See more : Gorani Industries Limited (GORANIN.BO) Income Statement Analysis – Financial Results

Complete financial analysis of Prudential Bancorp, Inc. (PBIP) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Prudential Bancorp, Inc., a leading company in the Banks – Regional industry within the Financial Services sector.

- Data Patterns (India) Limited (DATAPATTNS.NS) Income Statement Analysis – Financial Results

- Public Joint-Stock Company Unipro (UPRO.ME) Income Statement Analysis – Financial Results

- Danske Invest Nye Markeder Obligationer (DKINMOBL.CO) Income Statement Analysis – Financial Results

- BB Biotech AG (BION.SW) Income Statement Analysis – Financial Results

- Grupo Aeroportuario del Sureste, S. A. B. de C. V. (ASRMF) Income Statement Analysis – Financial Results

Prudential Bancorp, Inc. (PBIP)

About Prudential Bancorp, Inc.

Prudential Bancorp, Inc. operates as the bank holding company for Prudential Bank that provides various banking products or services. The company accepts interest-bearing and non-interest-bearing checking, money market, savings, and certificates of deposit accounts. Its loan portfolio comprises single-family residential mortgage loans, construction and land development loans, non-residential or commercial real estate mortgage loans, home equity loans and lines of credit, and commercial business loans, as well as consumer loans, such as loans secured by deposit accounts and unsecured personal loans. The company also manages a portfolio of investment and mortgage-backed securities; and provides ATM, and online and mobile banking services. It operates a main office in Philadelphia, Pennsylvania, as well as nine additional full-service branch offices, including seven in Philadelphia, Philadelphia County; one in Drexel Hill, Delaware County; and one in Huntingdon Valley, Montgomery County, Pennsylvania. Prudential Bancorp, Inc. was incorporated in 1886 and is headquartered in Philadelphia, Pennsylvania.

| Metric | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 26.88M | 30.91M | 27.85M | 27.21M | 23.28M | 15.49M | 16.26M | 14.18M | 14.20M | 16.42M | 15.73M | 16.64M | 15.27M | 6.47M | 13.17M | 13.55M | 12.35M | 11.09M | 921.87K | 763.00K | 605.00K | 2.15M |

| Cost of Revenue | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 26.88M | 30.91M | 27.85M | 27.21M | 23.28M | 15.49M | 16.26M | 14.18M | 14.20M | 16.42M | 15.73M | 16.64M | 15.27M | 6.47M | 13.17M | 13.55M | 12.35M | 11.09M | 921.87K | 763.00K | 605.00K | 2.15M |

| Gross Profit Ratio | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 12.57M | 11.37M | 10.37M | 9.52M | 8.61M | 7.79M | 9.08M | 7.39M | 7.19M | 7.74M | 7.50M | 7.32M | 6.61M | 4.34M | 4.54M | 4.47M | 4.06M | 3.15M | 2.93M | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 100.00K | 186.00K | 279.00K | 246.00K | 214.00K | 103.00K | 165.00K | 186.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 12.67M | 11.55M | 10.65M | 9.76M | 8.82M | 7.90M | 9.24M | 7.58M | 7.19M | 7.74M | 7.50M | 7.32M | 6.61M | 4.34M | 4.54M | 4.47M | 4.06M | 3.15M | 2.93M | 0.00 | 0.00 | 0.00 |

| Other Expenses | -15.70M | -11.88M | -7.53M | -16.08M | -23.11M | -16.09M | -19.72M | -15.88M | -13.59M | 154.00K | 204.00K | 560.00K | 3.28M | 453.00K | 1.86M | -465.55K | -1.83M | -1.52M | 9.47M | 10.70M | 12.83M | 11.50M |

| Operating Expenses | -3.03M | -325.00K | 3.12M | -6.31M | -14.29M | -8.19M | -10.48M | -8.30M | -6.41M | 7.89M | 7.71M | 7.88M | 9.89M | 4.80M | 6.40M | 4.00M | 2.23M | 1.63M | 12.41M | 10.70M | 12.83M | 11.50M |

| Cost & Expenses | -3.03M | -325.00K | 3.12M | -6.31M | -14.29M | -8.19M | -10.48M | -8.30M | -6.41M | 7.89M | 7.71M | 7.88M | 9.89M | 4.80M | 6.40M | 4.00M | 2.23M | 1.63M | 12.41M | 10.70M | 12.83M | 11.50M |

| Interest Income | 38.04M | 42.23M | 44.04M | 34.85M | 26.34M | 17.48M | 16.68M | 16.47M | 16.77M | 18.98M | 21.69M | 25.11M | 27.39M | 26.41M | 26.91M | 24.54M | 21.08M | 19.51M | 18.81M | 19.22M | 19.14M | 18.60M |

