See more : The Keiyo Bank, Ltd. (8544.T) Income Statement Analysis – Financial Results

Complete financial analysis of REE Automotive Ltd. (REE) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of REE Automotive Ltd., a leading company in the Auto – Recreational Vehicles industry within the Consumer Cyclical sector.

- Platina Resources Limited (PTNUF) Income Statement Analysis – Financial Results

- Ronshine Service Holding Co., Ltd (2207.HK) Income Statement Analysis – Financial Results

- ALT Telecom Public Company Limited (ALT.BK) Income Statement Analysis – Financial Results

- AT & S Austria Technologie & Systemtechnik Aktiengesellschaft (AUS.DE) Income Statement Analysis – Financial Results

- Miyakoshi Holdings, Inc. (6620.T) Income Statement Analysis – Financial Results

REE Automotive Ltd. (REE)

About REE Automotive Ltd.

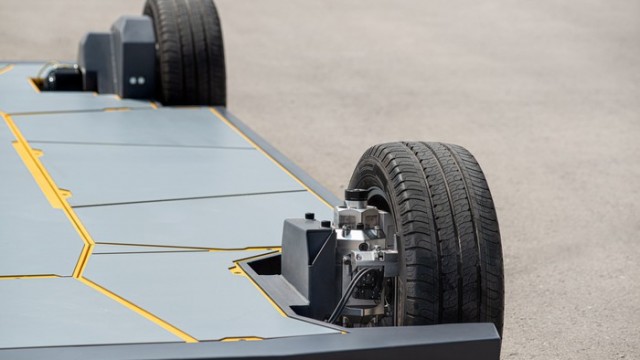

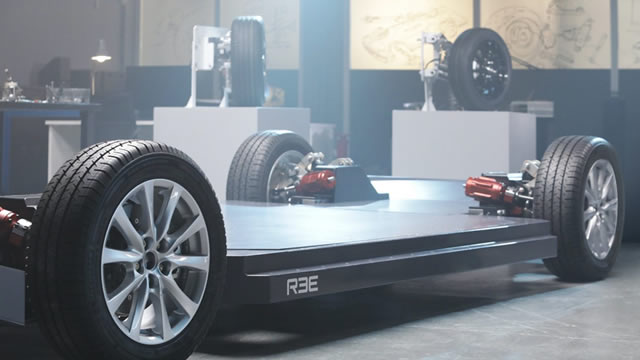

REE Automotive Ltd. operates in the e-mobility business. The company develops REEcorner technology, which integrates vehicle drive components, including steering, braking, suspension, powertrain, and control into the arch of the wheel. The company also develops REEboard, a flat and modular EV chassis. The company is headquartered in Herzliya, Israel.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 |

|---|---|---|---|---|---|

| Revenue | 1.61M | 0.00 | 6.00K | 388.00K | 681.00K |

| Cost of Revenue | 9.07M | 547.00K | 995.00K | 647.00K | 490.00K |

| Gross Profit | -7.46M | -547.00K | -989.00K | -259.00K | 191.00K |

| Gross Profit Ratio | -464.12% | 0.00% | -16,483.33% | -66.75% | 28.05% |

| Research & Development | 82.66M | 78.23M | 252.42M | 29.59M | 7.04M |

| General & Administrative | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 29.77M | 49.20M | 262.08M | 38.25M | 7.18M |

| Other Expenses | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 112.43M | 127.43M | 514.51M | 67.84M | 14.22M |

| Cost & Expenses | 121.50M | 127.97M | 515.50M | 68.49M | 14.71M |

| Interest Income | 4.35M | 2.79M | 423.00K | 409.00K | 1.83M |

| Interest Expense | 0.00 | -41.82M | 3.00K | -3.00K | 0.00 |

| Depreciation & Amortization | 5.80M | 4.91M | 484.00K | 166.00K | 82.00K |

| EBITDA | -114.09M | -100.76M | -503.57M | -67.93M | -13.94M |

| EBITDA Ratio | -7,095.21% | 0.00% | -8,767,266.67% | -17,501.29% | -2,047.43% |

| Operating Income | -119.89M | -127.97M | -515.50M | -68.10M | -14.03M |

| Operating Income Ratio | -7,455.97% | 0.00% | -8,591,600.00% | -17,551.03% | -2,059.47% |

| Total Other Income/Expenses | 4.32M | 22.30M | 11.45M | 385.00K | 1.83M |

| Income Before Tax | -115.57M | -105.67M | -504.05M | -67.71M | -12.20M |

| Income Before Tax Ratio | -7,187.06% | 0.00% | -8,400,816.67% | -17,451.80% | -1,790.75% |

| Income Tax Expense | -1.36M | 1.75M | 1.28M | -385.00K | -1.83M |

| Net Income | -114.21M | -107.42M | -505.33M | -67.33M | -10.37M |

| Net Income Ratio | -7,102.49% | 0.00% | -8,422,166.67% | -17,352.58% | -1,522.03% |

| EPS | -11.32 | -10.98 | -64.34 | -80.29 | -1.35 |

| EPS Diluted | -11.32 | -10.98 | -64.34 | -80.29 | -1.35 |

| Weighted Avg Shares Out | 10.09M | 9.78M | 7.85M | 838.54K | 7.66M |

| Weighted Avg Shares Out (Dil) | 10.09M | 9.78M | 7.85M | 838.54K | 7.66M |

REE Automotive Can Surprise Investors With a Comeback

Part Shortages Make REE's Electric Vehicle Revolution Harder

10X Capital Leadership Purchases Additional Shares In REE Automotive

REE Automotive to Participate in Series of Investor Conferences

Why This Electric Vehicle Stock Crashed 35% Today

REE Stock: Why Is REE Automotive Plunging 30% Today?

REE Automotive Receives $17M Funding From UK Government

REE Automotive Awarded $17 USD Million Funding from the UK Government

REE Automotive Ltd. (REE) CEO Daniel Barel on Q2 2021 Results - Earnings Call Transcript

REE Automotive Announces Second Quarter 2021 Financial Results

Source: https://incomestatements.info

Category: Stock Reports