See more : Inaba Seisakusho Co., Ltd. (3421.T) Income Statement Analysis – Financial Results

Complete financial analysis of New York Mortgage Trust, Inc. (NYMTP) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of New York Mortgage Trust, Inc., a leading company in the REIT – Mortgage industry within the Real Estate sector.

- H S India Limited (HOTLSILV.BO) Income Statement Analysis – Financial Results

- Gini Silk Mills Limited (GINISILK.BO) Income Statement Analysis – Financial Results

- Séché Environnement SA (SCHP.PA) Income Statement Analysis – Financial Results

- Hap Seng Plantations Holdings Berhad (5138.KL) Income Statement Analysis – Financial Results

- Aowei Holding Limited (1370.HK) Income Statement Analysis – Financial Results

New York Mortgage Trust, Inc. (NYMTP)

About New York Mortgage Trust, Inc.

New York Mortgage Trust, Inc. acquires, invests in, finances, and manages mortgage-related single-family and multi-family residential assets in the United States. Its targeted investments include residential loans, second mortgages, and business purpose loans; structured multi-family property investments, such as preferred equity in, and mezzanine loans to owners of multi-family properties, as well as joint venture equity investments in multi-family properties; non-agency residential mortgage-backed securities (RMBS); agency RMBS; commercial mortgage-backed securities (CMBS); and other mortgage, residential housing, and credit-related assets. The company qualifies as a real estate investment trust for federal income tax purposes. It generally would not be subject to federal corporate income taxes if it distributes at least 90% of its taxable income to its stockholders. The company was incorporated in 2003 and is headquartered in New York, New York.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 210.00M | 8.46M | 266.51M | -207.48M | 221.91M | 142.14M | 121.80M | 105.04M | 123.39M | 188.38M | 90.87M | 40.67M | 15.54M | 15.65M | 20.14M | -12.11M | -9.56M | 4.20M | 49.15M | 40.02M | 4.34M | 1.31M | 281.00K | 149.00K |

| Cost of Revenue | 112.19M | 383.65M | 28.85M | 12.34M | 14.70M | 13.60M | 48.06M | 38.48M | 44.91M | 6.43M | 3.87M | 0.00 | 0.00 | 0.00 | 2.12M | 13.98M | 9.56M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 97.82M | -375.19M | 237.66M | -219.81M | 207.20M | 128.54M | 73.74M | 66.56M | 78.48M | 181.95M | 87.01M | 40.67M | 15.54M | 15.65M | 18.02M | -26.10M | -19.11M | 4.20M | 49.15M | 40.02M | 4.34M | 1.31M | 281.00K | 149.00K |

| Gross Profit Ratio | 46.58% | -4,436.97% | 89.18% | 105.95% | 93.37% | 90.43% | 60.54% | 63.36% | 63.61% | 96.59% | 95.74% | 100.00% | 100.00% | 100.00% | 89.48% | 215.43% | 200.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | -0.80 | 0.78 | -1.94 | 0.23 | 0.22 | 0.22 | 0.20 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 49.57M | 93.33M | 48.91M | 42.23M | 36.37M | 28.23M | 22.87M | 24.51M | 29.12M | 34.03M | 16.05M | 11.39M | 10.52M | 7.95M | 3.89M | 3.48M | 865.00K | 714.00K | 30.98M | 17.12M | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 145.00K | 78.00K | 4.86M | 3.19M | 1.01M | 488.34K | 0.00 | 0.00 |

| SG&A | 49.57M | 93.33M | 48.91M | 42.23M | 36.37M | 28.23M | 22.87M | 24.51M | 29.12M | 34.03M | 16.05M | 11.39M | 10.52M | 7.95M | 3.89M | 3.48M | 1.01M | 792.00K | 35.84M | 20.31M | 1.01M | 488.34K | 0.00 | 0.00 |

| Other Expenses | 0.00 | 296.12M | -26.67M | -12.34M | -84.96M | 323.77M | 251.13M | -8.41M | 224.88M | 201.97M | 205.95M | 96.62M | 250.00K | 6.05M | 119.00K | 5.28M | 69.99M | 62.21M | 23.16M | -40.63M | 11.64M | 3.62M | 2.89M | 854.00K |

| Operating Expenses | 49.57M | 348.56M | 22.24M | 29.89M | -48.59M | 352.00M | 274.00M | 15.25M | 254.00M | 236.00M | 222.00M | 108.00M | 19.00M | 14.00M | 20.00M | 70.00M | 71.00M | 63.00M | 59.00M | -20.32M | 12.65M | 4.11M | 2.89M | 854.00K |

| Cost & Expenses | 161.75M | 348.56M | 22.24M | 29.89M | -48.59M | 352.00M | 274.00M | 15.25M | 254.00M | 236.00M | 222.00M | 108.00M | 19.00M | 14.00M | 3.40M | 6.91M | 71.00M | 63.00M | 59.00M | -20.32M | 12.65M | 4.11M | 2.89M | 854.00K |

