See more : Media Research Institute,Inc. (9242.T) Income Statement Analysis – Financial Results

Complete financial analysis of Tokyo Electron Limited (TOELY) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Tokyo Electron Limited, a leading company in the Semiconductors industry within the Technology sector.

- ViewRay, Inc. (VRAYQ) Income Statement Analysis – Financial Results

- Royal Bank of Canada (RY.SW) Income Statement Analysis – Financial Results

- Tobila Systems Inc. (4441.T) Income Statement Analysis – Financial Results

- Lier Chemical Co.,LTD. (002258.SZ) Income Statement Analysis – Financial Results

- Wuxi Delinhai Environmental Technology Co., Ltd. (688069.SS) Income Statement Analysis – Financial Results

Tokyo Electron Limited (TOELY)

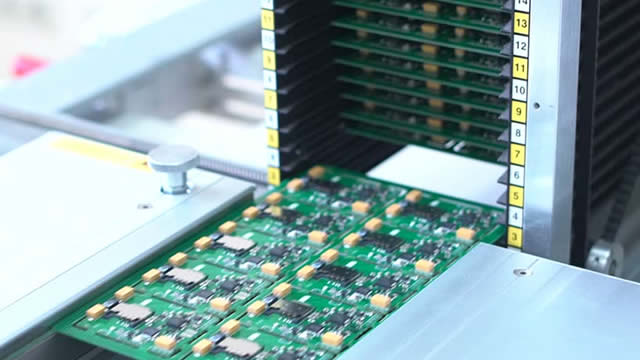

About Tokyo Electron Limited

Tokyo Electron Limited, together with its subsidiaries, develops, manufactures, and sells semiconductor and flat panel display (FPD) production equipment in Japan, Europe, North America, Taiwan, China, South Korea, and internationally. The company's Semiconductor Production Equipment segment offers coaters/developers, etch systems, deposition systems, and cleaning systems used in wafer processing; wafer probers used in wafer testing process; and wafer bonders/debonders. Its Flat Panel Display Production Equipment segment provides coaters/developers and etch/ash systems for use in the manufacture of FPDs, as well as inkjet printing systems for manufacturing OLED panels. The company also offers logistic, facility maintenance, and insurance services. Tokyo Electron Limited was incorporated in 1951 and is headquartered in Tokyo, Japan.

| Metric | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 1,830.53B | 2,209.03B | 2,003.81B | 1,399.10B | 1,127.29B | 1,278.24B | 1,130.73B | 799.72B | 663.95B | 613.12B | 612.17B | 497.30B |

| Cost of Revenue | 1,000.26B | 1,224.62B | 1,091.98B | 834.16B | 675.34B | 752.06B | 655.70B | 477.43B | 396.74B | 370.35B | 410.28B | 338.55B |

| Gross Profit | 830.27B | 984.41B | 911.82B | 564.95B | 451.94B | 526.18B | 475.03B | 322.29B | 267.21B | 242.77B | 201.89B | 158.75B |

| Gross Profit Ratio | 45.36% | 44.56% | 45.50% | 40.38% | 40.09% | 41.16% | 42.01% | 40.30% | 40.25% | 39.60% | 32.98% | 31.92% |

| Research & Development | 202.87B | 191.20B | 158.26B | 136.65B | 120.27B | 113.98B | 97.10B | 83.80B | 76.29B | 71.35B | 78.66B | 73.25B |

| General & Administrative | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 171.13B | 175.49B | 154.30B | 107.61B | 94.38B | 101.63B | 96.76B | 82.79B | 74.14B | 83.31B | 91.02B | 72.96B |

| Other Expenses | 1.00M | 3.46B | 1.60B | 2.16B | 3.55B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 374.01B | 366.68B | 312.55B | 244.26B | 214.65B | 215.61B | 193.86B | 166.59B | 150.42B | 156.85B | 216.81B | 142.65B |

| Cost & Expenses | 1,374.26B | 1,591.30B | 1,404.53B | 1,078.42B | 889.99B | 967.67B | 849.56B | 644.02B | 547.16B | 527.20B | 627.09B | 481.19B |

