See more : Cyviz AS (CYVIZ.OL) Income Statement Analysis – Financial Results

Complete financial analysis of Norwood Financial Corp. (NWFL) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Norwood Financial Corp., a leading company in the Banks – Regional industry within the Financial Services sector.

- Okamoto Glass Co., Ltd. (7746.T) Income Statement Analysis – Financial Results

- Chuo Gyorui Co., Ltd. (8030.T) Income Statement Analysis – Financial Results

- Amaero International Ltd (AMROF) Income Statement Analysis – Financial Results

- Strikewell Energy Corp. (SKKFF) Income Statement Analysis – Financial Results

- Legend Upstar Holdings Limited (MDICF) Income Statement Analysis – Financial Results

Norwood Financial Corp. (NWFL)

About Norwood Financial Corp.

Norwood Financial Corp. operates as the bank holding company for Wayne Bank that provides various banking products and services. The company accepts a range of deposit products, including interest-bearing and non-interest bearing transaction accounts, and statement savings and money market accounts, as well as certificate of deposits. It also provides various loans, such as commercial loans comprising lines of credit, revolving credit, term loans, mortgages, secured lending products, and letter of credit facilities; municipal finance lending; construction loans for commercial construction projects and single-family residences; land loans; consumer loans; mortgage lending to finance principal residences and second home dwellings; and indirect dealer financing of new and used automobiles, boats, and recreational vehicles. In addition, the company offers investment securities services; trust and investment products; and cash management, direct deposit, remote deposit capture, mobile deposit capture, mobile payment, automated clearing house activity, real estate settlement, and Internet and mobile banking services. Further, it engages in the annuity and mutual fund sale, and discount brokerage activities, as well as insurance agency business. The company serves consumers, businesses, nonprofit organizations, and municipalities. It operates fourteen offices in Northeastern Pennsylvania; and sixteen offices in Delaware, Sullivan, Ontario, Otsego, and Yates Counties, New York, as well as thirty-one automated teller machines. Norwood Financial Corp. was founded in 1870 and is headquartered in Honesdale, Pennsylvania.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 64.64M | 78.33M | 73.64M | 58.26M | 45.38M | 43.90M | 41.82M | 33.77M | 29.22M | 29.67M | 30.28M | 29.97M | 27.32M | 23.73M | 24.50M | 22.49M | 20.80M | 19.77M | 18.81M | 17.56M | 16.82M | 16.96M | 16.36M | 15.56M | 14.00M | 13.30M | 13.00M | 3.55M | 1.65M |

| Cost of Revenue | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 64.64M | 78.33M | 73.64M | 58.26M | 45.38M | 43.90M | 41.82M | 33.77M | 29.22M | 29.67M | 30.28M | 29.97M | 27.32M | 23.73M | 24.50M | 22.49M | 20.80M | 19.77M | 18.81M | 17.56M | 16.82M | 16.96M | 16.36M | 15.56M | 14.00M | 13.30M | 13.00M | 3.55M | 1.65M |

| Gross Profit Ratio | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 24.55M | 22.68M | 23.70M | 19.98M | 16.68M | 15.79M | 14.58M | 12.68M | 9.89M | 9.97M | 9.78M | 9.70M | 9.10M | 7.83M | 8.76M | 6.05M | 5.83M | 5.66M | 5.41M | 5.13M | 4.92M | 4.85M | 4.64M | 4.36M | 4.10M | 3.90M | 3.60M | 3.78M | 3.29M |

| Selling & Marketing | 630.00K | 516.00K | 473.00K | 385.00K | 267.00K | 257.00K | 268.00K | 283.00K | 240.00K | 224.00K | 208.00K | 222.00K | 205.00K | 187.00K | 186.00K | 213.00K | 235.00K | 224.00K | 159.00K | 156.00K | 170.00K | 168.00K | 131.00K | 185.00K | 100.00K | 100.00K | 200.00K | 0.00 | 0.00 |

| SG&A | 25.18M | 23.20M | 23.70M | 19.98M | 16.68M | 15.79M | 14.58M | 12.68M | 9.89M | 9.97M | 9.78M | 9.70M | 9.10M | 7.83M | 8.76M | 6.26M | 6.06M | 5.88M | 5.57M | 5.29M | 5.09M | 5.02M | 4.77M | 4.54M | 4.20M | 4.00M | 3.80M | 3.78M | 3.29M |

