See more : Public Joint-Stock Company “Pharmsynthez” (LIFE.ME) Income Statement Analysis – Financial Results

Complete financial analysis of Old Point Financial Corporation (OPOF) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Old Point Financial Corporation, a leading company in the Banks – Regional industry within the Financial Services sector.

- Hexing Electrical Co.,Ltd. (603556.SS) Income Statement Analysis – Financial Results

- Port of Tauranga Limited (PTAUF) Income Statement Analysis – Financial Results

- Advanced Info Service Public Company Limited (ADVANC-R.BK) Income Statement Analysis – Financial Results

- Pioneer Natural Resources Company (0KIX.L) Income Statement Analysis – Financial Results

- Xinhua Winshare Publishing and Media Co., Ltd. (601811.SS) Income Statement Analysis – Financial Results

Old Point Financial Corporation (OPOF)

About Old Point Financial Corporation

Old Point Financial Corporation operates as the bank holding company for The Old Point National Bank of Phoebus that provides consumer, mortgage, and business banking services for individual and commercial customers in Virginia. The company offers deposit products, including interest-bearing transaction accounts, money market deposit accounts, savings accounts, time deposits, and demand deposits. It also provides real estate construction, commercial, and mortgage loans, such as residential 1-4 family mortgages, multi-family and second mortgages, and equity lines of credit; and other loans, as well as cash management services. In addition, the company offers retirement planning, estate planning, financial planning, estate and trust administration, retirement plan administration, tax, and investment management services; and insurance products and wealth management services. It operates 14 branches in the Hampton Roads localities of Hampton, Newport News, Norfolk, Virginia Beach, Chesapeake, Williamsburg/James City County, York County, and Isle of Wight County; a loan production office in Richmond, Virginia; and a mortgage loan origination office in Charlotte, North Carolina. The company was founded in 1922 and is headquartered in Hampton, Virginia.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 59.47M | 55.72M | 53.68M | 48.50M | 47.90M | 46.56M | 43.43M | 40.33M | 39.80M | 39.08M | 37.92M | 41.77M | 41.73M | 43.55M | 39.97M | 40.22M | 38.16M | 36.02M | 34.53M | 33.81M | 30.99M | 29.30M | 25.49M | 22.62M | 21.01M | 5.56M | 4.87M | 4.74M | 4.67M | 4.19M | 4.27M | 6.35M |

| Cost of Revenue | -3.02M | 3.73M | 3.63M | 3.37M | 2.65M | 2.49M | 2.77M | 2.36M | 1.62M | 2.04M | 0.00 | 0.00 | 0.00 | 1.83M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 62.49M | 51.99M | 50.05M | 45.13M | 45.24M | 44.07M | 40.66M | 37.97M | 38.18M | 37.04M | 37.92M | 41.77M | 41.73M | 41.72M | 39.97M | 40.22M | 38.16M | 36.02M | 34.53M | 33.81M | 30.99M | 29.30M | 25.49M | 22.62M | 21.01M | 5.56M | 4.87M | 4.74M | 4.67M | 4.19M | 4.27M | 6.35M |

| Gross Profit Ratio | 105.08% | 93.31% | 93.24% | 93.05% | 94.46% | 94.66% | 93.63% | 94.16% | 95.94% | 94.78% | 100.00% | 100.00% | 100.00% | 95.81% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 31.43M | 28.05M | 26.08M | 26.17M | 24.82M | 24.03M | 25.49M | 21.31M | 22.67M | 22.20M | 21.36M | 22.46M | 23.43M | 23.41M | 22.53M | 17.04M | 15.93M | 15.19M | 14.38M | 13.20M | 12.11M | 11.08M | 10.12M | 9.34M | 8.68M | 7.80M | 7.67M | 7.41M | 7.18M | 7.05M | 6.81M | 5.95M |