| Interest Income | 258.66M | 258.39M | 206.87M | 350.16M | 694.61M | 455.80M | 366.09M | 319.31M | 336.84M | 378.85M | 291.73M | 137.53M | 24.29M | 19.90M | 31.10M | 44.12M | 50.56M | 64.88M | 77.48M | 27.30M | 7.61M | 2.99M | 1.57M | 625.00K |

| Interest Expense | 192.13M | 129.42M | 83.25M | 223.07M | 566.75M | 377.07M | 308.10M | 254.67M | 260.65M | 301.01M | 231.18M | 105.93M | 4.84M | 9.61M | 14.24M | 36.26M | 50.09M | 60.10M | 60.10M | 16.01M | 3.27M | 1.67M | 1.29M | 476.00K |

| Depreciation & Amortization | 24.62M | 671.86M | 11.16M | 214.72M | 577.97M | 367.02M | 326.49M | 282.96M | 542.00K | -2.67M | 13.42M | 10.49M | 126.00K | 669.00K | 692.00K | 1.42M | 2.38M | 4.59M | 7.99M | 2.36M | 123.57K | 271.01K | 0.00 | 0.00 |

| EBITDA | 206.44M | 0.00 | 251.86M | 0.00 | 117.69M | 449.56M | 0.00 | 0.00 | 0.00 | 136.19M | 0.00 | 0.00 | 4.81M | 6.14M | 10.88M | -18.07M | 0.00 | 0.00 | 0.00 | 351.00 | 0.00 | 0.00 | 3.17M | 1.00M |

| EBITDA Ratio | 98.30% | -2,181.63% | 92.70% | 131.48% | 53.03% | 316.29% | 331.38% | 316.99% | 278.58% | 234.06% | 345.86% | 358.07% | 65.47% | 109.17% | 132.05% | -112.07% | 29.30% | 1,182.83% | 110.29% | 55.12% | 394.09% | 433.65% | 1,128.11% | 673.15% |

| Operating Income | 48.25M | -311.30M | 195.66M | -287.53M | 173.32M | 478.90M | 7.28M | 325.31M | 343.20M | 136.19M | 68.96M | 28.17M | 4.81M | 16.42M | 10.88M | -25.76M | -5.18M | 45.07M | 46.22M | 19.70M | 16.99M | 5.42M | 3.17M | 1.00M |

| Operating Income Ratio | 22.98% | -3,681.45% | 73.41% | 138.58% | 78.10% | 336.93% | 5.98% | 309.71% | 278.14% | 72.30% | 75.88% | 69.26% | 30.96% | 104.89% | 54.04% | 212.68% | 54.22% | 1,073.51% | 94.04% | 49.23% | 391.24% | 413.01% | 1,128.11% | 673.15% |

| Total Other Income/Expenses | -125.97M | -105.98M | -15.70M | -27.36M | 172.26M | 97.58M | 84.64M | 65.00K | 0.00 | 6.40M | 0.00 | 0.00 | -278.00K | -7.23M | -15.67M | 1.66M | -52.47M | 0.00 | -60.10M | -791.47K | 0.00 | -1.94M | 4.49M | 1.23M |

| Income Before Tax | -77.72M | -340.11M | 190.93M | -287.26M | 172.48M | 103.74M | 91.92M | 70.66M | 82.55M | 142.59M | 69.69M | 29.10M | 5.24M | 1.14M | 11.67M | -24.11M | 0.00 | 0.00 | -13.89M | 3.69M | 0.00 | 0.00 | 1.88M | 527.00K |

| Income Before Tax Ratio | -37.01% | -4,022.08% | 71.64% | 138.45% | 77.72% | 72.98% | 75.47% | 67.27% | 66.90% | 75.69% | 76.69% | 71.55% | 33.75% | 7.25% | 57.94% | 199.00% | 0.00% | 0.00% | -28.26% | 9.21% | 0.00% | 0.00% | 669.40% | 353.69% |

| Income Tax Expense | 75.00K | 542.00K | 2.46M | 981.00K | -419.00K | -1.06M | 3.36M | 3.10M | 4.54M | 6.40M | 739.00K | 932.00K | 433.00K | -5.67M | 15.02M | 37.92M | 50.09M | 60.10M | -8.55M | -1.26M | 3.27M | 1.67M | 0.00 | 0.00 |

| Net Income | -48.67M | -340.65M | 193.20M | -288.24M | 173.74M | 102.89M | 91.98M | 67.55M | 78.01M | 136.19M | 68.96M | 28.28M | 4.78M | 6.81M | 11.67M | -24.11M | -55.27M | -15.03M | -5.34M | 4.95M | 13.73M | 3.75M | 1.88M | 527.00K |

