See more : Active Energy Group Plc (ATGVF) Income Statement Analysis – Financial Results

Complete financial analysis of Polestar Automotive Holding UK PLC (PSNY) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Polestar Automotive Holding UK PLC, a leading company in the Auto – Manufacturers industry within the Consumer Cyclical sector.

- Better Life Group Co., LTD. (1805.TW) Income Statement Analysis – Financial Results

- CMO Group PLC (CMO.L) Income Statement Analysis – Financial Results

- Ferguson plc (FERG.L) Income Statement Analysis – Financial Results

- La Française des Jeux Société anonyme (LFDJF) Income Statement Analysis – Financial Results

- Capcom Co., Ltd. (CCOEY) Income Statement Analysis – Financial Results

Polestar Automotive Holding UK PLC (PSNY)

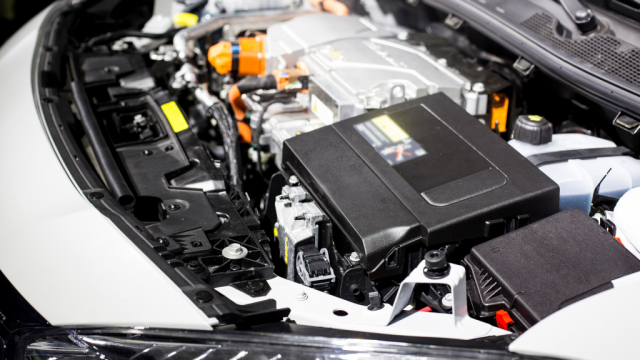

About Polestar Automotive Holding UK PLC

Polestar Automotive Holding UK PLC manufactures and sells premium electric vehicles. The company was founded in 2017 and is headquartered in Gothenburg, Sweden.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 |

|---|---|---|---|---|---|

| Revenue | 2.38B | 2.46B | 1.34B | 610.25M | 92.42M |

| Cost of Revenue | 2.79B | 2.34B | 1.34B | 553.72M | 39.79M |

| Gross Profit | -413.08M | 119.44M | 860.00K | 56.52M | 52.63M |

| Gross Profit Ratio | -17.37% | 4.85% | 0.06% | 9.26% | 56.94% |

| Research & Development | 158.41M | 170.99M | 232.92M | 183.85M | 34.39M |

| General & Administrative | 0.00 | 864.60M | 714.72M | 314.93M | 210.57M |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 949.68M | 864.60M | 714.72M | 314.93M | 210.57M |

| Other Expenses | -41.20M | -2.18M | -1.25M | 712.00K | -425.00K |

| Operating Expenses | 1.07B | 1.03B | 946.40M | 499.49M | 244.53M |

| Cost & Expenses | 3.86B | 3.38B | 2.28B | 1.05B | 284.32M |

| Interest Income | 32.28M | 8.55M | 1.40M | 3.20M | 13.29M |

| Interest Expense | 206.48M | 108.44M | 45.24M | 26.50M | 18.94M |

| Depreciation & Amortization | 115.01M | 158.39M | 239.16M | 216.08M | 32.55M |

| EBITDA | -809.90M | -213.10M | -722.71M | -226.89M | -148.32M |

| EBITDA Ratio | -34.05% | -29.26% | -52.72% | -36.66% | -160.50% |

| Operating Income | -1.48B | -913.96M | -945.54M | -442.97M | -191.91M |

| Operating Income Ratio | -62.22% | -37.12% | -70.71% | -72.59% | -207.66% |

| Total Other Income/Expenses | 278.00M | 836.10M | -61.58M | -30.84M | -4.97M |

| Income Before Tax | -1.20B | -449.01M | -1.01B | -471.32M | -195.96M |

| Income Before Tax Ratio | -50.53% | -18.24% | -75.32% | -77.24% | -212.04% |

| Income Tax Expense | -7.14M | 16.78M | 336.00K | 13.54M | 2.02M |

| Net Income | -1.19B | -465.79M | -1.01B | -484.86M | -197.98M |

| Net Income Ratio | -50.23% | -18.92% | -75.34% | -79.45% | -214.22% |

| EPS | -0.57 | -0.23 | -0.48 | -0.23 | -0.09 |

| EPS Diluted | -0.57 | -0.22 | -0.48 | -0.23 | -0.09 |

| Weighted Avg Shares Out | 2.10B | 2.03B | 2.12B | 1.68B | 2.12B |

| Weighted Avg Shares Out (Dil) | 2.11B | 2.11B | 2.12B | 1.68B | 2.12B |

Forget Lucid Group: 2 Electric Vehicle Stocks to Buy Instead

QS Stock: A Speculative Bet on an Uncertain EV Battery Revolution

After Tesla, Polestar quits Australia auto lobby as emissions fight escalates

Hop In! 3 White-Hot EV Stocks Ready to Fire On All Cylinders

3 EV Stocks to Eject Before the Hype Deflates

Polestar Automotive Holding UK PLC (PSNY) Q4 2023 Earnings Call Transcript

Why Polestar Stock Shot Higher Today

PSNY Stock Alert: Polestar Makes Moves With Its Joint Venture

PSNY Stock Alert: The $1 Billion Reason Polestar Is Up 20% Today

Polestar secures $950 million from a bank syndicate

Source: https://incomestatements.info

Category: Stock Reports