| Selling & Marketing | 13.11M | 473.00K | 370.00K | 381.00K | 552.00K | 611.00K | 575.00K | 612.00K | 584.00K | 822.00K | 809.00K | 758.00K | 1.36M | 1.49M | 1.42M | 773.00K | 724.00K | 775.00K | 748.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 44.54M | 28.05M | 26.08M | 26.17M | 24.82M | 24.03M | 25.49M | 21.31M | 22.67M | 22.20M | 21.36M | 22.46M | 24.78M | 24.90M | 23.94M | 17.81M | 16.66M | 15.97M | 15.13M | 13.20M | 12.11M | 11.08M | 10.12M | 9.34M | 8.68M | 7.80M | 7.67M | 7.41M | 7.18M | 7.05M | 6.81M | 5.95M |

| Other Expenses | 0.00 | -13.03M | -70.02M | -68.76M | -63.77M | -62.56M | -8.33M | -7.91M | 0.00 | 0.00 | -59.06M | -63.72M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -46.67M | -23.06M | -19.11M | -12.01M | -8.91M | -9.79M | 5.52M | 3.67M | 2.71M | 822.00K | 297.00K | -454.00K | -193.00K |

| Operating Expenses | 44.54M | 43.58M | -43.94M | -42.59M | -38.96M | -35.99M | 30.02M | 26.87M | 28.23M | 28.07M | -37.70M | -41.26M | 448.00K | 654.00K | 619.00K | 773.00K | 724.00K | 775.00K | 748.00K | -33.47M | -10.95M | -8.04M | -1.89M | 425.00K | -1.11M | 13.31M | 11.34M | 10.11M | 8.00M | 7.35M | 6.35M | 5.76M |

| Cost & Expenses | 44.54M | 47.31M | -43.94M | -42.59M | -38.96M | -35.99M | 32.78M | 29.23M | 29.84M | 30.11M | -37.70M | -41.26M | 448.00K | 2.48M | 619.00K | 773.00K | 724.00K | 775.00K | 748.00K | -33.47M | -10.95M | -8.04M | -1.89M | 425.00K | -1.11M | 13.31M | 11.34M | 10.11M | 8.00M | 7.35M | 6.35M | 5.76M |

| Interest Income | 66.30M | 47.96M | 42.18M | 39.88M | 40.02M | 37.97M | 32.78M | 29.71M | 30.16M | 30.16M | 29.73M | 32.48M | 36.19M | 40.84M | 41.26M | 46.50M | 49.02M | 44.89M | 36.49M | 33.64M | 33.17M | 34.11M | 35.11M | 33.64M | 29.48M | 27.81M | 25.24M | 23.38M | 21.53M | 19.23M | 19.11M | 20.99M |

| Interest Expense | 18.43M | 3.61M | 3.46M | 5.29M | 6.42M | 4.97M | 3.01M | 2.57M | 3.63M | 3.85M | 4.68M | 5.77M | 6.72M | 9.98M | 14.32M | 19.01M | 23.35M | 20.28M | 12.32M | 9.25M | 9.64M | 11.96M | 16.16M | 16.71M | 13.86M | 12.70M | 10.68M | 10.09M | 9.53M | 7.63M | 7.74M | 10.00M |

| Depreciation & Amortization | 2.58M | 2.42M | 2.44M | 2.53M | 2.54M | 2.47M | 2.74M | 2.73M | 2.54M | 2.28M | 1.95M | 1.88M | 1.82M | 1.94M | 1.85M | 1.77M | 1.69M | 1.54M | 1.39M | 1.30M | 1.37M | 1.44M | 1.48M | 1.38M | 1.25M | 990.00K | 941.00K | 883.00K | 768.00K | 884.00K | 919.00K | 704.00K |

| EBITDA | 0.00 | 730.00K | 358.00K | 219.00K | 235.00K | 151.00K | 151.00K | 597.00K | 453.00K | 180.00K | 214.00K | 0.00 | 6.17M | 3.64M | 7.19M | 11.21M | 12.82M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| EBITDA Ratio | 0.00% | 25.46% | 22.68% | 17.39% | 23.97% | 27.14% | 12.96% | 22.95% | 24.78% | 26.71% | 26.75% | 30.74% | 30.87% | 31.27% | 45.21% | 75.13% | 94.80% | 87.31% | 68.36% | 66.07% | 69.08% | 77.48% | 98.36% | 107.96% | 100.67% | 357.18% | 351.93% | 332.14% | 287.75% | 296.58% | 270.22% | 201.78% |

