See more : Bravura Solutions Limited (BVS.AX) Income Statement Analysis – Financial Results

Complete financial analysis of The RealReal, Inc. (REAL) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of The RealReal, Inc., a leading company in the Luxury Goods industry within the Consumer Cyclical sector.

- Being Holdings Co., Ltd. (9145.T) Income Statement Analysis – Financial Results

- Bridgford Foods Corporation (BRID) Income Statement Analysis – Financial Results

- Moleculin Biotech, Inc. (MBRX) Income Statement Analysis – Financial Results

- UniCredit S.p.A. (UNCRY) Income Statement Analysis – Financial Results

- GSP Automotive Group Wenzhou Co.,Ltd. (605088.SS) Income Statement Analysis – Financial Results

The RealReal, Inc. (REAL)

About The RealReal, Inc.

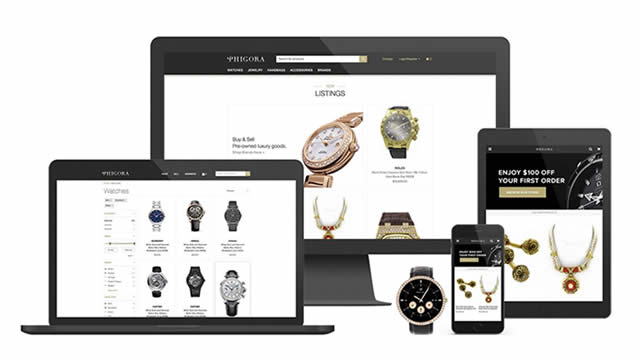

The RealReal, Inc. operates an online marketplace for consigned luxury goods in the United State. It offers various product categories, including women's, men's, kids', jewelry and watches, and home and art products. The company was incorporated in 2011 and is headquartered in San Francisco, California.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|---|---|

| Revenue | 549.30M | 603.49M | 467.69M | 298.27M | 318.04M | 207.38M | 137.52M |

| Cost of Revenue | 173.03M | 254.80M | 194.22M | 112.38M | 114.83M | 70.46M | 49.88M |

| Gross Profit | 376.28M | 348.69M | 273.48M | 185.88M | 203.21M | 136.92M | 87.64M |

| Gross Profit Ratio | 68.50% | 57.78% | 58.47% | 62.32% | 63.89% | 66.02% | 63.73% |

| Research & Development | 0.00 | 251.44M | 212.30M | 144.96M | 129.82M | 104.93M | 58.68M |

| General & Administrative | 182.45M | 195.16M | 176.42M | 141.76M | 110.66M | 168.66M | 102.72M |

| Selling & Marketing | 58.28M | 63.13M | 62.75M | 54.81M | 47.73M | 42.17M | 36.71M |

| SG&A | 240.73M | 258.29M | 239.17M | 196.58M | 158.40M | 210.82M | 139.43M |

| Other Expenses | 301.84M | 279.11M | 235.83M | 163.81M | 143.23M | -1.66M | -60.00K |

| Operating Expenses | 542.57M | 537.40M | 475.00M | 360.38M | 301.63M | 210.82M | 139.43M |

| Cost & Expenses | 715.60M | 792.20M | 669.21M | 472.77M | 416.46M | 281.28M | 189.31M |

| Interest Income | 8.81M | 3.19M | 365.00K | 2.52M | 4.59M | 1.05M | 355.00K |

| Interest Expense | 10.70M | 10.47M | 21.53M | 5.26M | 616.00K | 1.15M | 762.00K |

| Depreciation & Amortization | 31.70M | 47.27M | 42.97M | 34.91M | 13.41M | 9.29M | 5.63M |

| EBITDA | -109.05M | -138.53M | -171.55M | -135.56M | -84.21M | -65.22M | -45.86M |

| EBITDA Ratio | -19.85% | -26.13% | -37.97% | -51.40% | -25.95% | -31.45% | -33.34% |

| Operating Income | -166.29M | -188.71M | -201.52M | -174.50M | -98.42M | -73.90M | -51.78M |

| Operating Income Ratio | -30.27% | -31.27% | -43.09% | -58.50% | -30.95% | -35.64% | -37.66% |

| Total Other Income/Expenses | -1.90M | -7.11M | -21.14M | -2.92M | 1.88M | -1.76M | -467.00K |

| Income Before Tax | -168.19M | -196.27M | -236.05M | -177.41M | -96.55M | -75.67M | -52.25M |

| Income Before Tax Ratio | -30.62% | -32.52% | -50.47% | -59.48% | -30.36% | -36.49% | -37.99% |

| Income Tax Expense | 283.00K | 172.00K | 56.00K | 101.00K | 199.00K | 99.00K | 57.00K |

| Net Income | -168.47M | -196.45M | -236.11M | -177.52M | -96.75M | -75.77M | -52.31M |

| Net Income Ratio | -30.67% | -32.55% | -50.48% | -59.52% | -30.42% | -36.54% | -38.04% |

| EPS | -1.65 | -2.05 | -2.58 | -2.03 | -1.13 | -1.21 | -0.84 |

| EPS Diluted | -1.65 | -2.05 | -2.58 | -2.03 | -1.13 | -1.21 | -0.84 |

| Weighted Avg Shares Out | 101.81M | 95.92M | 91.41M | 87.59M | 85.87M | 62.53M | 62.53M |

| Weighted Avg Shares Out (Dil) | 101.81M | 95.92M | 91.41M | 87.59M | 85.87M | 62.53M | 62.53M |

The RealReal Announces Timing of Its Third Quarter 2024 Earnings Conference Call

Global Second-Hand Luxury Goods Markets, 2020-2024 & 2025-2030: Millennials and Gen Z Drive Amid Eco-Conscious Shift, Resale Platforms Like The RealReal and Vestiaire Collective Lead the Boom

Bet on 5 Top-Ranked Stocks With Rising P/E for Stellar Gains

The RealReal to Participate in Fireside Chat Hosted by Wells Fargo

Is The RealReal (REAL) Stock Outpacing Its Consumer Discretionary Peers This Year?

The RealReal (REAL) Loses -7.32% in 4 Weeks, Here's Why a Trend Reversal May be Around the Corner

The RealReal: Buy This Dip, Especially As Profitability Is Recovering

The 2024 Luxury Resale Report: The RealReal Reveals Top Brands and Trends Shaping the Market

3 Retail Stocks to Sell Before They Hit the Bankruptcy Bin

The RealReal (REAL) Reports Q2 Loss, Tops Revenue Estimates

Source: https://incomestatements.info

Category: Stock Reports