Complete financial analysis of Poshmark, Inc. (POSH) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Poshmark, Inc., a leading company in the Specialty Retail industry within the Consumer Cyclical sector.

- BLIS Technologies Limited (BLT.NZ) Income Statement Analysis – Financial Results

- PT MD Pictures Tbk (FILM.JK) Income Statement Analysis – Financial Results

- Australian United Investment Company Limited (AUI.AX) Income Statement Analysis – Financial Results

- CECEP Environmental Protection Equipment Co.,Ltd. (300140.SZ) Income Statement Analysis – Financial Results

- AJ1G, Inc. (AJYG) Income Statement Analysis – Financial Results

Poshmark, Inc. (POSH)

About Poshmark, Inc.

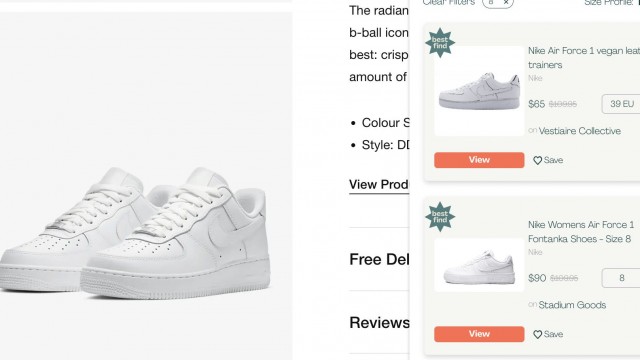

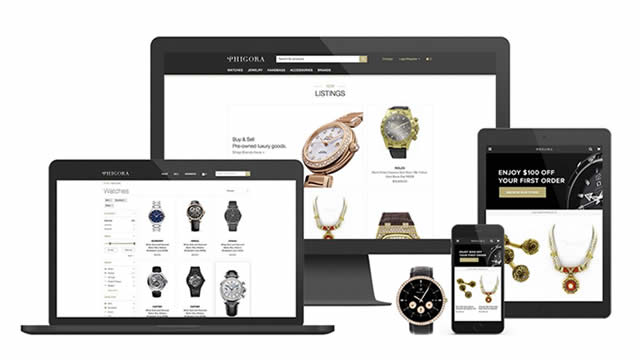

Poshmark, Inc. operates as a social marketplace for new and secondhand style products in the United States, Canada, India, and Australia. The company offers apparel, footwear, home, beauty, and pet products, as well as accessories. As of December 31, 2021, it had 7.6 million active buyers. The company was formerly known as GoshPosh, Inc. and changed its name to Poshmark, Inc. in 2011. Poshmark, Inc. was incorporated in 2011 and is headquartered in Redwood City, California.

| Metric | 2021 | 2020 | 2019 | 2018 |

|---|---|---|---|---|

| Revenue | 326.01M | 262.08M | 205.23M | 148.31M |

| Cost of Revenue | 51.86M | 43.51M | 34.14M | 22.84M |

| Gross Profit | 274.15M | 218.57M | 171.08M | 125.47M |

| Gross Profit Ratio | 84.09% | 83.40% | 83.36% | 84.60% |

| Research & Development | 58.71M | 30.03M | 25.03M | 15.48M |

| General & Administrative | 56.99M | 29.58M | 31.47M | 15.46M |

| Selling & Marketing | 142.69M | 92.92M | 132.47M | 88.44M |

| SG&A | 199.68M | 122.49M | 163.94M | 103.90M |

| Other Expenses | 60.19M | 42.65M | 31.94M | 21.10M |

| Operating Expenses | 318.58M | 195.17M | 220.91M | 140.49M |

| Cost & Expenses | 370.43M | 238.68M | 255.05M | 163.33M |

| Interest Income | 224.00K | 569.00K | 1.68M | 1.10M |

| Interest Expense | 224.00K | 569.00K | 1.68M | 0.00 |

| Depreciation & Amortization | 3.47M | 2.89M | 2.06M | 802.00K |

| EBITDA | -94.99M | 20.97M | -44.79M | -13.58M |

| EBITDA Ratio | -29.07% | 8.00% | -21.82% | -9.16% |

| Operating Income | -98.24M | 23.40M | -49.83M | -15.02M |

| Operating Income Ratio | -30.13% | 8.93% | -24.28% | -10.13% |

| Total Other Income/Expenses | -54.04M | -5.90M | 1.31M | 636.00K |

| Income Before Tax | -98.46M | 17.50M | -48.52M | -14.38M |

| Income Before Tax Ratio | -30.20% | 6.68% | -23.64% | -9.70% |

| Income Tax Expense | -134.00K | 657.00K | 174.00K | 91.00K |

| Net Income | -98.33M | 16.85M | -48.69M | -14.48M |

| Net Income Ratio | -30.16% | 6.43% | -23.73% | -9.76% |

| EPS | -1.34 | 0.23 | -0.76 | -0.21 |

| EPS Diluted | -1.34 | 0.23 | -0.76 | -0.21 |

| Weighted Avg Shares Out | 73.34M | 73.34M | 64.44M | 70.38M |

| Weighted Avg Shares Out (Dil) | 73.34M | 73.34M | 64.44M | 70.38M |

Ebay to Take on Poshmark, The RealReal for Luxury Resale Spend

Poshmark Exiting Overseas Markets to Focus on US

Poshmark Introduces Posh Shows, Live Shopping For Resale

Poshmark Invites Sellers to Go Live With ‘Posh Shows'

Poshmark lays off employees just two months after being acquired by Naver

How to snag discounts through Beni, an online shopping tool that hunts for resale deals on Poshmark, eBay, and The RealReal

Naver Completes Acquisition of Poshmark and Aims to Grow Globally

POSHMARK INVESTOR ALERT by the Former Attorney General of Louisiana: Kahn Swick & Foti, LLC Investigates Adequacy of Price and Process in Proposed Sale of Poshmark, Inc. - POSH

CONTINUED INVESTIGATION ALERT: Scott+Scott Attorneys at Law LLP Continues to Investigate NAVER Buyout of Poshmark – POSH

Poshmark (POSH) Reports Q3 Loss, Tops Revenue Estimates

Source: https://incomestatements.info

Category: Stock Reports