| Operating Income | 14.93M | 11.76M | 9.74M | 5.91M | 8.94M | 10.17M | 151.00K | 597.00K | 453.00K | 180.00K | 214.00K | 506.00K | 325.00K | 449.00K | 401.00K | 236.00K | 486.00K | 539.00K | 522.00K | 346.00K | 20.04M | 21.26M | 23.60M | 23.05M | 19.90M | 18.87M | 16.21M | 14.85M | 12.67M | 11.53M | 10.63M | 12.11M |

| Operating Income Ratio | 25.10% | 21.11% | 18.14% | 12.19% | 18.67% | 21.84% | 0.35% | 1.48% | 1.14% | 0.46% | 0.56% | 1.21% | 0.78% | 1.03% | 1.00% | 0.59% | 1.27% | 1.50% | 1.51% | 1.02% | 64.66% | 72.57% | 92.57% | 101.88% | 94.73% | 339.38% | 332.62% | 313.49% | 271.31% | 275.47% | 248.71% | 190.70% |

| Total Other Income/Expenses | -5.87M | -5.11M | 9.38M | -5.43M | 8.71M | -4.92M | -2.74M | -4.37M | -4.80M | -4.12M | -4.63M | 4.68M | -2.14M | -2.39M | -5.70M | -2.00M | -2.17M | 0.00 | 0.00 | 0.00 | -9.64M | -11.96M | -16.16M | -16.71M | -13.86M | -12.70M | -10.68M | -10.09M | -9.53M | -7.63M | -7.74M | -10.00M |

| Income Before Tax | 9.06M | 10.58M | 9.74M | 5.91M | 8.94M | 5.20M | -126.00K | 3.75M | 3.69M | 4.31M | 3.51M | 5.18M | 4.35M | 1.70M | 1.89M | 9.44M | 11.14M | 9.63M | 9.90M | 11.79M | 10.40M | 9.31M | 7.44M | 6.34M | 6.04M | 6.17M | 5.53M | 4.75M | 3.14M | 3.91M | 2.88M | 2.11M |

| Income Before Tax Ratio | 15.24% | 18.99% | 18.14% | 12.19% | 18.67% | 11.16% | -0.29% | 9.30% | 9.27% | 11.03% | 9.26% | 12.41% | 10.43% | 3.89% | 4.74% | 23.48% | 29.18% | 26.75% | 28.66% | 34.87% | 33.54% | 31.77% | 29.20% | 28.03% | 28.74% | 111.01% | 113.48% | 100.38% | 67.22% | 93.36% | 67.46% | 33.28% |

| Income Tax Expense | 1.33M | 1.47M | 1.30M | 521.00K | 1.08M | 279.00K | -97.00K | 82.00K | 54.00K | 196.00K | 348.00K | 995.00K | 1.06M | 149.00K | 211.00K | 2.65M | 3.17M | 2.61M | 2.63M | 3.21M | 2.57M | 2.26M | 1.73M | 1.21M | 1.22M | 1.54M | 1.44M | 1.31M | 797.00K | 1.14M | 667.00K | 376.00K |

| Net Income | 7.73M | 9.11M | 8.44M | 5.39M | 7.86M | 4.92M | -29.00K | 3.67M | 3.63M | 4.12M | 3.16M | 4.19M | 3.29M | 1.55M | 1.68M | 6.79M | 7.97M | 7.02M | 7.27M | 8.58M | 7.83M | 7.05M | 5.71M | 5.13M | 4.82M | 4.64M | 4.09M | 3.45M | 2.34M | 2.77M | 2.22M | 1.74M |

