See more : Alerio Gold Corp. (ALEEF) Income Statement Analysis – Financial Results

Complete financial analysis of Odyssey Marine Exploration, Inc. (OMEX) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Odyssey Marine Exploration, Inc., a leading company in the Specialty Business Services industry within the Industrials sector.

- Sasfin Holdings Limited (SFN.JO) Income Statement Analysis – Financial Results

- Maschinenfabrik Heid AG (HED.VI) Income Statement Analysis – Financial Results

- Nogin, Inc. (NOGN) Income Statement Analysis – Financial Results

- Alkyl Amines Chemicals Limited (ALKYLAMINE.BO) Income Statement Analysis – Financial Results

- Europlasma SA (1EZ0.BE) Income Statement Analysis – Financial Results

Odyssey Marine Exploration, Inc. (OMEX)

About Odyssey Marine Exploration, Inc.

Odyssey Marine Exploration, Inc., together with its subsidiaries, discovers, validates, and develops seafloor resources worldwide. The company provides specialized mineral exploration, project development, and marine services to clients. It also offers resource assessment, project planning, research, and project management services. The company was founded in 1986 and is headquartered in Tampa, Florida.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 803.80K | 1.33M | 921.24K | 2.04M | 3.07M | 3.28M | 1.25M | 4.68M | 5.33M | 1.32M | 23.91M | 13.20M | 15.73M | 21.00M | 4.35M | 4.10M | 6.15M | 5.06M | 10.04M | 0.00 | 73.88K | 0.00 | 9.98K | 1.00 | 250.00 | 235.75K | 13.50K | 0.00 | 2.11K |

| Cost of Revenue | 4.30M | 9.89M | 9.55M | 10.92M | 7.93M | 3.69M | 3.44M | 8.27M | 12.88M | 19.72M | 26.72M | 18.18M | 21.70M | 19.76M | 680.53K | 631.61K | 2.29M | 1.09M | 1.10M | 0.00 | 2.41M | 1.16M | 782.96K | 605.87K | 404.29K | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | -3.49M | -8.56M | -8.63M | -8.89M | -4.85M | -412.81K | -2.19M | -3.58M | -7.55M | -18.40M | -2.81M | -4.98M | -5.98M | 1.24M | 3.67M | 3.47M | 3.86M | 3.98M | 8.94M | 0.00 | -2.33M | -1.16M | -772.98K | -605.87K | -404.04K | 235.75K | 13.50K | 0.00 | 2.11K |

| Gross Profit Ratio | -434.73% | -641.11% | -936.72% | -435.92% | -157.98% | -12.60% | -175.41% | -76.54% | -141.56% | -1,391.01% | -11.73% | -37.73% | -38.00% | 5.90% | 84.35% | 84.61% | 62.72% | 78.52% | 89.06% | 0.00% | -3,156.99% | 0.00% | -7,749.19% | -60,586,500.00% | -161,616.80% | 100.00% | 100.00% | 0.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 3.69M | 3.44M | 8.27M | 11.43M | 19.48M | 26.02M | 17.94M | 21.29M | 19.57M | 12.59M | 18.61M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 23.97K | 169.32K | 171.37K | 229.61K | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 5.65M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 384.14K | 520.70K | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 88.77K | 51.61K | 0.00 | 0.00 |

| SG&A | 6.84M | 8.49M | 6.32M | 3.75M | 5.49M | 5.65M | 6.17M | 7.96M | 11.46M | 9.79M | 14.16M | 10.61M | 9.39M | 9.15M | 9.43M | 9.83M | 27.62M | 23.72M | 20.59M | 0.00 | 5.21M | 1.44M | 681.07K | 804.85K | 486.07K | 472.92K | 572.31K | 0.00 | 0.00 |

| Other Expenses | 0.00 | -164.61K | 4.06M | -36.21K | 819.52K | 48.80K | 63.07K | 467.40K | 388.60K | 104.92K | 581.54K | 9.00K | 47.55K | 44.76K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 6.84M | 8.49M | 6.32M | 3.75M | 5.49M | 5.65M | 6.17M | 7.96M | 11.46M | 9.79M | 14.16M | 10.61M | 9.39M | 17.65M | 22.02M | 28.44M | 27.62M | 23.72M | 20.59M | 0.00 | 5.21M | 1.46M | 850.39K | 1.01M | 743.94K | 1.05M | 1.02M | 38.01K | 76.26K |

