See more : Eco Safe Systems USA, Inc. (ESFS) Income Statement Analysis – Financial Results

Complete financial analysis of Poshmark, Inc. (POSH) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Poshmark, Inc., a leading company in the Specialty Retail industry within the Consumer Cyclical sector.

- Arr Planner Co., Ltd. (2983.T) Income Statement Analysis – Financial Results

- Aura Energy Limited (AUEEF) Income Statement Analysis – Financial Results

- Hamon & Cie (International) SA (HAMO.BR) Income Statement Analysis – Financial Results

- Next Digital Limited (0282.HK) Income Statement Analysis – Financial Results

- AVG Logistics Limited (AVG.NS) Income Statement Analysis – Financial Results

Poshmark, Inc. (POSH)

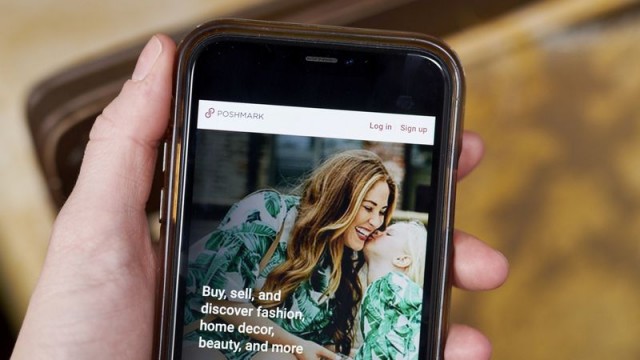

About Poshmark, Inc.

Poshmark, Inc. operates as a social marketplace for new and secondhand style products in the United States, Canada, India, and Australia. The company offers apparel, footwear, home, beauty, and pet products, as well as accessories. As of December 31, 2021, it had 7.6 million active buyers. The company was formerly known as GoshPosh, Inc. and changed its name to Poshmark, Inc. in 2011. Poshmark, Inc. was incorporated in 2011 and is headquartered in Redwood City, California.

| Metric | 2021 | 2020 | 2019 | 2018 |

|---|---|---|---|---|

| Revenue | 326.01M | 262.08M | 205.23M | 148.31M |

| Cost of Revenue | 51.86M | 43.51M | 34.14M | 22.84M |

| Gross Profit | 274.15M | 218.57M | 171.08M | 125.47M |

| Gross Profit Ratio | 84.09% | 83.40% | 83.36% | 84.60% |

| Research & Development | 58.71M | 30.03M | 25.03M | 15.48M |

| General & Administrative | 56.99M | 29.58M | 31.47M | 15.46M |

| Selling & Marketing | 142.69M | 92.92M | 132.47M | 88.44M |

| SG&A | 199.68M | 122.49M | 163.94M | 103.90M |

| Other Expenses | 60.19M | 42.65M | 31.94M | 21.10M |

| Operating Expenses | 318.58M | 195.17M | 220.91M | 140.49M |

| Cost & Expenses | 370.43M | 238.68M | 255.05M | 163.33M |

| Interest Income | 224.00K | 569.00K | 1.68M | 1.10M |

| Interest Expense | 224.00K | 569.00K | 1.68M | 0.00 |

| Depreciation & Amortization | 3.47M | 2.89M | 2.06M | 802.00K |

| EBITDA | -94.99M | 20.97M | -44.79M | -13.58M |

| EBITDA Ratio | -29.07% | 8.00% | -21.82% | -9.16% |

| Operating Income | -98.24M | 23.40M | -49.83M | -15.02M |

| Operating Income Ratio | -30.13% | 8.93% | -24.28% | -10.13% |

| Total Other Income/Expenses | -54.04M | -5.90M | 1.31M | 636.00K |

| Income Before Tax | -98.46M | 17.50M | -48.52M | -14.38M |

| Income Before Tax Ratio | -30.20% | 6.68% | -23.64% | -9.70% |

| Income Tax Expense | -134.00K | 657.00K | 174.00K | 91.00K |

| Net Income | -98.33M | 16.85M | -48.69M | -14.48M |

| Net Income Ratio | -30.16% | 6.43% | -23.73% | -9.76% |

| EPS | -1.34 | 0.23 | -0.76 | -0.21 |

| EPS Diluted | -1.34 | 0.23 | -0.76 | -0.21 |

| Weighted Avg Shares Out | 73.34M | 73.34M | 64.44M | 70.38M |

| Weighted Avg Shares Out (Dil) | 73.34M | 73.34M | 64.44M | 70.38M |

Poshmark Stock Surges After Buyout News

Poshmark shares open 15% up on Tuesday: explained here

POSH Stock Alert: Halper Sadeh LLC Is Investigating Whether the Sale of Poshmark, Inc. Is Fair to Shareholders

Korean Internet Giant Naver To Buy American Fashion Reseller Poshmark For $1.2 Billion

South Korean Internet Giant Buys Poshmark in $1.2 Billion Deal

Naver to Acquire Poshmark | Business Wire

South Korean internet firm to acquire Poshmark for $1.2 billion

South Korea's Naver to Buy Poshmark in Bid to Boost eCommerce

Poshmark to be bought by South Korean internet company Naver in $1.2 billion deal

South Korea's Naver to buy U.S. e-commerce site Poshmark for $1.2 billion

Source: https://incomestatements.info

Category: Stock Reports