See more : Braime Group PLC (BMTO.L) Income Statement Analysis – Financial Results

Complete financial analysis of Unrivaled Brands, Inc. (UNRV) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Unrivaled Brands, Inc., a leading company in the Drug Manufacturers – Specialty & Generic industry within the Healthcare sector.

- AirIQ Inc. (AILQF) Income Statement Analysis – Financial Results

- VIZSLA ROYALTIES CORP (VROY.V) Income Statement Analysis – Financial Results

- Lithium Chile Inc. (LITH.V) Income Statement Analysis – Financial Results

- Yuanta Financial Holding Co., Ltd. (2885.TW) Income Statement Analysis – Financial Results

- Isleworth Healthcare Acquisition Corp. (ISLEW) Income Statement Analysis – Financial Results

Unrivaled Brands, Inc. (UNRV)

Industry: Drug Manufacturers - Specialty & Generic

Sector: Healthcare

Website: https://www.unrivaledbrands.com

About Unrivaled Brands, Inc.

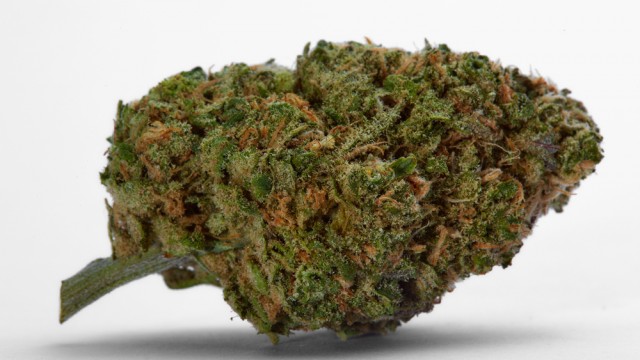

Unrivaled Brands, Inc. cultivates, produces, distributes, and retails medical and adult use cannabis products in California, Oregon, and Nevada. It also operates medical marijuana retail and adult use dispensaries, cultivation, and production facilities. The company was formerly known as Terra Tech Corp. and changed its name to Unrivaled Brands, Inc. in July 2021. Unrivaled Brands, Inc. was founded in 2010 and is based in Santa Ana, California.

| Metric | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 52.02M | 47.67M | 14.29M | 28.05M | 31.33M | 35.80M | 25.33M | 9.98M | 7.09M | 2.13M | 552.58K | 0.00 | 0.00 | 0.00 |

| Cost of Revenue | 35.12M | 35.71M | 10.69M | 13.40M | 18.90M | 30.32M | 22.76M | 8.96M | 6.94M | 2.04M | 451.71K | 0.00 | 0.00 | 0.00 |

| Gross Profit | 16.90M | 11.97M | 3.60M | 14.65M | 12.43M | 5.48M | 2.57M | 1.02M | 152.99K | 88.92K | 100.87K | 0.00 | 0.00 | 0.00 |

| Gross Profit Ratio | 32.48% | 25.10% | 25.20% | 52.24% | 39.68% | 15.30% | 10.16% | 10.19% | 2.16% | 4.18% | 18.25% | 0.00% | 0.00% | 0.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 52.04M | 46.99M | 24.41M | 43.83M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 28.99K | 16.44K | 17.33K |

| Selling & Marketing | 2.12M | 1.27M | 190.00K | 1.49M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 54.16M | 48.26M | 24.60M | 45.32M | 43.30M | 25.36M | 20.72M | 9.83M | 18.33M | 3.58M | 1.07M | 28.99K | 16.44K | 17.33K |

| Other Expenses | 156.50M | -433.00K | 964.00K | 144.00K | 0.00 | 565.52K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 210.66M | 48.26M | 24.60M | 45.32M | 43.30M | 25.36M | 20.72M | 9.83M | 18.33M | 3.58M | 1.07M | 28.99K | 16.44K | 17.33K |

| Cost & Expenses | 245.78M | 83.96M | 35.29M | 58.72M | 62.20M | 55.68M | 43.48M | 18.79M | 25.27M | 5.61M | 1.52M | 28.99K | 16.44K | 17.33K |

| Interest Income | 4.17M | 1.78M | 1.39M | 9.29M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 4.17M | 1.78M | 2.93M | 9.30M | 13.09M | 2.68M | 1.79M | 1.17M | 1.10M | 1.28M | 62.20K | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 13.40M | 8.96M | 964.00K | 6.29M | 4.98M | 3.65M | 2.54M | 645.29K | 438.78K | 41.31K | 14.09K | 0.00 | 0.00 | 0.00 |