| Net Income Ratio | 13.00% | 16.35% | 15.72% | 11.11% | 16.41% | 10.57% | -0.07% | 9.10% | 9.13% | 10.53% | 8.34% | 10.03% | 7.88% | 3.55% | 4.21% | 16.88% | 20.88% | 19.50% | 21.05% | 25.38% | 25.25% | 24.07% | 22.40% | 22.69% | 22.95% | 83.37% | 83.91% | 72.74% | 50.15% | 66.23% | 51.85% | 27.36% |

| EPS | 1.54 | 1.80 | 1.61 | 1.03 | 1.51 | 0.96 | -0.01 | 0.77 | 0.73 | 0.83 | 0.64 | 0.84 | 0.66 | 0.31 | 0.34 | 1.39 | 1.61 | 1.41 | 1.45 | 1.72 | 1.58 | 1.44 | 1.18 | 1.06 | 1.00 | 0.96 | 0.85 | 1.45 | 0.98 | 1.17 | 0.94 | 0.75 |

| EPS Diluted | 1.54 | 1.80 | 1.61 | 1.03 | 1.51 | 0.96 | -0.01 | 0.77 | 0.73 | 0.83 | 0.64 | 0.84 | 0.66 | 0.31 | 0.34 | 1.38 | 1.59 | 1.39 | 1.42 | 1.68 | 1.54 | 1.42 | 1.17 | 1.06 | 0.99 | 0.95 | 0.85 | 1.45 | 0.98 | 1.17 | 0.94 | 0.75 |

| Weighted Avg Shares Out | 5.03M | 5.07M | 5.24M | 5.22M | 5.20M | 5.14M | 4.99M | 4.96M | 4.96M | 4.96M | 4.96M | 4.96M | 4.95M | 4.93M | 4.91M | 4.90M | 4.96M | 4.99M | 5.02M | 5.00M | 4.95M | 4.89M | 4.86M | 4.86M | 4.84M | 4.82M | 4.80M | 2.39M | 2.39M | 2.36M | 2.34M | 2.31M |

| Weighted Avg Shares Out (Dil) | 5.03M | 5.07M | 5.24M | 5.22M | 5.20M | 5.14M | 4.99M | 4.96M | 4.96M | 4.96M | 4.96M | 4.96M | 4.95M | 4.93M | 4.94M | 4.94M | 5.00M | 5.06M | 5.12M | 5.11M | 5.10M | 4.99M | 4.90M | 4.94M | 4.85M | 4.87M | 4.83M | 2.39M | 2.39M | 2.36M | 2.34M | 2.31M |

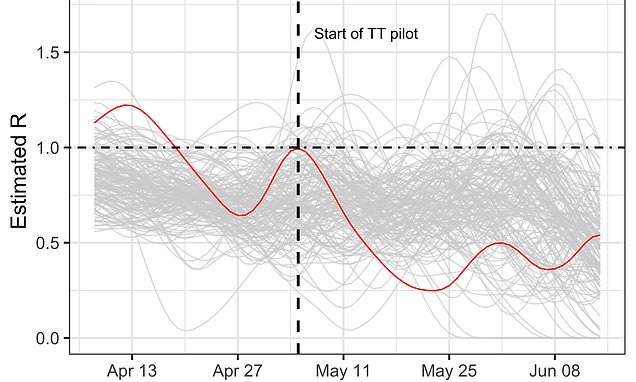

Test and Trace DID work on the Isle of Wight, study finds

English lockdown might have reduced COVID-19 infections more than thought, scientists say

Microsoft Co. (NASDAQ:MSFT) Shares Sold by OLD Point Trust & Financial Services N A

Plymouth UK’s big staycation boom winner as lockdown eased

10 places in UK will benefit most from staycation boom

10 places in UK will benefit most from staycation boom

Staycation boom to boost Plymouth and the Isle of Wight

House prices fall for first time in eight years

House prices fall for first time in eight years

Amazing ferry destinations comply with social distancing rules

Source: https://incomestatements.info

Category: Stock Reports