See more : AmRest Holdings SE (EAT.WA) Income Statement Analysis – Financial Results

Complete financial analysis of ORBCOMM Inc. (ORBC) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of ORBCOMM Inc., a leading company in the Communication Equipment industry within the Technology sector.

- PT Aneka Gas Industri Tbk (AGII.JK) Income Statement Analysis – Financial Results

- Valneva SE (VALN) Income Statement Analysis – Financial Results

- Zhejiang Hisun Pharmaceutical Co., Ltd. (600267.SS) Income Statement Analysis – Financial Results

- Metalyst Forgings Limited (METALFORGE.NS) Income Statement Analysis – Financial Results

- Zhejiang Bangjie Holding Group Co.,Ltd (002634.SZ) Income Statement Analysis – Financial Results

ORBCOMM Inc. (ORBC)

About ORBCOMM Inc.

ORBCOMM Inc. provides Internet of Things solutions in the United States, South America, Japan, Europe, and internationally. The company offers network connectivity, devices, device management, and web reporting applications that are designed to track, monitor, control, and enhance security for various assets, such as trailers, trucks, rail cars, sea containers, power generators, fluid tanks, marine vessels, diesel or electric powered generators, oil and gas wells, pipeline monitoring equipment, irrigation control systems, and utility meters in transportation and supply chain, heavy equipment, fixed asset monitoring, and maritime industries, as well as for governments. It also provides satellite automatic identification service data services for vessel navigation and to enhance maritime safety for government and commercial customers; and vehicle fleet management, as well as in-cab and fleet vehicle solutions using various network platforms, including its own constellation of low-Earth orbit satellites and accompanying ground infrastructure, as well as terrestrial-based cellular communication services through reseller agreements with various cellular wireless providers. In addition, the company offers customer solutions utilizing additional satellite network service options through service agreements with third party mobile satellite providers; and resells service using the two-way Inmarsat plc satellite network to provide higher bandwidth. It markets and sells its products and services directly to original equipment manufacturers, government customers, and end-users, as well as indirectly through market channel partners and affiliates. ORBCOMM Inc. was founded in 2001 and is headquartered in Rochelle Park, New Jersey.

| Metric | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 248.47M | 272.01M | 276.14M | 254.22M | 186.74M | 178.29M | 96.24M | 74.21M | 64.50M | 46.31M | 36.68M | 27.57M | 30.09M | 28.15M | 24.52M | 15.53M | 10.87M | 7.08M | 3.27M | 1.99M |

| Cost of Revenue | 114.73M | 130.64M | 146.63M | 150.19M | 92.95M | 90.52M | 48.68M | 37.93M | 30.59M | 22.44M | 14.19M | 27.15M | 15.91M | 18.07M | 20.81M | 12.68M | 10.81M | 0.00 | 6.91M | 5.34M |

| Gross Profit | 133.74M | 141.37M | 129.51M | 104.03M | 93.79M | 87.77M | 47.56M | 36.28M | 33.91M | 23.87M | 22.48M | 415.00K | 14.18M | 10.08M | 3.71M | 2.85M | 61.00K | 7.08M | -3.64M | -3.35M |

| Gross Profit Ratio | 53.83% | 51.97% | 46.90% | 40.92% | 50.23% | 49.23% | 49.42% | 48.89% | 52.57% | 51.54% | 61.30% | 1.51% | 47.13% | 35.82% | 15.15% | 18.32% | 0.56% | 100.00% | -111.38% | -168.34% |

| Research & Development | 12.72M | 14.72M | 13.41M | 8.94M | 6.25M | 6.47M | 2.90M | 2.80M | 2.46M | 1.24M | 663.00K | 714.00K | 1.12M | 1.06M | 1.81M | 1.34M | 778.00K | 0.00 | 439.00K | 275.00K |