| Interest Expense | 14.80M | 19.43M | 19.29M | 10.14M | 5.27M | 3.33M | 3.43M | 3.40M | 4.34M | 5.78M | 7.10M | 9.42M | 12.94M | 14.65M | 14.78M | 11.93M | 9.30M | 9.00M | 9.71M | 10.37M | 11.66M | 11.00M |

| Depreciation & Amortization | 435.00K | 484.00K | 619.00K | 625.00K | 665.00K | 325.00K | 304.00K | 320.00K | 337.00K | 345.00K | 342.00K | 355.00K | 328.00K | 336.00K | 205.00K | 196.07K | 127.57K | 17.41K | -102.62K | 0.00 | 0.00 | 0.00 |

| EBITDA | 24.28M | 31.06M | 31.59M | 21.53M | 9.65M | 7.63M | 6.08M | 6.19M | 8.13M | 10.00M | 7.34M | 13.95M | 12.79M | 11.60M | 19.77M | 17.74M | 14.70M | 12.74M | 13.23M | 11.46M | 13.43M | 13.65M |

| EBITDA Ratio | 90.34% | 100.51% | 113.44% | 79.10% | 41.46% | 49.24% | 37.41% | 43.68% | 57.27% | 60.89% | 46.66% | 83.82% | 83.77% | 179.32% | 150.15% | 130.98% | 119.07% | 114.85% | 1,434.67% | 1,502.10% | 2,219.83% | 635.24% |

| Operating Income | 23.85M | 30.58M | 30.97M | 20.90M | 8.99M | 7.31M | 5.78M | 5.87M | 7.80M | 9.65M | 7.00M | 13.59M | 12.47M | 11.26M | 19.57M | 17.54M | 14.58M | 12.72M | 13.33M | 11.46M | 13.43M | 13.65M |

| Operating Income Ratio | 88.72% | 98.95% | 111.22% | 76.81% | 38.60% | 47.15% | 35.54% | 41.42% | 54.90% | 58.79% | 44.48% | 81.68% | 81.62% | 174.12% | 148.59% | 129.53% | 118.04% | 114.69% | 1,445.80% | 1,502.10% | 2,219.83% | 635.24% |

| Total Other Income/Expenses | -14.80M | -19.43M | -19.29M | -10.14M | -5.27M | -3.33M | -3.43M | -3.40M | -4.34M | -5.78M | -7.10M | -9.42M | -12.94M | -14.65M | -14.78M | -11.93M | -9.30M | -9.00M | -9.71M | -7.57M | -10.72M | -9.56M |

| Income Before Tax | 9.05M | 11.16M | 11.68M | 10.77M | 3.72M | 3.98M | 2.35M | 2.47M | 3.45M | 3.88M | -100.00K | 4.18M | -476.00K | -3.39M | 4.78M | 5.61M | 5.28M | 3.72M | 3.62M | 3.89M | 2.72M | 4.09M |

| Income Before Tax Ratio | 33.67% | 36.09% | 41.95% | 39.56% | 15.98% | 25.68% | 14.44% | 17.43% | 24.31% | 23.60% | -0.64% | 25.10% | -3.12% | -52.40% | 36.33% | 41.42% | 42.75% | 33.53% | 392.78% | 510.09% | 448.76% | 190.27% |

| Income Tax Expense | 1.27M | 1.60M | 2.15M | 3.70M | 941.00K | 1.26M | 116.00K | 690.00K | 1.70M | 1.28M | -212.00K | 1.05M | 350.00K | 755.00K | 1.39M | 1.77M | 1.89M | 1.25M | 1.25M | -1.40M | 943.00K | 1.44M |

| Net Income | 7.78M | 9.56M | 9.53M | 7.06M | 2.78M | 2.72M | 2.23M | 1.78M | 1.76M | 2.59M | 112.00K | 3.13M | -826.00K | -4.15M | 3.40M | 3.84M | 3.39M | 2.47M | 2.37M | 2.49M | 1.77M | 2.64M |

| Net Income Ratio | 28.95% | 30.92% | 34.23% | 25.96% | 11.94% | 17.56% | 13.73% | 12.56% | 12.36% | 15.79% | 0.71% | 18.81% | -5.41% | -64.07% | 25.80% | 28.33% | 27.47% | 22.29% | 256.86% | 326.87% | 292.89% | 123.04% |

