See more : Pacific Empire Minerals Corp. (PEMSF) Income Statement Analysis – Financial Results

Complete financial analysis of NVE Corporation (NVEC) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of NVE Corporation, a leading company in the Semiconductors industry within the Technology sector.

- PT Pratama Widya Tbk (PTPW.JK) Income Statement Analysis – Financial Results

- Play Magnus AS (PMGMF) Income Statement Analysis – Financial Results

- Longport, Inc. (LPTI) Income Statement Analysis – Financial Results

- Asset World Corp Public Company Limited (AWC-R.BK) Income Statement Analysis – Financial Results

- Health Advance Inc. (HADV) Income Statement Analysis – Financial Results

NVE Corporation (NVEC)

About NVE Corporation

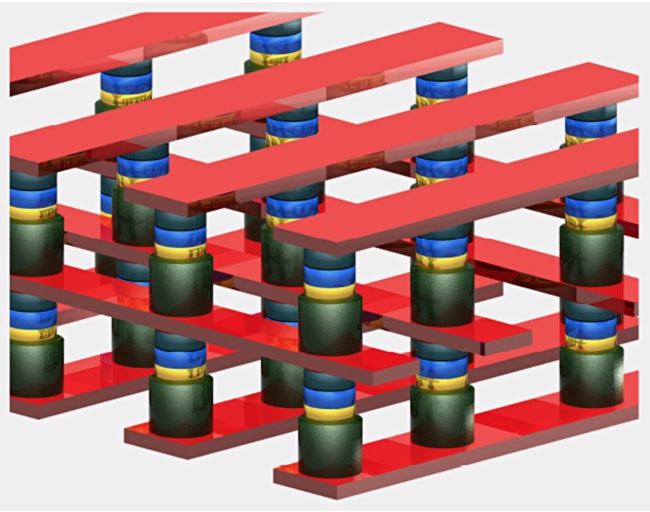

NVE Corporation develops and sells devices that use spintronics, a nanotechnology that relies on electron spin to acquire, store, and transmit information in the United States and internationally. The company manufactures spintronic products, including sensors and couplers for use in acquiring and transmitting data. Its products comprise standard sensors to detect the presence of a magnetic or metallic material to determine position or speed primarily for the factory automation market; and custom and medical sensors for medical devices to replace electromechanical magnetic switches. The company also offers spintronic couplers for industrial Internet of Things market. In addition, it undertakes contracts for research and development, and licensing of spintronic magnetoresistive random access memory technology. NVE Corporation was founded in 1989 and is headquartered in Eden Prairie, Minnesota.

| Metric | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 29.80M | 38.25M | 26.99M | 21.37M | 25.41M | 26.47M | 29.86M | 28.33M | 27.72M | 30.58M | 25.93M | 27.03M | 28.58M | 31.20M | 28.15M | 23.37M | 20.53M | 16.46M | 12.17M | 11.62M | 12.01M | 9.45M | 7.00M | 7.17M | 3.86M | 5.50M | 5.95M | 8.75M | 5.90M |

| Cost of Revenue | 6.77M | 8.06M | 6.26M | 4.12M | 4.89M | 5.22M | 6.27M | 6.08M | 6.62M | 6.02M | 5.72M | 7.03M | 9.33M | 9.78M | 8.31M | 6.72M | 6.83M | 5.79M | 6.22M | 7.01M | 7.44M | 5.91M | 5.82M | 381.94K | 176.52K | 300.00K | 3.46M | 4.62M | 3.04M |

| Gross Profit | 23.03M | 30.19M | 20.72M | 17.24M | 20.52M | 21.26M | 23.59M | 22.25M | 21.10M | 24.56M | 20.21M | 20.01M | 19.25M | 21.41M | 19.83M | 16.65M | 13.70M | 10.67M | 5.95M | 4.60M | 4.57M | 3.54M | 1.17M | 6.78M | 3.68M | 5.20M | 2.48M | 4.13M | 2.87M |

| Gross Profit Ratio | 77.28% | 78.92% | 76.79% | 80.71% | 80.76% | 80.30% | 78.99% | 78.54% | 76.13% | 80.32% | 77.94% | 74.01% | 67.37% | 68.64% | 70.47% | 71.23% | 66.71% | 64.84% | 48.90% | 39.64% | 38.02% | 37.43% | 16.77% | 94.67% | 95.42% | 94.55% | 41.77% | 47.24% | 48.56% |

| Research & Development | 2.73M | 2.58M | 2.93M | 3.18M | 3.69M | 4.11M | 3.70M | 3.34M | 3.06M | 3.00M | 3.59M | 2.57M | 2.60M | 1.27M | 1.12M | 1.22M | 1.49M | 2.18M | 1.72M | 1.39M | 1.10M | 1.31M | 1.58M | 5.05M | 0.00 | 1.90M | 1.78M | 7.25M | 303.00K |