| General & Administrative | 70.18M | 69.59M | 66.99M | 55.75M | 46.92M | 44.40M | 30.99M | 26.13M | 21.85M | 20.04M | 16.73M | 17.17M | 18.93M | 17.69M | 15.73M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 70.18M | 69.59M | 66.99M | 55.75M | 46.92M | 44.40M | 30.99M | 26.13M | 21.85M | 20.04M | 16.73M | 17.17M | 18.93M | 17.69M | 15.73M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Other Expenses | 50.74M | 50.70M | 49.68M | 45.68M | 42.80M | 26.57M | 10.86M | 0.00 | 0.00 | 0.00 | 0.00 | -44.25M | -1.37M | 0.00 | 0.00 | 9.34M | 8.65M | 0.00 | 5.79M | 4.59M |

| Operating Expenses | 133.63M | 135.01M | 130.08M | 110.38M | 95.97M | 77.44M | 44.74M | 28.92M | 24.31M | 21.27M | 17.39M | -26.36M | 18.68M | 18.75M | 17.55M | 10.69M | 9.42M | 0.00 | 6.23M | 4.87M |

| Cost & Expenses | 248.36M | 265.65M | 276.71M | 260.56M | 188.92M | 167.96M | 93.42M | 66.85M | 54.90M | 43.71M | 31.59M | 787.00K | 34.59M | 36.82M | 38.35M | 23.37M | 20.23M | 0.00 | 13.14M | 10.21M |

| Interest Income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 19.96M | 21.15M | 21.06M | 17.65M | 9.09M | 5.24M | 149.00K | 58.00K | 56.00K | 164.00K | 192.00K | 193.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 50.74M | 50.70M | 49.68M | 45.68M | 42.80M | 26.57M | 10.86M | 6.00M | 4.82M | 5.00M | 4.32M | 19.12M | 3.24M | 2.42M | 2.37M | 2.01M | 2.20M | -20.40M | 5.01M | -653.00K |

| EBITDA | 38.41M | 57.81M | 49.15M | 1.64M | 28.89M | 19.79M | 6.73M | 11.95M | 15.01M | 5.97M | -876.00K | 15.87M | -1.30M | -1.17M | -8.84M | -7.09M | -10.19M | -13.32M | -4.86M | -8.87M |

| EBITDA Ratio | 15.46% | 21.25% | 17.80% | 0.65% | 15.47% | 11.10% | 6.99% | 16.11% | 23.28% | 12.89% | -2.39% | 57.57% | -4.33% | -4.17% | -36.06% | -45.63% | -93.75% | -188.07% | -148.62% | -445.63% |

| Operating Income | 108.00K | 6.36M | -565.00K | -6.34M | -2.18M | 10.34M | 2.82M | 7.36M | 9.60M | 2.59M | 5.09M | 26.78M | -4.50M | -8.66M | -13.83M | -7.84M | -9.36M | 7.08M | -9.87M | -8.22M |

| Operating Income Ratio | 0.04% | 2.34% | -0.20% | -2.50% | -1.17% | 5.80% | 2.93% | 9.92% | 14.88% | 5.60% | 13.88% | 97.15% | -14.95% | -30.77% | -56.41% | -50.49% | -86.17% | 100.00% | -302.05% | -412.81% |

| Total Other Income/Expenses | -32.28M | -20.11M | -20.72M | -55.26M | -20.53M | -22.11M | -6.94M | -1.31M | 698.00K | -1.82M | -6.50M | -29.03M | 398.00K | 25.00K | 271.00K | -1.02M | -1.76M | 0.00 | 0.00 | 0.00 |

| Income Before Tax | -32.17M | -13.75M | -21.28M | -61.60M | -22.71M | -11.77M | -4.12M | 6.05M | 10.29M | 771.00K | -1.41M | -2.25M | -4.10M | -8.64M | -13.56M | -8.86M | -11.12M | 0.00 | 0.00 | 0.00 |

| Income Before Tax Ratio | -12.95% | -5.05% | -7.71% | -24.23% | -12.16% | -6.60% | -4.28% | 8.16% | 15.96% | 1.67% | -3.84% | -8.15% | -13.63% | -30.68% | -55.30% | -57.04% | -102.34% | 0.00% | 0.00% | 0.00% |

| Income Tax Expense | 1.66M | 4.38M | 4.66M | -409.00K | 517.00K | 1.23M | 408.00K | 1.30M | 1.39M | 827.00K | -216.00K | -28.83M | 398.00K | 25.00K | 271.00K | -1.02M | -1.76M | 20.40M | -5.01M | 653.00K |

