See more : COFCO Biotechnology Co., Ltd. (000930.SZ) Income Statement Analysis – Financial Results

Complete financial analysis of SkyWater Technology, Inc. (SKYT) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of SkyWater Technology, Inc., a leading company in the Semiconductors industry within the Technology sector.

- WSM for Information Technology Co. (9595.SR) Income Statement Analysis – Financial Results

- ACG Acquisition Company Limited (ACG.L) Income Statement Analysis – Financial Results

- Sheetal Cool Products Limited (SCPL.BO) Income Statement Analysis – Financial Results

- Academies Australasia Group Limited (AKG.AX) Income Statement Analysis – Financial Results

- Veolia Environnement S.A. (VEOEY) Income Statement Analysis – Financial Results

SkyWater Technology, Inc. (SKYT)

About SkyWater Technology, Inc.

SkyWater Technology, Inc., together with its subsidiaries, provides semiconductor development and manufacturing services. The company offers engineering and process development support services to co-create technologies with customers; and semiconductor manufacturing services for various silicon-based analog and mixed-signal, power discrete, microelectromechanical systems, and rad-hard integrated circuits. It serves customers operating in the computation, aerospace and defense, automotive and transportation, bio-health, consumer, and industrial/internet of things industries. The company was incorporated in 2017 and is headquartered in Bloomington, Minnesota.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|---|

| Revenue | 286.68M | 212.94M | 162.85M | 140.44M | 136.73M | 132.17M |

| Cost of Revenue | 227.39M | 186.97M | 170.32M | 117.75M | 111.38M | 100.83M |

| Gross Profit | 59.29M | 25.97M | -7.47M | 22.69M | 25.35M | 31.34M |

| Gross Profit Ratio | 20.68% | 12.19% | -4.59% | 16.16% | 18.54% | 23.71% |

| Research & Development | 10.17M | 9.43M | 8.75M | 4.21M | 6.33M | 2.21M |

| General & Administrative | 4.84M | 5.17M | 7.98M | 17.25M | 14.39M | 11.21M |

| Selling & Marketing | 58.46M | 46.30M | 43.60M | 7.78M | 4.33M | 3.96M |

| SG&A | 63.91M | 46.30M | 43.60M | 25.03M | 18.72M | 15.17M |

| Other Expenses | 0.00 | 0.00 | -2.71M | 2.09M | 9.27M | 0.00 |

| Operating Expenses | 74.08M | 55.73M | 49.63M | 31.33M | 34.32M | 17.38M |

| Cost & Expenses | 301.47M | 242.71M | 219.95M | 149.08M | 145.70M | 118.21M |

| Interest Income | 0.00 | 5.19M | 3.54M | 5.50M | 6.55M | 7.84M |

| Interest Expense | 10.83M | 5.19M | 3.54M | 5.50M | 6.55M | 0.00 |

| Depreciation & Amortization | 28.93M | 28.19M | 27.37M | 18.87M | 16.66M | 15.09M |

| EBITDA | 14.14M | -2.68M | -23.28M | 9.57M | 3.23M | 28.97M |

| EBITDA Ratio | 4.93% | -0.74% | -18.26% | 7.28% | 5.63% | 21.97% |

| Operating Income | -14.79M | -29.77M | -57.10M | -8.64M | -8.97M | 13.96M |

| Operating Income Ratio | -5.16% | -13.98% | -35.07% | -6.15% | -6.56% | 10.56% |

| Total Other Income/Expenses | -10.83M | -6.30M | 2.91M | -6.15M | -11.01M | -13.98M |

| Income Before Tax | -25.61M | -36.06M | -54.19M | -14.80M | -19.98M | -21.00K |

| Income Before Tax Ratio | -8.93% | -16.94% | -33.28% | -10.53% | -14.61% | -0.02% |

| Income Tax Expense | -521.00K | 809.00K | -6.79M | 4.92M | -3.56M | 44.00K |

| Net Income | -30.76M | -36.87M | -47.40M | -19.71M | -16.42M | -65.00K |

| Net Income Ratio | -10.73% | -17.32% | -29.11% | -14.04% | -12.01% | -0.05% |

| EPS | -0.68 | -0.90 | -1.19 | -0.50 | -0.42 | 0.00 |

| EPS Diluted | -0.68 | -0.90 | -1.19 | -0.50 | -0.42 | 0.00 |

| Weighted Avg Shares Out | 45.51M | 40.84M | 39.84M | 39.06M | 39.06M | 39.06M |

| Weighted Avg Shares Out (Dil) | 45.51M | 40.84M | 39.84M | 39.06M | 39.06M | 39.06M |

SkyWater Announces Participation in Upcoming Investor Conferences

Analyzing SkyWater Technology (NASDAQ:SKYT) and SPI Energy (NASDAQ:SPI)

1 Small-Cap Chip Stock Just Tanked Nearly 30% -- Time to Buy?

SkyWater Florida Achieves DMEA Category 1A Trusted Supplier Accreditation

SkyWater Technology, Inc. (SKYT) Q1 2024 Earnings Call Transcript

SkyWater and Lumotive Announce Qualification and Production Start for World's First Commercially Available Optical Beamforming Chip

Speculative Standouts: 7 ‘Strong Buy' Stocks to Snag for Under $20

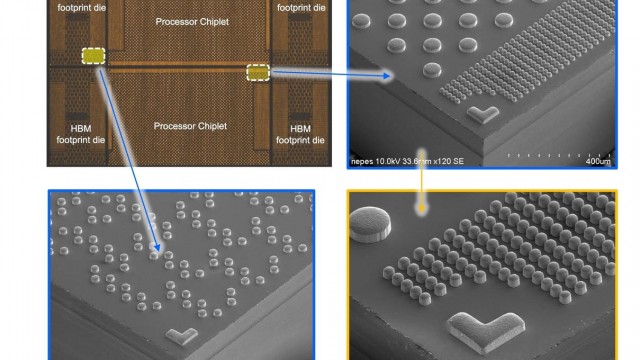

SkyWater Technology Is Lowering Barriers To Advanced Chip Packaging

SkyWater Technology to Announce First Quarter Financial Results on May 8th, 2024

3 Stocks Under $10 That Could Make You a Millionaire by 2030

Source: https://incomestatements.info

Category: Stock Reports