See more : Villeroy & Boch AG (VIB3.DE) Income Statement Analysis – Financial Results

Complete financial analysis of New York Mortgage Trust, Inc. (NYMTP) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of New York Mortgage Trust, Inc., a leading company in the REIT – Mortgage industry within the Real Estate sector.

- Max Resource Corp. (MXROF) Income Statement Analysis – Financial Results

- Quik Super Online Ltd. (QUIK.TA) Income Statement Analysis – Financial Results

- AltaGas Ltd. (ALA.TO) Income Statement Analysis – Financial Results

- Bebida Beverage Company (BBDA) Income Statement Analysis – Financial Results

- Thayer Ventures Acquisition Corporation (TVACW) Income Statement Analysis – Financial Results

New York Mortgage Trust, Inc. (NYMTP)

About New York Mortgage Trust, Inc.

New York Mortgage Trust, Inc. acquires, invests in, finances, and manages mortgage-related single-family and multi-family residential assets in the United States. Its targeted investments include residential loans, second mortgages, and business purpose loans; structured multi-family property investments, such as preferred equity in, and mezzanine loans to owners of multi-family properties, as well as joint venture equity investments in multi-family properties; non-agency residential mortgage-backed securities (RMBS); agency RMBS; commercial mortgage-backed securities (CMBS); and other mortgage, residential housing, and credit-related assets. The company qualifies as a real estate investment trust for federal income tax purposes. It generally would not be subject to federal corporate income taxes if it distributes at least 90% of its taxable income to its stockholders. The company was incorporated in 2003 and is headquartered in New York, New York.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 210.00M | 8.46M | 266.51M | -207.48M | 221.91M | 142.14M | 121.80M | 105.04M | 123.39M | 188.38M | 90.87M | 40.67M | 15.54M | 15.65M | 20.14M | -12.11M | -9.56M | 4.20M | 49.15M | 40.02M | 4.34M | 1.31M | 281.00K | 149.00K |

| Cost of Revenue | 112.19M | 383.65M | 28.85M | 12.34M | 14.70M | 13.60M | 48.06M | 38.48M | 44.91M | 6.43M | 3.87M | 0.00 | 0.00 | 0.00 | 2.12M | 13.98M | 9.56M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 97.82M | -375.19M | 237.66M | -219.81M | 207.20M | 128.54M | 73.74M | 66.56M | 78.48M | 181.95M | 87.01M | 40.67M | 15.54M | 15.65M | 18.02M | -26.10M | -19.11M | 4.20M | 49.15M | 40.02M | 4.34M | 1.31M | 281.00K | 149.00K |

| Gross Profit Ratio | 46.58% | -4,436.97% | 89.18% | 105.95% | 93.37% | 90.43% | 60.54% | 63.36% | 63.61% | 96.59% | 95.74% | 100.00% | 100.00% | 100.00% | 89.48% | 215.43% | 200.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | -0.80 | 0.78 | -1.94 | 0.23 | 0.22 | 0.22 | 0.20 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 49.57M | 93.33M | 48.91M | 42.23M | 36.37M | 28.23M | 22.87M | 24.51M | 29.12M | 34.03M | 16.05M | 11.39M | 10.52M | 7.95M | 3.89M | 3.48M | 865.00K | 714.00K | 30.98M | 17.12M | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 145.00K | 78.00K | 4.86M | 3.19M | 1.01M | 488.34K | 0.00 | 0.00 |

| SG&A | 49.57M | 93.33M | 48.91M | 42.23M | 36.37M | 28.23M | 22.87M | 24.51M | 29.12M | 34.03M | 16.05M | 11.39M | 10.52M | 7.95M | 3.89M | 3.48M | 1.01M | 792.00K | 35.84M | 20.31M | 1.01M | 488.34K | 0.00 | 0.00 |

| Other Expenses | 0.00 | 296.12M | -26.67M | -12.34M | -84.96M | 323.77M | 251.13M | -8.41M | 224.88M | 201.97M | 205.95M | 96.62M | 250.00K | 6.05M | 119.00K | 5.28M | 69.99M | 62.21M | 23.16M | -40.63M | 11.64M | 3.62M | 2.89M | 854.00K |

| Operating Expenses | 49.57M | 348.56M | 22.24M | 29.89M | -48.59M | 352.00M | 274.00M | 15.25M | 254.00M | 236.00M | 222.00M | 108.00M | 19.00M | 14.00M | 20.00M | 70.00M | 71.00M | 63.00M | 59.00M | -20.32M | 12.65M | 4.11M | 2.89M | 854.00K |