| Cost & Expenses | 11.14M | 18.38M | 15.87M | 14.67M | 13.42M | 9.34M | 9.61M | 16.23M | 24.33M | 29.52M | 40.88M | 28.78M | 31.10M | 37.41M | 22.70M | 29.07M | 29.91M | 24.81M | 21.69M | 0.00 | 5.21M | 2.62M | 1.63M | 1.62M | 1.15M | 1.05M | 1.02M | 38.01K | 76.26K |

| Interest Income | 412.63K | 96.48K | 4.04K | 5.12K | 151.00 | 56.41K | 112.00 | 0.00 | 137.00 | 25.30K | 9.97K | 24.42K | 3.88K | 3.90K | 38.26K | 227.15K | 335.07K | 103.58K | 57.88K | 0.00 | 23.96K | 33.30K | 65.71K | 23.46K | 30.12K | 10.77K | 7.86K | 0.00 | 2.11K |

| Interest Expense | 5.04M | 14.09M | 10.83M | 6.92M | 5.36M | 3.14M | 2.73M | 2.40M | 4.55M | 1.56M | 3.58M | 6.26M | 1.16M | 515.88K | 334.36K | 196.41K | 475.37K | 305.64K | 121.44K | 0.00 | 109.23K | 5.62K | 5.76K | 93.66K | 101.90K | 61.79K | 111.65K | 0.00 | 0.00 |

| Depreciation & Amortization | 421.43K | 249.47K | 154.75K | 142.09K | 169.67K | 453.47K | 760.77K | 1.06M | 1.42M | 5.51M | 1.94M | 1.59M | 1.89M | 2.16M | 2.28M | 2.62M | 3.54M | 3.14M | 1.45M | 0.00 | 380.01K | 101.37K | 72.32K | 34.88K | 28.26K | 27.30K | 13.89K | 0.00 | 0.00 |

| EBITDA | 1.58M | -27.27M | -5.14M | -14.03M | -9.97M | -5.51M | -7.53M | -5.62M | -15.28M | -25.07M | -8.85M | -10.33M | -13.18M | -20.66M | -16.02M | -22.03M | -19.82M | -16.61M | -10.20M | 0.00 | -4.76M | -2.52M | -1.55M | -1.58M | -1.12M | -783.38K | -991.16K | -38.01K | -74.15K |

| EBITDA Ratio | 196.17% | -1,263.40% | -1,164.88% | -614.44% | -304.50% | -168.16% | -603.39% | -213.81% | -322.61% | -1,744.23% | -60.37% | -105.80% | -115.45% | -79.25% | -368.95% | -538.89% | -330.11% | -344.87% | -102.41% | 0.00% | -6,475.41% | 0.00% | -15,261.77% | -248,361,300.00% | -444,270.00% | -366.94% | -7,341.96% | 0.00% | -3,509.28% |

| Operating Income | -10.34M | -17.04M | -14.95M | -12.64M | -10.35M | -6.07M | -8.36M | -10.55M | -21.52M | -28.19M | -16.97M | -15.59M | -15.37M | -16.41M | -18.35M | -24.97M | -23.76M | -19.74M | -11.65M | 0.00 | -5.14M | -2.62M | -1.62M | -1.62M | -1.15M | -810.68K | -1.01M | -38.01K | -74.15K |

| Operating Income Ratio | -1,286.09% | -1,276.99% | -1,622.94% | -619.89% | -336.70% | -185.22% | -669.38% | -225.30% | -403.81% | -2,131.16% | -70.95% | -118.10% | -97.72% | -78.13% | -422.19% | -608.20% | -386.54% | -389.91% | -116.07% | 0.00% | -6,953.22% | 0.00% | -16,274.36% | -161,696,600.00% | -459,193.60% | -343.87% | -7,444.87% | 0.00% | -3,509.28% |

