See more : USD Partners LP (USDP) Income Statement Analysis – Financial Results

Complete financial analysis of The RealReal, Inc. (REAL) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of The RealReal, Inc., a leading company in the Luxury Goods industry within the Consumer Cyclical sector.

- Clean Energy Technologies, Inc. (CETY) Income Statement Analysis – Financial Results

- CDL Investments New Zealand Limited (CDI.NZ) Income Statement Analysis – Financial Results

- Dawonsys Co.,Ltd. (068240.KQ) Income Statement Analysis – Financial Results

- Jizhong Energy Resources Co., Ltd. (000937.SZ) Income Statement Analysis – Financial Results

- Dawushan Farm Technology Co., Ltd. (6952.TW) Income Statement Analysis – Financial Results

The RealReal, Inc. (REAL)

About The RealReal, Inc.

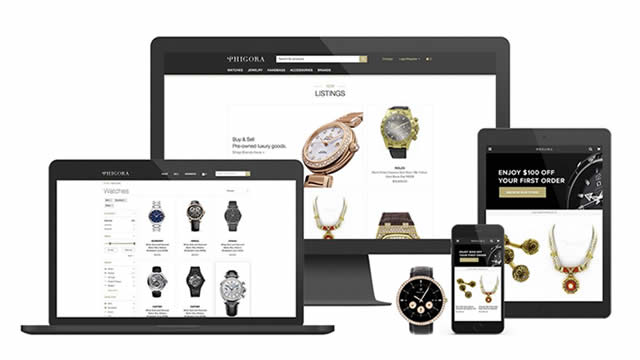

The RealReal, Inc. operates an online marketplace for consigned luxury goods in the United State. It offers various product categories, including women's, men's, kids', jewelry and watches, and home and art products. The company was incorporated in 2011 and is headquartered in San Francisco, California.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|---|---|

| Revenue | 549.30M | 603.49M | 467.69M | 298.27M | 318.04M | 207.38M | 137.52M |

| Cost of Revenue | 173.03M | 254.80M | 194.22M | 112.38M | 114.83M | 70.46M | 49.88M |

| Gross Profit | 376.28M | 348.69M | 273.48M | 185.88M | 203.21M | 136.92M | 87.64M |

| Gross Profit Ratio | 68.50% | 57.78% | 58.47% | 62.32% | 63.89% | 66.02% | 63.73% |

| Research & Development | 0.00 | 251.44M | 212.30M | 144.96M | 129.82M | 104.93M | 58.68M |

| General & Administrative | 182.45M | 195.16M | 176.42M | 141.76M | 110.66M | 168.66M | 102.72M |

| Selling & Marketing | 58.28M | 63.13M | 62.75M | 54.81M | 47.73M | 42.17M | 36.71M |

| SG&A | 240.73M | 258.29M | 239.17M | 196.58M | 158.40M | 210.82M | 139.43M |

| Other Expenses | 301.84M | 279.11M | 235.83M | 163.81M | 143.23M | -1.66M | -60.00K |

| Operating Expenses | 542.57M | 537.40M | 475.00M | 360.38M | 301.63M | 210.82M | 139.43M |

| Cost & Expenses | 715.60M | 792.20M | 669.21M | 472.77M | 416.46M | 281.28M | 189.31M |

| Interest Income | 8.81M | 3.19M | 365.00K | 2.52M | 4.59M | 1.05M | 355.00K |

| Interest Expense | 10.70M | 10.47M | 21.53M | 5.26M | 616.00K | 1.15M | 762.00K |

| Depreciation & Amortization | 31.70M | 47.27M | 42.97M | 34.91M | 13.41M | 9.29M | 5.63M |

| EBITDA | -109.05M | -138.53M | -171.55M | -135.56M | -84.21M | -65.22M | -45.86M |

| EBITDA Ratio | -19.85% | -26.13% | -37.97% | -51.40% | -25.95% | -31.45% | -33.34% |

| Operating Income | -166.29M | -188.71M | -201.52M | -174.50M | -98.42M | -73.90M | -51.78M |

| Operating Income Ratio | -30.27% | -31.27% | -43.09% | -58.50% | -30.95% | -35.64% | -37.66% |

| Total Other Income/Expenses | -1.90M | -7.11M | -21.14M | -2.92M | 1.88M | -1.76M | -467.00K |

| Income Before Tax | -168.19M | -196.27M | -236.05M | -177.41M | -96.55M | -75.67M | -52.25M |

| Income Before Tax Ratio | -30.62% | -32.52% | -50.47% | -59.48% | -30.36% | -36.49% | -37.99% |

| Income Tax Expense | 283.00K | 172.00K | 56.00K | 101.00K | 199.00K | 99.00K | 57.00K |

| Net Income | -168.47M | -196.45M | -236.11M | -177.52M | -96.75M | -75.77M | -52.31M |

| Net Income Ratio | -30.67% | -32.55% | -50.48% | -59.52% | -30.42% | -36.54% | -38.04% |

| EPS | -1.65 | -2.05 | -2.58 | -2.03 | -1.13 | -1.21 | -0.84 |

| EPS Diluted | -1.65 | -2.05 | -2.58 | -2.03 | -1.13 | -1.21 | -0.84 |

| Weighted Avg Shares Out | 101.81M | 95.92M | 91.41M | 87.59M | 85.87M | 62.53M | 62.53M |

| Weighted Avg Shares Out (Dil) | 101.81M | 95.92M | 91.41M | 87.59M | 85.87M | 62.53M | 62.53M |

Why TheRealReal Stock Jumped Today

The RealReal, Inc. (REAL) Q2 2023 Earnings Call Transcript

The RealReal (REAL) Q2 Earnings: How Key Metrics Compare to Wall Street Estimates

The RealReal (REAL) Reports Q2 Loss, Misses Revenue Estimates

The RealReal Announces Second Quarter 2023 Results

The RealReal Announces Timing of Its Second Quarter 2023 Earnings Conference Call

4 Consumer Products-Discretionary Stocks to Tap Amid Improving Industry Trends

1 Michael Burry Stock Down 93% You'll Regret Not Buying on the Dip

Fast-paced Momentum Stock The RealReal (REAL) Is Still Trading at a Bargain

The RealReal: Resilient And Expanding Customer Base, Maintain 'Buy'

Source: https://incomestatements.info

Category: Stock Reports