| EBITDA | -193.76M | -29.15M | -12.76M | -39.29M | -24.48M | -16.23M | -18.15M | -8.17M | -17.74M | -3.45M | -957.91K | -28.99K | -16.44K | -17.33K |

| EBITDA Ratio | -372.51% | -57.33% | -140.25% | -86.91% | -84.74% | -45.34% | -71.65% | -81.92% | -250.00% | -162.08% | -173.35% | 0.00% | 0.00% | 0.00% |

| Operating Income | -193.76M | -36.29M | -21.00M | -30.67M | -30.87M | -19.88M | -18.15M | -8.82M | -18.17M | -3.49M | -5.77M | -28.99K | -16.44K | -17.33K |

| Operating Income Ratio | -372.51% | -76.12% | -147.00% | -109.33% | -98.52% | -55.53% | -71.65% | -88.39% | -256.19% | -164.03% | -1,044.55% | 0.00% | 0.00% | 0.00% |

| Total Other Income/Expenses | -1.87M | -5.89M | -9.12M | -17.77M | -8.60M | -13.65M | -9.84M | -546.10K | -3.99M | -2.66M | -63.53K | 0.00 | 0.00 | 0.00 |

| Income Before Tax | -195.63M | -42.18M | -13.80M | -48.44M | -39.47M | -33.53M | -27.99M | -9.36M | -22.17M | -6.15M | -5.84M | -28.99K | -16.44K | -17.33K |

| Income Before Tax Ratio | -376.11% | -88.47% | -96.59% | -172.70% | -125.98% | -93.66% | -110.49% | -93.86% | -312.46% | -289.14% | -1,056.05% | 0.00% | 0.00% | 0.00% |

| Income Tax Expense | -2.78M | 885.00K | 13.04M | 6.87M | 279.61K | -347.46K | -1.07M | 44.00K | 13.46K | 1.65K | 879.00 | 28.99K | 16.44K | 17.33K |

| Net Income | -192.85M | -43.06M | -26.84M | -55.31M | -39.75M | -32.68M | -26.92M | -9.23M | -21.89M | -6.15M | -5.84M | -28.99K | -16.44K | -17.33K |

| Net Income Ratio | -370.76% | -90.33% | -187.88% | -197.17% | -126.87% | -91.28% | -106.28% | -92.48% | -308.55% | -289.22% | -1,056.21% | 0.00% | 0.00% | 0.00% |

| EPS | -0.33 | -0.11 | -0.14 | -0.52 | -0.56 | -0.71 | -0.93 | -0.52 | -1.88 | -0.93 | -1.14 | 0.00 | 0.00 | 0.00 |

| EPS Diluted | -0.33 | -0.11 | -0.14 | -0.52 | -0.56 | -0.71 | -0.93 | -0.52 | -1.88 | -0.93 | -1.14 | 0.00 | 0.00 | 0.00 |

| Weighted Avg Shares Out | 589.55M | 376.63M | 191.98M | 106.04M | 71.03M | 46.07M | 28.84M | 17.79M | 11.62M | 6.60M | 5.13M | 79.69M | 100.18M | 100.00M |

| Weighted Avg Shares Out (Dil) | 589.55M | 376.63M | 191.98M | 106.04M | 71.03M | 46.07M | 28.84M | 17.79M | 11.62M | 6.60M | 5.13M | 79.69M | 100.18M | 100.00M |

Unrivaled Brands appoints Sabas Carrillo as its new interim CEO

Unrivaled Brands makes brisk progress on its 100-day turnaround plan and focuses on growth

Unrivaled Brands makes brisk progress on its 100-day turnaround plan and focuses on profitable growth

Unrivaled Brands posts 907.5% revenue jump in 1Q thanks to transformation plan

Unrivaled Brands outlines 100-day transformation plan to drive profitability

Unrivaled Brands sees big jump in 4Q and FY2021 revenue as it builds scale in the West Coast cannabis space

Key Trends Coming Out Of Q1 2022

Unrivaled Brands adds Paradise Smokes for California distribution

Unrivaled Brands Sells Dyer Property For $13.4M Retiring $9.0M Debt

Unrivaled Brands Expands Product Offering Via Deal With POTTERS Cannabis Co.

Source: https://incomestatements.info

Category: Stock Reports