See more : Shell plc (L3H.F) Income Statement Analysis – Financial Results

Complete financial analysis of Pangaea Logistics Solutions, Ltd. (PANL) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Pangaea Logistics Solutions, Ltd., a leading company in the Marine Shipping industry within the Industrials sector.

- Compugen Ltd. (CGEN.TA) Income Statement Analysis – Financial Results

- SOHM, Inc. (SHMN) Income Statement Analysis – Financial Results

- monday.com Ltd. (MNDY) Income Statement Analysis – Financial Results

- L&T Technology Services Limited (LTTS.NS) Income Statement Analysis – Financial Results

- Luxin Venture Capital Group Co., Ltd. (600783.SS) Income Statement Analysis – Financial Results

Pangaea Logistics Solutions, Ltd. (PANL)

About Pangaea Logistics Solutions, Ltd.

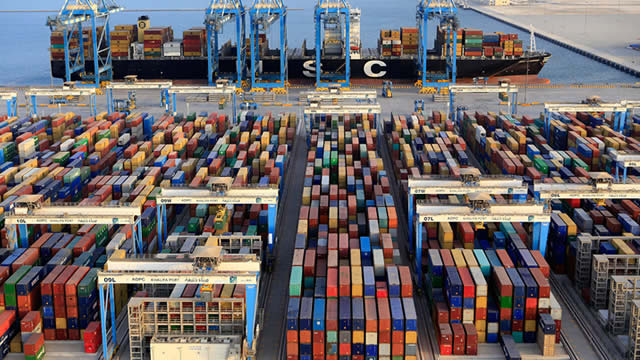

Pangaea Logistics Solutions, Ltd., together with its subsidiaries, provides seaborne dry bulk logistics and transportation services to industrial customers worldwide. The company offers various dry bulk cargoes, such as grains, coal, iron ore, pig iron, hot briquetted iron, bauxite, alumina, cement clinker, dolomite, and limestone. Its ocean logistics services comprise cargo loading, cargo discharge, vessel chartering, voyage planning, and technical vessel management. As of March 16, 2022, the company owned and operated a fleet of 25 vessels. Pangaea Logistics Solutions, Ltd. was founded in 1996 and is based in Newport, Rhode Island.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 499.27M | 699.71M | 718.10M | 382.90M | 412.20M | 372.97M | 385.09M | 238.02M | 287.33M | 398.28M | 392.47M | 387.06M |

| Cost of Revenue | 430.13M | 570.77M | 620.27M | 344.75M | 362.22M | 319.56M | 345.48M | 212.35M | 245.85M | 380.38M | 359.49M | 349.21M |

| Gross Profit | 69.14M | 128.94M | 97.84M | 38.14M | 49.97M | 53.42M | 39.61M | 25.67M | 41.49M | 17.90M | 32.98M | 37.85M |

| Gross Profit Ratio | 13.85% | 18.43% | 13.62% | 9.96% | 12.12% | 14.32% | 10.29% | 10.78% | 14.44% | 4.49% | 8.40% | 9.78% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 22.58M | 20.10M | 18.97M | 15.92M | 17.38M | 16.48M | 15.16M | 12.77M | 14.97M | 12.83M | 11.60M | 11.03M |

| Selling & Marketing | 200.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 22.78M | 20.10M | 18.97M | 15.92M | 17.38M | 16.48M | 15.16M | 12.77M | 14.97M | 12.83M | 11.60M | 11.03M |

| Other Expenses | 1.74M | 807.14K | 1.13M | 982.35K | 314.85K | 677.09K | 1.84M | -158.53K | -926.76K | -3.69M | 45.94K | 0.00 |

| Operating Expenses | 22.78M | 20.10M | 18.97M | 15.92M | 17.38M | 16.48M | 15.16M | 12.77M | 14.97M | 12.83M | 11.60M | 17.41M |

| Cost & Expenses | 454.65M | 590.87M | 639.23M | 360.67M | 379.60M | 336.04M | 360.64M | 225.12M | 260.81M | 393.21M | 371.09M | 366.61M |

| Interest Income | 3.57M | 21.49M | 11.51M | 7.83M | 9.28M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 4.53M |

| Interest Expense | 17.49M | 21.49M | 11.51M | 7.83M | 9.28M | 8.90M | 8.27M | 5.74M | 5.86M | 6.23M | 7.02M | 0.00 |