| Net Income Ratio | -23.17% | -4,028.49% | 72.49% | 138.93% | 78.29% | 72.39% | 75.52% | 64.31% | 63.22% | 72.30% | 75.88% | 69.53% | 30.74% | 43.48% | 57.94% | 199.00% | 578.36% | -358.05% | -10.87% | 12.36% | 316.04% | 285.60% | 669.40% | 353.69% |

| EPS | -0.99 | -3.61 | 2.03 | -3.11 | 3.14 | 2.79 | 2.72 | 2.00 | 2.48 | 5.92 | 4.44 | 4.32 | 1.84 | 2.88 | 5.00 | -11.66 | -121.87 | -166.64 | -11.95 | 56.00 | 30.23 | 84.29 | 42.28 | 11.84 |

| EPS Diluted | -0.99 | -3.61 | 2.03 | -3.11 | 2.86 | 2.79 | 2.64 | 2.00 | 2.48 | 5.92 | 4.44 | 4.32 | 1.84 | 2.88 | 4.76 | -11.66 | -121.87 | -166.64 | -11.95 | 56.00 | 30.23 | 84.29 | 42.28 | 11.84 |

| Weighted Avg Shares Out | 91.04M | 94.32M | 94.81M | 92.61M | 60.65M | 36.86M | 27.96M | 27.40M | 27.10M | 21.97M | 14.78M | 6.52M | 2.62M | 2.36M | 2.34M | 2.07M | 453.50K | 90.20K | 446.83K | 444.93K | 454.05K | 44.49K | 44.49K | 44.49K |

| Weighted Avg Shares Out (Dil) | 91.04M | 94.32M | 95.24M | 92.75M | 60.65M | 36.86M | 32.59M | 27.40M | 27.10M | 21.97M | 14.78M | 6.52M | 2.62M | 2.36M | 2.97M | 2.07M | 453.50K | 90.20K | 446.83K | 445.00K | 454.05K | 44.49K | 44.49K | 44.49K |

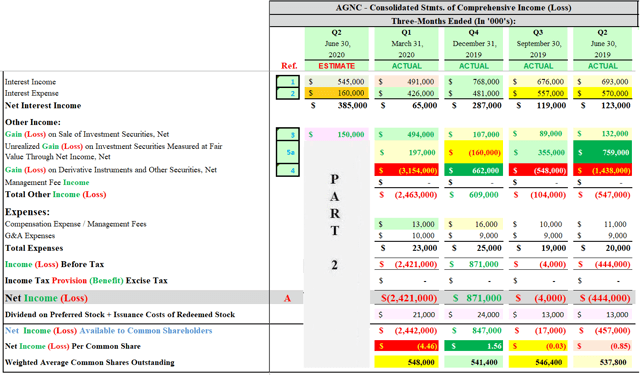

AGNC Investment's Q2 2020 Income Statement And Earnings Projection - Part 1 (Notable Changes; Includes Current Recommendation)