| Total Other Income/Expenses | 6.45M | -11.97M | -1.18M | -8.46M | -5.15M | -3.04M | -2.66M | 1.47M | 272.87K | -950.85K | 2.60M | -2.60M | -856.61K | -6.94M | -273.52K | 123.87K | -72.96K | 656.66K | 11.14K | 0.00 | -58.26K | 500.00 | -28.68K | 901.52K | -9.05K | 81.68K | 0.00 | 0.00 | 0.00 |

| Income Before Tax | -3.88M | -30.88M | -16.13M | -21.09M | -15.50M | -9.10M | -11.02M | -9.08M | -21.25M | -29.14M | -14.37M | -18.18M | -16.23M | -23.34M | -18.63M | -24.84M | -23.83M | -19.09M | -11.64M | 0.00 | -5.20M | -2.62M | -1.65M | -715.44K | -1.16M | -729.00K | 0.00 | -38.01K | -74.15K |

| Income Before Tax Ratio | -483.28% | -2,313.87% | -1,750.66% | -1,034.79% | -504.39% | -277.93% | -882.77% | -193.85% | -398.69% | -2,203.03% | -60.07% | -137.78% | -103.17% | -111.15% | -428.48% | -605.18% | -387.72% | -376.94% | -115.96% | 0.00% | -7,032.07% | 0.00% | -16,561.88% | -71,544,200.00% | -462,812.00% | -309.23% | 0.00% | 0.00% | -3,509.28% |

| Income Tax Expense | 0.00 | 6.18M | 8.72M | 599.01K | 1.12M | -740.77K | -471.36K | 102.34K | 1.90M | -481.06K | 496.06K | 6.27M | -3.53M | -1.89M | 334.36K | 196.41K | 72.96K | -656.66K | 3.28M | 0.00 | -5.76M | -28.18K | -31.26K | -831.32K | 80.84K | -30.65K | 103.79K | 0.00 | 0.00 |

| Net Income | 5.35M | -23.14M | -9.96M | -14.81M | -10.44M | -5.17M | -7.76M | -6.32M | -18.21M | -26.47M | -10.74M | -18.18M | -16.23M | -23.34M | -18.63M | -24.84M | -23.83M | -19.09M | -14.92M | 0.00 | 566.88K | -2.59M | -1.59M | -785.64K | -1.23M | -780.03K | -1.11M | -38.01K | -74.15K |

| Net Income Ratio | 665.07% | -1,733.78% | -1,080.76% | -726.68% | -339.73% | -157.90% | -621.52% | -134.87% | -341.58% | -2,001.17% | -44.92% | -137.78% | -103.17% | -111.15% | -428.48% | -605.18% | -387.72% | -376.94% | -148.66% | 0.00% | 767.31% | 0.00% | -15,960.93% | -78,564,200.00% | -491,527.60% | -330.87% | -8,213.70% | 0.00% | -3,509.28% |

| EPS | 0.27 | -1.34 | -0.75 | -1.41 | -1.12 | -0.60 | -0.95 | -0.84 | -2.46 | -3.74 | -1.57 | -2.95 | -2.77 | -4.27 | -3.98 | -6.06 | -6.07 | -4.96 | -4.23 | 0.00 | 0.24 | -1.12 | -0.90 | -0.71 | -1.39 | -0.91 | -2.33 | -0.05 | -0.36 |

| EPS Diluted | 0.27 | -1.34 | -0.75 | -1.41 | -1.12 | -0.60 | -0.95 | -0.84 | -2.46 | -3.74 | -1.57 | -2.95 | -2.77 | -4.27 | -3.98 | -6.06 | -6.07 | -4.96 | -4.23 | 0.00 | 0.24 | -1.12 | -0.90 | -0.71 | -1.39 | -0.91 | -2.33 | -0.05 | -0.36 |

| Weighted Avg Shares Out | 19.94M | 17.31M | 13.30M | 10.54M | 9.35M | 8.58M | 8.21M | 7.56M | 7.41M | 7.07M | 6.86M | 6.16M | 5.85M | 5.47M | 4.68M | 4.10M | 3.93M | 3.85M | 3.53M | 0.00 | 2.36M | 2.31M | 1.76M | 1.11M | 881.93K | 859.63K | 476.78K | 696.70K | 203.33K |

