See more : Aktiebolaget Fastator (publ) (FASTAT.ST) Income Statement Analysis – Financial Results

Complete financial analysis of Odyssey Marine Exploration, Inc. (OMEX) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Odyssey Marine Exploration, Inc., a leading company in the Specialty Business Services industry within the Industrials sector.

- ThinkSmart Limited (TSLMF) Income Statement Analysis – Financial Results

- Mordechai Aviv Taasiot Beniyah (1973) Ltd. (AVIV.TA) Income Statement Analysis – Financial Results

- Calumet Specialty Products Partners, L.P. (CLMT) Income Statement Analysis – Financial Results

- FP Newspapers Inc. (FPNUF) Income Statement Analysis – Financial Results

- Sunfly Intelligent Technology Co., LTD (300423.SZ) Income Statement Analysis – Financial Results

Odyssey Marine Exploration, Inc. (OMEX)

About Odyssey Marine Exploration, Inc.

Odyssey Marine Exploration, Inc., together with its subsidiaries, discovers, validates, and develops seafloor resources worldwide. The company provides specialized mineral exploration, project development, and marine services to clients. It also offers resource assessment, project planning, research, and project management services. The company was founded in 1986 and is headquartered in Tampa, Florida.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 803.80K | 1.33M | 921.24K | 2.04M | 3.07M | 3.28M | 1.25M | 4.68M | 5.33M | 1.32M | 23.91M | 13.20M | 15.73M | 21.00M | 4.35M | 4.10M | 6.15M | 5.06M | 10.04M | 0.00 | 73.88K | 0.00 | 9.98K | 1.00 | 250.00 | 235.75K | 13.50K | 0.00 | 2.11K |

| Cost of Revenue | 4.30M | 9.89M | 9.55M | 10.92M | 7.93M | 3.69M | 3.44M | 8.27M | 12.88M | 19.72M | 26.72M | 18.18M | 21.70M | 19.76M | 680.53K | 631.61K | 2.29M | 1.09M | 1.10M | 0.00 | 2.41M | 1.16M | 782.96K | 605.87K | 404.29K | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | -3.49M | -8.56M | -8.63M | -8.89M | -4.85M | -412.81K | -2.19M | -3.58M | -7.55M | -18.40M | -2.81M | -4.98M | -5.98M | 1.24M | 3.67M | 3.47M | 3.86M | 3.98M | 8.94M | 0.00 | -2.33M | -1.16M | -772.98K | -605.87K | -404.04K | 235.75K | 13.50K | 0.00 | 2.11K |

| Gross Profit Ratio | -434.73% | -641.11% | -936.72% | -435.92% | -157.98% | -12.60% | -175.41% | -76.54% | -141.56% | -1,391.01% | -11.73% | -37.73% | -38.00% | 5.90% | 84.35% | 84.61% | 62.72% | 78.52% | 89.06% | 0.00% | -3,156.99% | 0.00% | -7,749.19% | -60,586,500.00% | -161,616.80% | 100.00% | 100.00% | 0.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 3.69M | 3.44M | 8.27M | 11.43M | 19.48M | 26.02M | 17.94M | 21.29M | 19.57M | 12.59M | 18.61M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 23.97K | 169.32K | 171.37K | 229.61K | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 5.65M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 384.14K | 520.70K | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 88.77K | 51.61K | 0.00 | 0.00 |

| SG&A | 6.84M | 8.49M | 6.32M | 3.75M | 5.49M | 5.65M | 6.17M | 7.96M | 11.46M | 9.79M | 14.16M | 10.61M | 9.39M | 9.15M | 9.43M | 9.83M | 27.62M | 23.72M | 20.59M | 0.00 | 5.21M | 1.44M | 681.07K | 804.85K | 486.07K | 472.92K | 572.31K | 0.00 | 0.00 |

| Other Expenses | 0.00 | -164.61K | 4.06M | -36.21K | 819.52K | 48.80K | 63.07K | 467.40K | 388.60K | 104.92K | 581.54K | 9.00K | 47.55K | 44.76K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 6.84M | 8.49M | 6.32M | 3.75M | 5.49M | 5.65M | 6.17M | 7.96M | 11.46M | 9.79M | 14.16M | 10.61M | 9.39M | 17.65M | 22.02M | 28.44M | 27.62M | 23.72M | 20.59M | 0.00 | 5.21M | 1.46M | 850.39K | 1.01M | 743.94K | 1.05M | 1.02M | 38.01K | 76.26K |

| Cost & Expenses | 11.14M | 18.38M | 15.87M | 14.67M | 13.42M | 9.34M | 9.61M | 16.23M | 24.33M | 29.52M | 40.88M | 28.78M | 31.10M | 37.41M | 22.70M | 29.07M | 29.91M | 24.81M | 21.69M | 0.00 | 5.21M | 2.62M | 1.63M | 1.62M | 1.15M | 1.05M | 1.02M | 38.01K | 76.26K |