| Cost & Expenses | 161.75M | 348.56M | 22.24M | 29.89M | -48.59M | 352.00M | 274.00M | 15.25M | 254.00M | 236.00M | 222.00M | 108.00M | 19.00M | 14.00M | 3.40M | 6.91M | 71.00M | 63.00M | 59.00M | -20.32M | 12.65M | 4.11M | 2.89M | 854.00K |

| Interest Income | 258.66M | 258.39M | 206.87M | 350.16M | 694.61M | 455.80M | 366.09M | 319.31M | 336.84M | 378.85M | 291.73M | 137.53M | 24.29M | 19.90M | 31.10M | 44.12M | 50.56M | 64.88M | 77.48M | 27.30M | 7.61M | 2.99M | 1.57M | 625.00K |

| Interest Expense | 192.13M | 129.42M | 83.25M | 223.07M | 566.75M | 377.07M | 308.10M | 254.67M | 260.65M | 301.01M | 231.18M | 105.93M | 4.84M | 9.61M | 14.24M | 36.26M | 50.09M | 60.10M | 60.10M | 16.01M | 3.27M | 1.67M | 1.29M | 476.00K |

| Depreciation & Amortization | 24.62M | 671.86M | 11.16M | 214.72M | 577.97M | 367.02M | 326.49M | 282.96M | 542.00K | -2.67M | 13.42M | 10.49M | 126.00K | 669.00K | 692.00K | 1.42M | 2.38M | 4.59M | 7.99M | 2.36M | 123.57K | 271.01K | 0.00 | 0.00 |

| EBITDA | 206.44M | 0.00 | 251.86M | 0.00 | 117.69M | 449.56M | 0.00 | 0.00 | 0.00 | 136.19M | 0.00 | 0.00 | 4.81M | 6.14M | 10.88M | -18.07M | 0.00 | 0.00 | 0.00 | 351.00 | 0.00 | 0.00 | 3.17M | 1.00M |

| EBITDA Ratio | 98.30% | -2,181.63% | 92.70% | 131.48% | 53.03% | 316.29% | 331.38% | 316.99% | 278.58% | 234.06% | 345.86% | 358.07% | 65.47% | 109.17% | 132.05% | -112.07% | 29.30% | 1,182.83% | 110.29% | 55.12% | 394.09% | 433.65% | 1,128.11% | 673.15% |

| Operating Income | 48.25M | -311.30M | 195.66M | -287.53M | 173.32M | 478.90M | 7.28M | 325.31M | 343.20M | 136.19M | 68.96M | 28.17M | 4.81M | 16.42M | 10.88M | -25.76M | -5.18M | 45.07M | 46.22M | 19.70M | 16.99M | 5.42M | 3.17M | 1.00M |

| Operating Income Ratio | 22.98% | -3,681.45% | 73.41% | 138.58% | 78.10% | 336.93% | 5.98% | 309.71% | 278.14% | 72.30% | 75.88% | 69.26% | 30.96% | 104.89% | 54.04% | 212.68% | 54.22% | 1,073.51% | 94.04% | 49.23% | 391.24% | 413.01% | 1,128.11% | 673.15% |

| Total Other Income/Expenses | -125.97M | -105.98M | -15.70M | -27.36M | 172.26M | 97.58M | 84.64M | 65.00K | 0.00 | 6.40M | 0.00 | 0.00 | -278.00K | -7.23M | -15.67M | 1.66M | -52.47M | 0.00 | -60.10M | -791.47K | 0.00 | -1.94M | 4.49M | 1.23M |

| Income Before Tax | -77.72M | -340.11M | 190.93M | -287.26M | 172.48M | 103.74M | 91.92M | 70.66M | 82.55M | 142.59M | 69.69M | 29.10M | 5.24M | 1.14M | 11.67M | -24.11M | 0.00 | 0.00 | -13.89M | 3.69M | 0.00 | 0.00 | 1.88M | 527.00K |

| Income Before Tax Ratio | -37.01% | -4,022.08% | 71.64% | 138.45% | 77.72% | 72.98% | 75.47% | 67.27% | 66.90% | 75.69% | 76.69% | 71.55% | 33.75% | 7.25% | 57.94% | 199.00% | 0.00% | 0.00% | -28.26% | 9.21% | 0.00% | 0.00% | 669.40% | 353.69% |

| Income Tax Expense | 75.00K | 542.00K | 2.46M | 981.00K | -419.00K | -1.06M | 3.36M | 3.10M | 4.54M | 6.40M | 739.00K | 932.00K | 433.00K | -5.67M | 15.02M | 37.92M | 50.09M | 60.10M | -8.55M | -1.26M | 3.27M | 1.67M | 0.00 | 0.00 |