| General & Administrative | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1.22M | 1.44M | 1.46M | 1.75M | 2.31M | 2.24M | 2.24M | 2.38M | 2.47M | 2.41M | 2.18M | 2.16M | 1.95M | 1.76M | 1.87M | 1.83M | 1.84M | 1.81M | 1.37M | 434.46K | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 1.78M | 1.96M | 1.47M | 1.32M | 1.32M | 1.22M | 1.44M | 1.46M | 1.75M | 2.31M | 2.24M | 2.24M | 2.38M | 2.47M | 2.41M | 2.18M | 2.16M | 1.95M | 1.76M | 1.87M | 1.83M | 1.84M | 1.81M | 1.37M | 434.46K | 2.10M | 3.15M | 2.79M | 1.20M |

| Other Expenses | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 300.00K | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 4.51M | 4.55M | 4.40M | 4.50M | 5.01M | 5.33M | 5.14M | 4.80M | 4.81M | 5.31M | 5.82M | 4.81M | 4.98M | 3.74M | 3.54M | 3.40M | 3.65M | 4.13M | 3.48M | 3.26M | 2.93M | 3.15M | 3.39M | 6.42M | 434.46K | 4.30M | 4.93M | 10.03M | 1.51M |

| Cost & Expenses | 11.29M | 12.61M | 10.66M | 8.62M | 9.90M | 10.55M | 11.41M | 10.88M | 11.43M | 11.33M | 11.54M | 11.84M | 14.31M | 13.53M | 11.85M | 10.12M | 10.48M | 9.92M | 9.70M | 10.27M | 10.38M | 9.06M | 9.21M | 6.80M | 610.98K | 4.60M | 8.39M | 14.65M | 4.54M |

| Interest Income | 1.95M | 1.45M | 1.17M | 1.50M | 1.79M | 1.79M | 1.56M | 1.65M | 1.89M | 2.19M | 2.12M | 2.36M | 2.35M | 2.02M | 1.62M | 1.17M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 0.00 | 0.00 | 1.17M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 646.85K | 0.00 | 0.00 | 0.00 | 1.10M | 0.00 | 0.00 | 4.14K |

| Depreciation & Amortization | 308.15K | 257.61K | 424.98K | 542.93K | 549.97K | 705.20K | 979.65K | 1.15M | 850.97K | 934.37K | 844.34K | 647.16K | 500.12K | 411.55K | 389.27K | 473.74K | 560.53K | 530.05K | 569.89K | 573.44K | 524.73K | 511.05K | 332.29K | 256.28K | 1.69M | 300.00K | 342.17K | 206.03K | 101.98K |

| EBITDA | 18.83M | 25.64M | 16.75M | 13.29M | 16.06M | 16.63M | 19.43M | 18.59M | 17.14M | 20.19M | 15.24M | 15.84M | 14.77M | 18.08M | 16.69M | 14.90M | 10.61M | 7.08M | 3.04M | 1.92M | 1.63M | 901.48K | -1.89M | 623.31K | 3.25M | 1.20M | -2.10M | -5.69M | 1.46M |

| EBITDA Ratio | 63.17% | 67.04% | 60.51% | 59.64% | 61.05% | 60.16% | 65.06% | 65.64% | 61.83% | 66.00% | 58.76% | 58.61% | 51.69% | 57.96% | 59.29% | 63.76% | 51.41% | 42.83% | 24.63% | 16.04% | 17.28% | 8.63% | -29.28% | 8.73% | 43.62% | 43.64% | -35.76% | -65.44% | 24.75% |

| Operating Income | 18.52M | 25.64M | 16.33M | 12.74M | 15.51M | 15.92M | 18.45M | 17.45M | 16.29M | 19.25M | 14.39M | 15.20M | 14.27M | 17.67M | 16.30M | 13.25M | 10.05M | 6.55M | 2.47M | 1.34M | 1.63M | 390.43K | -2.22M | 110.76K | 3.25M | 900.00K | -2.44M | -5.90M | 1.36M |

| Operating Income Ratio | 62.14% | 67.04% | 60.51% | 59.64% | 61.05% | 60.16% | 61.78% | 61.59% | 58.76% | 62.95% | 55.50% | 56.22% | 49.94% | 56.64% | 57.90% | 56.70% | 48.95% | 39.76% | 20.30% | 11.57% | 13.58% | 4.13% | -31.70% | 1.55% | 84.16% | 16.36% | -41.07% | -67.43% | 23.02% |

| Total Other Income/Expenses | 1.95M | 1.45M | 1.17M | 1.50M | 1.79M | 1.79M | 1.56M | 1.65M | 1.89M | 2.19M | 2.12M | 2.36M | 2.35M | 2.02M | 1.62M | 1.18M | 1.03M | 646.23K | 369.75K | 276.07K | 243.36K | 86.17K | 162.76K | 16.50K | 1.69M | -1.10M | 99.34K | 57.04K | -4.14K |