| Net Income | -33.94M | -18.42M | -26.24M | -61.28M | -23.51M | -13.25M | -4.68M | 4.60M | 8.74M | -18.00K | -5.17M | -3.44M | -4.54M | -3.59M | -11.22M | -9.10M | -12.39M | -13.32M | -4.86M | -8.87M |

| Net Income Ratio | -13.66% | -6.77% | -9.50% | -24.11% | -12.59% | -7.43% | -4.87% | 6.20% | 13.55% | -0.04% | -14.09% | -12.48% | -15.09% | -12.75% | -45.74% | -58.59% | -114.02% | -188.07% | -148.62% | -445.63% |

| EPS | -0.43 | -0.23 | -0.34 | -0.84 | -0.33 | -0.19 | -0.08 | 0.10 | 0.19 | 0.00 | -0.12 | -0.08 | -0.11 | -0.09 | -1.32 | -1.07 | -1.46 | -0.37 | -0.83 | -1.52 |

| EPS Diluted | -0.43 | -0.23 | -0.34 | -0.84 | -0.33 | -0.19 | -0.08 | 0.09 | 0.18 | 0.00 | -0.12 | -0.08 | -0.11 | -0.09 | -1.32 | -1.07 | -1.46 | -0.37 | -0.57 | -1.04 |

| Weighted Avg Shares Out | 78.06M | 79.26M | 77.60M | 72.88M | 70.91M | 70.42M | 56.68M | 47.42M | 46.64M | 44.58M | 42.59M | 42.40M | 41.98M | 39.71M | 8.49M | 8.49M | 8.49M | 36.30M | 5.82M | 5.82M |

| Weighted Avg Shares Out (Dil) | 78.06M | 79.26M | 77.60M | 72.88M | 70.91M | 70.42M | 56.68M | 48.77M | 47.51M | 44.58M | 42.59M | 42.40M | 41.98M | 39.71M | 8.49M | 8.49M | 8.49M | 36.30M | 8.54M | 8.54M |

Africa Wildlife Tracking Leverages ORBCOMM’s Satellite IoT Technology to Support Conservation Efforts Around the World

