See more : Team17 Group plc (TM17.L) Income Statement Analysis – Financial Results

Complete financial analysis of Orgenesis Inc. (ORGS) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Orgenesis Inc., a leading company in the Biotechnology industry within the Healthcare sector.

- Avanti Helium Corp. (AVN.V) Income Statement Analysis – Financial Results

- Seapeak LLC (SEAL-PA) Income Statement Analysis – Financial Results

- Truist Financial Corporation (TFC-PO) Income Statement Analysis – Financial Results

- AS VEF (UIJ.MU) Income Statement Analysis – Financial Results

- BT Brands, Inc. (BTBDW) Income Statement Analysis – Financial Results

Orgenesis Inc. (ORGS)

About Orgenesis Inc.

Orgenesis Inc., a biotech company, focusing on cell and gene therapies worldwide. The company develops a Point of Care (POCare) platform that includes a pipeline of licensed POCare therapeutics that are processed and produced in closed automated POCare technology systems across a collaborative POCare network. It focuses on autologous therapies, with processes and systems that are developed for each therapy using a closed and automated processing system approach that is validated for compliant production near the patient at their point of care for treatment of the patient. The company was formerly known as Business Outsourcing Service, Inc. and changed its name to Orgenesis Inc. in August 2011. Orgenesis Inc. was incorporated in 2008 and is based in Germantown, Maryland.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 530.00K | 36.03M | 35.50M | 7.65M | 33.26M | 18.66M | 10.09M | 6.40M | 2.97M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Cost of Revenue | 6.26M | 20.44M | 28.16M | 30.62M | 18.12M | 10.70M | 6.81M | 7.66M | 3.88M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 500.00 |

| Gross Profit | -5.73M | 15.59M | 7.34M | -22.97M | 15.14M | 7.96M | 3.28M | -1.26M | -906.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -500.00 |

| Gross Profit Ratio | -1,080.19% | 43.26% | 20.68% | -300.13% | 45.53% | 42.65% | 32.53% | -19.70% | -30.46% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Research & Development | 11.09M | 6.01M | 36.64M | 83.99M | 12.46M | 6.46M | 2.48M | 2.16M | 1.07M | 1.69M | 1.64M | 2.31M | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 34.62M | 16.16M | 15.40M | 19.35M | 25.25M | 16.61M | 10.69M | 6.45M | 4.04M | 2.88M | 3.82M | 2.68M | 72.35K | 21.17K | 25.65K | 0.00 |

| Selling & Marketing | 464.00K | -566.00K | -687.00K | -380.00K | 1.15M | 1.21M | 599.00K | 397.00K | 326.00K | 144.00K | 187.83K | 140.94K | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 34.62M | 16.16M | 14.71M | 18.97M | 25.25M | 16.61M | 10.69M | 6.45M | 4.04M | 2.88M | 3.82M | 2.68M | 72.35K | 21.17K | 25.65K | 3.00K |

| Other Expenses | 0.00 | 788.00K | -1.33M | 474.00K | 2.04M | -1.02M | 1.63M | 2.12M | 1.20M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 3.00K |

| Operating Expenses | 45.76M | 22.95M | 50.02M | 103.43M | 39.74M | 22.06M | 14.80M | 10.23M | 6.31M | 4.58M | 5.46M | 4.99M | 72.35K | 21.17K | 25.65K | 3.00K |

| Cost & Expenses | 52.01M | 43.39M | 50.02M | 103.43M | 57.86M | 32.75M | 21.60M | 17.88M | 10.19M | 4.58M | 5.46M | 4.99M | 72.35K | 21.17K | 25.65K | 3.50K |

| Interest Income | 0.00 | 1.82M | 943.00K | 1.25M | 498.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 2.17M | 1.82M | 1.29M | 1.06M | 461.00K | 2.75M | 1.23M | 689.00K | 696.00K | 691.09K | 172.51K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 1.56M | 1.98M | 1.86M | 1.44M | 3.81M | 2.62M | 2.60M | 2.92M | 1.99M | 4.55K | 3.26K | 1.41K | 0.00 | 15.00K | 0.00 | 0.00 |

| EBITDA | -60.72M | -8.30M | -15.72M | -94.21M | -18.91M | -12.39M | -9.85M | -9.04M | -2.64M | -4.80M | -5.36M | -5.00M | -72.35K | -6.17K | -25.65K | -3.50K |

| EBITDA Ratio | -11,456.23% | -19.15% | -39.00% | -1,244.08% | -62.73% | -65.47% | -100.96% | -135.77% | -175.52% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Operating Income | -53.64M | -7.37M | -42.68M | -95.78M | -24.60M | -14.65M | -11.23M | 11.28M | -7.21M | -4.58M | -5.46M | -4.99M | -72.35K | -21.17K | -25.65K | -3.50K |

| Operating Income Ratio | -10,120.00% | -20.45% | -120.22% | -1,251.71% | -73.98% | -78.53% | -111.31% | 176.29% | -242.47% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Total Other Income/Expenses | -10.81M | -1.85M | -1.15M | -1.63M | -47.00K | -2.83M | -3.66M | -1.26M | 1.85M | -927.10K | -78.66K | -519.21K | 0.00 | -15.00K | 0.00 | 0.00 |