| Interest Income | 2.57B | 1.24B | 616.00M | 521.00M | 1.12B | 1.79B | 858.00M | 722.00M | 547.00M | 901.00M | 3.16B | 1.66B |

| Interest Expense | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 266.00M |

| Depreciation & Amortization | 52.41B | 43.10B | 36.93B | 34.04B | 29.30B | 24.68B | 21.22B | 18.50B | 20.23B | 22.03B | 29.15B | 27.77B |

| EBITDA | 508.68B | 660.82B | 636.20B | 354.73B | 266.60B | 335.25B | 302.39B | 174.20B | 137.02B | 110.14B | 61.36B | 40.32B |

| EBITDA Ratio | 27.79% | 29.91% | 31.75% | 25.35% | 23.65% | 26.23% | 26.74% | 21.78% | 20.64% | 17.96% | 10.02% | 8.11% |

| Operating Income | 456.26B | 617.72B | 599.27B | 320.69B | 237.29B | 310.57B | 281.17B | 155.70B | 116.79B | 88.11B | 32.21B | 12.55B |

| Operating Income Ratio | 24.93% | 27.96% | 29.91% | 22.92% | 21.05% | 24.30% | 24.87% | 19.47% | 17.59% | 14.37% | 5.26% | 2.52% |

| Total Other Income/Expenses | 17.18B | 7.13B | -2.57B | -3.65B | 7.33B | 10.94B | -5.93B | -6.58B | -10.32B | -1.29B | -43.96B | 5.22B |

| Income Before Tax | 473.44B | 624.86B | 596.70B | 317.04B | 244.63B | 321.51B | 275.24B | 149.12B | 106.47B | 86.83B | -11.76B | 17.76B |

| Income Before Tax Ratio | 25.86% | 28.29% | 29.78% | 22.66% | 21.70% | 25.15% | 24.34% | 18.65% | 16.04% | 14.16% | -1.92% | 3.57% |

| Income Tax Expense | 109.48B | 153.27B | 159.62B | 74.10B | 59.42B | 73.28B | 70.84B | 33.87B | 28.53B | 14.90B | 7.46B | 11.41B |

| Net Income | 363.96B | 471.58B | 437.08B | 242.94B | 185.21B | 248.23B | 204.37B | 115.21B | 77.89B | 71.89B | -19.41B | 6.08B |

| Net Income Ratio | 19.88% | 21.35% | 21.81% | 17.36% | 16.43% | 19.42% | 18.07% | 14.41% | 11.73% | 11.72% | -3.17% | 1.22% |

| EPS | 781.20 | 1.01K | 935.95 | 520.74 | 390.19 | 504.53 | 415.16 | 234.09 | 153.70 | 133.38 | -36.07 | 11.30 |

| EPS Diluted | 781.20 | 1.00K | 931.30 | 517.77 | 388.01 | 502.41 | 413.74 | 233.45 | 153.33 | 133.38 | -36.07 | 11.30 |

| Weighted Avg Shares Out | 465.90M | 467.93M | 466.99M | 466.53M | 474.66M | 492.00M | 492.27M | 492.16M | 506.77M | 538.96M | 538.06M | 537.54M |

| Weighted Avg Shares Out (Dil) | 465.90M | 469.77M | 469.32M | 469.21M | 477.32M | 494.08M | 493.96M | 493.50M | 507.99M | 538.95M | 538.06M | 537.54M |

'Foreign investors are back': Japan stocks surge to their highest since 1990

Tokyo Electron Limited (TOELF) Q4 2023 Earnings Call Transcript

Tokyo Electron expects profit dip as chipmakers slow investment

Japan's $54 Billion Bet on Chip Manufacturing -- 5 Stocks to Buy Now

1 Top Chip Stock You've Never Heard of Worth a Look If You Like Dividends

Tokyo Electron: Last Word On Export Rules To China Yet To Come

March'23 Semi-Cap Recap

Tokyo Electron Limited (TOELF) Q3 2023 Earnings Call Transcript

Tokyo Electron A Strong Buy As Sector Holds On

Tokyo Electron: Weak Guidance For H2 Of FY2023, But Shares Remain Cheap

Source: https://incomestatements.info

Category: Stock Reports