| Income Before Tax | 20.47M | 27.09M | 17.50M | 14.24M | 17.30M | 17.71M | 20.01M | 19.10M | 18.18M | 21.44M | 16.52M | 17.56M | 16.62M | 19.69M | 17.92M | 14.43M | 11.08M | 7.19M | 2.84M | 1.62M | 1.87M | 646.85K | -2.10M | 127.26K | 4.94M | -200.00K | -2.34M | -5.84M | 1.35M |

| Income Before Tax Ratio | 68.67% | 70.82% | 64.85% | 66.66% | 68.09% | 66.90% | 67.00% | 67.41% | 65.58% | 70.10% | 63.68% | 64.94% | 58.17% | 63.12% | 63.65% | 61.73% | 53.97% | 43.69% | 23.34% | 13.95% | 15.61% | 6.85% | -30.03% | 1.78% | 128.06% | -3.64% | -39.40% | -66.77% | 22.95% |

| Income Tax Expense | 3.34M | 4.40M | 2.99M | 2.55M | 2.78M | 3.20M | 6.10M | 6.15M | 5.88M | 7.07M | 5.38M | 5.73M | 5.24M | 6.33M | 5.92M | 4.64M | 3.89M | 2.41M | 1.04M | -138.40K | -233.02K | -646.85K | 2.10M | -16.50K | 244.33K | -500.00K | 83.90K | 318.78K | 527.00K |

| Net Income | 17.12M | 22.69M | 14.51M | 11.69M | 14.53M | 14.51M | 13.91M | 12.95M | 12.29M | 14.37M | 11.14M | 11.83M | 11.38M | 13.36M | 12.00M | 9.78M | 7.19M | 4.78M | 1.80M | 1.76M | 2.11M | 646.85K | -2.10M | 127.26K | 4.70M | 300.00K | -2.43M | -6.16M | 827.63K |

| Net Income Ratio | 57.46% | 59.33% | 53.76% | 54.73% | 57.16% | 54.80% | 46.59% | 45.71% | 44.35% | 46.98% | 42.94% | 43.76% | 39.82% | 42.83% | 42.63% | 41.86% | 35.01% | 29.04% | 14.77% | 15.14% | 17.55% | 6.85% | -30.03% | 1.78% | 121.73% | 5.45% | -40.81% | -70.42% | 14.02% |

| EPS | 3.54 | 4.70 | 3.00 | 2.42 | 3.00 | 3.00 | 2.87 | 2.68 | 2.53 | 2.96 | 2.30 | 2.44 | 2.37 | 2.83 | 2.56 | 2.10 | 1.55 | 1.03 | 0.39 | 0.39 | 0.49 | 0.16 | -0.61 | 0.05 | 23.00 | 1.50 | -12.86 | -41.73 | 7.00 |

| EPS Diluted | 3.54 | 4.70 | 3.00 | 2.42 | 3.00 | 2.99 | 2.87 | 2.68 | 2.53 | 2.95 | 2.29 | 2.43 | 2.34 | 2.76 | 2.47 | 2.04 | 1.51 | 1.00 | 0.39 | 0.37 | 0.45 | 0.15 | -0.61 | 0.04 | 23.00 | 1.50 | -12.86 | -41.73 | 7.00 |

| Weighted Avg Shares Out | 4.83M | 4.83M | 4.83M | 4.83M | 4.85M | 4.84M | 4.84M | 4.84M | 4.85M | 4.86M | 4.85M | 4.84M | 4.80M | 4.73M | 4.69M | 4.66M | 4.64M | 4.62M | 4.58M | 4.51M | 4.30M | 4.13M | 3.42M | 3.37M | 203.98K | 194.17K | 188.68K | 147.66K | 117.02K |

| Weighted Avg Shares Out (Dil) | 4.84M | 4.83M | 4.84M | 4.83M | 4.85M | 4.85M | 4.85M | 4.84M | 4.85M | 4.87M | 4.87M | 4.86M | 4.86M | 4.84M | 4.86M | 4.79M | 4.76M | 4.77M | 4.67M | 4.73M | 4.73M | 4.32M | 3.42M | 3.54M | 203.98K | 197.10K | 188.68K | 147.66K | 117.02K |

Spin Memory raises $8.5m for MRAM push to market – Blocks and Files

NVE Corporation's (NVEC) CEO Daniel Baker on Q1 2021 Results - Earnings Call Transcript

Optimum Investment Advisors Takes Position in Everspin Technologies Inc (NASDAQ:MRAM)

Spin Memory Announces Extension of Series B Funding

2 Interesting Semiconductor Stocks: Intel And NVEC

Nevada launches annual incentives to accelerate EV adoption - Electrek

EGEB: E-bus trailblazer Chile orders 150 more for its capital - Electrek

Source: https://incomestatements.info

Category: Stock Reports