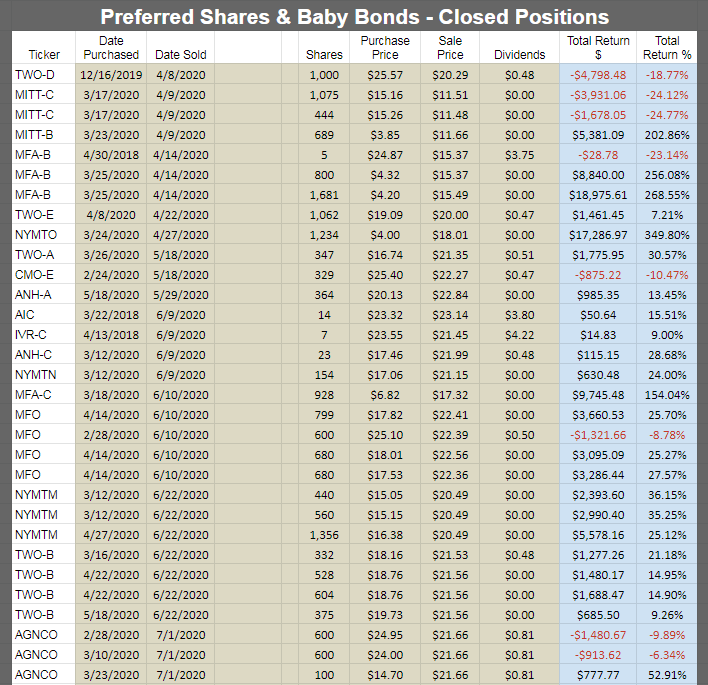

This Is How To Reduce Risk Without Losing Income

