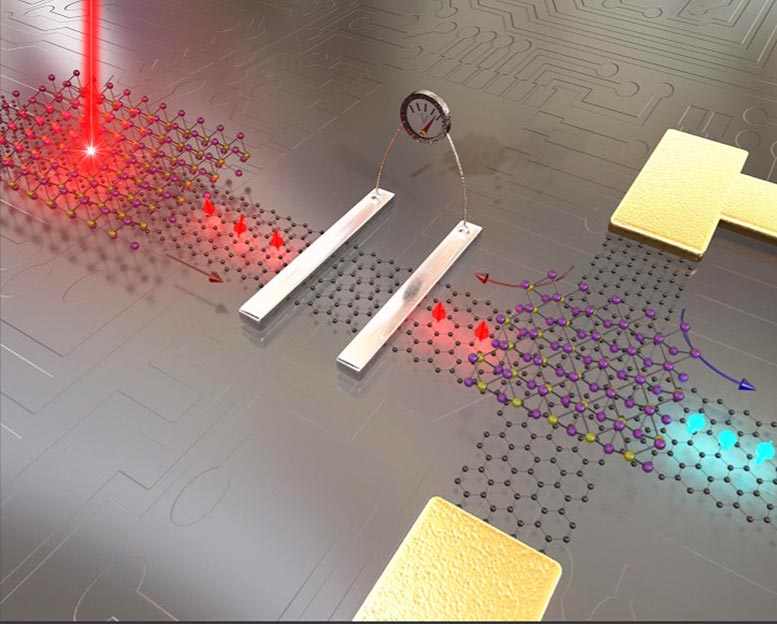

Progressing Electronics Beyond Moore’s Law With Graphene and 2D Materials

Global Toggle-MRAM Market 2020: Growth Rate, Production Volume and Future Opportunities From 2025

Source: https://incomestatements.info

Category: Stock Reports