| EPS | 1.00 | 1.12 | 1.07 | 0.78 | 0.33 | 0.37 | 0.27 | 0.20 | 0.18 | 0.27 | 0.01 | 0.33 | -0.08 | -0.38 | 0.30 | 0.32 | 0.27 | 0.19 | 0.18 | 0.19 | 0.14 | 0.20 |

| EPS Diluted | 1.00 | 1.12 | 1.07 | 0.78 | 0.32 | 0.36 | 0.27 | 0.19 | 0.18 | 0.27 | 0.01 | 0.32 | -0.08 | -0.38 | 0.30 | 0.32 | 0.27 | 0.19 | 0.18 | 0.19 | 0.14 | 0.20 |

| Weighted Avg Shares Out | 7.77M | 8.53M | 8.91M | 9.06M | 8.42M | 7.35M | 8.27M | 8.90M | 9.66M | 9.60M | 11.20M | 9.48M | 10.33M | 10.83M | 11.32M | 11.99M | 12.50M | 13.02M | 13.02M | 13.02M | 13.02M | 13.02M |

| Weighted Avg Shares Out (Dil) | 7.77M | 8.53M | 8.91M | 9.06M | 8.68M | 7.56M | 8.27M | 9.37M | 9.66M | 9.60M | 11.20M | 9.78M | 10.33M | 10.83M | 11.32M | 11.99M | 12.50M | 13.02M | 13.02M | 13.02M | 13.02M | 13.02M |

Bailing On The U.S. Now Looks Like Prudential Plc's Best Chance For Value Creation (NYSE:PUK)

The 5 Undervalued Blue Chip High Dividend Growth Stocks You Need To Buy Now

Glenmede Trust Co. NA Trims Stock Holdings in Prudential Financial Inc (NYSE:PRU)

Prudential names Susan Somersille Johnson chief marketing officer

Analysts Set Prudential plc (LON:PRU) PT at GBX 1,408.93

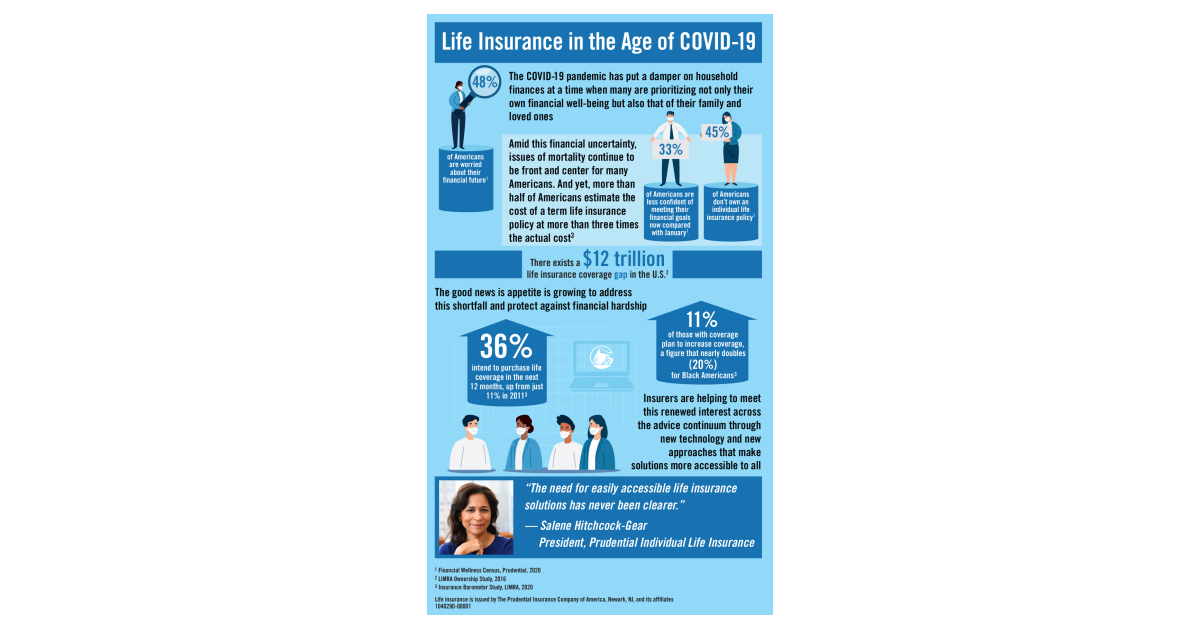

Pandemic is increasing money woes, interest in life insurance, Prudential finds

Virtusa Highlights Merits of Significant Premium Transaction with Baring Private Equity Asia

Source: https://incomestatements.info

Category: Stock Reports