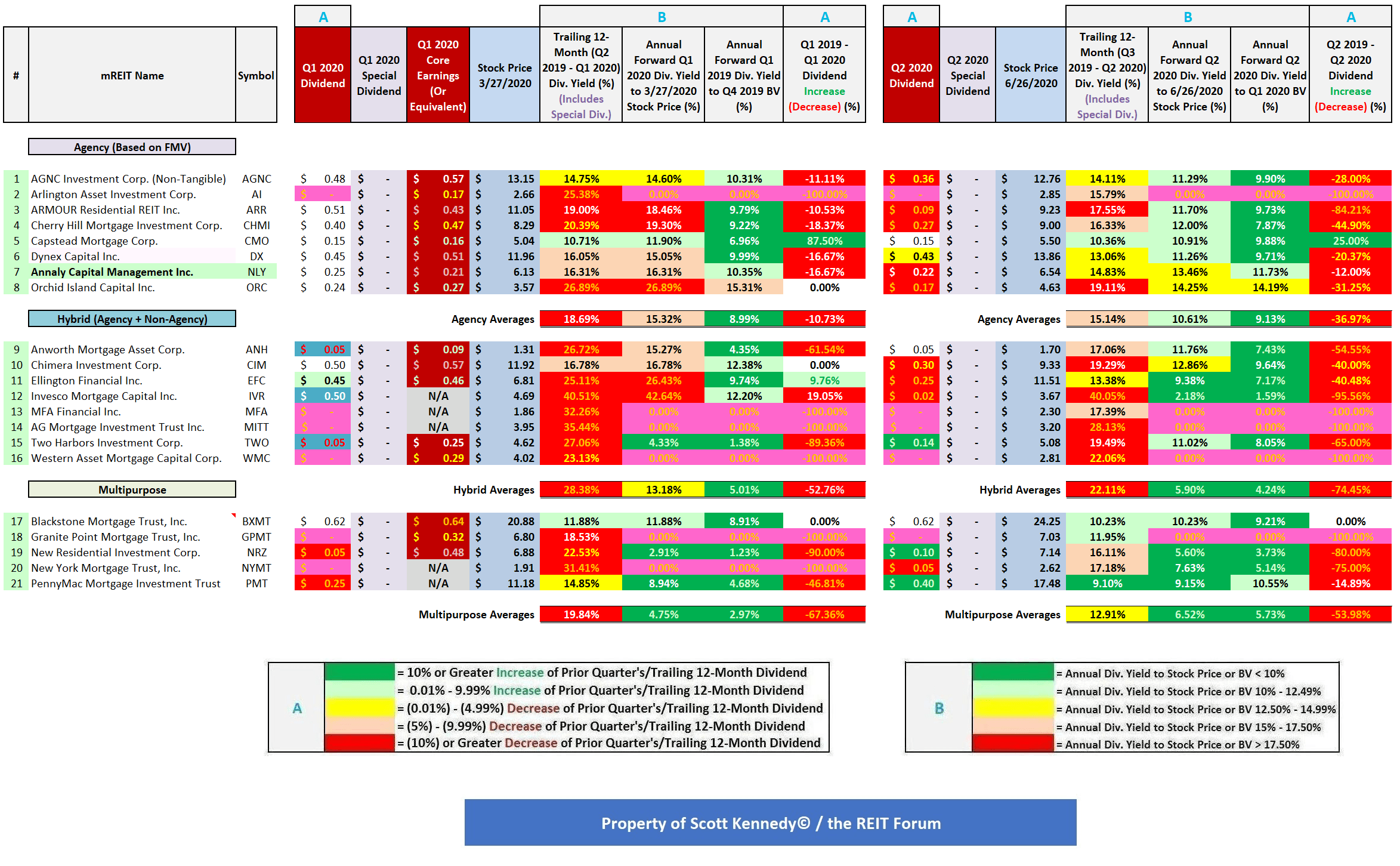

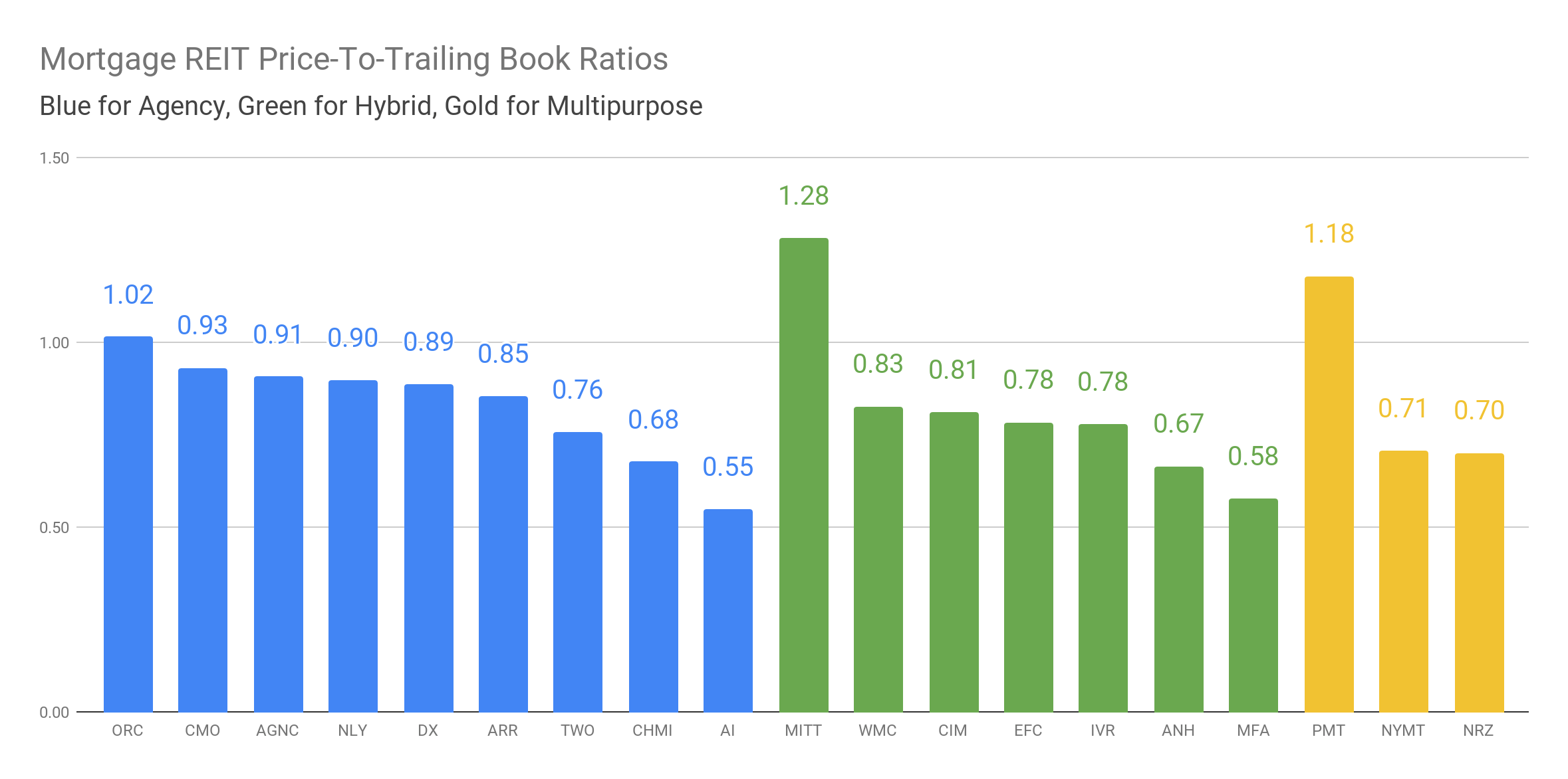

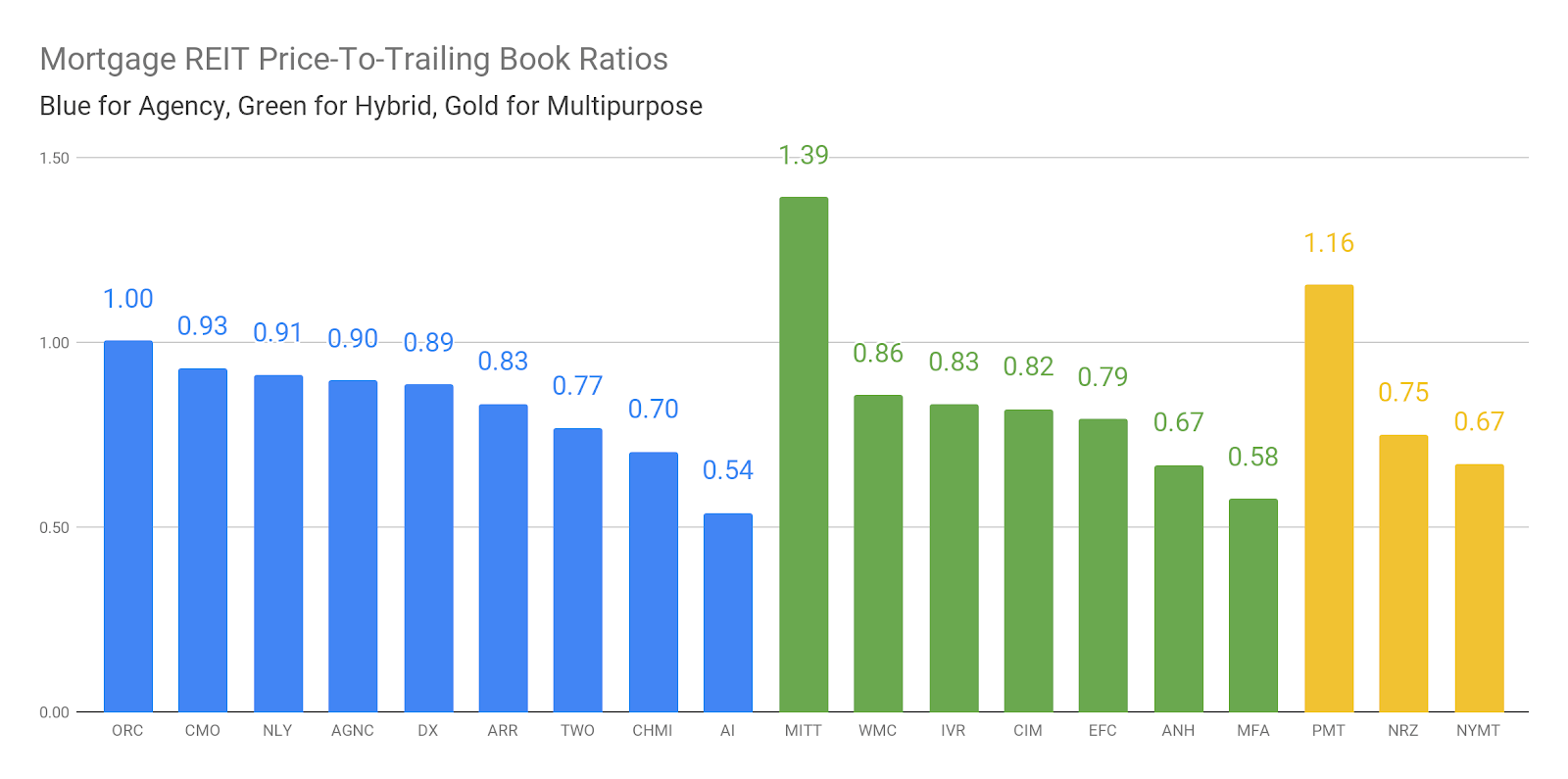

Annaly Capital's Dividend, BV, And Valuation Vs. 20 mREIT Peers - Part 2 (Includes Q3-Q4 2020 Dividend Projection)