| Net Income | -48.67M | -340.65M | 193.20M | -288.24M | 173.74M | 102.89M | 91.98M | 67.55M | 78.01M | 136.19M | 68.96M | 28.28M | 4.78M | 6.81M | 11.67M | -24.11M | -55.27M | -15.03M | -5.34M | 4.95M | 13.73M | 3.75M | 1.88M | 527.00K |

| Net Income Ratio | -23.17% | -4,028.49% | 72.49% | 138.93% | 78.29% | 72.39% | 75.52% | 64.31% | 63.22% | 72.30% | 75.88% | 69.53% | 30.74% | 43.48% | 57.94% | 199.00% | 578.36% | -358.05% | -10.87% | 12.36% | 316.04% | 285.60% | 669.40% | 353.69% |

| EPS | -0.99 | -3.61 | 2.03 | -3.11 | 3.14 | 2.79 | 2.72 | 2.00 | 2.48 | 5.92 | 4.44 | 4.32 | 1.84 | 2.88 | 5.00 | -11.66 | -121.87 | -166.64 | -11.95 | 56.00 | 30.23 | 84.29 | 42.28 | 11.84 |

| EPS Diluted | -0.99 | -3.61 | 2.03 | -3.11 | 2.86 | 2.79 | 2.64 | 2.00 | 2.48 | 5.92 | 4.44 | 4.32 | 1.84 | 2.88 | 4.76 | -11.66 | -121.87 | -166.64 | -11.95 | 56.00 | 30.23 | 84.29 | 42.28 | 11.84 |

| Weighted Avg Shares Out | 91.04M | 94.32M | 94.81M | 92.61M | 60.65M | 36.86M | 27.96M | 27.40M | 27.10M | 21.97M | 14.78M | 6.52M | 2.62M | 2.36M | 2.34M | 2.07M | 453.50K | 90.20K | 446.83K | 444.93K | 454.05K | 44.49K | 44.49K | 44.49K |

| Weighted Avg Shares Out (Dil) | 91.04M | 94.32M | 95.24M | 92.75M | 60.65M | 36.86M | 32.59M | 27.40M | 27.10M | 21.97M | 14.78M | 6.52M | 2.62M | 2.36M | 2.97M | 2.07M | 453.50K | 90.20K | 446.83K | 445.00K | 454.05K | 44.49K | 44.49K | 44.49K |

The Fight Against Housing

New York Mortgage Trust (NYMT) Stock Sinks As Market Gains: What You Should Know

New York Mortgage Trust (NYMT) Stock Moves -1.49%: What You Should Know

How To Retire: It's The End Of The World As We Know It (And I Feel Fine)

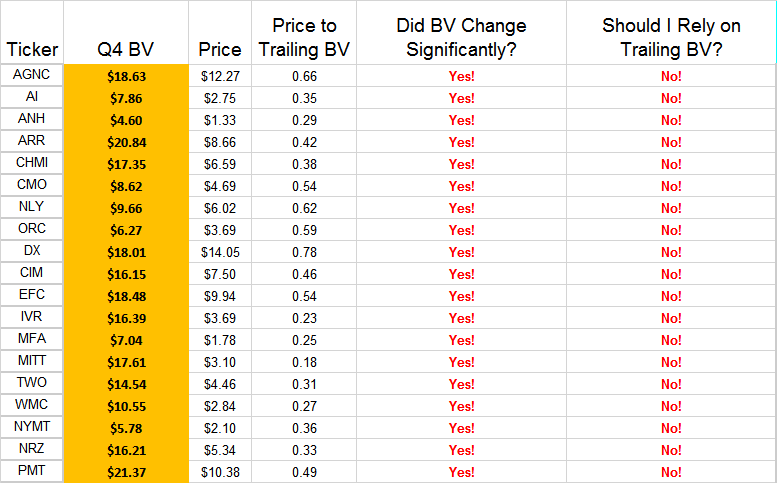

Quick And Dirty mREIT Discounts For 04/19/2020

New York Mortgage Trust (NYMT) Stock Sinks As Market Gains: What You Should Know

Morning Market Stats in 5 Minutes

Afternoon Market Stats in 5 Minutes

Stocks - Marathon, Spirit Aero Rise in Premarket on Crisis Measures

Edited Transcript of NYMT earnings conference call or presentation 22-Feb-19 2:00pm GMT

Source: https://incomestatements.info

Category: Stock Reports