| Other Expenses | 0.00 | -12.92M | -66.48M | -59.87M | -45.24M | -38.80M | -36.65M | -34.20M | -28.31M | -26.16M | -25.29M | -23.58M | -21.30M | -15.56M | -16.19M | -9.54M | -5.73M | -7.29M | -10.04M | -10.84M | -9.53M | -8.38M | -5.12M | -3.86M | -4.10M | -4.20M | -4.20M | 3.13M | 4.41M |

| Operating Expenses | 35.28M | 2.24M | -42.78M | -39.89M | -28.56M | -22.04M | -22.07M | -21.52M | -18.42M | -16.20M | -15.51M | -13.88M | -12.21M | -7.73M | -7.43M | -3.28M | 327.00K | -1.41M | -4.47M | -5.55M | -4.45M | -3.37M | -343.00K | 685.00K | 100.00K | -200.00K | -400.00K | 6.91M | 7.70M |

| Cost & Expenses | 35.28M | 2.24M | -42.78M | -39.89M | -28.56M | -22.04M | -22.07M | -21.52M | -18.42M | -16.20M | -15.51M | -13.88M | -12.21M | -7.73M | -7.43M | -3.28M | 327.00K | -1.41M | -4.47M | -5.55M | -4.45M | -3.37M | -343.00K | 685.00K | 100.00K | -200.00K | -400.00K | 6.91M | 7.70M |

| Interest Income | 95.54M | 75.67M | 71.07M | 58.46M | 47.28M | 42.50M | 38.99M | 32.24M | 27.78M | 27.77M | 28.26M | 29.41M | 27.77M | 25.69M | 26.84M | 28.10M | 29.26M | 25.95M | 21.77M | 19.01M | 19.35M | 21.56M | 23.76M | 23.94M | 21.20M | 20.20M | 19.90M | 18.31M | 15.82M |

| Interest Expense | 33.47M | 7.27M | 5.76M | 7.98M | 8.68M | 5.66M | 4.08M | 3.65M | 3.26M | 3.21M | 3.60M | 4.65M | 5.18M | 6.02M | 7.73M | 9.69M | 11.98M | 9.77M | 6.51M | 4.99M | 6.02M | 7.61M | 10.21M | 10.88M | 9.10M | 8.50M | 8.80M | 8.12M | 6.90M |

| Depreciation & Amortization | 1.46M | 1.57M | 1.60M | 1.44M | 1.11M | 1.02M | 1.07M | 848.00K | 656.00K | 693.00K | 731.00K | 723.00K | 639.00K | 511.00K | 598.00K | 629.00K | 731.00K | 856.00K | 1.02M | 596.00K | 1.19M | 1.03M | 791.00K | 790.00K | 900.00K | 900.00K | 1.00M | 522.08K | 640.13K |

| EBITDA | 22.61M | 37.96M | 32.46M | 19.80M | 17.93M | 17.23M | 15.82M | 9.44M | 8.20M | 10.96M | 11.90M | 12.16M | 11.81M | 12.11M | 9.94M | 11.37M | 10.96M | 9.14M | 8.43M | 7.01M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| EBITDA Ratio | 34.97% | 57.74% | 42.07% | 31.72% | 37.29% | 52.12% | 47.59% | 38.78% | 39.20% | 47.74% | 51.20% | 56.10% | 57.67% | 69.58% | 72.12% | 88.21% | 105.09% | 97.19% | 81.66% | 71.78% | 80.67% | 86.21% | 102.74% | 109.48% | 107.14% | 105.26% | 104.62% | 309.13% | 606.73% |

| Operating Income | 21.15M | 43.65M | 30.86M | 18.37M | 16.82M | 21.86M | 19.75M | 12.25M | 10.80M | 13.47M | 14.77M | 16.09M | 15.12M | 16.00M | 17.07M | 19.21M | 21.12M | 18.36M | 14.34M | 12.01M | 12.37M | 13.59M | 16.01M | 16.24M | 14.10M | 13.10M | 12.60M | 10.46M | 9.35M |