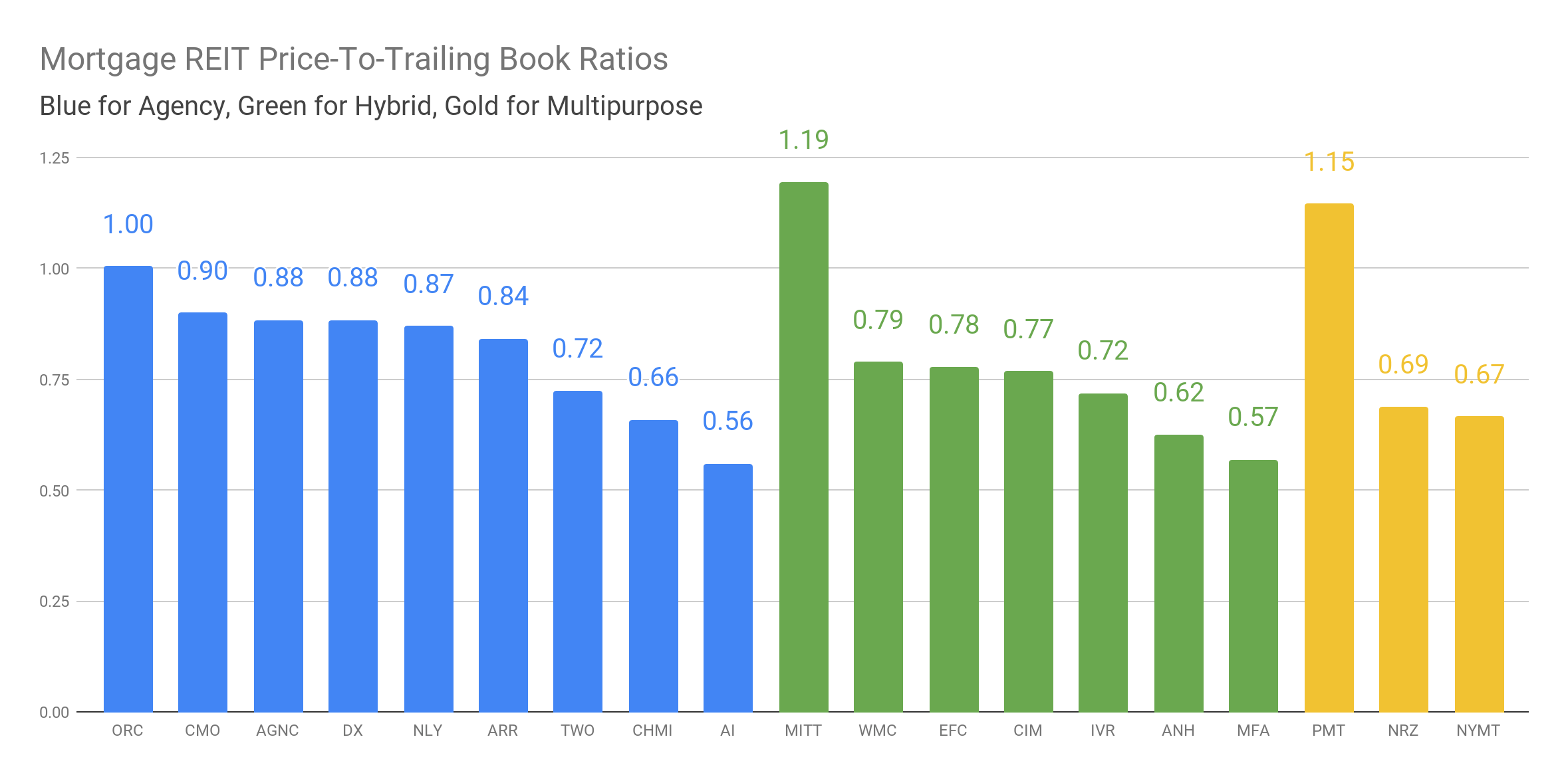

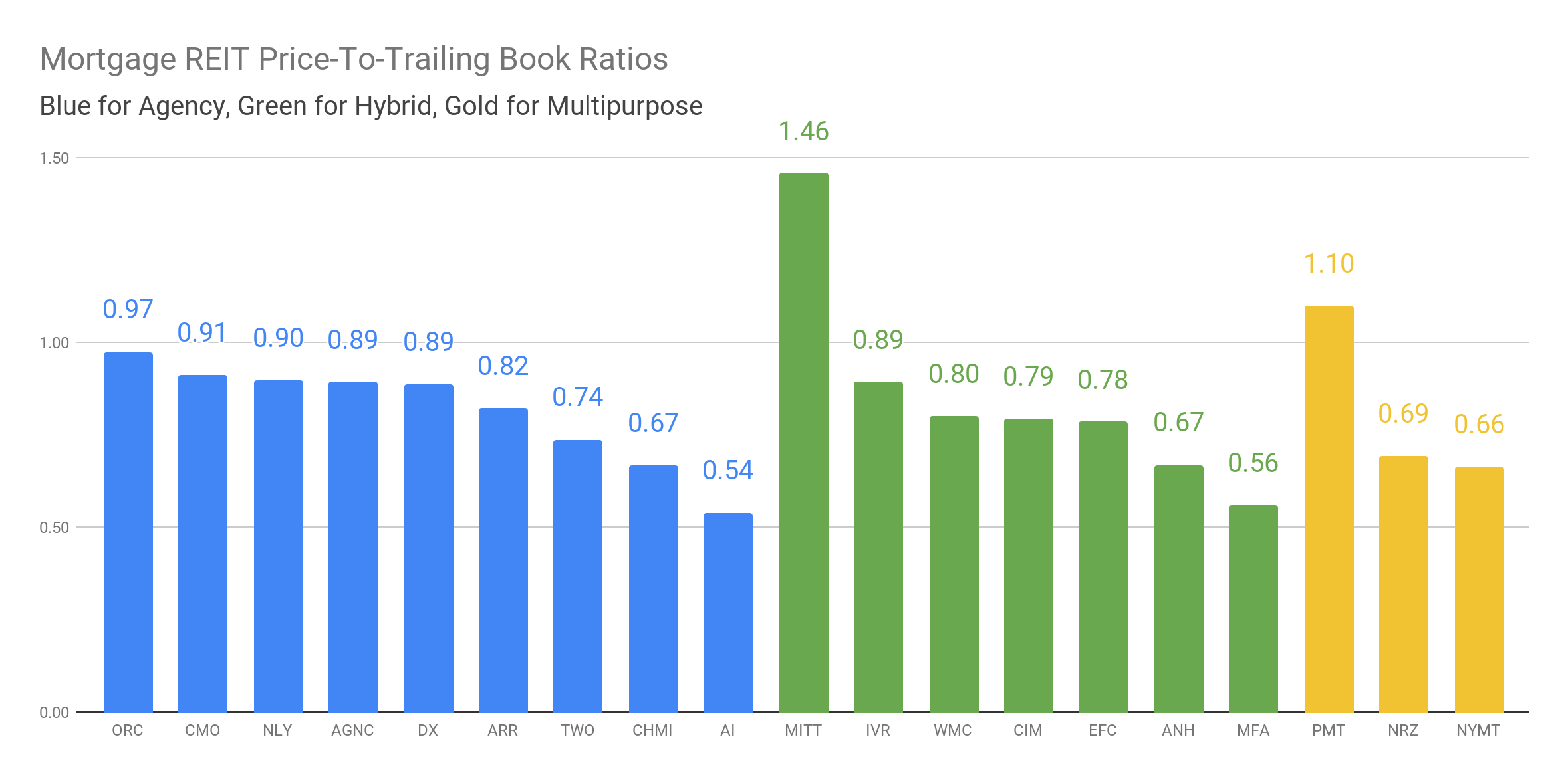

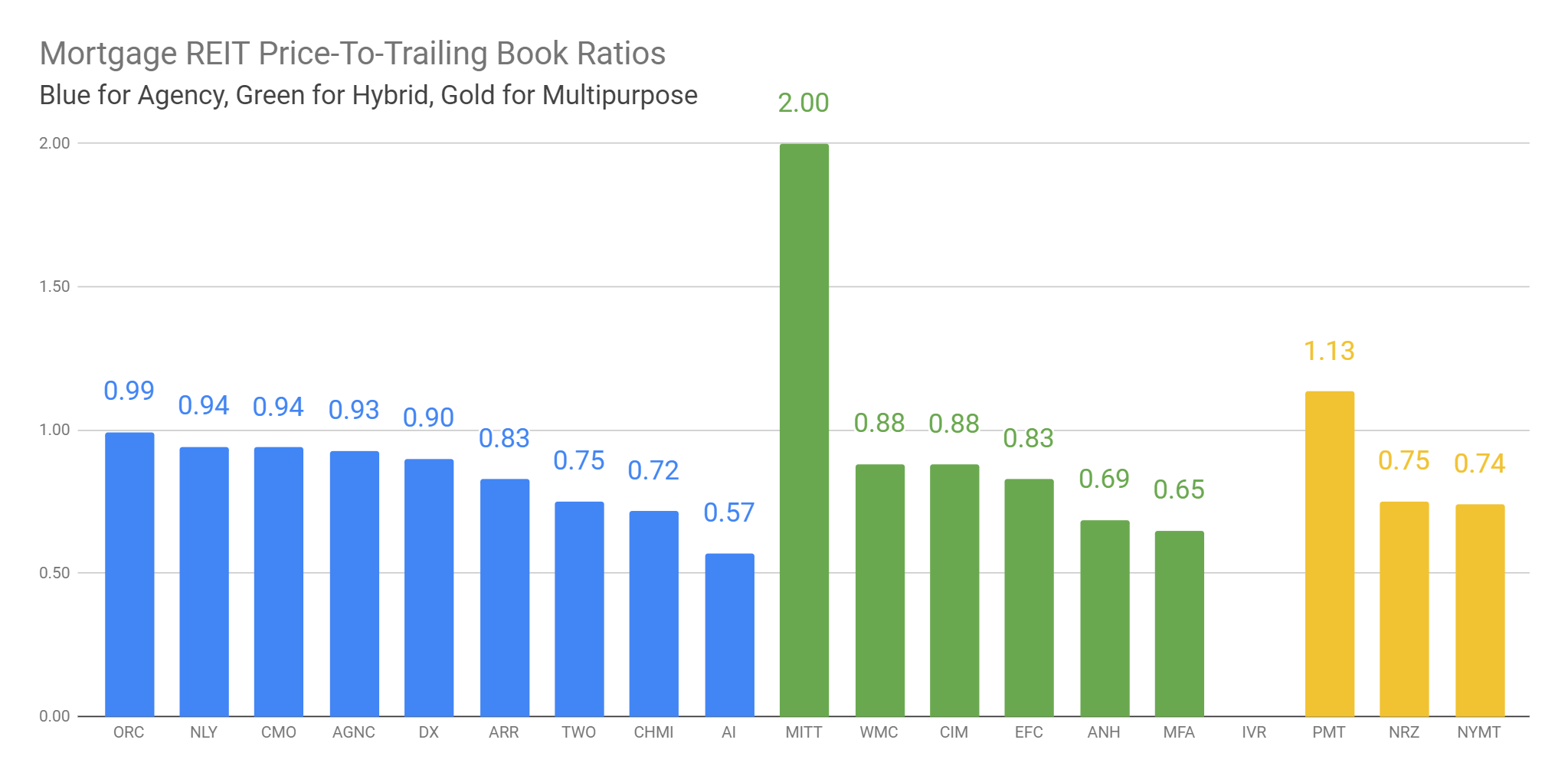

3 Mortgage REITs At Lofty Valuations

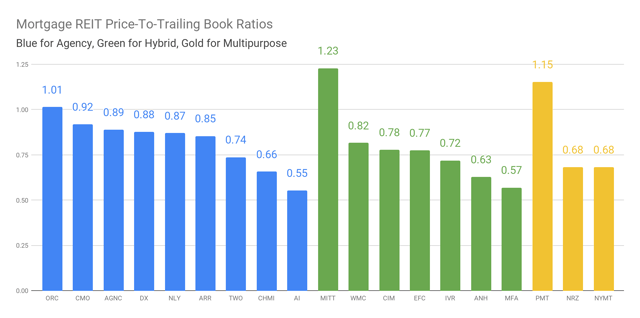

Quick And Dirty Discounts To Book For 6/29/2020

Ditch Premium Prices

Finding Bargains Among Mortgage REITs

Reality Comes For Mortgage REITs

Dividends Are Back

Zacks Investment Research Downgrades NY MTG TR INC/SH (NASDAQ:NYMT) to Hold

Source: https://incomestatements.info

Category: Stock Reports