| Weighted Avg Shares Out (Dil) | 20.12M | 17.31M | 13.30M | 10.54M | 9.35M | 8.58M | 8.21M | 7.56M | 7.41M | 7.07M | 6.86M | 6.16M | 5.85M | 5.47M | 4.68M | 4.10M | 3.93M | 3.85M | 3.53M | 0.00 | 2.36M | 2.31M | 1.76M | 1.11M | 881.93K | 859.63K | 476.78K | 696.70K | 203.33K |

Investor Group Led By Litigation Funder Drumcliffe Acquires Additional Equity Stake in Odyssey Marine Exploration, Inc. (NASDAQ:OMEX)

Odyssey Marine Exploration Reports Second Quarter 2021 Results

Odyssey Marine Exploration Reports First Quarter 2021 Results

Odyssey Marine Exploration Reports Full Year 2020 Results and Updates Current Projects

Odyssey Marine Exploration's First Memorial in NAFTA Case Published

Odyssey Marine Exploration Prepared for Strong 2021 with Increased NAFTA Funding and 2020 Successes

Odyssey Marine Exploration Reports Third Quarter 2020 Results

'A miracle if anyone got clean': Australia's drug users fight for treatment during pandemic

Allied Esports’ VIE.gg CS:GO Legend Series Reaches 1.7 Million Unique Viewers

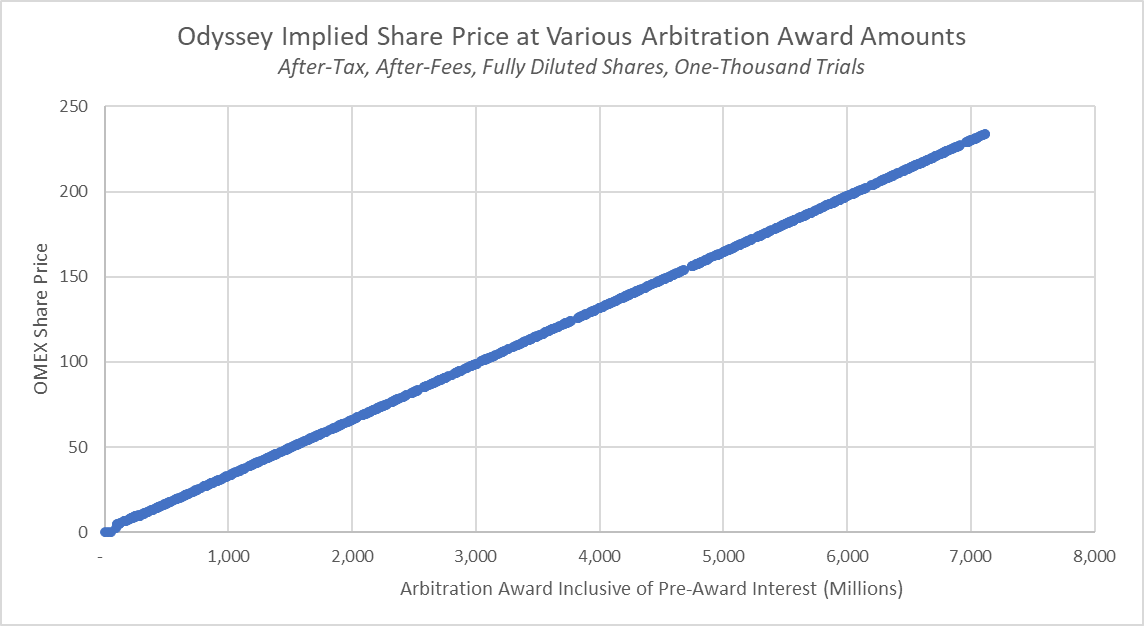

Odyssey Marine Exploration: Arbitration Arbitrage And 100%+ Upside

Source: https://incomestatements.info

Category: Stock Reports