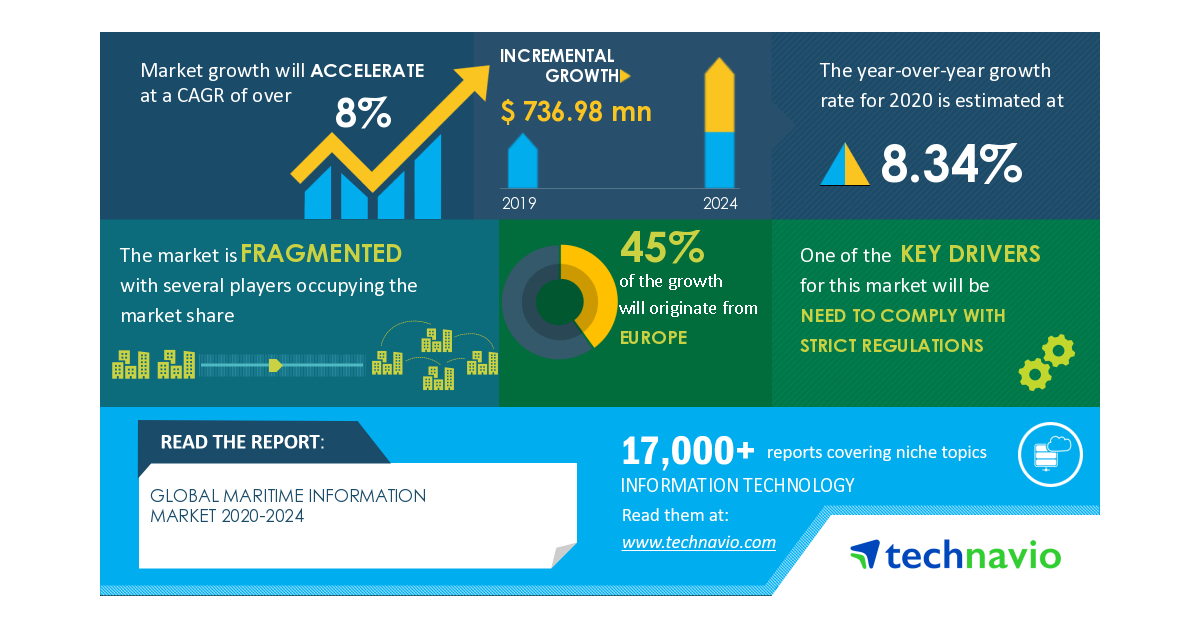

Maritime Information Market Will Showcase Positive Impact During 2020-2024 | Need to Comply With Strict Regulations to Boost the Market Growth | Technavio

Armellini Express Selects ORBCOMM’s In-Cab Solution to Boost Fleet Efficiency and Driver Performance

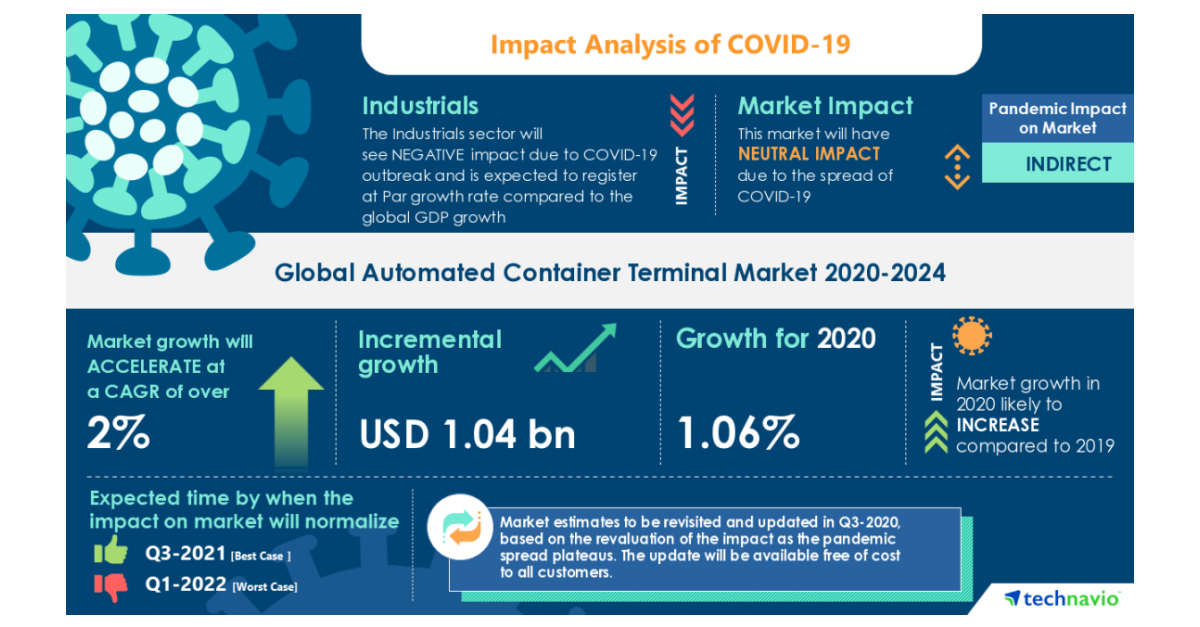

Maritime Information Market- Roadmap for Recovery from COVID-19 | Need To Comply With Strict Regulations to Boost the Market Growth | Technavio

Acorn Energy: Incremental Revenue All Drops To Bottom Line (OTCMKTS:ACFN)

ORBCOMM Appoints Rick Ochsendorf as Senior Vice President of Customer Operations for Its North America Transportation Business

ORBCOMM Receives 2020 IoT Evolution Product of the Year Award

ORBCOMM Receives 2020 IoT Evolution Product of the Year Award

Automated Container Terminal Market Highlights the Impact of COVID-19 2020-2024 | Robotization of Container Terminals in the US to Boost Market Growth | Technavio

ORBCOMM Inc. (ORBC) CEO Marc Eisenberg on Q2 2020 Results - Earnings Call Transcript

Source: https://incomestatements.info

Category: Stock Reports