| Interest Income | 412.63K | 96.48K | 4.04K | 5.12K | 151.00 | 56.41K | 112.00 | 0.00 | 137.00 | 25.30K | 9.97K | 24.42K | 3.88K | 3.90K | 38.26K | 227.15K | 335.07K | 103.58K | 57.88K | 0.00 | 23.96K | 33.30K | 65.71K | 23.46K | 30.12K | 10.77K | 7.86K | 0.00 | 2.11K |

| Interest Expense | 5.04M | 14.09M | 10.83M | 6.92M | 5.36M | 3.14M | 2.73M | 2.40M | 4.55M | 1.56M | 3.58M | 6.26M | 1.16M | 515.88K | 334.36K | 196.41K | 475.37K | 305.64K | 121.44K | 0.00 | 109.23K | 5.62K | 5.76K | 93.66K | 101.90K | 61.79K | 111.65K | 0.00 | 0.00 |

| Depreciation & Amortization | 421.43K | 249.47K | 154.75K | 142.09K | 169.67K | 453.47K | 760.77K | 1.06M | 1.42M | 5.51M | 1.94M | 1.59M | 1.89M | 2.16M | 2.28M | 2.62M | 3.54M | 3.14M | 1.45M | 0.00 | 380.01K | 101.37K | 72.32K | 34.88K | 28.26K | 27.30K | 13.89K | 0.00 | 0.00 |

| EBITDA | 1.58M | -27.27M | -5.14M | -14.03M | -9.97M | -5.51M | -7.53M | -5.62M | -15.28M | -25.07M | -8.85M | -10.33M | -13.18M | -20.66M | -16.02M | -22.03M | -19.82M | -16.61M | -10.20M | 0.00 | -4.76M | -2.52M | -1.55M | -1.58M | -1.12M | -783.38K | -991.16K | -38.01K | -74.15K |

| EBITDA Ratio | 196.17% | -1,263.40% | -1,164.88% | -614.44% | -304.50% | -168.16% | -603.39% | -213.81% | -322.61% | -1,744.23% | -60.37% | -105.80% | -115.45% | -79.25% | -368.95% | -538.89% | -330.11% | -344.87% | -102.41% | 0.00% | -6,475.41% | 0.00% | -15,261.77% | -248,361,300.00% | -444,270.00% | -366.94% | -7,341.96% | 0.00% | -3,509.28% |

| Operating Income | -10.34M | -17.04M | -14.95M | -12.64M | -10.35M | -6.07M | -8.36M | -10.55M | -21.52M | -28.19M | -16.97M | -15.59M | -15.37M | -16.41M | -18.35M | -24.97M | -23.76M | -19.74M | -11.65M | 0.00 | -5.14M | -2.62M | -1.62M | -1.62M | -1.15M | -810.68K | -1.01M | -38.01K | -74.15K |

| Operating Income Ratio | -1,286.09% | -1,276.99% | -1,622.94% | -619.89% | -336.70% | -185.22% | -669.38% | -225.30% | -403.81% | -2,131.16% | -70.95% | -118.10% | -97.72% | -78.13% | -422.19% | -608.20% | -386.54% | -389.91% | -116.07% | 0.00% | -6,953.22% | 0.00% | -16,274.36% | -161,696,600.00% | -459,193.60% | -343.87% | -7,444.87% | 0.00% | -3,509.28% |

| Total Other Income/Expenses | 6.45M | -11.97M | -1.18M | -8.46M | -5.15M | -3.04M | -2.66M | 1.47M | 272.87K | -950.85K | 2.60M | -2.60M | -856.61K | -6.94M | -273.52K | 123.87K | -72.96K | 656.66K | 11.14K | 0.00 | -58.26K | 500.00 | -28.68K | 901.52K | -9.05K | 81.68K | 0.00 | 0.00 | 0.00 |

| Income Before Tax | -3.88M | -30.88M | -16.13M | -21.09M | -15.50M | -9.10M | -11.02M | -9.08M | -21.25M | -29.14M | -14.37M | -18.18M | -16.23M | -23.34M | -18.63M | -24.84M | -23.83M | -19.09M | -11.64M | 0.00 | -5.20M | -2.62M | -1.65M | -715.44K | -1.16M | -729.00K | 0.00 | -38.01K | -74.15K |

| Income Before Tax Ratio | -483.28% | -2,313.87% | -1,750.66% | -1,034.79% | -504.39% | -277.93% | -882.77% | -193.85% | -398.69% | -2,203.03% | -60.07% | -137.78% | -103.17% | -111.15% | -428.48% | -605.18% | -387.72% | -376.94% | -115.96% | 0.00% | -7,032.07% | 0.00% | -16,561.88% | -71,544,200.00% | -462,812.00% | -309.23% | 0.00% | 0.00% | -3,509.28% |