| Operating Income Ratio | 32.71% | 55.73% | 41.91% | 31.53% | 37.07% | 49.79% | 47.23% | 36.27% | 36.95% | 45.40% | 48.78% | 53.68% | 55.33% | 67.42% | 69.67% | 85.41% | 101.57% | 92.86% | 76.25% | 68.38% | 73.57% | 80.15% | 97.90% | 104.40% | 100.71% | 98.50% | 96.92% | 294.43% | 567.85% |

| Total Other Income/Expenses | 0.00 | 0.00 | 0.00 | -2.05M | -4.85M | -4.88M | -5.43M | -6.55M | -4.13M | -4.76M | -3.19M | -768.00K | 0.00 | 0.00 | -598.00K | 0.00 | -10.96M | 0.00 | 0.00 | -596.00K | -6.02M | -7.61M | -10.21M | -10.88M | -9.10M | -8.50M | -8.80M | -8.12M | -6.90M |

| Income Before Tax | 21.15M | 36.39M | 30.86M | 18.37M | 16.82M | 16.20M | 14.75M | 8.60M | 7.54M | 10.26M | 11.17M | 11.44M | 9.94M | 9.98M | 9.35M | 9.51M | 9.14M | 8.59M | 7.84M | 7.01M | 6.35M | 5.98M | 5.80M | 5.36M | 5.00M | 4.60M | 3.80M | 2.34M | 2.45M |

| Income Before Tax Ratio | 32.71% | 46.45% | 41.91% | 31.53% | 37.07% | 36.91% | 35.27% | 25.45% | 25.80% | 34.59% | 36.90% | 38.17% | 36.36% | 42.04% | 38.14% | 42.30% | 43.95% | 43.45% | 41.67% | 39.94% | 37.75% | 35.25% | 35.48% | 34.48% | 35.71% | 34.59% | 29.23% | 65.88% | 149.04% |

| Income Tax Expense | 4.39M | 7.15M | 5.95M | 3.29M | 2.61M | 2.55M | 6.55M | 1.88M | 1.63M | 2.61M | 2.71M | 3.04M | 2.58M | 2.66M | 2.28M | 2.84M | 2.63M | 2.68M | 2.34M | 2.00M | 1.69M | 1.62M | 1.60M | 1.50M | 1.50M | 1.40M | 1.10M | 468.39K | 652.27K |

| Net Income | 16.76M | 29.23M | 24.92M | 15.08M | 14.22M | 13.65M | 8.20M | 6.71M | 5.91M | 7.66M | 8.47M | 8.40M | 7.36M | 7.31M | 7.06M | 6.68M | 6.51M | 5.91M | 5.50M | 5.01M | 4.65M | 4.35M | 4.20M | 3.86M | 3.50M | 3.20M | 2.70M | 1.87M | 1.80M |

| Net Income Ratio | 25.93% | 37.32% | 33.83% | 25.89% | 31.32% | 31.09% | 19.60% | 19.87% | 20.22% | 25.81% | 27.96% | 28.04% | 26.92% | 30.82% | 28.83% | 29.69% | 31.31% | 29.90% | 29.22% | 28.53% | 27.67% | 25.67% | 25.69% | 24.81% | 25.00% | 24.06% | 20.77% | 52.69% | 109.43% |

| EPS | 2.07 | 3.59 | 3.05 | 2.09 | 2.27 | 2.19 | 1.32 | 1.16 | 1.07 | 1.40 | 1.55 | 1.55 | 1.45 | 1.61 | 1.56 | 1.48 | 1.42 | 1.28 | 1.13 | 1.09 | 1.03 | 0.98 | 0.96 | 0.60 | 0.80 | 0.74 | 0.31 | 0.21 | 0.39 |

| EPS Diluted | 2.07 | 3.58 | 3.04 | 2.09 | 2.24 | 2.17 | 1.31 | 1.15 | 1.07 | 1.40 | 1.55 | 1.55 | 1.45 | 1.60 | 1.55 | 1.46 | 1.39 | 1.25 | 1.11 | 1.07 | 1.01 | 0.97 | 0.95 | 0.59 | 0.80 | 0.73 | 0.31 | 0.21 | 0.39 |