| Income Before Tax | -64.44M | -11.96M | -17.95M | -96.74M | -25.48M | -17.77M | -13.68M | -10.74M | -5.36M | -5.50M | -5.54M | -5.00M | -72.35K | -36.17K | -25.65K | -3.50K |

| Income Before Tax Ratio | -12,159.43% | -33.20% | -50.56% | -1,264.19% | -76.61% | -95.24% | -135.56% | -167.91% | -180.26% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Income Tax Expense | 473.00K | 209.00K | 108.00K | -1.61M | 563.00K | 1.34M | -1.31M | -1.55M | -900.00K | 691.09K | 172.51K | 9.58K | 0.00 | 0.00 | 0.00 | 0.00 |

| Net Income | -55.36M | -12.17M | -18.06M | -95.13M | -26.04M | -18.29M | -12.37M | -9.19M | -4.46M | -5.50M | -5.54M | -5.00M | -72.35K | -36.17K | -25.65K | -3.50K |

| Net Income Ratio | -10,445.47% | -33.78% | -50.87% | -1,243.17% | -78.30% | -98.05% | -122.58% | -143.72% | -150.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| EPS | -1.91 | -0.48 | -0.74 | -4.46 | -1.64 | -1.37 | -1.28 | -1.08 | -0.96 | -1.22 | -1.32 | -1.11 | -0.01 | -0.01 | 0.00 | 0.00 |

| EPS Diluted | -1.91 | -0.48 | -0.74 | -4.46 | -1.64 | -1.37 | -1.27 | -1.08 | -0.94 | -1.21 | -1.32 | -1.11 | -0.01 | -0.01 | 0.00 | 0.00 |

| Weighted Avg Shares Out | 29.01M | 25.10M | 24.27M | 21.32M | 15.91M | 13.37M | 9.68M | 8.52M | 4.65M | 4.51M | 4.20M | 4.52M | 6.71M | 6.71M | 6.71M | 6.71M |

| Weighted Avg Shares Out (Dil) | 29.01M | 25.10M | 24.27M | 21.32M | 15.91M | 13.37M | 9.71M | 8.52M | 4.74M | 4.56M | 4.21M | 4.52M | 6.71M | 6.71M | 6.71M | 6.71M |

HC Wainwright Reiterates Buy Rating for Avid Bioservices (NASDAQ:CDMO)

Add Piramal Enterprises, target price Rs 1,420: ICICI Securities

Avid Bioservices, Inc. (NASDAQ: CDMO) Q4 2020 Earnings Call Transcript | AlphaStreet

Avid Bioservices, Inc. (CDMO) Q4 2020 Earnings Call Transcript | The Motley Fool

Implied Volatility Surging for Avid Bioservices (CDMO) Stock Options

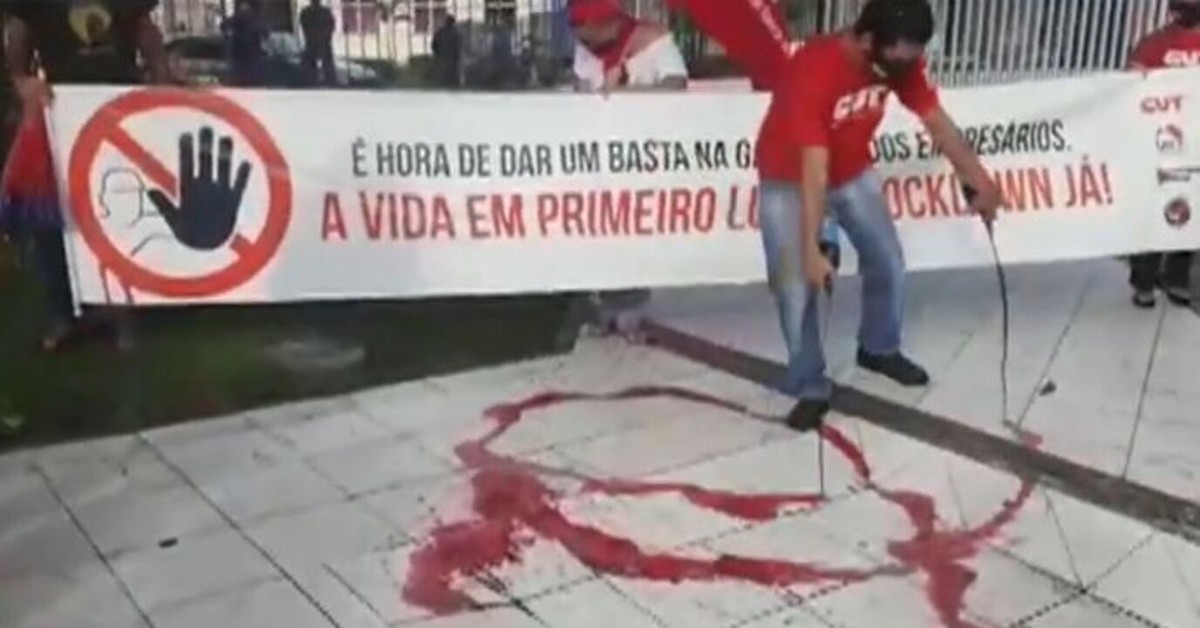

Ato contra afrouxamento das medidas de combate ao novo coronavírus é realizado em Aracaju

AGC Biologics erweitert Entwicklungskapazitäten für pDNA-Services am Standort Heidelberg

Source: https://incomestatements.info

Category: Stock Reports