See more : Adkins Energy LLC (ADKIL) Income Statement Analysis – Financial Results

Complete financial analysis of SkyWater Technology, Inc. (SKYT) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of SkyWater Technology, Inc., a leading company in the Semiconductors industry within the Technology sector.

- JDM JingDaMachine(Ningbo)Co.Ltd (603088.SS) Income Statement Analysis – Financial Results

- FinTech Acquisition Corp. VI (FTVIU) Income Statement Analysis – Financial Results

- Awakn Life Sciences Corp. (AWKN.NE) Income Statement Analysis – Financial Results

- Logiq, Inc. (LGIQ.NE) Income Statement Analysis – Financial Results

- Pear Therapeutics, Inc. (PEARW) Income Statement Analysis – Financial Results

SkyWater Technology, Inc. (SKYT)

About SkyWater Technology, Inc.

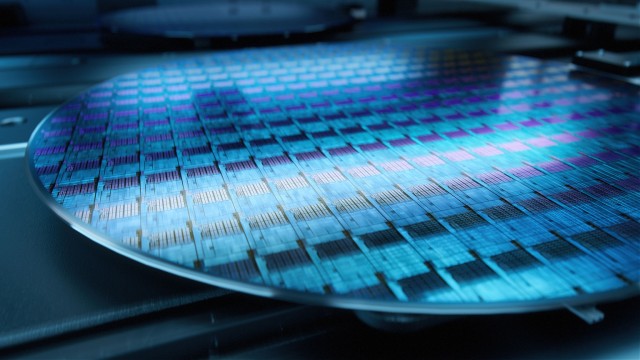

SkyWater Technology, Inc., together with its subsidiaries, provides semiconductor development and manufacturing services. The company offers engineering and process development support services to co-create technologies with customers; and semiconductor manufacturing services for various silicon-based analog and mixed-signal, power discrete, microelectromechanical systems, and rad-hard integrated circuits. It serves customers operating in the computation, aerospace and defense, automotive and transportation, bio-health, consumer, and industrial/internet of things industries. The company was incorporated in 2017 and is headquartered in Bloomington, Minnesota.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|---|

| Revenue | 286.68M | 212.94M | 162.85M | 140.44M | 136.73M | 132.17M |

| Cost of Revenue | 227.39M | 186.97M | 170.32M | 117.75M | 111.38M | 100.83M |

| Gross Profit | 59.29M | 25.97M | -7.47M | 22.69M | 25.35M | 31.34M |

| Gross Profit Ratio | 20.68% | 12.19% | -4.59% | 16.16% | 18.54% | 23.71% |

| Research & Development | 10.17M | 9.43M | 8.75M | 4.21M | 6.33M | 2.21M |

| General & Administrative | 4.84M | 5.17M | 7.98M | 17.25M | 14.39M | 11.21M |

| Selling & Marketing | 58.46M | 46.30M | 43.60M | 7.78M | 4.33M | 3.96M |

| SG&A | 63.91M | 46.30M | 43.60M | 25.03M | 18.72M | 15.17M |

| Other Expenses | 0.00 | 0.00 | -2.71M | 2.09M | 9.27M | 0.00 |

| Operating Expenses | 74.08M | 55.73M | 49.63M | 31.33M | 34.32M | 17.38M |

| Cost & Expenses | 301.47M | 242.71M | 219.95M | 149.08M | 145.70M | 118.21M |

| Interest Income | 0.00 | 5.19M | 3.54M | 5.50M | 6.55M | 7.84M |

| Interest Expense | 10.83M | 5.19M | 3.54M | 5.50M | 6.55M | 0.00 |

| Depreciation & Amortization | 28.93M | 28.19M | 27.37M | 18.87M | 16.66M | 15.09M |

| EBITDA | 14.14M | -2.68M | -23.28M | 9.57M | 3.23M | 28.97M |

| EBITDA Ratio | 4.93% | -0.74% | -18.26% | 7.28% | 5.63% | 21.97% |

| Operating Income | -14.79M | -29.77M | -57.10M | -8.64M | -8.97M | 13.96M |

| Operating Income Ratio | -5.16% | -13.98% | -35.07% | -6.15% | -6.56% | 10.56% |

| Total Other Income/Expenses | -10.83M | -6.30M | 2.91M | -6.15M | -11.01M | -13.98M |

| Income Before Tax | -25.61M | -36.06M | -54.19M | -14.80M | -19.98M | -21.00K |

| Income Before Tax Ratio | -8.93% | -16.94% | -33.28% | -10.53% | -14.61% | -0.02% |

| Income Tax Expense | -521.00K | 809.00K | -6.79M | 4.92M | -3.56M | 44.00K |

| Net Income | -30.76M | -36.87M | -47.40M | -19.71M | -16.42M | -65.00K |

| Net Income Ratio | -10.73% | -17.32% | -29.11% | -14.04% | -12.01% | -0.05% |

| EPS | -0.68 | -0.90 | -1.19 | -0.50 | -0.42 | 0.00 |

| EPS Diluted | -0.68 | -0.90 | -1.19 | -0.50 | -0.42 | 0.00 |

| Weighted Avg Shares Out | 45.51M | 40.84M | 39.84M | 39.06M | 39.06M | 39.06M |

| Weighted Avg Shares Out (Dil) | 45.51M | 40.84M | 39.84M | 39.06M | 39.06M | 39.06M |

SkyWater Florida and BRIDG Announce Installation of Nordson's Leading C-SAM System to Enhance Metrology Capabilities at the Center for Neovation

SkyWater Technology: Expecting A Q2 Results Beat

Paul Sura to lead Technology and Manufacturing Operations at SkyWater

SkyWater Technology to Announce Second Quarter Financial Results on August 7, 2023

Weebit Nano’s ReRAM IP now fully qualified in SkyWater

3 Stocks to Buy That Could Be the Next Nvidia

SkyWater Technology: Favorable Outlook Supports A Higher Multiple

SkyWater Technology, Inc. (SKYT) Q1 2023 Earnings Call Transcript

SkyWater Technology to Announce First Quarter Financial Results on May 8, 2023

5 Best Growth Stocks to Buy Now Under $20

Source: https://incomestatements.info

Category: Stock Reports