| Income Tax Expense | 0.00 | 6.18M | 8.72M | 599.01K | 1.12M | -740.77K | -471.36K | 102.34K | 1.90M | -481.06K | 496.06K | 6.27M | -3.53M | -1.89M | 334.36K | 196.41K | 72.96K | -656.66K | 3.28M | 0.00 | -5.76M | -28.18K | -31.26K | -831.32K | 80.84K | -30.65K | 103.79K | 0.00 | 0.00 |

| Net Income | 5.35M | -23.14M | -9.96M | -14.81M | -10.44M | -5.17M | -7.76M | -6.32M | -18.21M | -26.47M | -10.74M | -18.18M | -16.23M | -23.34M | -18.63M | -24.84M | -23.83M | -19.09M | -14.92M | 0.00 | 566.88K | -2.59M | -1.59M | -785.64K | -1.23M | -780.03K | -1.11M | -38.01K | -74.15K |

| Net Income Ratio | 665.07% | -1,733.78% | -1,080.76% | -726.68% | -339.73% | -157.90% | -621.52% | -134.87% | -341.58% | -2,001.17% | -44.92% | -137.78% | -103.17% | -111.15% | -428.48% | -605.18% | -387.72% | -376.94% | -148.66% | 0.00% | 767.31% | 0.00% | -15,960.93% | -78,564,200.00% | -491,527.60% | -330.87% | -8,213.70% | 0.00% | -3,509.28% |

| EPS | 0.27 | -1.34 | -0.75 | -1.41 | -1.12 | -0.60 | -0.95 | -0.84 | -2.46 | -3.74 | -1.57 | -2.95 | -2.77 | -4.27 | -3.98 | -6.06 | -6.07 | -4.96 | -4.23 | 0.00 | 0.24 | -1.12 | -0.90 | -0.71 | -1.39 | -0.91 | -2.33 | -0.05 | -0.36 |

| EPS Diluted | 0.27 | -1.34 | -0.75 | -1.41 | -1.12 | -0.60 | -0.95 | -0.84 | -2.46 | -3.74 | -1.57 | -2.95 | -2.77 | -4.27 | -3.98 | -6.06 | -6.07 | -4.96 | -4.23 | 0.00 | 0.24 | -1.12 | -0.90 | -0.71 | -1.39 | -0.91 | -2.33 | -0.05 | -0.36 |

| Weighted Avg Shares Out | 19.94M | 17.31M | 13.30M | 10.54M | 9.35M | 8.58M | 8.21M | 7.56M | 7.41M | 7.07M | 6.86M | 6.16M | 5.85M | 5.47M | 4.68M | 4.10M | 3.93M | 3.85M | 3.53M | 0.00 | 2.36M | 2.31M | 1.76M | 1.11M | 881.93K | 859.63K | 476.78K | 696.70K | 203.33K |

| Weighted Avg Shares Out (Dil) | 20.12M | 17.31M | 13.30M | 10.54M | 9.35M | 8.58M | 8.21M | 7.56M | 7.41M | 7.07M | 6.86M | 6.16M | 5.85M | 5.47M | 4.68M | 4.10M | 3.93M | 3.85M | 3.53M | 0.00 | 2.36M | 2.31M | 1.76M | 1.11M | 881.93K | 859.63K | 476.78K | 696.70K | 203.33K |

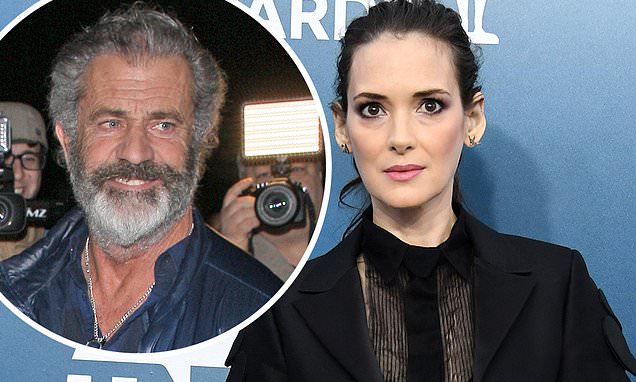

Winona Ryder claims Mel Gibson called her an 'oven-dodger'

Odyssey Marine Exploration (NASDAQ:OMEX) Stock Price Crosses Above 200-Day Moving Average of $3.89

10 Mind-Blowing Psychological Thrillers From The 2010s (That Will Stick With You For Days)

Elite: Dangerous Odyssey — Everything you need to know

You don't have to pay to fall in love with these Android games!

Today's Best Game Deals: Donkey Kong Tropical Freeze $42, Celeste $7, more - 9to5Toys

Multiple organizations bidding to acquire OneEleven from Oxford

The Elite: Dangerous Odyssey expansion will launch without VR

K2 Asset Management bolsters FUM, takes on Asia

CAFC Finds Administrative Procedures Act Claims Against USPTO Barred for Lack of Final Agency Action, Statute of Limitations

Source: https://incomestatements.info

Category: Stock Reports