| Depreciation & Amortization | 30.07M | 29.49M | 22.97M | 17.06M | 18.53M | 17.62M | 15.61M | 14.11M | 12.73M | 11.67M | 9.61M | 6.68M |

| EBITDA | 76.10M | 138.32M | 101.85M | 39.28M | 44.86M | 54.55M | 40.92M | 27.00M | 39.25M | 4.25M | 32.15M | 26.32M |

| EBITDA Ratio | 15.24% | 19.88% | 14.34% | 10.52% | 12.48% | 14.81% | 10.88% | 11.28% | 13.34% | 3.27% | 7.91% | 6.80% |

| Operating Income | 44.62M | 105.51M | 78.87M | 19.70M | 32.91M | 36.07M | 15.17M | 12.89M | 20.53M | -2.49M | 21.38M | 19.64M |

| Operating Income Ratio | 8.94% | 15.08% | 10.98% | 5.14% | 7.98% | 9.67% | 3.94% | 5.42% | 7.14% | -0.63% | 5.45% | 5.08% |

| Total Other Income/Expenses | -15.62M | -20.00M | -6.50M | -7.00M | -6.21M | -12.09M | -6.93M | -3.73M | -7.16M | -11.15M | -5.87M | -3.73M |

| Income Before Tax | 29.00M | 85.51M | 72.37M | 12.69M | 17.05M | 23.98M | 9.10M | 9.16M | 13.37M | -13.65M | 15.51M | 15.91M |

| Income Before Tax Ratio | 5.81% | 12.22% | 10.08% | 3.31% | 4.14% | 6.43% | 2.36% | 3.85% | 4.65% | -3.43% | 3.95% | 4.11% |

| Income Tax Expense | 0.00 | 8.66M | 17.79M | 10.15M | 14.98M | 10.95M | 10.20M | -461.63K | 8.46M | 7.27M | -1.04M | 18.60M |

| Net Income | 26.32M | 79.49M | 67.23M | 2.54M | 2.07M | 17.76M | 7.81M | 7.46M | 11.28M | -12.13M | 15.45M | -2.69M |

| Net Income Ratio | 5.27% | 11.36% | 9.36% | 0.66% | 0.50% | 4.76% | 2.03% | 3.13% | 3.92% | -3.05% | 3.94% | -0.69% |

| EPS | 0.59 | 1.79 | 1.53 | 0.06 | 0.05 | 0.42 | 0.20 | 0.21 | 0.32 | -0.65 | 1.15 | -30.77 |

| EPS Diluted | 0.58 | 1.76 | 1.50 | 0.06 | 0.05 | 0.42 | 0.20 | 0.21 | 0.32 | -0.65 | 1.15 | -30.77 |

| Weighted Avg Shares Out | 44.77M | 44.40M | 44.00M | 43.42M | 42.75M | 42.25M | 38.41M | 35.16M | 34.78M | 18.73M | 13.42M | 87.32K |

| Weighted Avg Shares Out (Dil) | 45.48M | 45.06M | 44.85M | 43.82M | 43.27M | 42.78M | 38.93M | 35.38M | 34.96M | 18.73M | 13.42M | 87.33K |

Pangaea Logistics Solutions, Ltd. (PANL) Q3 2024 Earnings Call Transcript

Pangaea Logistics (PANL) Meets Q3 Earnings Estimates

Pangaea Logistics Solutions Ltd. Reports Financial Results for the Quarter Ended September 30, 2024

PANGAEA LOGISTICS SOLUTIONS ANNOUNCES THIRD QUARTER 2024 CONFERENCE CALL DATE

Pangaea Logistics Solutions Announces Agreement to Purchase Third Party Equity Ownership of Nordic Bulk Partners

Pangaea Logistics Solutions Expands Into Handysize Bulk Carrier Segment, Buy

Pangaea Logistics Solutions and M.T. Maritime Management Announce Agreement to Combine Fleets of Dry Bulk Vessels in All-Stock Transaction

69 All Star And Graham Value Stocks; 49 Fit To Buy In August

Pangaea Logistics Solutions: Upgrading On Improved Near-Term Outlook And Discounted Valuation

Pangaea Logistics (PANL) Tops Q2 Earnings and Revenue Estimates

Source: https://incomestatements.info

Category: Stock Reports