| Weighted Avg Shares Out | 8.10M | 8.14M | 8.18M | 7.20M | 6.26M | 6.23M | 6.21M | 5.79M | 5.52M | 5.47M | 5.45M | 5.41M | 5.08M | 4.55M | 4.54M | 4.52M | 4.59M | 4.62M | 4.86M | 4.59M | 4.50M | 4.44M | 4.37M | 4.33M | 4.35M | 4.31M | 13.42M | 8.85M | 4.61M |

| Weighted Avg Shares Out (Dil) | 8.08M | 8.18M | 8.20M | 7.23M | 6.33M | 6.29M | 6.26M | 5.82M | 5.54M | 5.47M | 5.45M | 5.42M | 5.08M | 4.57M | 4.56M | 4.57M | 4.67M | 4.71M | 4.96M | 4.69M | 4.61M | 4.49M | 4.40M | 4.36M | 4.37M | 4.35M | 13.42M | 8.85M | 4.61M |

Mapping Ohio’s 25,250 coronavirus cases, updates and trends

Chris Dziadul Reports: Invitation to a special CEE webinar

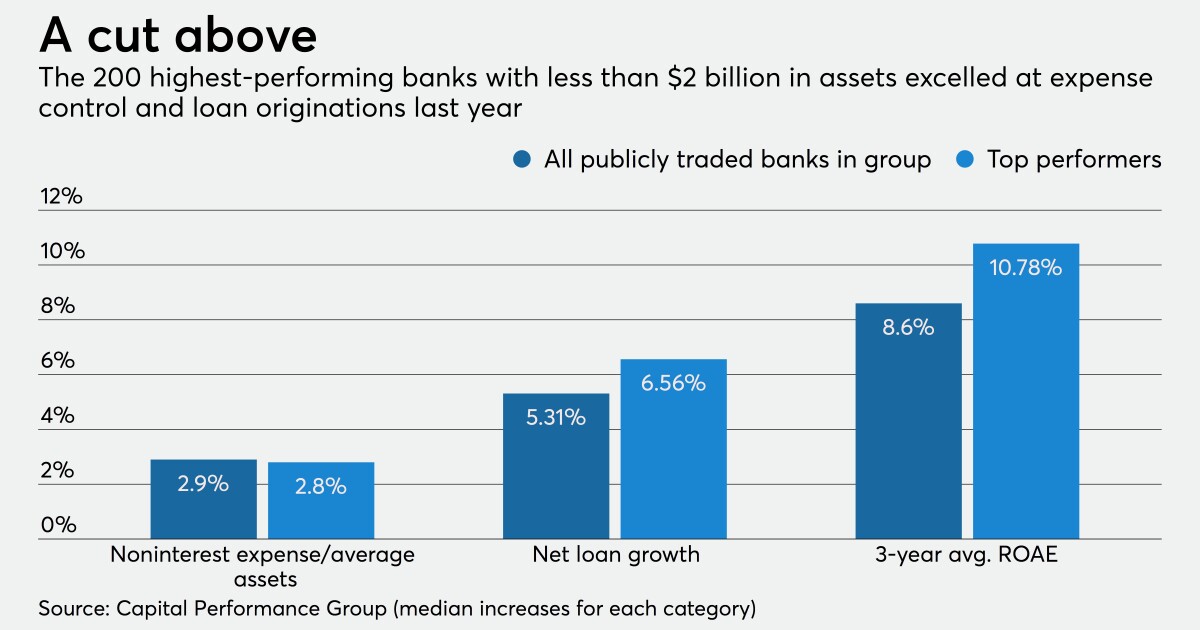

Will pandemic reshuffle the top 200 publicly traded community banks?

Dividend Champion And Contender Highlights: Week Of April 26

Dividend Stock Analysis – Norwood Financial Corp. (NWFL)

Dividend Stock Analysis – Norwood Financial Corp. (NWFL)

Bert's September Dividend Stock Watch List - Dividend Diplomats

Expected Dividend Increases in January 2019 - Dividend Diplomats

Lanny's Stock Purchases - August 13th through September 9th - Dividend Diplomats

Lanny's September Dividend Income Summary - Dividend Diplomats

Source: https://incomestatements.info

Category: Stock Reports